Lockheed 401k Faqs: What Is A Self

Another common question I get when first sitting down with a new Lockheed Martin client is what is this self-directed brokerage account thing in my 401k? You might have seen it in the Your Asset Allocation & Balance by Fund section of your 401k statement.

The self-directed brokerage account allows you to invest outside of the normal 401k investment options available to you. Participants can invest in individual stocks, bonds, ETFs and mutual funds that are not available outside the SDBA.

The account is opened at TD Ameritrade, a brokerage firm separate from Voya .

Managing Your Own Retirement Savings Requires Discipline

Self-directed brokerage accounts are designed for advanced investors who know how to research and manage their investments. The Financial Industry Regulatory Authority, Inc. cautions investors that the additional choices come with additional responsibilities. Unfortunately, individual investors often fall victim to the behavior gap due to mistakes related to emotional decision-making. Having discipline as an investor typically requires a focus on things within your control, such as asset allocation, contribution rates, minimizing costs, and asset location ).

Lending Possibilities From A 401k Or Ira

Regular IRAs cannot be used to make loans but self-directed IRAs and 401ks sometimes allow investors to make loans to certain qualified persons including the investor, their spouse, their children, or their parents. Loans can be made to invest in real estate, land, small businesses, or for other limited uses. However, just because the rule exists doesnât mean investors should use it. Before deciding to lend out money from a self-directed account, investors should do their research â making the wrong move could mean that the IRS becomes involved and the investor loses the tax advantages on their account.

Don’t Miss: How To Find Out If You Have Unclaimed 401k Money

The Needs Of Most Americans

Experts recommend that you will need 80% of your income at retirement to maintain current living standards. These accounts don’t come close to meeting that need for most Americans. In fact, according to a 2019 study done by Fidelity Investments, the average plan has about $112,300 at retirement.

According to Vanguard, one of the largest providers of 401 plans, they now advise clients to contribute 12% to 15% of their paycheck to their 401, but most employees pay far less than that.

Putting a person’s retirement planning back into their own hands may save the company money, but recent data proves that it isn’t best for the employee. Asking somebody with little or no knowledge of investment markets to make such important decisions based on a stack of prospectuses that they don’t understand, doesn’t appear to be working.

However, thanks to the self-directed option in some 401 plans, there is another way for employees to maximize their 401 savings and ensure that their retirement needs are met.

How To Set Up A Self

To be eligible to open a self-directed 401 you must have earned taxable compensation during the current financial year. Employers may offer self-directed 401 plans as an alternative to a traditional 401. In this instance, a self-directed 401 would also be managed by the plan administrator.

There are three main ways that you can fund your self-directed 401:

- Transfers: transferring funds from previous 401s, , SIMPLE IRAs and traditional IRAs the only funds that cant be transferred are Roth IRAs

- Profit sharing: receiving a direct share of profits can be up to 25% of the sponsoring entitys profit

- Contributions: deferring income into the account

Notably, the contribution limits for self-directed 401 are the same as the contribution limits for traditional 401 plans. For 2022, that limit is $20,500. For catch-up contributions, which are available to anyone over the age of 50, the limit is an additional $6,500, bringing the total contribution limit to $27,000 in 2022.

Also Check: What Happens To 401k When You Leave Your Job

Roundabout Prohibited Transaction Question:

While the solo 401k investment rules allow for promissory note investments, this transaction would result in a roundabout prohibited transaction because the rules do not allow for a transaction that is prohibited to be done indirectly. In other words, while your brother is not a disqualified party from a solo 401k investment perspective, if he were to turn around and loan those borrowed funds or other funds to you, the IRS would view as you essentially processing a promissory note from your own solo 401k which is prohibited. Dont confuse this rule with the solo 401k participant loan rules, though. To learn more about the difference between a promissory note investment and a solo 401k participant loan.

Understand The Eligibility Conditions

Firstly acquaint yourself with the eligibility conditions. The primary eligibility condition is that you, as the business owner, can only participate as the plan is designed only for a single participant. You will not be eligible for the plan if you have full-time employees who would qualify for a 401.

