What Happens If I Dont Withdraw My Rmd By The Deadline

If you dont withdraw your annual RMD, or if your withdrawal doesnt meet the minimum required, the RMD amount that remains in your investment account will be taxed at 50%. To avoid unnecessary taxation, its important to calculate your RMD correctly and be aware of IRS RMD deadlines.

Currently, qualifying retirement account holders must take their initial distribution by April 1, and all subsequent distributions must be made by Dec 31. During the first qualifying year, account holders typically must make an initial withdrawal by of that year and another by December 31 of that same year.

What If I Withdraw Too Little Or Dont Take An Rmd

If you dont make a proper RMD by the appropriate deadline, Uncle Sam will tax you 50% of the difference between the amount you withdrew that year and the amount you were supposed to take out that year.

However, you dont have to take your RMD in one lump sum. You can take it in increments throughout the year. Just make sure you withdraw the total RMD amount for the year by December 31. In some cases, however, you can delay RMDs.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our investing reporters and editors focus on the points consumers care about most how to get started, the best brokers, types of investment accounts, how to choose investments and more so you can feel confident when investing your money.

Investing disclosure:

The investment information provided in this table is for informational and general educational purposes only and should not be construed as investment or financial advice. Bankrate does not offer advisory or brokerage services, nor does it provide individualized recommendations or personalized investment advice. Investment decisions should be based on an evaluation of your own personal financial situation, needs, risk tolerance and investment objectives. Investing involves risk including the potential loss of principal.

Also Check: How To Borrow Money From My 401k

Inheriting A 401 From A Non

If you inherit a 401 from someone who was not your spouse, you must rollover the funds into an inherited IRA. And, owing to a rule change in the SECURE Act, you would be required to withdraw the money within five or 10 years, depending on when the account holder died.

The five-year rule comes into play if the person died in 2020 or before the 10-year rule applies if they died in 2021 or later.

Use Your Rmd To Pay Your Taxes

You can also use your RMD to simplify tax payments. With the RMD solution, you can ask your IRA custodian to withhold enough money from your RMD to pay your entire tax bill on all your income sources for the year. That saves you the hassle of making quarterly estimated tax payments and can help you avoid underpayment penalties.

Because withholding is considered to be evenly paid throughout the year, this strategy works even if you wait to take your RMD in December. By waiting until later in the year to take the RMD, youll have a better estimate of your actual tax bill and can fine-tune how much to withhold to cover that bill.

Don’t Miss: How To Make A 401k Account

Penalties For Missing Rmd Deadlines

What happens if you miss the deadline? You could get hit with one of Uncle Sams harshest penalties50% of the shortfall. If you were supposed to take out $15,000 but only took $11,000, for example, youd owe a $2,000 penalty plus income tax on the shortfall.

But this harshest of penalties may be forgivenif you ask for reliefand the IRS is known to be relatively lenient in these situations. You can request relief by filing Form 5329, with a letter of explanation including the action you took to fix the mistake.

One way to avoid forgetting: Ask your IRA custodian to automatically withdraw RMDs.

Company Sponsored Retirement Plans

The requirement to take an RMD depends on whether the individual in question is an owner of the company and whether he or she is still actively employed.

- Ownership: Any individual who owns more than 5% of the company that sponsors the plan as of the date he or she turns age 72 must begin taking RMDs regardless of their ongoing employment status.

- Employment Status: For non-owners as well as those who own 5% or less of the company, the RMD requirement kicks in as of the later of the date the participant reaches age 72 or the date he or she terminates employment. That means a non-owner who is 72 does not have to start taking RMDs as long as he or she remains actively employed by the plan sponsor.

It should also be noted that if a participant who is age 72 passes away, his or her beneficiary may be required to take RMDs even though that person might be under age 72.

Note: For active participants who reached age 70 1/2 on or before December 31, 2019, the RMD requirement kicks in on April 1st of the year following the later of the year the participant reached age 70.5 or the year he or she terminates employment.

Recommended Reading: What Percent Should You Put In 401k

Taxes To Keep In Mind

RMDs are taxed as ordinary income for the tax year in which they are taken. If you have after tax money including non-deductible contributions made to your Traditional IRA, you must calculate your RMD based on the total balance, but your taxable income may be reduced proportionately for the after tax amounts.

It’s important to withdraw at least the RMD each year. If you do not satisfy all of your RMD, you may be subject to a 50% excise tax on the amount not distributed as required. You can take more than your RMD, however excess amounts taken will not offset the RMD amounts in future years.

