When A Traditional 401 Makes More Sense

I generally recommend that clients contribute to a traditional 401 because a Roth doesnt have the same conversion option. Especially if youre a parent with kids at home, you may want to take the tax deduction now to help you save on taxes and increase your cash flow.

With a traditional 401, you have more control over when and where you pay your taxes since you may be living in a different state when you retire. If you experience a period of lower income, it may present a great opportunity to convert a traditional 401 into a Roth individual retirement account at a lower tax rate.

For example, individuals who stop working prior to their full retirement age and dont start taking Social Security immediately may see a significant drop in their tax rate. This can be a tax-efficient time to convert. The same holds true for changing your retirement address to avoid cities and states that impose larger income taxes. Therefore, it doesnt make sense to contribute to a Roth 401 while living in New York City unless you know that you are going to retire in an area with a similarly high tax rate. For many of us, the added flexibility associated with a traditional 401 is what, in my opinion, makes it the employer-sponsored retirement plan of choice.

Understanding Taxes With A Roth 401

Withdrawals from a Roth 401 are not taxed if theyre considered qualified distributions. In order for a distribution to be considered qualified, it must meet these criteria:

- The account must have been held for at least five years.

- You must be at least 59 1/2 years old.

- Qualified distributions may also be taken if youre disabled, or if you die and the account is passed on to your heirs.

Your entire qualified distribution is free of taxes. This means that the money you contributed, plus all of the gains you earned on the money while it was invested, can be withdrawn tax-free. This is what makes the Roth 401 such a powerful retirement savings tool.

Roth 401 Contribution Limits

Both Roth 401s and traditional 401s have the same contribution limits. In 2021, employees may contribute up to $19,500, with additional catch-up contributions of $6,500 available for savers who will be 50 by the end of the year. For 2022, the maximum employee contribution is $20,500, plus an extra $6,500 if youre 50 or older.

| 2021 Limit | ||

|---|---|---|

|

Catch-Up Contributions for those 50 or Older |

$6,500 |

$6,500 |

These limits are cumulative: If you have more than one 401 accountfor instance, both a Roth 401 and a traditional 401, or 401 accounts with two employers after changing jobscombined annual contributions to both accounts cannot exceed the limits.

The combined limit on employer matching contributions and employee contributions in 2021 is the lower of $58,000 or 100% of an employees compensation . For employees over 50, the combined limit is $64,500 in 2021, inclusive of the $6,500 catchup contribution. In 2022, the maximum is $61,000 or $67,500 if you are 50 or older.

You May Like: How To Set Up 401k In Quickbooks

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Which Is Right For You

A Roth IRA is a great way to save for retirement if you dont work for a company that offers a 401. But if your employer offers a 401 and matches part of your contributions, try to contribute enough to get the full match. Otherwise, youre passing up free money.

Fortunately, you dont have to pick between a Roth IRA vs. a 401. As long as your income falls within the Roth IRA income limits, you can fund both accounts.

Once youve gotten your full employer 401 match, it often makes sense to focus next on maxing out your Roth IRA because with it, you have more investment options and the ability to access your contributions whenever you want. If you have extra money to invest beyond that, you can increase your 401 contributions.

Also Check: How Soon Can I Get My 401k After I Quit

Should I Roll Over My Traditional 401 To A Roth 401

There isnt a one-size-fits-all answer when it comes to rolling over your retirement savings to a Roth account. If it makes sense for your situation, a Roth conversion is a great way to take advantage of tax-free growth on your accounts.

But keep in mind that rolling over a traditional 401 means paying taxes on it now. And if youre converting a large sum all at once, it could bump you into a higher tax bracket . . . which means a bigger tax bill.

If you can pay cash for the taxes without taking money out of your nest egg and youre still several years away from retirement, it may make sense to roll it over. But whatever you do, do not pull that money out of the investment itself!

Before you roll over accounts, make sure to sit down with an experienced investment professional. Theyll help you understand the tax impact of rolling over your 401 and figure out whether it makes sense for your situation.

As More Employers Offer Both Retirement Plans It’s Important For Employees To Know The Difference

More and more employers are adding Roth options to their 401 plans. If you recently gained the option to save in a Roth account, you may need to examine the advantages and disadvantages of a Roth 401versus a traditional 401.

The biggest difference between a Roth account and a traditional 401 account is how you’re taxed. With a traditional 401, you’ll save on income tax now and pay income tax on your withdrawals in retirement. With a Roth 401 you’ll pay income tax on your contributions, but no tax when you withdraw funds from the account. However, there are several caveats to consider.

