Tip : Money Stylespender Or Saver

Some people spend all of their available money, some people tend to save it. That’s no judgment against spenders: How you manage your money can help you choose which type of account may make sense for you.

Other things equal, and assuming contributions of similar size, traditional accounts preserve more money to spend today while Roth accounts tend to provide more money to spend in the future. Traditional 401, 403, and IRA contributions leave money in your pocket because they generally lower your current taxable income. But these tax savings can help you reach your retirement goal only if you invest them. If you spend your tax savings, it’s not going to help you when you retire.

On the other hand, a contribution to a Roth account reduces the amount of money left in your pocket compared with a similar contribution to a traditional account, because you pay taxes on your contributions up front. If youre like many people who tend to spend their take-home pay, opting for a Roth and thus having less available to spend might be a good thing when it comes to your retirement savings. In other words, because youve already paid your taxes today, you get more to spend tomorrow.

Which type of account may be right for you?

Sam ends up with the most. His Roth IRA, like Sara and Brian’s traditional IRAs, grows to $38,061, but unlike them he doesn’t have to pay any tax when he withdraws the money. The Roth IRA gives Sam 2 advantages over the other 2 investors:

Traditional And Roth 401 Plans

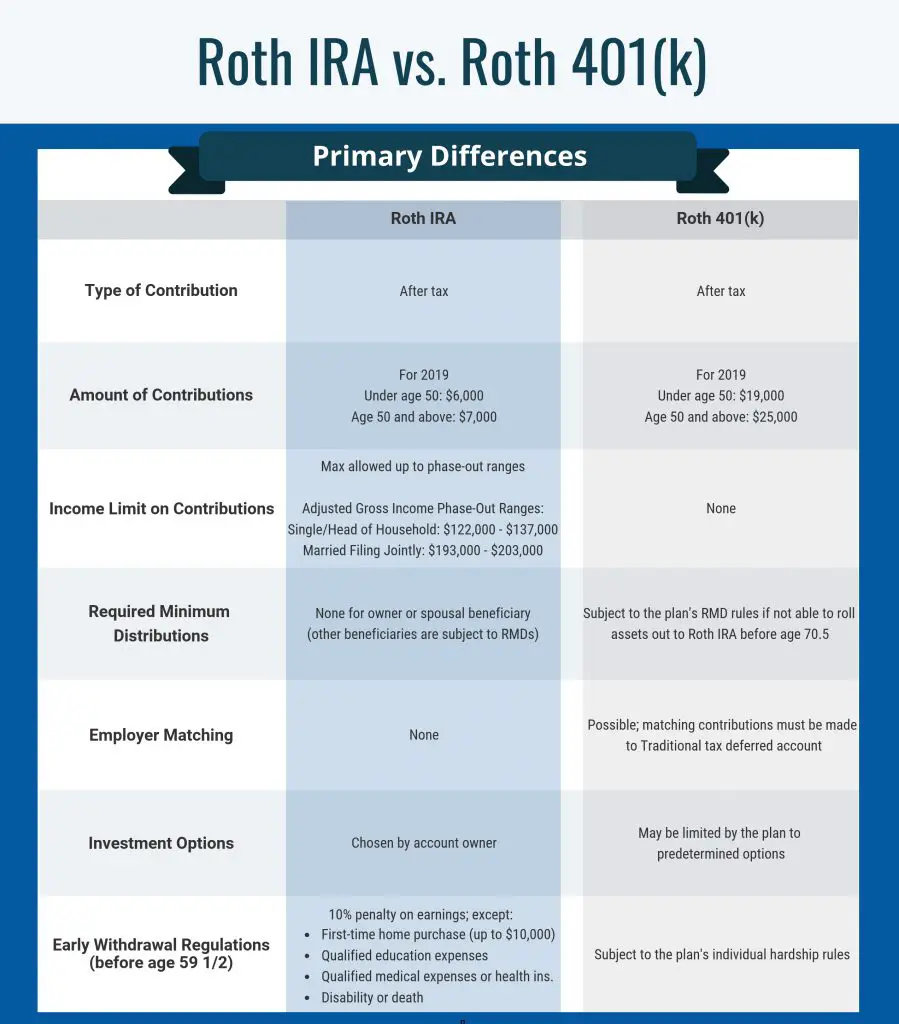

Individuals who want to save for retirement may have the option to invest in a 401 or Roth 401 plan. Both plans are named for the section of the U.S. income tax code that created them. Both plans offer tax advantages, either now or in the future.

