What If You Contribute Too Much

If you discover that you contributed more to your IRA than you’re allowed, you’ll want to withdraw the amount of your overcontributionand fast. Failure to do so in a timely way could leave you liable for a 6% excise tax every year on the amount that exceeds the limit.

The penalty is waived if you withdraw the money before you file your taxes for the year in which the contribution was made. You also need to calculate what your excess contributions earned while they were in the IRA and withdraw that amount from the account, as well.

The investment gain must also be included in your gross income for the year and taxed accordingly. What’s more, if you are under 59½, you’ll owe a 10% early withdrawal penalty on that amount.

How To Make A 401 And Roth Ira Work Together

At this point, you may ask whether you should put your money in a 401 or a Roth IRA. The answer is yes.

If youre eligible for a 401 and a Roth IRA, the best-case scenario is that you invest in both accounts . That way, youre taking advantage of your employer match and getting the tax benefits of a Roth IRA.

Heres how that works in three simple steps: Lets say you make $60,000 a year and youre under 50. Your goal is to invest 15%$9,000 in this casein retirement.

- You start by investing in your 401 up to the match that your company offers. Lets say, in this case, that its 3% of your gross income . You invest $1,800 in your 401 to reach the employer match. This leaves you with $7,200 more to invest.

- Then, you max out your Roth IRA. You can only contribute $6,000, so that leaves you with $1,200.

- Return to your 401 and invest the remaining $1,200.

Remember, if youre older than 50, there are catch-up contributions you can make to max out your Roth IRA at $7,000 and your 401 at $26,000.

You may be wondering what you should do if your employer doesnt offer a 401 and youve maxed out your Roth IRA for the year. The short answer? You need your money to grow. You can still work with an investment pro to invest in growth stock mutual funds that arent connected with a retirement account. After you invest your money, leave it alone. Investing is a marathonnot a sprint.

Maximizing Your Contributions Can Pay Off

Is it worth making maximum contributions? Absolutely. Lets say that you contribute $1,200 to an IRA every year over a 10-year period. With an annual, compounded return of 6%, your savings would total $16,765. On the other hand, if you contribute $6,000 to an IRA annually, and keep the other factors the same, you would end up with $83,830. The numbers are even more impressive for workplace plans, such as the 401 and 403, which have higher contribution limits.

Also Check: How Can I Get Money From My 401k

Investments Declining Maybe Its A Good Time To Convert A Traditional Ira Or 401 To A Roth Ira

getty

Instead of fretting about falling markets, consider whether they are an opportunity to convert all or part of a traditional IRA or 401 plan to a Roth IRA.

Lower investment prices can reduce the cost of converting assets into tax-free Roth IRA assets. When all or part of a traditional IRA or 401 is converted to a Roth IRA, the amount converted is included in gross income as ordinary income. You pay taxes at your regular rate on the converted amount.

When a portfolio declines, you can convert more of it for the same tax cost that would have been incurred before the market decline. Or you can convert the same amount of the investment for a lower tax cost. If the investments recover, youve turned more wealth into tax-free wealth than you could have before. Thats also the case if you sell the losing assets before or after the conversion and reinvest in better-performing assets in the Roth IRA.

A conversion that didnt make sense before the market decline might be attractive to you after the decline. Or a conversion that looked attractive before might be more attractive now.

Most IRA custodians will allow you to convert specific holdings of an IRA. For example, if you have some stocks with lower values, you can transfer those shares to a Roth IRA as a conversion.

Your 401 Is Generally Safe From Commercial Creditors

The reason your 401 and other qualified retirement plans are off-limits to commercial creditors is rooted in their special legal status. Under the Employment Retirement Income Security Act of 1974 , the funds in your 401 only legally belong to you once you withdraw them as income. Until then, they’re legally the property of the plan administratoryour employerwho cannot release them to anyone but you.

This ERISA protection means that savings held in a regular 401 are shielded from garnishment by commercial creditors, even if you file for bankruptcy. Indeed, the protection for the funds held in 401 accounts is greater than for those held in an IRA, which are not covered by ERISA and are only protected to a certain limit. Under the Bankruptcy Abuse Prevention and Consumer Protection Act of 2005 , $1 million of your IRA savings is exempt from garnishment in the event of bankruptcy.

It’s worth noting, however, that funds are protected only as long as they are in your 401 account. Once you withdraw them, for any reason, those distributions are fair game for creditors to pursue.