Don’t Miss: How Do I Withdraw Money From My 401k Fidelity

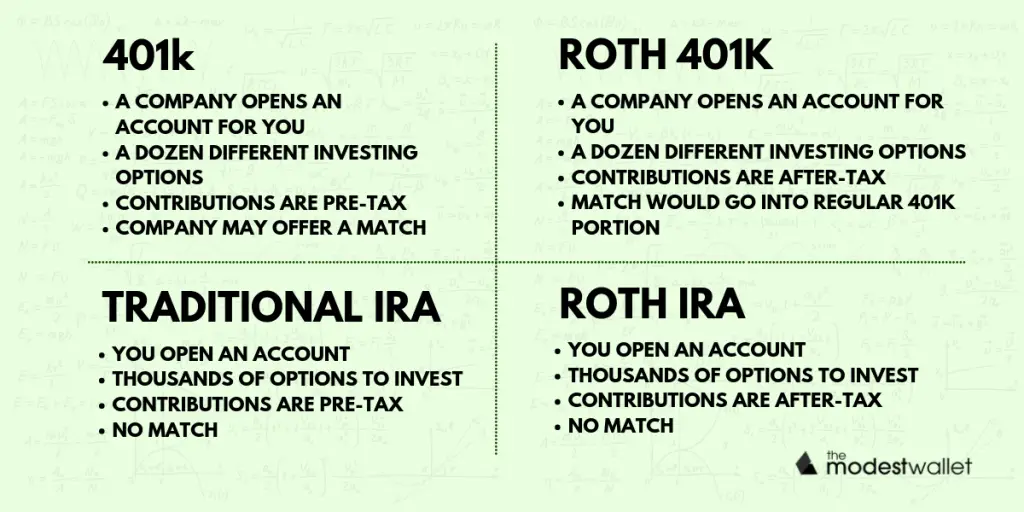

What Is A Roth 401k

A Roth 401k is an employer-sponsored retirement plan. But unlike a traditional 401k, contributions are made with after-tax dollars.

