What Is A Hardship Withdrawal

A hardship withdrawal is an urgent removal of funds from a retirement plan and is usually done in emergency situations. Conducting a hardship withdrawal is considered a special distribution, which is exempt from any sort of financial repercussions if the withdrawal meets specific criteria.

Due to immediate need, a hardship withdrawal is usually done without a credit check.

An individual cannot withdraw in excess of their financial burden. The U.S. Internal Revenue Service states that such withdrawal is done for immediate and heavy financial need.

Only Withdraw The Minimum Amount

While this approach wont technically help you avoid penalties and taxes, it can help you minimize the impact overall. You should only withdraw the exact amount you need for your emergency.

Dont add an extra 30-50% to cover taxes and penalties if you can afford to replace any amount lost to penalties from your pocket.

Remember, youll stunt your retirement income with every withdrawal. Similarly, you should only ever withdraw from your 401 in a real emergency. Its counter-productive to withdraw from your 401 for a luxury purchase or even to pay off debt.

How Can I Avoid Paying Taxes On My 401k Withdrawal

Here’s how to minimize 401 and IRA withdrawal taxes in retirement:

Don’t Miss: How To Find Missing 401k Accounts

What Is The Difference Between A Hardship Withdrawal And A 401 Loan

Hardship withdrawals are allowed when there is an immediate, pressing need. The amount on these withdrawals is dependent on how much you need for the financial situation, and the IRS will tax them. 401 loans are better for cases where the financial need is not dire. You’ll be able to borrow half of whatever is in your account, but you will be required to pay it back.

Advantages Of A Hardship Withdrawal

In a time of financial distress and need, proceeding with a hardship withdrawal can be a financial self-preservation saving strategy. Listed below are the advantages of taking out a hardship withdrawal:

- It provides immediate financial relief.

- It reduces financial stress, anxiety, and worry.

- The funds can be distributed quickly, without a background check.

- Individuals can access funding for legitimate purposes, such as medical expenses, university tuition, and housing costs.

It should be emphasized that a hardship withdrawal should only be done in situations where there is no other option present. This is because there are a number of long-lasting tax implications that may be felt by the individual.

Read Also: How Do I See How Much Is In My 401k

Why Did Gethuman Write How Do I Withdraw My Retirement Or 401k Money From My Merrill Lynch Account

After thousands of Merrill Lynch customers came to GetHuman in search of an answer to this problem , we decided it was time to publish instructions. So we put together How Do I Withdraw My Retirement or 401k Money from My Merrill Lynch Account? to try to help. It takes time to get through these steps according to other users, including time spent working through each step and contacting Merrill Lynch if necessary. Best of luck and please let us know if you successfully resolve your issue with guidance from this page.

Convert The 401 To An Ira

Individual retirement accounts typically have different withdrawal rules compared to 401s. So, converting to an IRA first might save you the 10% early withdrawal penalty.

Theres also no mandatory tax withholding on IRA withdrawals, so youre almost certain of a bigger check. Youll still pay the tax when its time to file returns, but youll have more money to deal with the situation in the immediate term.

Its a perfect option to go with for those in a lower tax bracket sure of getting refunds.

However, before switching to an IRA, you need to make sure you understand the peculiarities, including fees.

Also Check: How To Combine Fidelity 401k Accounts

Types Of 401 Hardship Withdrawals

A hardship withdrawal is defined by the IRS as a withdrawal that is ânecessary to satisfy an immediate and heavy financial need.â Account holders are expected to exercise all other available options to meet their financial need before dipping into their 401, and after a hardship withdrawal is made, they cannot defer income into their account for 6 months.

The IRS allows hardship withdrawals for the following reasons, but plans may vary in what they permit. Some hardship withdrawals do come with income tax and the 10% penalty, some do not.

Can I Withdraw From My 401k If I Have An Outstanding Loan

Restrictions will vary by company but most let you withdraw no more than 50% of your vested account value as a loan. You can use 401 loan money for anything at all. Though you may repay the money you withdraw, you lose the compounded interest you would have received had the money just sat in your account.

