Best Fidelity Funds For Your 401k: Total Bond

Manager: Ford ONeilExpenses: 0.45%

Primary manager Ford ONeil uses the Barclays U.S. Universal Bond Index as an investment guide for Fidelitys diversified bond fund, Fidelity Total Bond Fund .

Investments in this $17 billion-plus fund are allocated across investment-grade , high-yield and emerging-market bonds. The investment-grade debt includes a 29% total weighting in U.S. Treasuries. The result? A 30-day yield around 3.5%.

Foreign holdings make up 9.8% of the investments.

Jim Lowell is the editor of Fidelity Investor. Fidelity Investor today and youll also receive his free report on the top sector funds and ETFs for 2015.

Article printed from InvestorPlace Media, https://investorplace.com/2015/03/10-best-fidelity-funds-401k/.

About Fidelity Mutual Funds

Fidelity Investments is among the largest and most successful financial services companies on earth, with more than $4 trillion in assets under management as of March 2022.

Founded in 1946, with roots in the Fidelity Fund established in 1930, innovation has long been at the forefront of the business, especially in mutual funds. Fidelity pioneered the practice of regularly updating a mutual funds net asset value and was the first firm to offer same-day trading of fund shares.

What Is Fidelitys Routing Number

Want to fund your Fidelity 401k or perhaps another Fidelity retirement account? Youll probably want to know which routing numbers to use. Always double-check to make sure youre taking down the right information. A single incorrect digit means the funds will go elsewhere, failing the transaction.

Routing numbers are usually well within your reach for a quick look-up. Aside from here, you can also find Fidelity routing numbers on the financial institutions website, with live chat support available. Or, if you have your Fidelity checks handy, just look for your routing number there.

Cash Back and No Annual Fees: Fidelity Rewards Visa Signature Review

Also Check: What Is The Difference Between Annuity And 401k

Where Fidelity Go Falls Short

Tax strategy: The company does not offer tax-loss harvesting, one of the features that makes robo-advisors stand out for taxable accounts.

No human advisor guidance: Although Fidelity Go has investment advisors managing and rebalancing portfolios, these advisors do not give financial planning guidance or answer other investment questions.

Benefits Of The Mit 401 Plan

When you enroll in and contribute to your 401 account, you are 100% vested that is you fully own your contributions, MITs matching contributions, and all interest earned on the investments you choose through the Plan.

In addition, you receive tax benefits when you contribute to your MIT Supplemental 401 account. You can choose when you receive your tax benefits right away, with pre-tax contributions, or later on, with Roth post-tax contributions.

Save on a pre-tax basis and receive tax benefits now

- Your 401 contributions are deducted from your paycheck before taxes are applied, reducing your current taxable income and therefore your taxes.

- In retirement, you will pay federal and state income taxes on any amount you withdraw from the plan.

Save on a post-tax basis and receive tax benefits later

- Your 401 contributions are taken out of your paycheck after federal and state income taxes have been applied, so they will not reduce your current taxable income or your taxes.

- In retirement, you will pay no taxes on any amount you withdraw as long as you take the distribution after age 59½ and at least 5 years after the first Roth contribution was made.

Don’t Miss: What Is A Solo 401k Plan

Fidelity To Let 401 Customers Add Bitcoin To Their Retirement Accounts

Fidelity Investments customers with a 401 account will be able to invest a portion of their account funds in bitcoin starting later this year, the first time a major retirement plan provider is adding cryptocurrency to their menu.

Dave Gray, head of workplace retirement offerings at Fidelity, said Tuesday that the company expects blockchain technology the foundation for cryptocurrency to play an important role in financial services. Fidelity is the nation’s largest retirement services provider, managing plans for 23,000 employers.

Although it’s considered highly unstable by most financial experts, bitcoin reached its highest price last year in part because more companies began accepting it as a form of payment. In another sign that cryptocurrency is gradually becoming a mainstream investment, Wall Street firms have created exchange-traded funds around crypto futures.

Despite the risks of wild price swings, roughly 40 million Americans have invested in cryptocurrencies, including about 43% of men ages 18 to 29. according to the Pew Research Center. Fidelity said it estimates that roughly 80 million individual investors in the U.S. own or have previously invested in a digital currency.

Khawar said companies should “exercise extreme care before they consider adding a cryptocurrency option” for employees.

What Are The Risks And Rewards Of Crypto As Part Of Your 401 Strategy

Despite the risks, at least one employer has signed up to offer Fidelity’s new product to its employees: MicroStrategy, a business and software services company. Its CEO, Michael Saylor, has been a vocal proponent of bitcoin.

