What Is A 401

A 401 is a retirement plan offered by some employers. These plans allow you to contribute directly from your paycheck, so theyre an easy and effective way to save and invest for retirement. There are two main types of 401s:

-

A traditional 401: This is the most common type of 401. Your contributions are made pre-tax, and they and your investment earnings grow tax-deferred. Youll be taxed on distributions in retirement.

-

A Roth 401: About half of employers who offer a 401 offer this variation. Your contributions are made after taxes, but distributions in retirement are not taxed as income. That means your investment earnings grow federally tax-free.

Provisions For Changing Jobs

Most 401 plans permit the employee who terminates employment the options of receiving the 401 balance in a lump sum or to receive periodic payments or to roll over the proceeds to an IRA or other employer-sponsored retirement plan. Additionally, some 401 plans permit the terminated employee to retain their 401 balance in their former employer’s plan. Amounts that are retained in a former employer’s 401 plan or transferred to another employer’s plan or IRA postpone the taxation until amounts are subsequently distributed from the plan or IRA the money was rolled into.

When receiving funds from a 401 with the intention to roll the amount to an IRA:

- The rollover must be completed in 60 days.

- Employers must withhold 20% of the proceeds as a withholding tax. It is up to the participant to make up this 20%, or it will be treated as a distribution. The money withheld will be used as a credit against any income tax liability.

- Neither the 60-day rule nor the 20% withholding apply to amounts directly transferred to an IRA or other qualified plan.

What Happens If You Exceed The 401 Contribution Limit

If you go over the maximum 401 contribution for a given tax year, this is called an “excess contribution.” Excess contributions are subject to double-taxation if you do not disburse them by April 15 of the year following the tax year in question. If you discover you made an excess contribution, reach out to your plan administrator immediately to correct the issue.