Here Are The 401 Rmd Rules For 2021 And 2022

401 accounts are workplace retirement savings plans that employees can contribute to with pre-tax dollars, sometimes receiving matching contributions from employers.

Those who contribute to workplace 401s must know the rules for 401 required minimum distributions, or RMDs, since RMD rules mandate that accountholders begin withdrawing money at age 72 or face substantial IRS penalties equal to 50% of the amount that should have been withdrawn.

This guide will explain why RMDs exist, what the RMD rules are for 401 plans, what exceptions exist, how RMDs can be avoided, and how RMDs affect you if you inherit a 401.

Don’t Miss: How Much Money Do I Have In My 401k

How Fidelity Can Help You Plan

If you are taking RMDs, we can help you:

- Use our Planning & Guidance Center to get a holistic view of your retirement income plan and see how long your money may last.

- Adjust your portfolio as your life changes. Schedule an appointment with one of our experienced advisors to create a customized path forward.

How Do You Figure Out Monthly 401k Distribution At Retirement

Read this article to find out the answer to, “How does a 401k work when you’re ready for distributions?” You and Your 401K

A 401k plan is a defined contribution plan that can help you prepare for life beyond your earning years. If you dont take your mandatory 401k distribution payments, however, you can lose some of your money. Find out when you should withdraw from your retirement savings and perhaps use your 401k to retire early.

Read Also: Can You Withdraw Your 401k If You Quit Your Job

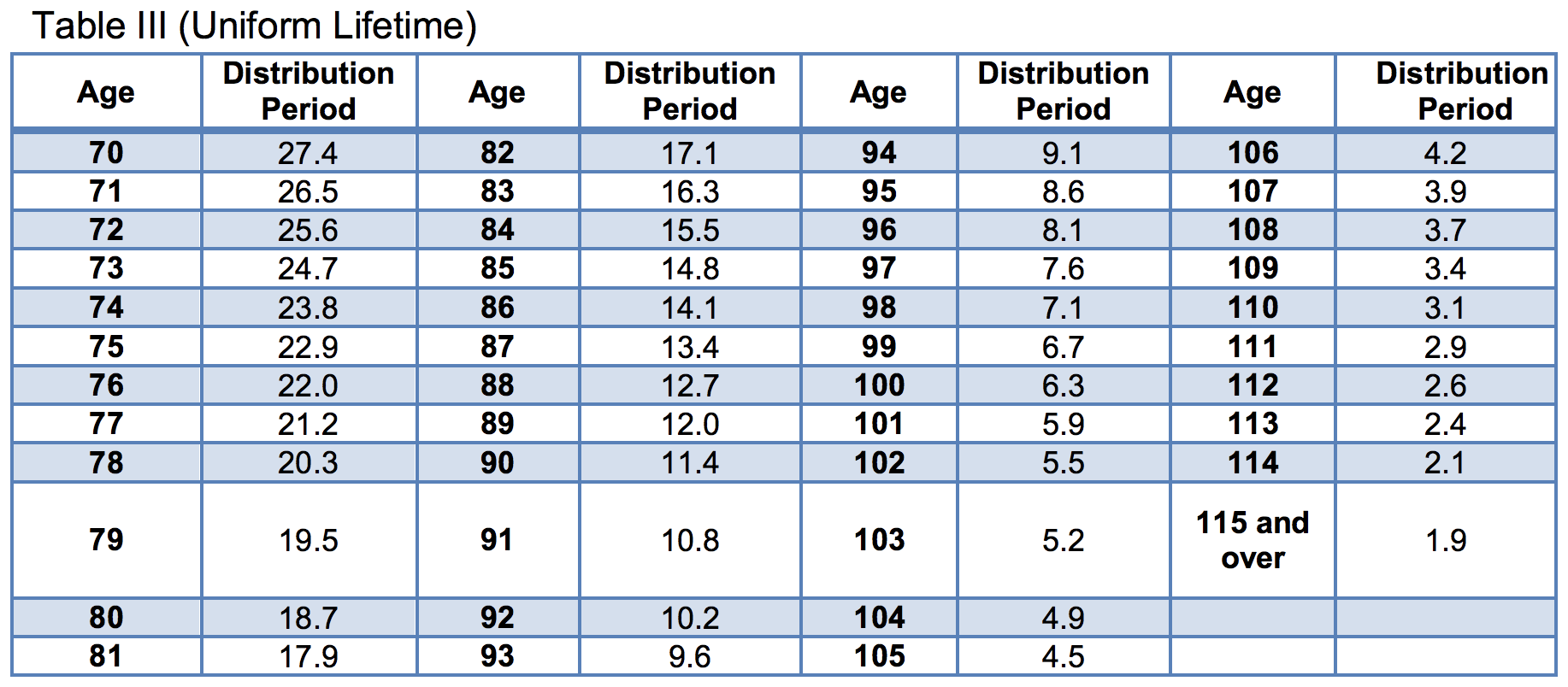

Uniform Lifetime Table To Calculate 401k Minimum Required Distributions

To Calculate the MRD, example:

If Retiree turns 77 during this year, the MRD is calculated as:

MRD = Market Value of Retirement Savings / DivisorMRD = $250,000 / 21.2

| Age of 401k Retirement Savings Account Owner | Divisor |

Welcome to Research401k.com A Complete Resource On Important 401k Retirement Plan Topics such as Rollovers, Roth IRA Accounts, Contribution Limits, Hardship Withdrawals, Self-Employed 401k and more!

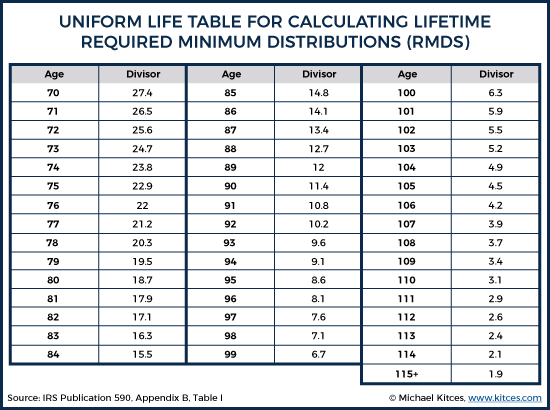

How To Calculate Rmd

Except for an Inherited IRA, you can calculate your RMD by dividing your tax-deferred retirement account balance as of December 31 of the previous year by your life expectancy factor.

The IRS provides the worksheet for the life expectancy factor. It is wise always to confirm that you are using the latest information from the IRS website.

There are two tables provided for the Life expectancy factor:

- Uniform Lifetime Table, for use by unmarried owners, married owners whose spouses arent more than ten years younger, and married owners whose spouses arent the sole beneficiaries of their IRAs.

- Joint Life and Last Survivor Expectancy Table, for use by owners whose spouses are more than ten years younger and are the sole beneficiaries of their IRAs. Thus, this Joint Life Expectancy Table considers the last survivors expectancy and reduces the RMD.

The RMD formula is:

RMD = Account balance as of December 31 / Life expectancy factor

Example: How to calculate RMD when one spouse is more than ten years younger and is the IRAs sole beneficiary.

Farouk turned 72 last year, and his wife is 60. She is the sole beneficiary of his IRA.

-

Find IRA balance as of December 31 of the previous year: his IRA balance was $270,000.

-

Find the life expectancy factor according to the IRS Joint Life Expectancy Table: Farouks life expectancy factor is 27 which is the corresponding factor for 72 and 60 .

-

Divide the account balance by the factor number to get RMD:

RMD = $270,000 / 27 = $10,000

Don’t Miss: When I Leave My Job What Happens To 401k

Why Required Minimum Distributions Exist

The government provides a tax break for retirement savings by allowing workers to contribute to a 401 with pre-tax funds and enjoy tax-free growth on investments within a 401.

Uncle Sam wants to collect its piece of the money eventually, though, so RMD rules exist to make sure those who have invested in a 401 begin taking the money out during retirement.

RMDs ensure workers take out a set minimum amount of money each year based on their life expectancy. Withdrawals that follow RMD rules are taxed as ordinary income.

I Failed To Take Out Rmds In Prior Tax Years Is There A Penalty

Yes. There is no statute of limitations on how far back the IRS can look for RMD mistakes. If you have discovered mistakes in prior years withdrawal amounts, correct those figures immediately.

If you can provide evidence that you made a reasonable mistake when calculating distributions for prior years, the IRS does have the ability to waive penalty fees. The most common reasons considered for waiving fees include serious illness or dementia.

Read Also: Can I Rollover My 401k Into An Existing Ira

What Is The Point Of This Requirement

In short, taxes. The tax benefits afforded to certain types of retirement accounts are there to incentivize people to save for their retirement. Those benefits are often in the form of a tax deferral, meaning that amounts are deductible when contributed to the plan and taxable at the time of withdrawal. Congress was concerned that these accounts could be used as a way to permanently avoid taxation if the funds accumulated there indefinitely. The RMD rules address this by requiring that a portion be withdrawn each year.

If You Dont Need Your Rmd For Living Expenses Here Are Three Options:

Reinvest your RMD.