Don’t Miss: Can I Transfer From 401k To Roth Ira

Questions About Contribution Limit Basics

Your employees can contribute to a 401 and an IRA at the same time. Thats because an IRA is a personal account, self-managed by each individual, while a 401 is only available through an employer. While saving in both ways is highly encouraged, the IRS allows taxpayers to put a lot more savings into a 401 than an IRA. Between all their personal IRAs, a person can only contribute $6,000 per year, unless theyre 50 or older, when they can contribute $7,000. By comparison, the maximum contribution an individual is allowed to make to a 401 is $19,500 a year for employees under 50, and $26,000 for those over 50. At any age, thats more than triple what can be saved in an IRA. When an employee approaches you about contribution limit basics, you can emphasize how much theyre allowed to save and how much your company matches.

Yes If You Can Max Out Both Accounts

Heres a simple question to ask yourself: Can I contribute to 401 and IRA plans up to the annual limits, based on my income and spending? If so, this can go a long way in funding your dreams for retirement.

This assumes, of course, that you can realistically afford to contribute $19,500 to a 401 each year along with up to $6,000 to an IRA. If youre trying to pay down debt, save for your childs college expenses, or reach other financial goals, then fully funding multiple retirement accounts may not be realistic.

If you are planning to contribute the maximum to both a traditional IRA and a 401, consider your budget and spending. And youll need to do some research into how that may affect your retirement tax deductions.

Read Also: Can I Use My 401k To Buy Investment Property

Disadvantages Of A Roth Ira

Just like a 401, a Roth IRA has its downsides:

- Contribution limit. You can only invest up to $6,000 in a Roth IRA each year or $7,000 if youre age 50 or older.3 Thats a lot less than the 401 contribution limit.

- Income limits. If youre single or the head of a household, your modified adjusted gross income has to be less than $125,000 to contribute the full amount to a Roth IRA. If youre married and file your taxes jointly with your spouse, your MAGI must be less than $198,000. If your income is above these limits, the amount you can invest is reduced. And if you make $140,000 or more as a single individual or $208,000 or more as a married couple filing jointly, youre not eligible for a Roth IRA.4 However, the traditional IRA would still be an option.

How To Avoid Paying Tax On Excess Contributions

You can avoid paying the 6% tax by withdrawing excess contributions, along with any earnings they’ve generated, before the due date for individual tax returns. For contributions made in 2021, that deadline is April 18, 2022. Be aware: To receive these funds by the April 18 deadline, you should ideally request them a month or more in advance.

Contact your 401 plan administrator to request a corrective distribution that includes the excess money you contributed and the interest or appreciation you earned on it. They should issue an amended W-2 with your distributed funds added to your wages for the year. If you overcontributed to an IRA, follow the same steps with your financial institution. You should receive Form 1099-R, which shows what you made on your excess contribution so you can add it to your taxable income.