With a traditional 401, you defer income taxes on contributions and earnings. With a Roth 401, your contributions are made after taxes and the tax benefit comes later: your earnings may be withdrawn tax-free in retirement.

Also Check: How To Divide 401k In Divorce

Its Not Only About Taxes

Taxes are important, and they’re the primary factor in this debate. But there are other points to consider:

-

Whether youre eligible for a Roth IRA.Roth IRAs have income limits Roth 401s do not. If you earn too much to be eligible for the Roth IRA, the Roth 401 is a chance to get access to the Roths tax-free investment growth.

-

Certain income thresholds in retirement. Taking some of your retirement income from a Roth can lower your gross income in the eyes of the IRS, which may in turn lower your retirement expenses. A lower income in retirement may reduce the taxes you pay on your Social Security benefits and the cost of your Medicare premiums that are tied to income.

-

Access to your retirement money. Unfortunately, the Roth 401 doesnt have the flexibility of a Roth IRA you can’t remove contributions at any time. In fact, in some ways its less flexible than a traditional 401, due to that five-year rule: Even if you hit age 59½, your distribution wont be qualified unless youve also held the account at least five years. Thats something to keep in mind if youre getting a late start.

-

Required minimum distributions in retirement. Both accounts require account owners to begin taking distributions at age 72, but money in a Roth 401 can easily be rolled into a Roth IRA, which will then allow you to avoid those distributions and even pass that money on to heirs.

Also Check: Can I Rollover My 401k Into My Spouse’s Ira

What Kinds Of Mutual Funds Should I Choose For My Roth 401

Diversifying your portfolio is key to maintaining a healthy amount of risk in your retirement savings. Thats why it’s important to balance your investment among four types of mutual funds: growth and income, growth, aggressive growth, and international funds.

If one type of fund isnt performing as well, the other ones can help your portfolio stay balanced. Not sure which funds to select based on your Roth 401 options? Sit down with an investment professional who can help you understand the different types of funds, so you can choose the right mix.

What Does Roth Mean Where Did The Term Come From Why Is It Called Roth Is Roth An Acronym

Lets start with the word Roth. The word Roth originates from Senator William Roth of Delaware. In 1989 Senator Roth teamed up with Senator Bob Packwood of Oregon. They proposed the IRA Plus Plan which allowed individuals to invest up to $2,000 with no tax deductions. The earnings could be later withdrawn tax-free at retirement.

The Roth IRA was eventually established by the Taxpayer Relief Act of 1997 and named after Senator Roth. In 2000, 46.3 million taxpayers held IRA accounts amounting to $2.6 trillion. Only about $77 billion was held in Roth IRAs. Seven years later the number of IRA owners jumped to 50 million with $3.3 trillion invested.

Don’t Miss: How Much Should I Put In 401k

Types Of Retirement Accounts: Iras And 401s

We can help. By learning about your options, you can choose the type of savings account thats right for your life, now and in the future.

Lets start with the two most common ways to saveIndividual Retirement Accounts and 401 accounts. Well break down the similarities and differences between traditional 401s and traditional IRAs, then share details around Roth IRAs and Roth 401s, giving you a basic understanding of each.

What Happens To My Roth 401 When I Quit

Once you leave your job with an employer you have four options about what to do with your Roth 401 plan.

Also Check: Can I Invest My 401k

Heres What To Do On Roth 401 Vs Roth Ira:

-

If your 401 investments are pricey, contribute just enough to get the company match, and then proceed directly to a brokerage to open a Roth IRA.

-

If your 401 offers low-cost mutual funds, then youre ready to check out our chart to decide whether the Roth IRA or Roth 401 makes the most sense for you. Or, if youre ready to maximize your retirement savings, go ahead and contribute to both.

Talk With An Investment Pro About Your Roth 401

If you want to learn more about your Roth 401 or other investing options, find an investing pro in your area. A financial advisor can help you understand your investments and make confident decisions.

A do-it-yourself approach to investing is never a good idea. Even the pros work with a financial advisor! Your familys future is way too important to wing it.