You can use it to potentially grow your investment portfolio. Simply reinvest the distribution into an existing general investing account or open a new general investing account to help you save for goals that are important to you. Earnings in a general account are taxable, but you have the flexibility to manage the money without limits, penalties or restriction.

Help a loved one pay for college.

You can use your RMD to invest in a 529 college savings plan. These funds can be used for college costs, but also K-12 expenses and student loan repayment. Any earnings are tax-free when used for qualified expenses.

Support a charity you believe in.

Satisfy your RMD by donating up to $100,000 to one or more eligible charities, known as a qualified charitable distribution . The distribution is excluded from taxable income.

Don’t Miss: Can You Have A Traditional Ira And 401k

Other Restrictions On Inherited 401 Accounts

Bear in mind that the company which sponsored the 401 may have restrictions on how inherited funds must be handled. In some cases, you may be able to keep 401 funds in the account, or you might be required to withdraw all funds within a certain time period.

In addition, state laws governing the inheritance of 401 assets can come into play.

If youve inherited a 401, its probably best to consult a professional who can help you sort out your individual situation.

What If Your Spouse Is A Different Age

If youre married and your spouse is more than 10 years younger than you, you have to use a different life expectancy factor to determine your RMD. The IRS has a separate table for married couples with age differences called the Joint Life Expectancy Table. With this table, your life expectancy factor is based on both peoples ages.

For example, lets say Harriet, age 75, is married to Joe, age 64. Her IRA balance is $100,000 as of December 31 of last year. The IRS Joint Life Expectancy Table says their factor is 23.6. By dividing the balance by 23.6, Harriets RMD is $4,237.29.

You May Like: How Do I Open A Roth 401k

What Is The Deadline For Taking The Rmd Each Year

RMDs are due by December 31 of each year however, for the year a participant first turns age 72, the initial RMD deadline is not until April 1st of the following year. For example, a participant who reaches age 72 in 2022 has until April 1, 2023 to take his or her first RMD, with each subsequent RMD paid by December 31 of each year.

It is important to note that that same participant is also required to take an RMD for 2023 no later than December 31, 2023. That means he or she ends up taking two RMDs in the same year and then a single RMD in each year thereafter.

Important Note: Work with your recordkeeping service provider or platform provider to process distributions timely, as most platforms will have a deadline of mid-December to ensure the checks can be processed and delivered before the end of the plan year. Your recordkeeping service provider, platform, TPA, or investment advisor is not authorized to approve or process an RMD without a distribution form.

How Much Do I Have To Withdraw Each Year

The amount changes each year, according to your age. Start by calculating how much you had in all your tax-deferred accounts as of December 31 of the previous year. Next, find your age on the IRS uniform lifetime table and the corresponding distribution period. The distribution period is an estimate of how many years youll be taking RMDs. If youre 72, for example, the distribution period is 25.6 years, based on your life expectancy. Then divide your balance by the distribution period. Lets say you have a combined $100,000 in your tax-deferred retirement accounts. $100,000 divided by 25.6 is $3,906.25, which is the amount you must withdraw. If you are in the 25 percent combined state and local tax bracket, youll owe $976.56 in taxes on your RMD.

You can take your RMD out of one account, or take bits from each one, so long as you withdraw the required minimum.

Join today and save 25% off the standard annual rate. Get instant access to discounts, programs, services, and the information you need to benefit every area of your life.

Also Check: Should I Do 401k Or Roth Ira

Why Do Rmds Exist

You may find yourself wondering why there is a required minimum distribution for your IRA. After all, its your money, so why cant you take it out of your account at your own pace? The answer to this question is the same as the answer to many questions when it comes to financial matters: taxes.

You dont pay taxes on the money in your IRA when you put it in. Instead, you pay taxes when you withdraw the funds in retirement. The money will be taxed according to your current tax bracket. This is beneficial if you are in a lower tax bracket in retirement than you were when you first earned the money and were probably earning a much higher total income.

If you were to leave all of your money in your IRA, it would eventually become eligible to be passed on as inheritance and perhaps end up un-taxed. The required minimum distribution forces you to take out some money while it can still be taxed.

How Are Rmds Taxed

Withdrawals from your retirement accounts are generally included in your taxable income, unless your contributions were made on an after-tax basis to a Roth account. For example, if you have a Roth 401, your withdrawals are not included in your taxable income.

Your RMDs may push your income into a higher tax bracket, affecting the taxes you pay for Medicare and Social Security.

Recommended Reading: Can I Roll My Old 401k Into A Roth Ira