Also Check: How Do I Access My 401k Funds

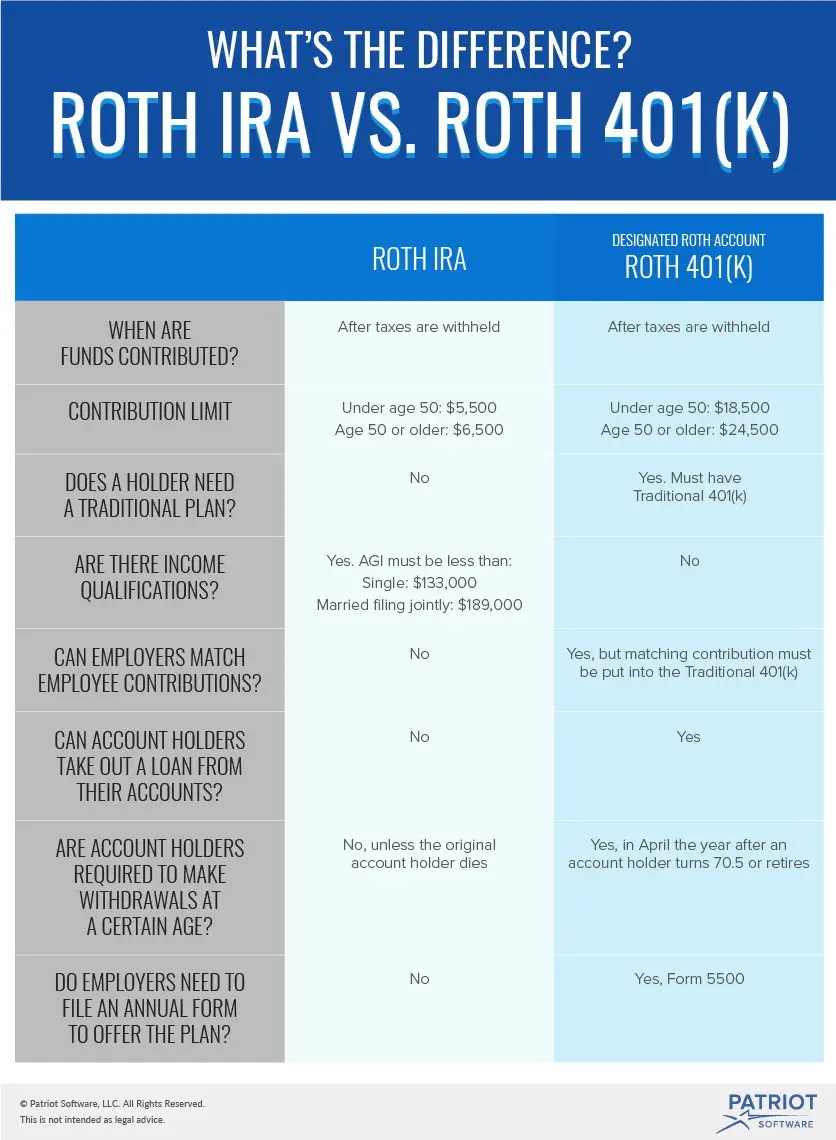

Questions About Traditional Vs Roth Plans

Even if theyre opening a personal IRA, employees might still come to you with questions about how to divide their savings strategy between two accounts. The general distinction between a traditional IRA, Roth IRA, 401 and Roth 401 lies in when their money is taxed. With a traditional 401 or IRA, no contributions or funds from interest will be taxed until the money is used during retirement. Traditional IRAs and 401s offer money the opportunity to grow tax-deferred.

Roth IRAs and Roth 401s differ in that the taxes are paid when the money is deposited in the account, but theres no tax later when the funds are withdrawn, and no tax on the earnings if the distribution is qualified. Employees can decide which type of account to contribute to by considering what they expect their tax bracket to be during retirement. Many factors, like deducting children from taxes, the end of tax credits for paying interest on a mortgage or student loans, even an increase in tax rates could mean people are in a different tax bracket after retirement, even if their income stays the same or goes down. If employees expect to be in a lower tax bracket during retirement, a traditional plan may be best, because they wont pay taxes on their contributions until they withdraw them later, when theyre taxed at a lower rate. However, if the employee expects to be in a higher tax bracket, a Roth plan in which taxes are paid now may be a better choice.

When To Roll Over Your 401 To An Ira

Rolling over your 401 to an IRA is possible only if you’re leaving your current employer or your employer is discontinuing your 401 plan. It is an alternative to:

- Leave your money invested in your existing 401

- Rollover to your new employer’s 401

- Withdrawal from your 401, which would trigger a 10% penalty if you aren’t 59 1/2 or older

A rollover or IRA) does not have tax consequences. This would not be the case if you do a rollover to a Roth IRA.

Rolling over a 401 to an IRA provides you with the opportunity to choose which brokerage you want to hold your retirement funds. It may be the right choice if:

- Your new employer doesn’t offer a 401 plan

- You cannot keep your money invested in your current workplace plan because your plan is being discontinued or your 401 administration won’t allow you to stay invested for some other reason

- Your new employer’s 401 plan charges high fees, offers limited investments, or has other drawbacks

- You’d prefer a wider choice of investment options

However, there are some downsides to consider:

- While 401 loans allow you to borrow against your retirement funds, no such option exists with an IRA.

- Transferring company stock can be complicated account, read up on an “NUA strategy” that could save you a lot of money.)

If these downsides aren’t deal breakers for you, the next step is figuring out how to roll over your 401 to an IRA.

Recommended Reading: How To Roll Over 401k To New Company

Who Is Eligible To Open An Ira Can Anyone Open One

- Traditional IRA. If youre younger than 72 and you have taxable income, you or your spouse can contribute to a traditional IRA. How much of your contributions will be deductible will depend on your income and filing status.