“MicroStrategy looks forward to working with Fidelity to become the first public company to offer their employees the option to invest in bitcoin as part of our 401 program,” Saylor said in a statement. “Teaming with companies like Fidelity that are innovating in bitcoin for corporations is important to us, as is furthering the development of the bitcoin ecosystem for institutional investors.”

Morningstar’s Hume said MicroStrategy’s announcement is likely part of its brand to be first-movers in the cryptocurrency space. According to a company presentation, MicroStrategy currently holds 129,218 bitcoin at $30,000 apiece, it is worth a total of about $3.9 billion.

So far, Fidelity is the only large retirement services platform or investment brokerage firm to offer a bitcoin 401 product. Vanguard said it had no plans to do so.

“Since cryptocurrencies are highly speculative in their current state, Vanguard believes its long-term investment case is weak,” it said in a September 2021 note to clients its most recent opinion on the matter.

You May Like: What Is A Safe Harbor 401k Plan

Avoid These 5 Common 401 Mistakes To Maximize Your Returns

- Half of Americans now have access to 401 retirement savings plans.

- The average 401 retirement plan employer match has reached an all-time high of 4.7%.

- But many investors are making mistakes that will leave them short of retirement goals.

If youre in the lucky half of Americans who have access to a 401 retirement savings plan, you probably understand its appeal. Your money grows tax-free until withdrawal, contributions are automatically deducted from your paycheck and you might even get free money in the form of an employer match.

But many Americans are making mistakes with their 401 accounts that could be costing them some serious dollars. Missteps range from failing to contribute enough to receive an employer match, to overpaying in plan fees and costs. As the economy booms and the average 401 balance rises, these mistakes could be having an even more pronounced effect on Americans retirement accounts.

Also Check: Can I Roll Part Of My 401k To An Ira

Best For Low Operating Costs: Charles Schwab

Not many names are as well known in the financial industry as Charles Schwab. Charles Schwab offers Index Advantage 401 plans with low fees it also has some other plans you can choose from.

You can get plan advice and access to accounts that offer interest through the Schwab Bank. Its plans have no annual fees plan members get full access to all investing services.

If youre self-employed or own your business, you can pay into an individual 401 plan. These plans offer many of the same benefits as a traditional 401. One great thing about the individual 401 plan is that you can direct where you invest your money.

This plan has monthly service fees that vary based on your needs. Payments into your plan are tax-deductible, and gains are tax-deferred.

All Charles Schwab plans come with planning help and 24/7 service and support.

Recommended Reading: How Is 401k Paid Out

Also Check: What Is The Penalty For Taking Money Out Of 401k

Fidelity To Allow Retirement Savings Allocation To Bitcoin In 401 Accounts

A sign marks a Fidelity Investments office in Boston, Massachusetts, U.S. September 21, 2016. REUTERS/Brian Snyder

Register now for FREE unlimited access to Reuters.com

The family controlled asset manager said MicroStrategy Inc , a major bitcoin corporate backer, will be the first employer to use the new product, which will be made available to other employers by the middle of the year.

Through the new offering, employees will be able to invest in bitcoin through a Digital Assets Account within the core lineup of their 401 plans, Fidelity said.

Register now for FREE unlimited access to Reuters.com

Fidelity also said that Newfront, a retirement consulting services provider, has indicated that the DAA will help address a growing need among their client base.

Plan sponsors will be able to decide on employee contribution in the DAA and set limits on exchanging such contribution to bitcoin, Fidelity said, adding that additional updates on the new offering will be made available in the coming months.

Dave Gray, head of workplace retirement offerings and platforms at Fidelity, said the plan will initially be limited to bitcoin, but expects other digital assets to be made available in the future, according to a report by the Wall Street Journal, which was the first to report the news.

Register now for FREE unlimited access to Reuters.com

Also Check: Can I Rollover Solo 401k To Ira

Calculate Your Risk Tolerance

All investing is risky and returns are never guaranteed, but it can actually be more risky to keep too much of your savings in cash, thanks to inflation.

Still, you dont want to go all in on one stock or investment, particularly if a rocky market makes you uneasy and anxious, or likely to do something drastic, like pull your money out of your account.

Youll want to determine an appropriate asset allocation, or how much of your investments will be in stocks and how much will be in safer investments, like bonds. Stocks have the potential for greater returns, but can be more volatile than bonds. Bonds are more stable, but offer potentially lower returns over time.

Financial advisors often recommend using the following formula to determine your asset allocation: 110 minus your age equals the percentage of your portfolio that should be invested in equities, while the rest should be in bonds.

But think about your investing horizon. If you have decades until youre going to retire , then you can afford a bit more risk. You might choose an 80-20 stock mix for now. When youre older, youll start scaling that back, depending on your goals and, again, your appetite for risk. Experts suggest checking that your investments are properly aligned with your risk tolerance each year and rebalancing as necessary, though how often you actually do will vary based on personal preference.