Also Check: How Much Can An Employer Match In A 401k

Buying Or Distributing Solo 401k Owned Real Estate Question:

Excellent and popular questions. First, no you cannot buy property such as a condo from your own solo 401k plan as that would result in violation of the following prohibited transaction rule.

Sale, exchange, or leasing of property between a plan and a party in interest .

However, it would not be prohibited if you take an in-kind solo 401k distribution of the property since the rules allow for distributions in the form of an asset instead of cash. You can also spread the tax liability by taking partial in-kind distributions of the property. You will need to get the property appraised each time you process a partial distribution, however.

Is It Possible To Follow A Different Path

Increasingly, however, employers are making self-directed brokerage accounts available in their 401 plans in response to employee demand for more investment options. As many as 40% of 401 plans now offer this type of account. In fact, the balance in self-directed brokerage 401 accounts had continued to rise last year , despite the havoc in the COVID-19 markets.

A self-directed brokerage 401 account is held by the plan administrator, but the plan participant has, in effect, their own brokerage account in which all transactions are made at their direction. The investment choices are usually much more numerous than in the plan menu. Some employers give more freedom than others. For instance, some SDBAs only allow you access to a greater menu of mutual funds, while others allow you to invest in individual stocks, bonds, ETFs and a broader array of mutual funds.

So, essentially, the good news is wider investment options but the bad news is higher risk.

You May Like: Is There A 401k For Self Employed

How Do I Open A Sdba

Enjoy trading and researching investments online? A SDBA might be a good option for you.

First, you have to be eligible. You need at least $4000 in the core funds or target date retirement funds and have to deposit at least $3,000 into the new SDBA account.

Top open the account, you have to complete a TD Ameritrade SDBA application. The application may be downloaded from the Savings Plan Web Tool or you can call the Savings Plan Information Line to get an SDBA application mailed to you.

To get to the Savings Plan Web Tool, visit LM People at https://www.lmpeople.com. Youll need to determine on the application what type of account you want to open, then fax the application back to the number on the form. Your account should be open in a few business days.