Looking for a qualified investing pro? Try the SmartVestor program! Its a free way to find top-rated financial advisors near you. Start building a relationship with an investing pro who understands the financial journey youre on.

You May Like: Who Has The Best 401k Match

Pros And Cons Of A Roth 401k

A big advantage that the Roth 401k has over the Roth IRA is the possibility of an employer matching your contributions up to a certain percentage. Employer matches are the closest thing there is to free money, so if youre deciding between a Roth 401k vs. a Roth IRA keep this in mind. Its also important to note here, though, that if you receive an employer Roth 401k match, the matching funds would also go into a traditional 401k.

A con, however, is that a Roth 401k account typically has fewer investment options than a Roth IRA.

Roth Ira Vs 401 At A Glance

| Individual stocks and bonds, mutual funds, and ETFs. | Employer is responsible for choosing the investments. Mutual funds are the most common. | |

| Withdrawal Rules | Can withdraw contributions at any time without paying taxes or penalties, unless under age 59 ½. | Taxes and 10% penalty due for withdrawing money before age 59 ½, or age 55 if youve left your job. Some withdrawal exceptions exist that avoid 10% penalty. |

A Roth IRA is a type of individual retirement arrangement, though its more commonly referred to as an individual retirement account. You choose a brokerage, fund the account, and decide what you want to invest the money in. You dont get a tax break when you fund a Roth IRA. However, your withdrawals are tax-free when you reach age 59 ½, though you can access your contributions at any time without paying taxes or a penalty.

A 401 is an employer-sponsored retirement plan that allows you to defer a portion of your salary, which lowers your taxable income. However, more than 86% of plans now allow employees to also make post-tax Roth contributions, according to the Plan Sponsor Council of Americas 64th Annual Survey of 401 and Profit Sharing Plans. Some plans match a portion of employee contributions, providing extra incentive to invest.

You can contribute to both a Roth IRA and a traditional IRA in a tax year. However, your contributions between the two accounts cant exceed the IRA contribution limit for the year.

Don’t Miss: What Year Did 401k Start

How Much Money Should You Have In Your 401 When You Retire

When you want to retire is the biggest factor that determines how much money you need in your 401. The average retirement age for most people is some time in their 60s or 70s.

Some general guidelines are as follows. By the time youre 30, you should have saved half of your annual salary. So if youre earning $50,000 by age 30, you should have $25,000 in retirement savings. By age 40, you should have saved twice your annual salary. By age 50, it goes up to four times. Age 60, six times. If you reach 67 and are earning $75,000 per year, you should have $600,000 saved.

A Roth Conversion Will Trigger A Tax Bill But This Years Stock Market Volatility May Work In Your Favor

If youve been thinking about converting money from a traditional individual retirement account to a Roth IRA, this may be a prime time to bust a move.

Last Monday, the Dow Jones Industrial Averageplunged 876 points following a stomach-churning inflation report. The S& P 500 stepped into bear-market territory after dropping 3.9%, or 151.23 points. On top of that, the Federal Reserve raised interest rates by 75 basis points during Junes Federal Open Market Committee meeting.

The recent market moves may not be good for your portfolio, but it could be a potential win if you decide to do a Roth conversion. Here are a few items to consider before you shift funds from a traditional to a Roth IRA.

Read Also: Can You Use Your 401k For A House Down Payment

Recommended Reading: How To Get My 401k Money From Walmart

Whether Or Not You Want To Withdraw Roth Ira Contributions Or Earnings

The most important factor in your decision should be how much money you are able to contribute to each account because this will determine how soon you can retire.

Since the limit for Roth IRA is lower than that for a 401, if you have the choice of contributing to one or the other, it is usually better to contribute to a Roth IRA because you will not get an immediate tax break and your money can grow without paying taxes.

Roth 401k Vs Roth Ira: How Are They Similar

Before we look at the differences between Roth IRAs and Roth 401ks, lets look at the similarities. Heres the big one: with both of these accounts, your investments grow without the burden of taxation. This can mean a larger nest egg when you decide youre ready to retire.

Also, in most circumstances, you can withdraw money from both a Roth IRA and a Roth 401k income tax-free after you turn 59 1/2. Practically, this means favorable tax treatment in retirement, since you wont have to pay taxes on the distributions you take after you hit 59 ½.

