Alternatives To A 401 Early Withdrawal

As we mentioned, a 401 early withdrawal can be used in a financial emergency, but it shouldnt be your first choice. The good news is there are plenty of other options available to you.

There are several alternatives to an early withdrawal from retirement, however, most of them mean going into debt, Woodward said. The only difference is your credit will not be used in determining your eligibility for a 401 loan. Your credit will be used for credit cards , HELOCs, personal loans, and any other type of loan.

Your creditworthiness is a major factor when youre borrowing money. Some of the options below may only be available if you have good credit. In other cases, a poor credit score could make the loan cost-prohibitive.

When A Problem Occurs

The vast majority of 401 plans operate fairly, efficiently and in a manner that satisfies everyone involved. But problems can arise. The Department of Labor lists signs that might alert you to potential problems with your plan including:

- consistently late or irregular account statements

- late or irregular investment of your contributions

- inaccurate account balance

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

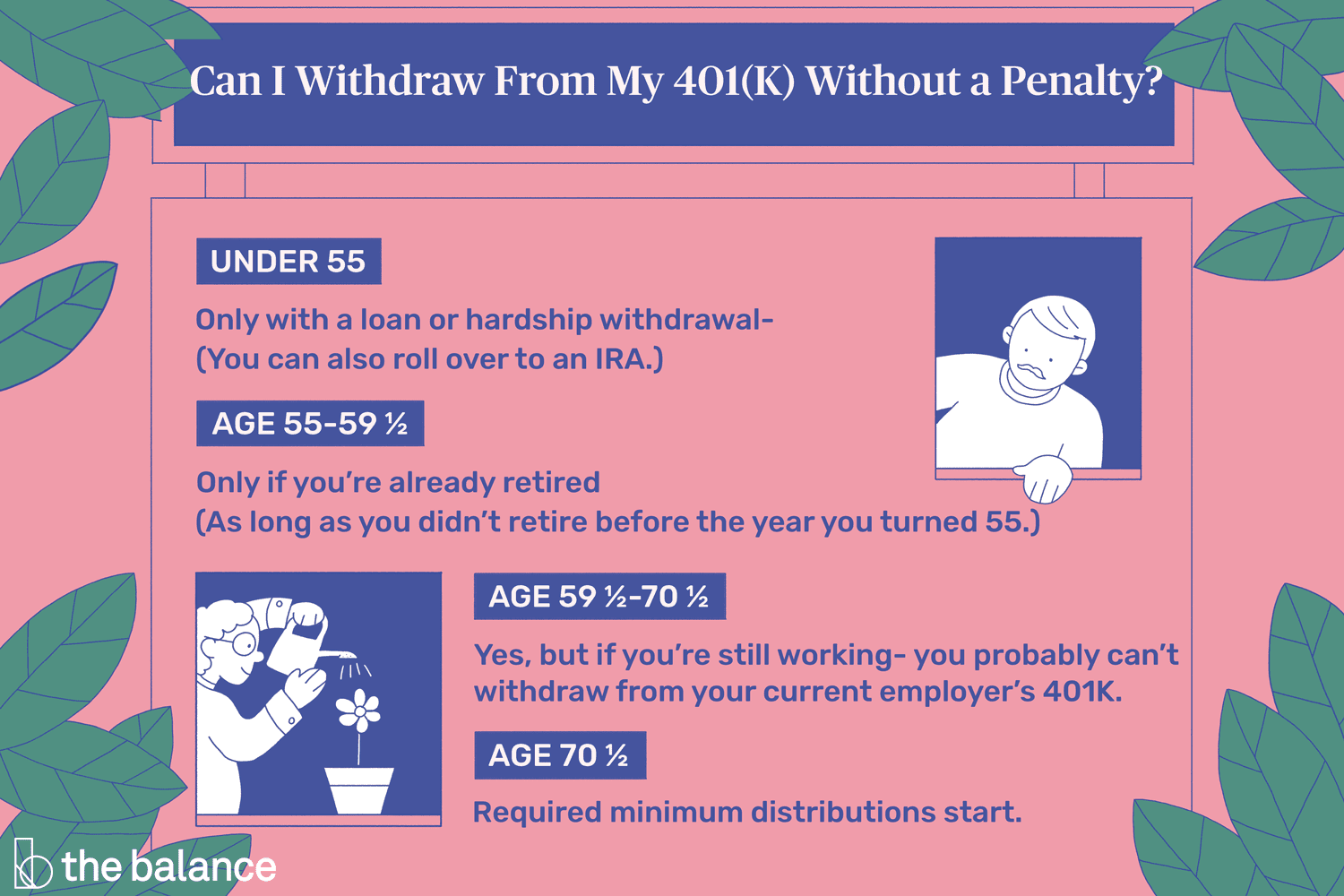

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

You May Like: Can I Roll Over 401k Into Ira

What Happens If A Person Does Not Take A Rmd By The Required Deadline

If an account owner fails to withdraw a RMD, fails to withdraw the full amount of the RMD, or fails to withdraw the RMD by the applicable deadline, the amount not withdrawn is taxed at 50%. The account owner should file Form 5329, Additional Taxes on Qualified Plans and Other Tax-Favored Accounts PDF, with his or her federal tax return for the year in which the full amount of the RMD was not taken.

How To Calculate Required Minimum Distribution

Required minimum distributions are withdrawals you have to make from most retirement plans when you reach the age of 72 . The amount you must withdraw depends on the balance in your account and your life expectancy as defined by the IRS. If you have more than one retirement account, you can take a distribution from each account or you can total your RMD amounts and take the distribution from one or more of the accounts. RMDs for a given year must be taken by December 31 of that year, though you get more time the first year you are required to take an RMD. If youre not sure whether to return the RMD or you need help with other retirement decisions, a financial advisor could help you figure out the best choices for your needs and goals.

Don’t Miss: How Do You Borrow From 401k

Hardship Withdrawal Vs 401 Loan: An Overview

Is it ever OK to borrow from your 401 plan, either as a 401 loan or a hardship withdrawal? After all, your plan is a powerful retirement savings tool and should be carefully handled. Indeed, data from Fidelity shows that the average account balance has climbed to $112,300, as of February 2020.