Don’t Miss: How To Take Out Money From My 401k

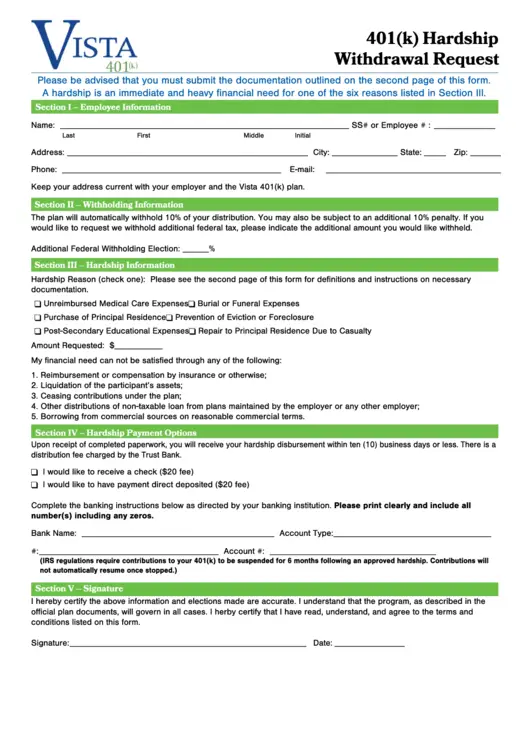

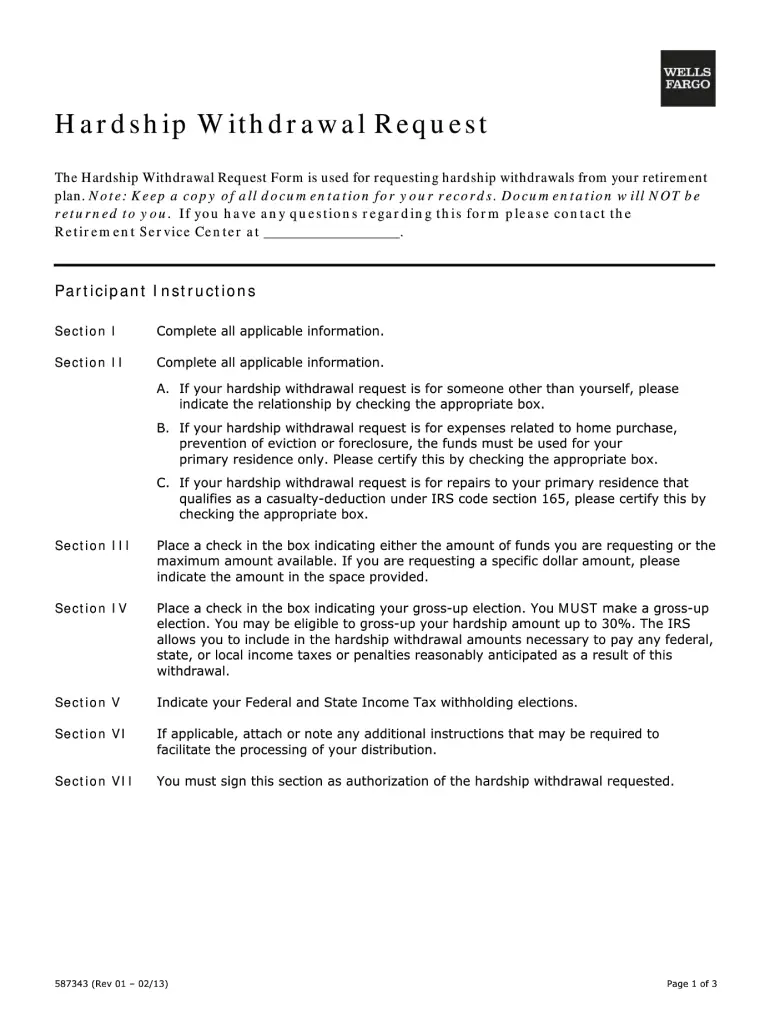

Sending The Hardship Withdrawalform To The Program

Once you receive the participants completedform, and Form W-4P , you must review and sign it as theAuthorized Plan Representative. Submit the completed Hardship Withdrawal Formto the Program via mail or email.