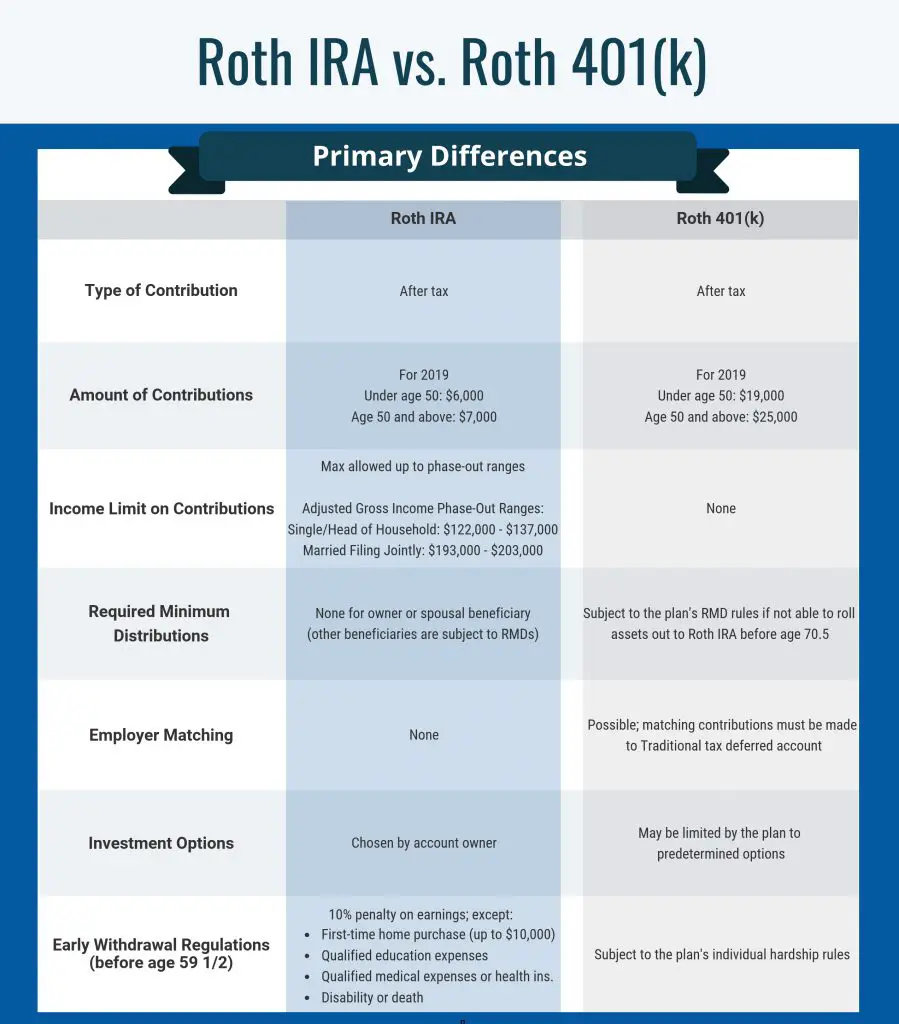

For context, the Roth 401k was introduced in 2006 to give Americans a new type of retirement savings vehicle to complement the popular Roth IRA, which was introduced in 1997. Roth IRAs and Roth 401ks are similar, but there are some pretty significant differences you should understand when deciding which one is right for you.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, sit down with a financial advisor or investment pro who can help you understand your choices so that you can make the best decision for your retirement future.

Need help looking for a qualified investment pro? Try the SmartVestor program! Its a free way to get connected with financial advisors near you. You can start building a relationship with a pro who understands the financial journey youre on today!

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.Learn More.

Read Also: How To Transfer 401k Between Jobs

Pros And Cons Of A Roth Ira

On the flip side, Roth IRAs generally offer more investment options than Roth 401ks. With a Roth IRA, you have the entire universe of investments to choose from, including stocks, bonds, cash equivalents, and alternative investments. With a Roth 401k, you are limited to the investment options offered by your employers 401k plan, which can be as few as three.

However, one con of a Roth IRA is the income limit associated with this type of account. If you earn too much money, you wont be able to contribute to this option. Roth IRAs also arent sponsored by an employer, which means that there is no employee contribution match.

Pros And Cons Of The Roth 401 And Roth Ira

The table below shows the pros and cons of both account types.

| Account Type |

|---|

|

Itâs worth noting that you might be able to avoid the required withdrawals from a Roth 401 by converting it to a Roth IRA.

Recommended Reading: What Should I Do With My Old Company 401k

Read Also: Can A Roth 401k Be Converted To A Roth Ira

How Roth And Traditional 401s Differ

The key difference between a Roth and traditional 401 comes down to when your savings are taxed.

Traditional 401s are pre-tax accounts, meaning the money comes straight “off the top” of your paycheck. As a result, you receive a current-year tax reduction of your income. In return, you’ll pay income tax when you start withdrawing money, usually after you retire.

A Roth 401, like a Roth IRA, is a post-tax account: Your contributions do not lower your taxable income in the year that you make them. However, on the flip side, all qualified distributions IRS-speak for withdrawals of your earnings are tax-free.

Here’s how a Roth 401 and 401 differ on paper:

Minimizing Taxes To Maximize Your Retirement Contributions

If you dont expect any material change in your income tax rate between your working years and retirement, it generally wont make a difference whether you choose a traditional 401 or a Roth 401. However, if you do expect some variation in your income tax rate, it makes sense to dig a bit deeper before making a final decision.

A major goal when making retirement contributions is to minimize taxes when your tax rate is high. But this is not always an easy thing to know because you must anticipate how your federal, state, and local income taxes could change over time. If you are working in a state with high income taxes, like California or New York, and you plan on retiring in a state with low income taxes, like Florida or Texas, using a traditional 401 would be preferred since the expected savings in state income tax today are likely to exceed the expected increase in federal income taxes in the future.

Though you cannot predict future tax rates, you can estimate how much income you will need in retirement and where you plan to live during your retirement years. Having these two pieces of information can help to clarify whether you should contribute to a traditional 401 or a Roth 401.

Read Also: How To Find Lost 401k

Enter The Roth 401k/403b

Almost 80% of these qualified plans now offer a Roth option for employee contributions. The main difference between Roth 401k contributions and Traditional 401k contributions is when you owe federal income tax on the money. When making Traditional contributions, you get an upfront tax benefit because your taxable income is reduced by the amount you contribute. For example, if youre in the 32% marginal tax bracket and you contribute the maximum $19,500 contribution for 2020, you would reduce your 2020 income tax bill by $6,240 which is significant savings to be sure. It isnt until you begin withdrawing your money that your withdrawals are taxed to you as regular income at whatever your marginal tax rate is for that year.