Consider Setting Up A Self

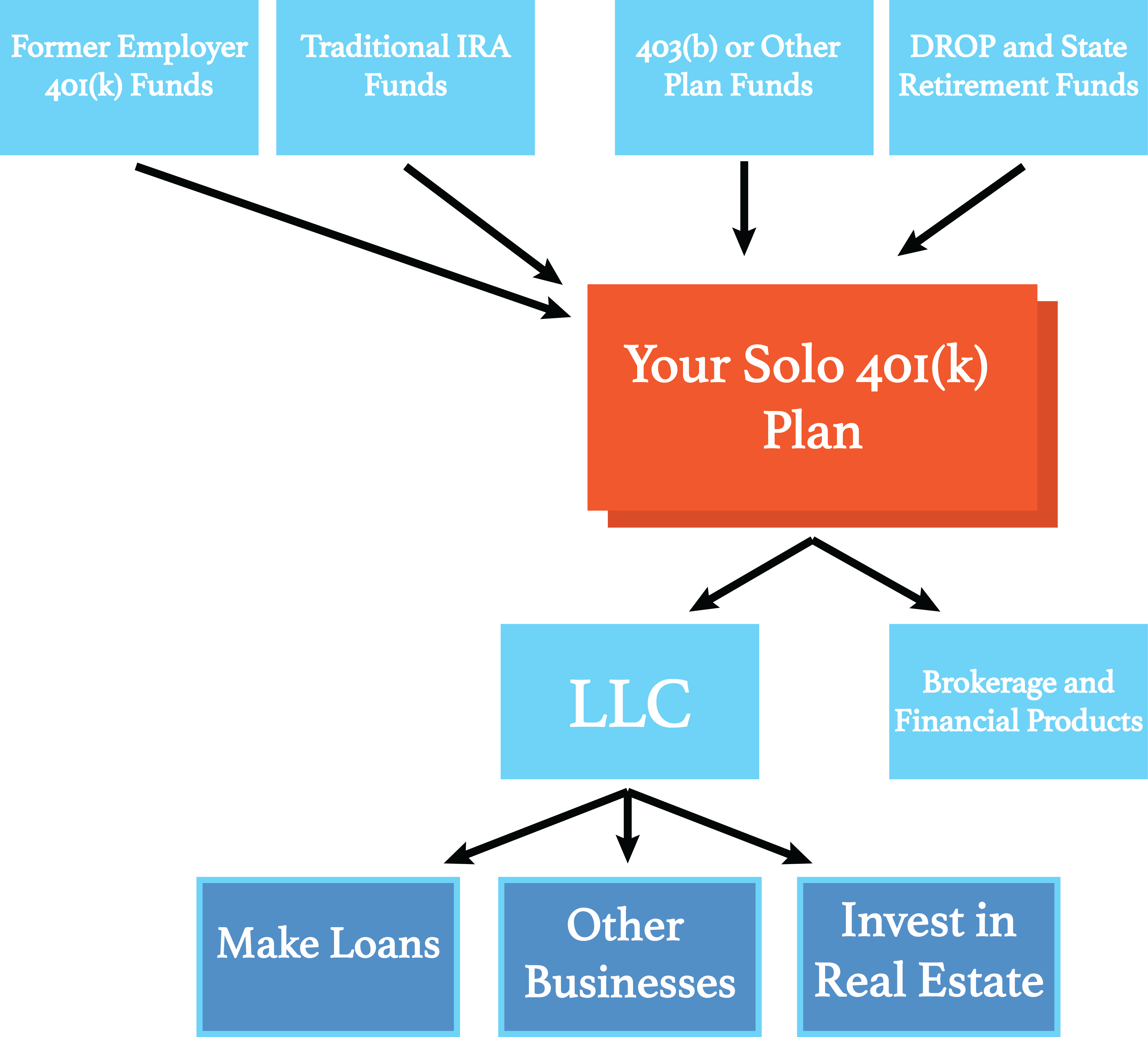

Investors who have a self-directed 401k can establish a Solo 401 LLC to manage their retirement savings. Essentially, an investor sets up an LLC owned by their IRA or 401. The investor doesnât own the LLC themselves.

Existing retirement accounts can even be rolled into the self-directed LLC. Why would investors do this? It allows them to access higher contribution limits of $54,000 or more with no need for a custodian or trustee. That means that investors donât have to pay fees or abide by institutional imposed limits on what kinds of assets to invest in within their retirement account

Also Check: How Do I Access My 401k Funds

Pros And 5 Cons Of A Self

Today, many Americans rely on the 401 plans set up by their employer as a means of saving for their eventual retirement. A 401 plan allows you to use your pre-tax dollars to invest in mutual funds, as well stocks, bonds, and Target Date funds. Most likely, a firm contracted by your employer manages your 401 plan. Often, the funds in these 401 accounts are automatically invested per your employer or managing firms direction. However, did you know there was a way to have more control and be more involved with your 401 investments? Aself-directed 401 offers you more control, flexibility, and investment diversity. Before opening one of these specialized types of 401 plans, take a look at the pros and cons below.

Transactions Between Related Parties

Don’t entangle your 401 plan with your family members. For this purpose, “family members” are your parents, grandparents, children, grandchildren, or spouse’s children or grandchildren.

This means you can’t lend your 401 money to any of these relatives, let them live in property owned by your 401 plan, invest that money in your relatives’ businesses, or otherwise cause your family members to benefit from your 401 investments.

Don’t Miss: How To Close 401k After Leaving Job

Financing Through A Solo 401k

With regards to getting financing through a Solo 401K, there are certain rules that the lender must abide by. The loan must be non-recourse, meaning that the only recourse for the lender is foreclosure on the property. The lender cannot take a guaranty from you personally.

The classification of a loan as non-recourse may lead your lender to change the terms of the loan from its non-retirement account loans, so you should make sure to let the lender know that the borrower will be a retirement account, and let them explain their policies with regards to this.

At Rehab Financial Group, LP, we adjust the loan to value for these loans, but the rest of the process remains substantially the same.

If you are seriously thinking about investing in real estate through a self-directed retirement vehicle, it is worth the expense to speak with your accountant, to make sure that you are following the rules, and to discuss any potential issues you may have.

