Should You Work With A Top 401 Recordkeeper

The lists of the top small and mid-sized 401 providers may not be the right starting point for your 401 recordkeeper search. When you are assessing your plan and considering switching providers, consider the how each providers features and strengths will play across the following aspects of your retirement plan:

- Employee Experience: Helps employees take advantage & save more

- Investment Help: Offers low-fee options like target date funds

- Administrative Work: Automates day-to-day 401 administration

- Compliance: Ensures your plan meets DOL and IRS requirements

- Low-Fee: Keeps administrative & individual investment costs in check

If youd prefer to focus on running your business and want to leave the provider search to an experienced 401 advisor lets get in touch! We believe that we can help you improve your current 401 and reduce your fees. Talk to us today.

*The following is our data section of our original report from January 2017, with data on the top 401 recordkeepers from 2015 and 2016. *

Best For Low Operating Costs: Charles Schwab

Not many names are as well known in the financial industry as Charles Schwab. Charles Schwab offers Index Advantage 401 plans with low fees it also has some other plans you can choose from.

You can get plan advice and access to accounts that offer interest through the Schwab Bank. Its plans have no annual fees plan members get full access to all investing services.

If you’re self-employed or own your business, you can pay into an individual 401 plan. These plans offer many of the same benefits as a traditional 401. One great thing about the individual 401 plan is that you can direct where you invest your money.

This plan has monthly service fees that vary based on your needs. Payments into your plan are tax-deductible, and gains are tax-deferred.

All Charles Schwab plans come with planning help and 24/7 service and support.

How Do You Get The Best 401 For Small Business

If your small business offers a 401 plan, you already know what a greatand very importantbenefit it can be to your employees. Considering the average working-age household has virtually no retirement savings,* encouraging your employees to save for a secure retirement can help ensure that the people you work with every day are ready for retirement on their terms.

Fisher Investments 401 Solutions is here to improve America’s retirement readiness, starting with customization that suits your business needs, one-on-one employee enrollment and education meetings, and a dedicated single point of contact to get your employees’ questions answered.

Visit these popular pages

You May Like: Can I Retire With 500k In My 401k

The Best 401 Providers

It’s never too early to start planning or saving for retirement, all the financial experts say. But if you work for yourself or own a small business, did you know you can establish a 401 — a tax-advantaged, defined contribution account named after a section of the U.S. Internal Revenue code?

Employers and employees can make contributions to their accounts through automatic payroll withholding, and employers can match some or all of the employee contributions.

There are two types of 401 plans, a traditional 401 and a Roth 401. Earnings resulting from choices made in the 401 aren’t taxed until money is withdrawn, and in a Roth 401k, withdrawals can be made tax-free. Contributions by employees into a 401 is pre-tax, and reduce the taxable income for the year they are contributed but are taxed as income when withdrawn. Contributions to a Roth 401 are made after-tax, so those withdrawals are tax-free.

Traditional pensions are defined-benefit plans in which a company contributes a defined amount to an employee’s retirement. But through the years, more and more employers have decided to shift the employees’ retirement savings and risk to the employees themselves.

Offerings in 401 plans from employers usually include stock and bond mutual funds, as well as target-date funds and guaranteed investment contracts issued by insurance companies, and even an employer’s stock.

Some plans require a minimum amount to start others have no minimum.

How Does A Sep Ira Work

You can contribute up to $61,000 or 25% of your compensation per year, whichever amount is less. If you’re self-employed, you calculate the 25% based on your net earnings.

The main downside is that the employer is required to contribute equally to every eligible employee in your company. And guess what? You’re considered an employee too! So if you want to contribute 10% of your salary to this plan, you also need to contribute 10% to everyone else.

Also Check: How To Choose Fidelity 401k Investments

Reviews Of Forusall Plan Administration Services From Around The Web

ForUsAll is a 401k Administrator dream come true for a fast growing company We switched to ForUsAll from another startup 401k provider in early 2017 and I cant believe how much better it is with ForUsAll. -Scott Orn, COO Kruze Consulting, Quora

The user experience from the employee perspective is simple and excellent. Our internal Customer Success team has been so wowed by Dave that we often reference him as a prototype for a perfect experience guide.

| In 2018, Guideline had accumulated more than 6,250 small business clients, amassing more than $700 million in assets under management, with more than $30 million added every month from payroll contributions alone. |

Top 5 401 Plan Providers For Small Businesses

Introduction:

As traditional pensions become increasingly rare for private sector employees, 401 plans are the standard retirement benefit the vast majority of employers offer to their staff. However, as anyone who has ever had to choose or administer a plan for their employees knows, not all 401 plans are created equal. With huge variances in important factors like investment options, fees, ease-of-use, and startup costs, choosing the right plan is not only a critical decision for your company, but for your employees as well. Below is an outline of what factors to look out for when selecting a new 401 plan provider and our recommendation on the best 401 providers for your small business.

What is a 401?