Don’t Miss: How Can I Get My Money From 401k

Contribution Limits In 2020 And 2021

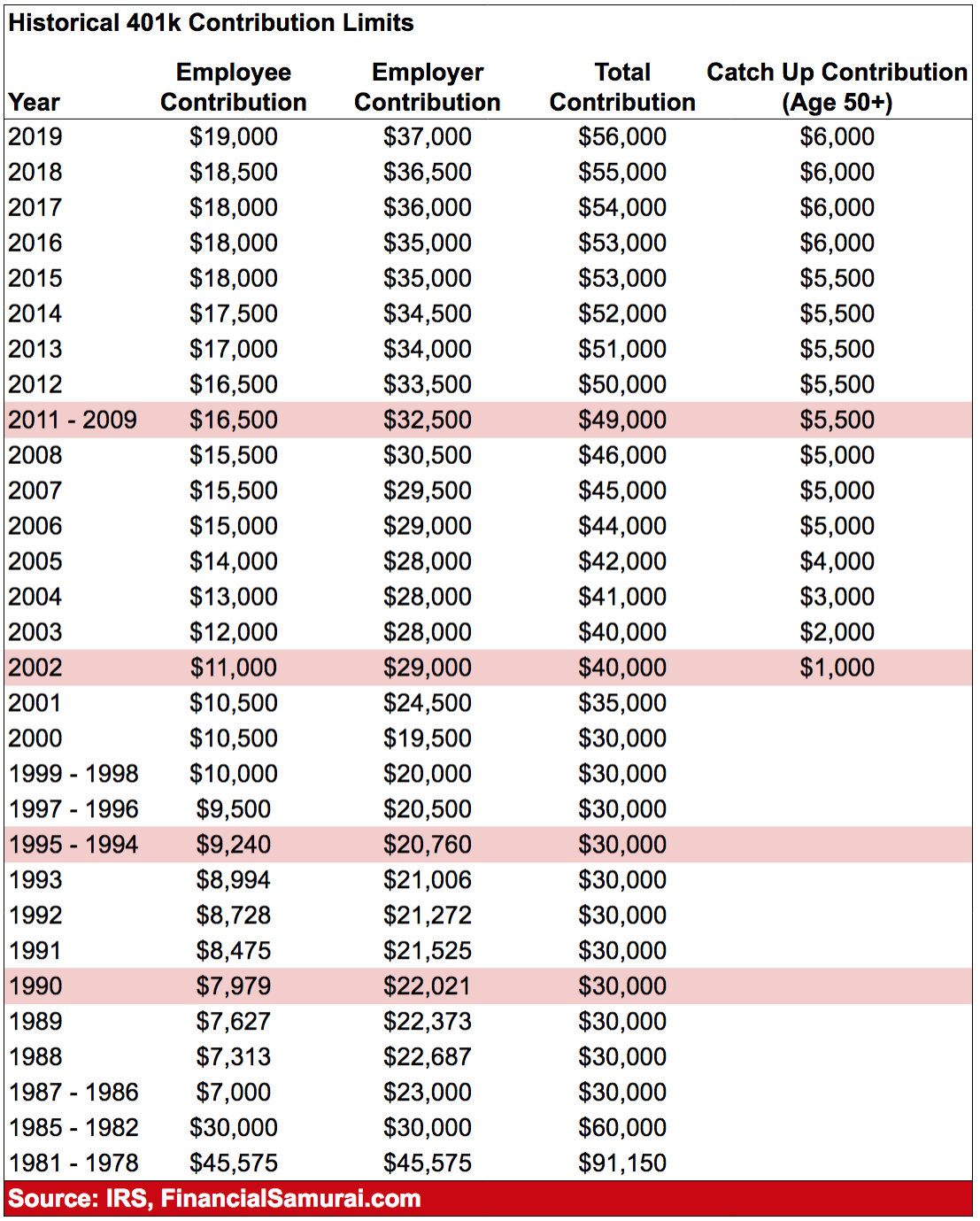

For 2021, the 401 limit for employee salary deferrals is $19,500, which is the same amount as the 401 2020 limit. Employer matches dont count toward this limit and can be quite generous.

However, the total contribution limit, which includes employer contributions , has increased to $58,000 in 2021, up from $57,000 in 2020.

On top of these amounts, workers aged 50 and older can add up to $6,500 more annually as a catch-up contribution.

The 401 contribution limits also apply to other so-called defined contribution plans, including:

- 403 plans, available to education and non-profit workers.

- Most 457 plans used by state and local government employees.

- The federal governments Thrift Savings Plan.

| 401 plan limits |

|---|

Limitation On Elective Deferrals

The maximum amount you can defer into your 401 plan adjusts each year for inflation. As of 2012, the standard limit is $17,000. However, for people age 50 and older, the contribution limit increases by $5,500 because of what is known as a catch-up contribution. This extra $5,500 increases the total limit for someone older than 50 to $22,500. The catch-up contribution does not count toward the general 401 plan contribution limits.

Dont Miss: When Can I Set Up A Solo 401k

You May Like: Do Employers Match Roth 401k

What Is Your Employer Match

The exact match amount varies from employer to employer, so you will need to ask human resources or your boss about the plan details to be sure your contributions meet the level of the maximum employer match.

Generally speaking, the average matching contribution is 4.3% of an employees pay. Nearly three-quarters of employers prefer to match 50 cents on the dollar, up to 6% of employee pay. About one-quarter of employers elect to match dollar-to-dollar, up to a maximum of 3% employee pay.

You want to be sure youre contributing at least enough to earn all of the matching dollars your employer offers. After all, this is FREE money.

How Do You Take A Withdrawal Or Loan From Your Fidelity 401

If you’ve explored all the alternatives and decided that taking money from your retirement savings is the best option, you’ll need to submit a request for a 401 loan or withdrawal. If your retirement plan is with Fidelity, log in to NetBenefits®Log In Required to review your balances, available loan amounts, and withdrawal options. We can help guide you through the process online.

Read Also: Can You Transfer Your 401k

What If Even 10% Is Too Much

For those who havent saved anything, I know its very hard to get started. But no matter what, you should at least contribute enough to get the employer match. A popular employer matching scheme is to match 50% of your first 6% of your salary. Lets say thats what your employer gives. For someone who make $50,000 a year that can contribute 6% a year, they will get $1,500 for free. $3,000 still sounds like a lot, I know, but do your best. Thats a little over $115 a paycheck. Find ways to spend less on what you already spend money on. Figure out what you can cut out of your budget. Think about it. Saving for retirement is still going to benefit you. Its not like you lose the money you saved in your 401k.