The recently enacted CARES Act lets you make a penalty-free COVID-19 related withdrawal or take out a loan from your 401 in 2020 with special repayment provisions and tax treatment.

The primary advantage of saving in a 401 is the ability to enjoy tax-deferred growth on your investments. When youre setting aside cash for the long term, a hands-off approach is usually best. Nevertheless, there are some scenarios in which taking money out of your 401 can make sense.

Before you pull the trigger, though, its important to understand the financial implications of tapping your retirement plan early. There are two basic avenues for taking some money out before reaching retirement age.

Retirement Plan And Ira Required Minimum Distributions Faqs

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

The Setting Every Community Up for Retirement Enhancement Act of 2019 became law on December 20, 2019. The Secure Act made major changes to the RMD rules. If you reached the age of 70½ in 2019 the prior rule applies, and you must take your first RMD by April 1, 2020. If you reach age 70 ½ in 2020 or later you must take your first RMD by April 1 of the year after you reach 72.

For defined contribution plan participants, or Individual Retirement Account owners, who die after December 31, 2019, , the SECURE Act requires the entire balance of the participant’s account be distributed within ten years. There is an exception for a surviving spouse, a child who has not reached the age of majority, a disabled or chronically ill person or a person not more than ten years younger than the employee or IRA account owner. The new 10-year rule applies regardless of whether the participant dies before, on, or after, the required beginning date, now age 72.

Your required minimum distribution is the minimum amount you must withdraw from your account each year. You generally have to start taking withdrawals from your IRA, SEP IRA, SIMPLE IRA, or retirement plan account when you reach age 72 . Roth IRAs do not require withdrawals until after the death of the owner.

For more information on IRAs, including required withdrawals, see:

You May Like: How To Close Your 401k

How Much Is Your 401k Taxed After Retirement

Shawn Plummer

CEO, The Annuity Expert

When you stop working, how much of your 401k is taxed? Its a question that many people ask themselves when they are planning for retirement. There are a lot of complexities to how this works, and the answer isnt always straightforward. This guide will go over how much is a 401k taxed after retirement, which should help you make better decisions about how to invest your money!

When Do I Have To Start Making Withdrawals From My Ira

You cant keep your funds in a retirement account indefinitely. Generally, youre required to start taking withdrawals from your traditional IRA when you reach age 70 ½ . Roth IRAs, however, dont require withdrawals until the owner of the account dies.