When you contribute to a Roth 401k/403b the money is taxed in reverse. Youll owe federal income tax on the amount you contribute for the year the contribution was made. However, assuming some basic conditions are met, youll wont owe any taxes on that money when its withdrawn. If youre in the 32% marginal tax bracket and you contribute $19,500 to your Roth account in 2020, youd owe $6,240 in federal income tax however, the IRS will never be able to tax that money, or the decades of compounded growth that it generates over the years, again! This benefit cannot be overstated!

If Tax Rates Dont Change

In the unlikely scenario that income tax rates dont go up between now and when you retire, there will be no difference between a Roth or traditional 401 investment. Whether youre taxed now or later your investment growth and payment will be the same.

David Weliver at Money Under 30 advises not to assume the tax payment will be the same whether you pay now or later.

Of course, no one knows for sure what taxes will be in the future, but most people assume taxes wont go down, he wrote. If youre young and professionally ambitious, its a good assumption that youll be in a higher tax bracket as a successful retiree than you are now on an entry-level salary.

Read Also: How Much Can I Rollover From 401k To Ira

You Can Withdraw Your Contributions From Either Plan At Any Time Tax

There is another unique feature of Roth accounts, and it applies to both Roth IRAs and Roth 401s. That is, you can withdraw your contributions from a Roth plan at any time, without having to pay either ordinary income tax or the 10% early withdrawal penalty on the distributions.

This is in part because Roth IRA contributions are not tax-deductible at the time they are made. But its also true because of IRS ordering rules for distributions that are unique to Roth plans. Those ordering rules enable you to take distributions of contributions, ahead of accumulated investment earnings.

There is some difference in exactly how early distributions are handled among Roth IRAs and Roth 401s.

Early distributions from Roth IRAs enable you to first withdraw your contributions which were not tax-deductible and then your accumulated investment earnings once all of the contributions have been withdrawn. This provides owners of Roth IRAs with the unique ability to access their money early, without incurring tax consequences.

With Roth 401s the contribution portion of your plan can also be withdrawn free of both ordinary income tax and early withdrawal penalties. But since theyre 401s, theyre also subject to pro-rata distribution rules.

If you have a Roth 401 that has $20,000 in it, comprised of $14,000 in contributions and $6,000 in investment earnings, then 30% of any early distribution that you take, will be considered to represent investment income.

Roth Ira Vs : What Are The Major Differences

The main difference between a Roth IRA and 401 is how the two accounts are taxed. With a 401, you invest pretax dollars, lowering your taxable income for that year. But with a Roth IRA, you invest after-tax dollars, which means your investments will grow tax-free.

Okay, folks, does anybody else feel like theyve been drinking water from a firehose? That was a lot of information! Lets review the main differences between the Roth IRA and the 401 so you can easily compare their features:

|

Feature |

Also Check: Is It Better To Rollover Your 401k

Weighing The Pros And Cons

Roth IRAs and Roth 401ks are both good options for retirement savers. The answer to which account is the better option will really depend on your unique situation. Its always a good idea to talk to your financial advisor to weigh the pros and cons and come up with what the best choice is for your situation.

Read More:What is a Fiduciary? Heres Why It Matters in Money Management

Which Is Best For You

This decision mainly comes down to how you want to put money into the account and how you want to take money out.

Lets start with today putting money in. If youd prefer to pay taxes now and get them out of the way, or you think your tax rate will be higher in retirement than it is now, choose a Roth 401.

Youre also giving yourself access to a more valuable pot of money in retirement: $100,000 in a Roth 401 is $100,000, while $100,000 in a traditional 401 is $100,000 less the taxes youll owe on each distribution.

In exchange, each Roth 401 contribution will reduce your paycheck by more than a traditional 401 contribution, since it’s made after taxes rather than before. If your primary goal is to reduce your taxable income now or to put off taxes until retirement because you think your tax rate will go down, you will do that with a traditional 401.

Just know that:

-

Youre kicking those taxes down the road, to a time when your income and tax rates are both relatively unknown and might be higher if you advance in your career and start earning more

-

If you want the after-tax value of your traditional 401 to equal what you could accumulate in a Roth 401, you need to invest the tax savings from each years traditional 401 contribution. For more on this, see our study on the Roth IRA advantage, which also applies here.

Also Check: Why Rollover Old 401k To Ira

Can I Have A Roth 401k And A Roth Ira

Yes, you can have both a Roth 401k and a Roth IRA. Keep in mind the contribution limits for each account.

If you receive a Roth 401k option through your employer, heres one strategy to consider: contribute enough money to your Roth 401k to receive the company match, since this match represents a risk-free return on your investment. Then you can also open a Roth IRA and contribute any additional retirement money you have to this account in order to diversify your retirement savings.