A 401 is an employer-sponsored retirement plan that invites employees to contribute up to $19,500 of their income towards their retirement savings. Employers can choose plans and providers that offer different selections of mutual and index funds for their employees to invest in. Employers can choose to match a portion of their employees contributions, but that is 100% optional.

What to Look For:

For example, an employee who contributed $1,000 per month to their 401 for 30 years the final value of their portfolio would be $1,468,000. If that annual return was changed to 8.5% , the final value of the portfolio would be $1,617,000, a difference of nearly $150,000!

That being said, here is a list of our top 5 401 providers for small businesses.

The Top Five:

In conclusion:

You May Like: Can I Take My Money Out Of My 401k

Guideline: Best Employee Retirement Plan For Compliance

Small business owners who don’t want to fail the IRS’ nondiscrimination tests but don’t have the time to manage it on their own will appreciate a safe harbor 401 plan. With a safe harbor 401, you comply with the IRS test as long as you match your employees’ contributions to their accounts â an added expense, yes, but an attractive way to recruit and retain top talent. Nobody does safe harbor plans better than Guideline, which is why it’s our best pick for compliance.

Editor’s score: 9/10

Let’s start with Guideline’s pricing. Its basic plan costs $49 plus $8 for each participating employee per month. For $79 a month, you get to pick and choose the offerings in the plan. For $129 per month, you get even more customizable features. The cheapest plan gets you integration with Gusto, while the most expensive plans give you a dedicated account rep. We like that even budget-conscious small businesses have access to a safe harbor plan. After all, the penalties for noncompliance can be expensive, not to mention time-consuming.

Human Interest: Best Employee Retirement Plan For Affordability

Variety is the spice of life, but for small business owners, particularly since the pandemic, cost matters â a lot. Many know they have to offer an employer-sponsored retirement plan to stay competitive but can’t afford to spend a ton on it. Cash-strapped small business owners need a low-cost plan that still provides a variety of investment choices and strong customer support. Human Interest checks off those boxes, which is why it’s our best pick for affordability. Its cheapest plan, Essentials, costs $120 a month plus $4 per employee. For that fee, you get integration with more than 100 payroll providers, the ability to create flexible plans, and automated plan administration and recordkeeping.

Editor’s score: 9.5/10

If you want Human Interest to handle everything â including procuring your ERISA bond, acting as your plan administrator and 3 fiduciary, and signing and filing your IRS documents â it will only cost you $150 a month plus $6 per employee. Its highest pricing plan costs $150 per month and $8 per employee, which gets you everything in the two other plans plus dedicated account management. Human Interest also charges a $499 one-time setup fee, which the company waives when running promotions. In contrast, other providers we examined charge a $250 one-time installation fee, a $500 annual fee, and $20 per participating employee.

Recommended Reading: What Is The Difference Between An Ira And A 401k

How To Set Up A 401k For A Small Business

Setting up a 401 for your small business includes some crucial steps, some of which can be outsourced. It’s important to remember that the employer maintains a fiduciary duty to ensure that the plan is providing a benefit to participants. The U.S. Department of Labor provides in-depth details of the process:

1. Create a 401 plan document

Create a plan document that complies with IRS Code and outlines the details of your retirement plan. Set up procedures to ensure the document is followed.

2. Set up a trust to hold the plan assets

A plan’s assets must be held in trust to assure its assets are used solely to benefit the participants and their beneficiaries. At least one trustee must handle the plan’s activities regarding contributions, plan investments, and distributions. Given that these decisions affect the plan’s financial integrity, selecting a trustee is a critically important decision. Another fiduciary, such as the employer who sponsors the qualified retirement plan, will generally assign the trustee.

3. Maintain records of 401 employee contributions and values

Maintain accurate records that track employee contributions and current plan values. Many small businesses choose to work with a 401 recordkeeper to help them manage plan setup and ongoing record management.

4. Provide information to plan participants

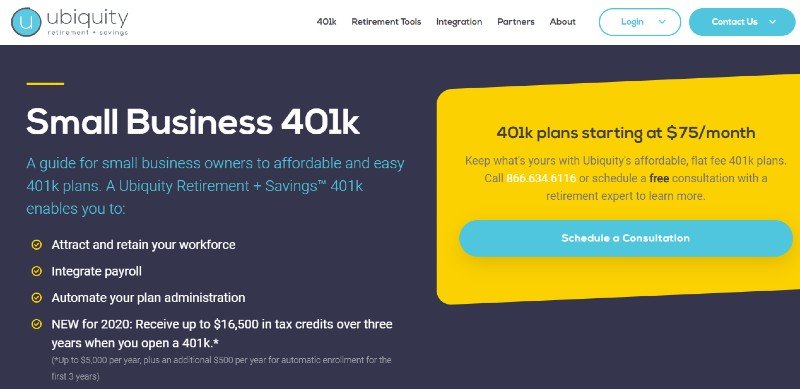

Benefits Of Small Business 401 Plans

There are a variety of benefits for offering a 401 plan. The most obvious benefit is to help your employees save for retirement.