Once the Program receives the properlycompleted and signed Hardship Withdrawal Form, the hardship withdrawal isprocessed and a check is issued withintwo business days. Hardship withdrawal checks are sent via overnight deliveryto the participant at the firm. In January of the next calendar year, theProgram will mail the participant an IRS Form 1099-R regarding any taxablewithdrawals for the prior tax year.

Any withdrawals processed by the close ofbusiness on the last business day of the quarter will be reflected on theparticipants quarterly statement. Quarterly statements are mailed no laterthan 10 business days after the end of each quarter.

Cashing Out Your 401k While Still Employed

The first thing to know about cashing out a 401k account while still employed is that you cant do it, not if you are still employed at the company that sponsors the 401k.

You can take out a loan against it, but you cant simply withdraw the money.

If you resign or get fired, you can withdraw the money in your account, but again, there are penalties for doing so that should cause you to reconsider. You will be subject to 10% early withdrawal penalty and the money will be taxed as regular income. Also, your employer must withhold 20% of the amount you cash out for tax purposes.

There are some exceptions to the rule that eliminate penalties, but they are very specific:

- You are over 55

- You are permanently disabled

- The money is needed for medical expenses that exceed 10% of your adjusted gross income

- You intend to cash out via a series of substantially equal payments over the rest of your life

- You are a qualified military reservist called to active duty

Recommended Reading: Who Is Eligible For Solo 401k

How To Withdraw Money From Your 401

The 401 has become a staple of retirement planning in the U.S. Millions of Americans contribute to their 401 plans with the goal of having enough money to retire comfortably when the time comes. Whether youve reached retirement age or need to tap your 401 early to pay for an unexpected expense, there are various ways to withdraw money from your employer-sponsored retirement account. A financial advisor can steer you through these decisions and help you manage your retirement savings.

Tips On 401 Withdrawals

- Talk with a financial advisor about your needs and how you can best meet them. SmartAssets financial advisor matching tool makes it easy to quickly connect with professional advisors in your local area. If youre ready, get started now.

- If youre considering withdrawing money from your 401 early, think about a personal loan instead. SmartAsset has a personal loan calculator to help you figure out payment methods.

Recommended Reading: When Can You Withdraw From 401k Without Penalty

Writing A Request Letter For A 401k Hardship Withdrawal

It is generally not allowed to withdraw money from an employer-sponsored retirement account, but there are exceptions. If the employee is faced with serious hardships that affect his or her financial situation, the Internal Revenue Service offers provision for hardship withdrawals.

Some employers do not allow such withdrawals, but if an employer does allow it, the employee must write a hardship withdrawal letter that gives the reason with details that he or she needs the money. It is recommended to include documentation that proves the case.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Read Also: Can I Open An Ira If I Have A 401k

What Are The Exceptions To Withdrawing From 401k

You may qualify to take a penalty-free withdrawal if you meet one of the following exceptions: You become totally disabled. You are in debt for medical expenses that exceed 7.5 percent of your adjusted gross income. You are required by court order to give the money to your divorced spouse, a child, or a dependent.

What Documentation Do I Need For A 401k Hardship Withdrawal

Documentation of the hardship application or request including your review and/or approval of the request. Financial information or documentation that substantiates the employee’s immediate and heavy financial need. This may include insurance bills, escrow paperwork, funeral expenses, bank statements, etc.