With a Roth IRA, you can withdraw contributions penalty-free, but earnings will generally be taxed and penalties assessed on any withdrawals made before age 59½, with a few exceptions. With Roth 401ks, withdrawals before age 59½ are usually taxed and assessed a penalty, but there are ways to avoid this .

Read More:When Can I Withdraw From My 401k or IRA Penalty-Free?

Also Check: How To Find Out Who Your 401k Is With

Whether Or Not Your Income Makes You Eligible For A Deductible Ira

Even though Roth IRA has a lower contribution limit than the deductible IRA if you are in a higher tax bracket now compared to what you expect your retirement tax bracket to be, then go with Roth IRA because withdrawals will be tax-free. If itâs vice versa, then a deductible IRA might be the better option for you.

How Much Should I Contribute To My 401

Most financial experts say you should contribute around 10%-15% of your monthly gross income to a retirement savings account, including but not limited to a 401.

There are limits on how much you can contribute to it that are outlined in detail below.

There are two methods of contributing funds to your 401.

The main way of adding new funds to your account is to contribute a portion of your own income directly.

This is usually done through automatic payroll withholding ).

The system mandates that the majority of direct financial contributions will come from your own pocket.

It is essential that, when making contributions, you consider the trajectory of the specific investments you are making to increase the likelihood of a positive return.

The second method comes from deposits that an employer matches.

Usually employers will match a deposit based on a set formula, such as 50 cents per dollar contributed by the employee.

However, employers are only able to contribute to a traditional 401, not a Roth 401 plan.

This is especially important to keep in mind if you want to utilize both types of plans.

A key variable to keep in mind is that there are set limits for how much you can add to a 401 in a single year.

For employees under 50 years of age, this amount is $19,500, as of 2020. For employees over 50 years of age, the amount is $25,000.

If you have a traditional 401, you can also elect to make non-deductible after-tax contributions.

Plan in Advance

Recommended Reading: How To Transfer Your 401k To Another Company

Contributing To Your 401 Retirement Plan

Contributing to a 401 plan is traditionally done through oneâs employer.

Typically, the employer will automatically enroll you in a 401 that you may contribute to at your discretion.

If you are self-employed, you may enroll in a 401 plan through an online broker, such as TD Ameritrade.

If your employer offers both types of 401 accounts, then you will most likely be able to contribute to either or both at your discretion.

To reiterate, with a traditional 401, making a contribution reduces your income taxes for that year, saving you money in the short term, but the funds will be taxed when they are withdrawn.

With a Roth 401, your contributions can be made only after taxation, which costs more in the short term, but the funds will be tax free when you withdraw them.

Because of this, deciding which plan will benefit you more involves figuring out in what tax bracket you will be when you retire.

If you expect to be in a lower tax bracket upon retirement, then a traditional 401 may help you more in the long term.

You will be able to take advantage of the immediate tax break while your taxes are higher, while minimizing the portion taken out of your withdrawal once you move to a lower tax bracket.

On the other hand, a Roth 401 may be more advantageous if you expect the opposite to be true.

In that case, you can opt to bite the bullet on heavy taxation today, but avoid a higher tax burden if your tax bracket moves up.

Roth 401 & Roth Ira Faqs

At what age should I stop contributing to my Roth IRA?

There is no age limit. You can contribute to your Roth IRA until death if you choose to.

Can you lose money in a Roth IRA?

Yes, a Roth IRA is a vehicle that holds investments. If your investments lose value you will lose money.

Can I max out my 401 and Roth 401?

Theoretically no. Your total contribution would be divided between both, so neither one would technically be maxed out. Aggregate contributions to 401 and Roth 401 are capped at $19,500 .

How much should I put in my Roth IRA monthly?

That depends on your retirement goals. A good financial plan will lay that out for you.

How can I withdraw from my Roth IRA without penalty?

All contributions can be withdrawn tax and penalty-free. Earnings, however, will be taxed and penalized if you have not met the five-year rule and they are not used for a qualified exception.

When can I take money out of my Roth 401 without penalty?

You are free to take any contributions out of your Roth 401 without penalty at any time. Only earnings will be subject to penalty.

Who qualifies for Roth 401?

Anyone who works for an employer that offers a 401 to their employees qualifies for a 401.

Recommended Reading: How To Roll Over 401k To Ira Vanguard