Other benefits of offering a small business 401 plan include:

- The ability to attract talented workers in todays competitive job market.

- Retaining valuable employees as they age and retirement becomes more important to them. Forty percent of small business employees said they would be willing to leave their current job for an employer that offers the benefit of a tax-deductible retirement savings options.

- Tax write-offs for the amount you contribute to employees plans as well as tax credits for the cost to set up and manage a qualifying plan.

If you are a solo-business owner, you can also enjoy more tax benefits, as you may be able to contribute as both an employee and an employer, depending on the plan.

Don’t Miss: Can I Have A Personal 401k

What Is A Simple Ira

The name SIMPLE makes you think this plan is super basic and easy. Well, it is, but the name actually stands for Savings Incentive Match Plan for Employees. This plan is geared toward small businesses with up to 100 employees. So if you’re a one-person band, this option isn’t for you! The contribution limit is much lower than the other plans we’ve discussedâ$14,000 in 2022, $17,000 if 50 or olderâbut it comes with a smaller burden as the employer.

Best 401 Companies For Small Business 2021

| ADP | |

|

Visit Paychex |

A 401 is a type of retirement savings plan that employers offer their employees as a benefit. The plan allows eligible employees to contribute a certain portion of their paycheck through salary deferral, before taxes, to a managed retirement plan. Some companies boost the benefit by matching all or a portion of the employee contributions.

401s have many benefits: contributions to the plan are tax-deductible, meaning you dont to pay income taxes on them, and savings accrue automatically, requiring little effort or attention from the 401 holder. Compared to the other principal type of retirement account, the main difference between an IRA and a 401 is that a 401 is always set up by an employer. However, simple IRAs are less like traditional IRAs and more similar to 401s in that they are employer-sponsored and also receive employer contributions, though a 401 generally has a much higher contribution limit than a simple IRA.

At a time when the job market is as strong as it is today, though, businesses are often fighting to attract the same limited talent to their company, instead of the other way around. Thats why offering a benefits plan such as a 401 is key.

But fret no more. Below is our list of the eight best 401 companies for small businesses in 2021.

Recommended Reading: Can You Transfer 403b To 401k

The 5 Most Popular 401 Contribution Features

Small business owners can have dramatically different goals for their 401 plan. While some want to maximize their personal contributions, others want to incentivize contributions from employees across the organization. The process of matching a small businesss goals to available 401 features is called plan design.

The five most popular contribution features that small businesses add to a 401 during the plan design process are:

Last year, we studied the plan designs of 3,975 small business 401 plans. Below is the adoption rate we found for each feature:

Well now walk you through each of these features and why you might want them.

Choose A Plan For Your Employees

Once you’ve chosen a retirement services provider, it’s time to decide on a plan that fits both your business and your employees’ needs. Options available to employers regardless of size, including businesses with only one employee, include:

1. A traditional 401 plan, which is the most flexible option. Employers can make contributions for all participants, match employees’ deferrals, do both, or neither.

2. The safe harbor 401 plan, which has several variations and requires the company to make a mandatory contribution to the plan participants. The contributions benefit the company, the business owner, and highly compensated employees by giving them greater ability to maximize salary deferrals.

3. An automatic enrollment 401 plan, which allows you to automatically enroll employees and place deductions from their salaries in certain default investments, unless employees elect otherwise. This arrangement encourages workers to participate in the company 401 plan and increase their retirement savings, which also benefits business owners. Automatic enrollment plans may also contain a safe harbor provision.

Recommended Reading: What Is The Difference Between And Ira And A 401k

Editor’s Note: Looking For Employee Retirement Plans For Your Company If You Would Like Information To Help You Choose The One That’s Right For You Use The Questionnaire Below To Have Our Partner Buyerzone Provide You With Information For Free:

The plan offers tax-deferred growth. If the business is incorporated, contributions are considered a business expense. If the business is not incorporated, the business owner can deduct contributions for him- or herself from personal income. The only disadvantages of this plan are that it may be slightly less convenient, as a plan administrator is required. Once plan assets reach $250,000, you’ll also have to file a Form 5500 with the IRS.

Best For Payroll Services: Paychex

If you own a small firm and are looking into 401 plans but also need a payroll service, Paychex has what you need. It has an all-in-one service for small employers with a fine reputation. Paychex’s lower-cost options are a nice break from some of the more expensive 401 providers.

Paychex also has HR services and benefits administration that you can use for your business. Business loans and other services also make up part of its services.

It is mainly an HR/payroll services company. However, it has teamed up with other 401 providers for you and takes care of your plan administration. If you choose to use its tax services, you’ll find it charges some extra fees for dealing with tax forms and tax services.

For one fee, Paychex makes for a less costly option for small companies that need more than one service.

Paychex has more than 100 offices around the country. Its customer support lines are open 24/7, making it easy to contact someone when you need help. Small employers are billed based on the number of workers and the number of pay periods each year.

Recommended Reading: How To Diversify 401k Portfolio