You May Like: How Much Tax To Rollover 401k To Roth Ira

Fidelity Investments And Paylocity Team Up To Provide Integrated Payroll Capabilities For Fidelity Advantage 401 Clients

Integration Will Drive Efficiency by Enabling Employers to Automate Contributions, Reduce Risk, and Deliver More Competitive Benefits

BOSTON-Fidelity Investments®, the countrys largest1 401 provider, and Paylocity, a leading provider of cloud-based HR and payroll software solutions, announced today that seamless access to payroll capabilities is now available with the Fidelity Advantage 401SM pooled employer plan . This enhancement will reduce the administrative burden on small- and mid-sized businesses offering retirement plans for their employees and help workers start saving towards their retirement goals.

Retirement benefits have traditionally been cost-prohibitive to smaller businesses, and workers are seeking financial security more than ever. According to a report2 by the Georgetown University Center for Retirement Initiatives, there are roughly 57 million private sector workers who do not have access to a retirement plan through their employers. This access gap more heavily impacts smaller businesses and disproportionately affects lower-income workers, younger workers, underrepresented communities, and women. At the same time, retirement planning is top-of-mind for workers, according to the Fidelity Investments 2021 State of Retirement Planning Study, which found that seven out of 10 workers in the U.S. are making changes to improve their retirement preparedness.

About Fidelity Investments

Adding Bitcoin To Your Fidelity 401 Account

In early 2022, Fidelity became the first major financial services firm to offer investors the chance to add crypto assets to their 401 retirement accounts. The company is a giant in the retirement business, holding more than $2 trillion in 401 assets, and administers the pension plans of more than 23,000 companies across the country. The company announced in April that by late 2022, employees will be able to add Bitcoin to their 401 accountsif their employer allows it.

Though this move was certainly a milestone for crypto, many analysts have been quick to point out that cryptocurrencies may be a poor choice for investors looking to build value over the long term.

- In early 2022, Fidelity Investments became the first firm to announce that employees could add cryptoin the form of Bitcointo their 401 accounts.

- The company will make this available to all 23,000 employers for which it oversees 401, and this is expected to be ready in the summer of 2022.

- Ultimately, it will depend on employers as to whether employees can add Bitcoin to their retirement accounts. Employers have a responsibility to offer prudent investment options in their 401 accounts, and at the moment, the Department of Labor has implicitly said that crypto doesnt meet this test.

- It remains to be seen, however, how many employers will allow their staff to buy Bitcoin in this way and at what volume.

You May Like: Can I Transfer Roth 401k To Roth Ira

How To Invest In El Salvador Bonds Via Fidelity

El Salvador bonds have gone down lately and I would like to invest in them. I use Fidelity to manage my 401k investment fund, but I can’t find any symbol to invest in related to El Salvador bonds.

Is there a fund of some sort that I can purchase that primarily deals with El Salvador bonds? I am based out of the USA.

- 1Do you know why they’ve gone down in value? What makes you think they will come back up?Sep 17, 2021 at 22:40

- 1 D StanleySep 17, 2021 at 22:41

- The imf downgraded their credit rating hitting their govt bonds, but I think the imf is wrong and I want to bet against them RobKohrSep 19, 2021 at 2:18

Most 401 programs have a very limited list of investments they allow. Many times it is a handful of stock funds , some bond funds, a few international choices, and the rest are geared to the estimated retirement date of the employee.

There as some companies that do allow the participants to access a broader set of investments via the investment company they work with. It is even possible that every possible investment is available.

If your 401 program doesn’t allow you to pick from this broader set of investments, then you will have to invest in those El Salvador bonds via an IRA or a taxable account.