How Much Tax Do You Pay On 401 Distributions

A withdrawal you make from a 401 after you retire is officially known as a distribution. While youve deferred taxes until now, these distributions are now taxed as regular income. That means you will pay the regular income tax rates on your distributions. You pay taxes only on the money you withdraw. If you withdraw $10,000 from your 401 over the course of the year, you will only pay income taxes on that $10,000. Its possible to withdraw your entire account in one lump sum, though this will likely push you into a higher tax bracket for the year, so its smart to take distributions more gradually.

The good news is that you will only have to pay income tax. Those FICA taxes only apply during your working years. You will have already paid those when you contributed to a 401 so you dont have to pay them when you withdraw money later.

State and local governments may also tax 401 distributions. As with the federal government, your distributions are regular income. The tax you pay depends on the income tax rates in your state. If you live in one of the states with no income tax, then you wont need to pay any income tax on your distributions. So depending on where you live, you may never have to pay state income taxes on your 401 money.

Recommended Reading: Can You Roll Your 401k Into An Ira

What Happens If You Contribute Too Much To Your 401

If your 401 contributions exceed the limits above, you may end up being taxed twice on your excess contributions: once as part of your taxable income for the year that you contribute and a second time when you withdraw from your plan. Earnings still grow tax-deferred until you withdraw them.

If you realize you contributed too much to your 401, notify your HR department or payroll department and plan administrator right away. During a normal year, you have until your tax filing deadlineusually April 15to fix the problem and get the money paid back to you.

Excess deferrals to a 401 plan will have to be withdrawn and returned to you. Your human resources or payroll department will have to adjust your W-2 to include the excess deferrals as part of your taxable income. If the excess deferrals had any earnings, you will receive another tax form that you must file the following tax year.

If You Start At Age :

With a 4% rate of return: $1,090.78 per month

- Annual salary needed if you save 10% of your income: $130,893

- Annual salary needed if you save 15% of your income: $87,262

With a 6% rate of return: $698.41 per month

- Annual salary needed if you save 10% of your income: $83,809

- Annual salary needed if you save 15% of your income: $55,872

With an 8% rate of return: $433.06 per month

- Annual salary needed if you save 10% of your income: $51,967

- Annual salary needed if you save 15% of your income: $34,644

You May Like: Can You Take Money From Your 401k

What Is A 401 And How Do They Work

A 401 is a retirement savings plan sponsored by employers. You fund the account with money from your paycheck, you can invest that money in the stock market, and you earn some tax perks for participating.

That’s the basic definition of a 401. The more interesting angle is what a 401 can do for you. The 401 is a powerful resource for achieving financial independence, especially when you start using it early in your career. Said another way, if you like money and wish to have more of it in the future, you can use a 401 to make that happen.

Read on for a closer look at how the 401 works, when you can withdraw funds from a 401, and what happens to your 401 if you change jobs.

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

Recommended Reading: What Is A Simple 401k

The Boring Glory Of Index Funds

Your best bet is to buy something called an index fund and keep it forever. Index funds buy every stock or bond in a particular category or market. The advantage is that you know youll be capturing all of the returns available in, say, big American stocks or bonds in emerging markets.

And yes, buying index funds is boring: You usually wont see enormous day-to-day swings in prices the same way you may if you owned Apple stock. But those big swings come with powerful feelings of greed, fear and regret, and those feelings may cause you to buy or sell your investments at the worst possible time. So best to avoid the emotional tumult by touching your investments

Are There Income Limits For 401s

While theres not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on highly compensated employees when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels arent participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $130,000 from the business in the preceding year and, if the employer ranks employees by compensation, was in the top 20%.

You May Like: What Is A Self Directed 401k

You Get A Tax Break For Contributing To A 401

With its name derived from the tax code, the 401 is an employer-based retirement savings account, known as a defined-contribution plan. You contribute pretax money from your salary, which lowers your taxable income and helps you cut your tax bill now. For instance, if you make $4,000 a month and save $500 a month in your 401, only $3,500 of your monthly earnings will be subject to tax. Plus, while inside the account, the money grows free from taxes, which can boost your savings.

Other Important Financial Goals To Consider

You should keep a few other things in mind as you decide how much to contribute to your 401 based on your own unique financial situation.

- Do you have a formal estate plan with a will and other critical papers ?