- Roth IRA. Anyone with earned income under a certain limit, and his or her spouse, can open and contribute to a Roth IRA. Theres no age restriction.

The Best Choice: Work With A Pro

Heres the deal: Investing is worth the hard work. If you dont save and invest now, you wont have anything to live on in retirement. It can be intimidating and complex, but you dont have to do this alone.

Talk with an investment professional like our SmartVestor Pros. Get someone on your team who will help you stay focused and chasing your dreams. They can walk you through your 401 and Roth IRA contribution options and create a plan for your situation.

About the author

Ramsey Solutions

Ramsey Solutions has been committed to helping people regain control of their money, build wealth, grow their leadership skills, and enhance their lives through personal development since 1992. Millions of people have used our financial advice through 22 books published by Ramsey Press, as well as two syndicated radio shows and 10 podcasts, which have over 17 million weekly listeners.

Don’t Miss: What Should I Invest In 401k

Can I Contribute To A 401 And Ira In The Same Year

The short answer is yes! However, the type of IRA you can contribute to and the ability to receive a tax deduction is dependent on a number of factors.

In general, anyone who has access to an employer defined contribution plan, such as a 401 plan, even if they do not make any contributions to the plan, may be limited in terms of the type of IRA they can contribute to in a given year. To be clear, an individual with access to a 401 plan at work is permitted to also make IRA contributions in that year. However, the type of IRA and the deductibility of the IRA contributions are contingent on a number of elements.

- If available, you CAN contribute to a 401 and IRA in the same year

- Your annual income will dictate how much you can contribute

- There are restrictions on the destructibility of your contributions

A Traditional Ira Can Be A Powerful Retirement

The traditional IRA is one of the best options in the retirement-savings toolbox. You can open a traditional IRA at a bank or a brokerage, and the universe of investments is wide open to you. But with that freedom comes responsibility. Traditional IRAs have a lot of rulesbreak one and you could face a penalty. Follow those rules, however, and you can end up with a sizable chunk of change down the road.

To make the most of a traditional IRA, here are 10 things you must know.

Recommended Reading: Does Borrowing From 401k Affect Credit Score

How Much Does It Cost To Roll Over A 401 To An Ira

If you do the process correctly, there should be few or no costs associated with rolling over a 401 to an IRA. Some 401 administrators may charge a transfer fee or an account closure fee, which is usually under $100.

Because moving your money from a 401 to an IRA allows you to avoid the 10% early withdrawal penalty that results if you withdraw money from a 401 before 59 1/2, it’s a far better option if you can’t keep your money invested in an old employer’s plan or move it to a 401 at your new company.

You should consider whether rolling over a 401 to an IRA is a better option than either leaving it invested when you leave your job or moving the money to your new employer’s retirement plan. If you can avoid 401 management fees and gain access to investments with lower expense ratios, an IRA may be a cheaper account option.

Can You Contribute To A Roth Ira And A Traditional Ira In The Same Year

You can contribute to a traditional IRA and a Roth IRA in the same year. If you qualify for both types, make sure your combined contribution amount does not exceed the annual limit. You can also contribute to a traditional IRA and a 401 in the same year. Contribution limits for each type of account apply.

Read Also: What Is Asset Allocation In 401k

Can I Roll Over My Workplace Retirement Plan Account Into An Ira

Almost any type of plan distribution can be rolled over into an IRA except:

-

Distributions of excess contributions and related earnings,

- A distribution that is one of a series of substantially equal payments,

- Withdrawals electing out of automatic contribution arrangements,

- Distributions to pay for accident, health or life insurance,

- Dividends on employer securities, or

- S corporation allocations treated as deemed distributions.

For details, see rollovers of retirement plan distributions. Distributions from a designated Roth account can only be rolled over to another designated Roth account or to a Roth IRA.

Do I Have To Start Taking Money Out Of My Ira At A Certain Age

- Traditional IRA. If your 70th birthday falls after July 1, 2019, you must start taking required minimum distributions at age 72 or face a heavy tax penalty.2

- Roth IRA. You actually dont have to withdraw any money at all. However, if you want to, you can start withdrawing funds once youve reached age 59½ and have had your account for at least 5 years.

You also will need to take the RMD if you have a rollover, SEP or SIMPLE IRA and for most 401 or 403 accounts.

Read Also: Is An Annuity A 401k