The amount that youre required to withdraw is called a required minimum distribution . You can withdraw more than the RMD amount, but withdrawals from a Traditional IRA are included in your taxable income. If you fail to make withdrawals that meet the RMD standards, you may be subject to a 50% excise tax. Roth IRAs do not require RMDs. Your money grows tax-free, since contributions are made from after-tax dollars, and your withdrawals in retirement aren’t taxed.

Read Also: How Much Will My 401k Be Worth When I Retire

Can I Take All My Money Out Of My 401 When I Retire

You are free to empty your 401 as soon as you reach age 59½or 55, in some cases. Its also possible to cash out before, although doing so would normally trigger a 10% early withdrawal penalty.

If you want to cash out everything, you can opt for a lump-sum payment. Think carefully before taking this approach, though. Withdrawing your savings all at once could result in a hefty tax bill and, if not managed wisely, leave you living in severe poverty later on in retirement.

Withdrawing Money From A 401 After Retirement

Once you have retired, you will no longer contribute to the 401 plan, and the plan administrator is required to maintain the account if it has more than a $5000 balance. If the account has less than $5000, it will trigger a lump-sum distribution, and the plan administrator will mail you a check with your full 401 balance minus 20% withholding tax.

Before you can start taking distributions, you should contact the plan administrator about the specific rules of the 401 plan. The plan sponsor must get your consent before initiating the distribution of your retirement savings. In some 401 plans, the plan administrator may require the consent of your spouse before sending a distribution. You can choose to receive non-periodic or periodic distributions from the 401 plan.

For required minimum distributions, the plan administrator calculates the amount of distribution for the qualified plans in each calendar year. The 401 may provide that you either receive the entire benefits in the 401 by the required beginning date or receive periodic distributions from the required date in amounts calculated to distribute the entire benefits over your life expectancy.

Recommended Reading: Can I Move 401k To Roth Ira

Understanding Early Withdrawal From A 401

Withdrawing money early from your 401 can carry serious financial penalties, so the decision should not be made lightly. It really should be a last resort.

Not every employer allows early 401 withdrawals, so the first thing you need to do is check with your human resources department to see if the option is available to you.

As of 2021, if you are under the age of 59½, a withdrawal from a 401 is subject to a 10% early withdrawal penalty. You will also be required to pay regular income taxes on the withdrawn funds.

For a $10,000 withdrawal, when all taxes and penalties are paid, you will only receive approximately $6,300.

After You Retire You Have An Important Choice To Make With Your 401 Account Here Are The Options Available Along With The Pros And Cons Of Each So You Can Determine Which Is Best For You

This article was updated on July 6, 2017, and was originally published on June 13, 2015.

If you’re planning to retire soon and have a 401 or similar employer-sponsored retirement plan, then you have an important question to answer: what happens with your retirement nest egg? You could choose to leave your money in the plan, take a lump sum payout or partial withdrawal, buy an annuity, or roll the money over to an IRA. All of these options have their pros and cons, so let’s see if we can figure out which is the best move for you.

You May Like: How To Allocate Your 401k

How Long Does It Take To Cash Out A 401

While the amount of time it takes to receive money differs by plan, administrator and employer, you can often expect to wait several weeks minimum to receive your funds. Some plans may also be bound by rules that prohibit them from distributing these funds more than once a quarter or year, extending this time horizon to 30 90 days or more.

As 401 plans are highly regulated, and subject to strict governance, it can often take a considerable amount of time to ensure that proper guidelines are followed. Complete paperwork must also be in hand in order for requests to process. Noting that any funds withdrawn are unlikely to become immediately available, be sure to consult your summary plan description document to learn more about the rules of your plan, and how long it can take to receive disbursements.

Review Your 401s Payout Policy

One key question in retirement is how youll create an income stream that is, a retirement paycheck from your savings. If your 401 lets you set up regular withdrawals or an installment payment plan, then it might make sense to keep your money in the plan.

If your 401 doesn’t allow for periodic payouts, consider rolling your savings over to an IRA.

A growing number of employers allow retiring workers to say, Pay out X dollars per month, says Steve Vernon, author of Retirement Game-Changers and a research scholar at the Stanford Center on Longevity.

But 401 plans vary widely. Some allow lump-sum disbursements only. Others might offer partial withdrawals, but the number is limited. If and when you need periodic payments, youll need an account that allows that. If your 401 doesnt, consider rolling your savings over to an individual retirement account. See this quick-start guide on 401 rollovers for more on this process.