- Can you cover health care expenses? Make sure you’re putting enough into your health savings account , both now and in the future, to cover medical expenses if you have a high-deductible health plan with an HSA combo.

- Do you have proper disability insurance coverage to protect you and your family if you miss work for six months or more due to illness or injury?

- Do you have long-term care plans in place if you’re nearing retirement?

Recommended Reading: How To Pull Money Out Of My 401k

What Is The Maximum 401k Contribution For 2021

That depends on your employer’s plan. The maximum the IRS allows for 2021 stayed the same as 2020. Currently, the cap sits at $19,500 but your employer may cap the amount below that. For people over 50 the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

For Financial Independence In Retirement

The 401 makes it easy to build wealth for retirement. Once you set your preferences, the work of saving and investing happens behind the scenes. Plus, you have tax savings and, possibly, matching contributions that expedite your savings momentum.

Here’s what it comes down to: The earlier you start contributing to a 401, the more you’ll get from its benefits and the richer you can be when you retire.

Also Check: How To Pull Out Of Your 401k

Transparency Is Our Policy Learn How It Impacts Everything We Do

Transparency is how we protect the integrity of our work and keep empowering investors to achieve their goals and dreams. And we have unwavering standards for how we keep that integrity intact, from our research and data to our policies on content and your personal data.

Wed like to share more about how we work and what drives our day-to-day business.

Don’t Forget The Match

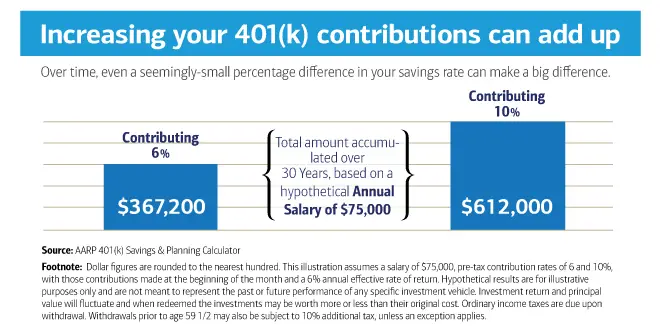

Of course, every person’s answer to this question depends on individual retirement goals, existing resources, lifestyle, and family decisions, but a common rule of thumb is to set aside at least 10% of your gross earnings as a start.

In any case, if your company offers a 401 matching contribution, you should put in at least enough to get the maximum amount. A typical match might be 3% of salary or 50% of the first 6% of the employee contribution.

It’s free money, so be sure to check if your plan has a match and contribute at least enough to get all of it. You can always ramp up or scale back your contribution later.

“There is no ideal contribution to a 401 plan unless there is a company match. You should always take full advantage of a company match because it is essentially free money that the company gives you,” notes Arie Korving, a financial advisor with Koving & Company in Suffolk, Va.

Many plans require a 6% deferral to get the full match, and many savers stop there. That may be enough for those who expect to have other resources, but for most, it probably won’t be.

If you start early enough, given the time your money has to grow, 10% may add up to a very nice nest egg, especially as your salary increases over time.

You May Like: How Do 401k Investments Work

S To Take Now To Improve Your Retirement Readiness

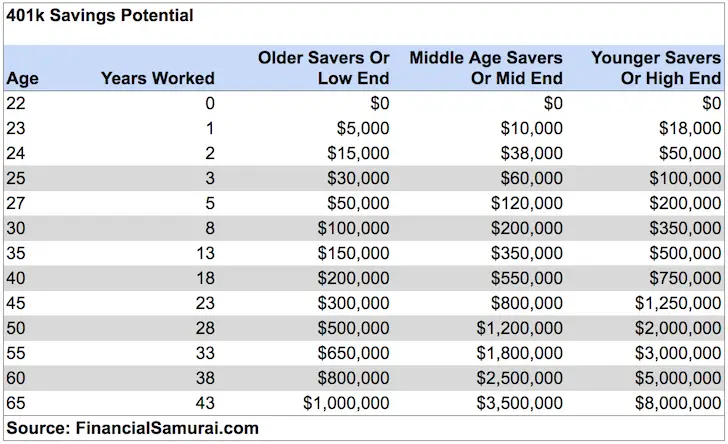

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Recommended Reading: How To Withdraw From 401k