Also Check: Can You Take Money Out Of 401k

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses dont necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Recommended Reading: When Can I Withdraw From My 401k

When A 401 Hardship Withdrawal Makes Sense

Many workers count on their 401s for the lions share of their retirement savings. That’s why these employer-sponsored plans shouldn’t be the first place you go if you need to make a major expenditure or are having trouble keeping up with your bills.

But if better options are exhaustedfor example, an emergency fund or outside investmentstapping your 401 early may be worth considering.

You May Like: Can I Set Up My Own 401k Plan

How Long Does It Take To Get My 401k Money After I Quit My Job

When you leave a job, you can decide to cash out your 401 money. Generally, when you request a payout, it can take a few days to two weeks to get your funds from your 401 plan. However, depending on the employer and the amount of funds in your account, the waiting period can be longer than two weeks.

Get A 0% Apr Credit Card

A 0% APR credit card will likely get you the funds you need, but you need to have good-to-excellent credit to be approved for one of these. You also need to be sure you can repay the balance in full before the 0% APR period ends. The average term on most of these cards is 18 months, but some providers may offer more or less time.

Recommended Reading: Can I Borrow From My 401k Without Penalty

Take A Home Equity Loan

If you own a home, you can consider going with a home equity loan instead. Youll need at least 20% equity to secure the loan. The average interest rate on these loans is around 5.33%, which is much better than the rates on other forms of financing . You should also note that there are no tax deductions unless youre reinvesting the loan into your home.

Hardship Withdrawals Allowed With Taxes And Penalty:

You May Like: How Do I Locate An Old 401k

How 401 Loans Work

A 401 loan lets you borrow money from your workplace retirement account on the condition that you pay back the amount you borrow with interest. The good news is that the payment amounts and the interest go right back into your account.

The interest rate you pay on a 401 loan can change over time. According to Debt.org, the interest rate you would pay on a 401 loan is usually a point or two above the lending rate used by banks. The rates used by banks is called the prime rate and it’s influenced by the federal funds rate, so it can change over time. So if the prime rate is 5.2%, the interest rate you pay on your 401 loan may be around 6.2% to 7.2%.

Because your 401 is an employer-sponsored account, you’ll need to abide by your employer’s plan rules around taking out a 401 loan. Many employers have limits for how much of your balance you’re allowed to borrow and how many loans you can take from your account per year you’ll need to double check the guidelines around your employer’s plan before you take the next steps to borrow from your 401.

Keep in mind that if you were to leave your job before repaying a 401 loan in its entirety, you might have to repay the money you borrowed immediately .

Additional Money Types Will Be Available For Hardship Distributions

- As of January 1, 2019 , earnings on employee deferrals, qualified nonelective contributions , qualified matching contributions , employer actual deferral percentage safe harbor and qualified automatic contribution arrangements safe harbor contributions, and earnings on all these amounts may be included in hardship distributions.

- A plan may decide not to allow these assets to be taken for hardship reasons.

Recommended Reading: What To Invest My 401k In

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Make Retirement Your Own Merrill Lynch

Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America Corporation. Trust, fiduciary and investment management services are provided by Bank of America, N.A. and its agents, Member FDIC, or U.S. Trust Company of Delaware.

Recommended Reading: How To Cash In Your 401k Early

Recommended Reading: How Do I Access My 401k Funds

Penalties For Home And Tuition Withdrawals

Under U.S. tax law, there are several other scenarios where an employer has a right, but not an obligation, to allow hardship withdrawals. These include the purchase of a principal residence, payment of tuition and other educational expenses, prevention of an eviction or foreclosure, and funeral costs.

However, in each of these situations, even if the employer does allow the withdrawal, the 401 participant who hasn’t reached age 59½ will be stuck with a sizable 10% penalty on top of paying ordinary taxes on any income. Generally, youll want to exhaust all other options before taking that kind of hit.

“In the case of education, student loans can be a better option, especially if they’re subsidized,” says Dominique Henderson, Sr., owner of DJH Capital Management, LLC, a registered investment advisory firm in Cedar Hill, Texas.