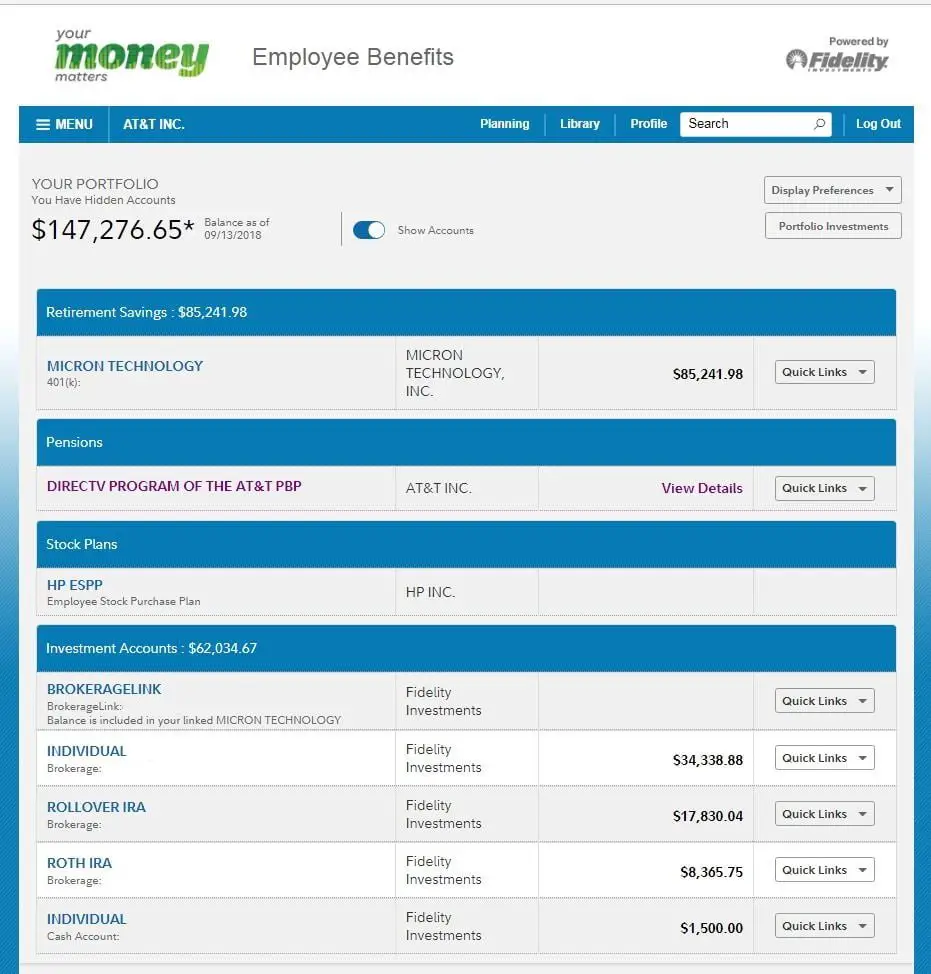

Fidelity Solo 401k Brokerage Account From My Solo 401k Financial

A Fidelity Investments Solo 401k brokerage account with checkbook control from My Solo 401k Financial is ideal for those looking to still have the option to invest in equities while also gaining checkbook control over their retirement funds for investing in alternative investments such as real estate, notes, tax liens, and private shares in addition to processing a solo 401k participant loan.

Recommended Reading: How Do I Find My 401k

Processing Solo 401k Loan Question:

I received the rollover check from John Hancock for my former employer 401k and will go into the local Fidelity Investments office tomorrow to deposit the check into the new brokerage account that you helped me set up for the self-directed solo 401k that you provide. I would like to make sure I understand the process to create a solo 401k participant loan against the balance. I think you all create the paperwork. Whats the method to move the loan amount from the fidelity account into my personal checking account. Do I just use the fidelity transfer functionality, get a check drafted or ?

Also, I will be rolling over an IRA account as well. Am I limited to 1 loan or can I take out a second loan against the additional amount?

Investment Giants Move Could Send Cryptocurrency Investing Further Into Mainstream If Employers Decide To Offer Option

Listen to article

Fidelity Investments plans to allow investors to put a bitcoin account in their 401s, the first major retirement-plan provider to do so.

Employees wont be able to start adding cryptocurrencies to their nest eggs right away, but later this year, the 23,000 companies that use Fidelity to administer their retirement plans will have the option to put bitcoin on the menu. The endorsement of the nations largest retirement-plan provider suggests crypto investing is moving further into the mainstream, but it remains to be seen whether employers will embrace it for their workers.

You May Like: How To Retrieve 401k Money

Regulators Skeptical Of Bitcoin For Retirement Legal Risks For Employers

The U.S. Labor Department, which regulates company sponsored retirement plans, said that Fidelitys could threaten the retirement security of Americans.

We have grave concerns with what Fidelity has done, Ali Khawar, acting assistant secretary of the Employee Benefits Security Administration, told The Wall Street Journal. The regulator is discussing its concerns with Fidelity, especially the 20% threshold.

Charles Field, managing partner of the San Diego office of Sanford Heisler Sharp and chair of the firms financial services group, says the SEC and Labor Departments warnings could provide support to any claimants in potential future litigation against companies and their fiduciaries.

Bitcoin still is experiencing growing pains, and with the next market upheaval will come claims that fiduciaries who approved Bitcoin breached their fiduciary duty of prudence, Field says. At this stage, there may not be enough disclosure out there that would protect employers from such claims. Employers who offer Bitcoin in their 401k plans do so at their own peril.

In addition to the potential legal risks to employers, its unclear just how appropriate of a retirement investment Bitcoin is. Bitcoin has been a tremendous investing success story up to this point, but many retirement investors are hoping to build wealth over several decades.