Read Also: How To Roll Your 401k Into A Self Directed Ira

Withdrawals From A 401

-

401 hardship withdrawals If you find yourself facing dire financial concerns and need cash urgently, your 401 plan may offer a hardship withdrawal option. Unlike a 401 loan, you wont have to repay the money you take out, but you will owe taxes and potentially a premature distribution penalty on the amount that you withdraw. In addition, IRS 401 hardship withdrawal rules state that you may not take out more money than what is needed to cover your hardship situation. In order to qualify for a 401 hardship withdrawal, your plan administrator must offer this option and you must be facing an immediate and heavy financial need. According to the IRS, approved 401 hardship withdrawal reasons include:

- Postsecondary tuition for you or your family

- Medical or funeral expenses for you or your family

- Certain costs related to buying, or repairing damage to, your primary residence

- Preventing your immediate eviction from or foreclosure of your primary residence

If you experience a financial hardship from a circumstance not on this list, you may still be able to qualify for a hardship withdrawal, so check with your plan administrator.

- In-service, non-hardship withdrawals

This type of withdrawal is only allowed under certain plans and is mainly used by those who would like to explore other investment options. Learn more about in-service distributions. An Ameriprise financial advisor can provide more detailed information on in-service 401 distributions.

The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Recommended Reading: What Percentage Should I Be Contributing To My 401k

Make Sure To Consider Tax Consequences

Now that you understand the major buckets you can withdraw retirement funds from, you must come up with a strategy to do so.

One of the major things to consider is how each type of withdrawal will impact your taxes.

You have to take RMDs, so youll have to pay income tax on that money. After that, you can explore the types of investment accounts you have.

Make a plan to withdraw money from the different types of accounts to keep your tax bill as low as possible over the long-term. This may mean you need to have a spending plan for the future to know how much income youll need each year.

A spending plan can help you determine when its most advantageous to withdraw money from each account.

The plan can offer guidance for when withdrawing from tax-free Roth accounts or when withdrawing from a traditional retirement account makes more sense.

Roll Over Your Assets To An Ira

For more retirement investment options and to maintain the tax-advantaged status of the account, roll your old 401 into an individual retirement account . You will have greater flexibility over access to your savings .1 Before-tax assets can roll over to a Traditional IRA while Roth assets can roll directly to a Roth IRA. Review the differences in investment options and fees between an IRA and your old and new employers 401 plans.

Also Check: Can You Use Your 401k For A House Down Payment

What Else Do I Need To Know

- If your employer makes contributions to your 401 plan you may be able to withdraw those dollars once you become vested . Check with your plan administrator for your plans withdrawal rules.

- If you are a reservist called to active duty after September 11, 2001, special rules may apply to you.

Important Note: Equitable believes that education is a key step toward addressing your financial goals, and this discussion serves simply as an informational and educational resource. It does not constitute investment advice, nor does it make a direct or indirect recommendation of any particular product or of the appropriateness of any particular investment-related option. Your unique needs, goals and circumstances require the individualized attention of your financial professional.

Equitable Financial Life Insurance Company issues life insurance and annuity products. Securities offered through Equitable Advisors, LLC, member FINRA, SIPC. Equitable Financial Life Insurance Company and Equitable Advisors are affiliated and do not provide tax or legal advice, and are not affiliated with Broadridge Investor Communication Solutions, Inc.

Take the next step

You May Like: How To Divide 401k In Divorce

Know How To Take Distributions

If you have several retirement accounts because of frequent job changes and youre approaching retirement, you now have the task of figuring out how to withdraw the money.

Will you have to tap all of your accounts? Probably not.

If you own a handful of traditional IRAs, you can withdraw from each of them. But the more efficient move may be to add the assets from all your accounts and take one withdrawal from a single IRA.

Consolidating IRAs into a single account can simplify paperwork, make it easier to compute future withdrawals and gain greater control over your asset allocation, Slott says.

However, you cant make withdrawals from an IRA to meet your RMD requirements for a 403, 401 or another plan.

Its vital to note that 401 plans cant be pooled to compute a single RMD, says George Jones, managing editor Wolters Kluwer Tax & Accounting. To streamline those, roll them into an IRA.

You May Like: How To Use My 401k To Start A Business