Depending on how the retirement plan is structured, you want to make sure to avoid losing the tax protections for retirement accounts and/or exposing yourself to liability for unrelated business tax income.

BACK TO REAL ESTATE BUSINESS STRATEGY

Sign up for RFGs Mailing List for Flipping Info and Updates

How To Open A Solo 401

You can open a solo 401 at most online brokers, though youll need an Employer Identification Number. The broker will provide a plan adoption agreement for you to complete, as well as an account application. Once youve done that, you can set up contributions. Youll have access to many of the investments offered by your broker, including mutual funds, index funds, exchange-traded funds, individual stocks and bonds.

If you want to make a contribution for this year, you must establish the plan by Dec. 31 and make your employee contribution by the end of the calendar year. You can typically make employer profit-sharing contributions until your tax-filing deadline for the tax year.

Note that once the plan gets rocking, it may require some additional paperwork the IRS requires an annual report on Form 5500-SF if your 401 plan has $250,000 or more in assets at the end of a given year.

If you need help managing the funds in your solo 401, robo-advisor Blooom will manage your 401 at your existing provider. If you want even more comprehensive financial help, you might opt for an online planning service. Companies such as Facet Wealth and Personal Capital offer low-cost access to human advisors and provide holistic guidance on your finances, including how to invest your 401.

Recommended Reading: What’s The Most I Can Contribute To My 401k

Understanding Expense Ratios For 401 Accounts

At first glance, it might seem strange that expense ratios for investments held in a 401 should be different from the same investments held in other types of investment accounts. If you are investing in Vanguards VWUSX, a popular choice for 401 plans, you might be attracted by the competitive 0.38% expense ratio the fund offers. But if you invest in this same fund via your 401 and carefully calculate the actual expense ratio you are paying, you may well find its higher than the advertised rate.

The reason is that 401 plans have costs and fees associated with them, and these are in addition to the fees charged by individual stock and bond funds. All 401 plans, in fact, are subject to a wide range of administrative fees that are charged alongside investment fees. These administrative fees cover costs like customer support, legal services, record keeping, and transaction processing. Some of these fees are covered by your employer, but typically most fees are passed onto the plans participants . All of these fees are lumped into the aggregate expense ratio for your 401.

Though 1% might not sound like much, it can make a big difference over the long term. Research by the Pew Charitable Trusts confirms that fees have a serious impact, noting that fees can affect savings directly by reducing the amount saved, and indirectly by lowering the amount available for compoundinga frequently overlooked but significant detriment to savings growth.

Start Your Own Business

The last option you have with your 401 plan is to start your own business. You can now use the money saved up from all those years of working and invest them in creating your own company or expanding an existing one.

It is a risk, but if you do it right, the profits you make will be well worth all the effort.

Read Also: Can I Set Up My Own 401k Plan

Rules Specific To A Self

The primary way that an Operating Agreement for a Self-Directed IRA with checkbook control differs from a standard LLC Operating Agreement is how the IRS rules for Self-Directed IRAs and 401Ks are handled. If you dont follow the rules, you can risk the tax-deferred status of your account. This could lead to the disqualification and result in severe tax consequences.

Here is what you need to know: At a minimum, your Operating Agreement must contain language to handle the following:

Prohibited Transactions and Investments: This is basically self-dealing and certain investments such as collectibles.

Disqualified Individuals: You may not buy an investment from or sell an investment to a disqualified person. You and your family members are disqualified individuals. The list is longer for IRS purposes, but these are the primary disqualified persons.

Indirect Benefits: The purpose of your pension is to provide for your retirement in the future. It is considered to be an indirect benefit if your tax-deferred fund is engaged in transactions that, in some way, benefit you personally today.

UBIT: This is a tax that occurs when leverage is used to develop profits in investments.

Is Day Trading Good For 401k

Some financial professionals object to brokerage accounts in 401 plans because they worry that some investors might be tempted to try short-term trading, also known as day trading. Day traders attempt to make money on rapid, short-term price changes in a number of different stocks. But they face the increased risk of substantial losses by trying to time their trades. Further, the critics say, stressing short-term gains is at odds with the goal of retirement savings, which is long-term growth.

Similarly, these same critics fear that being able to trade regularly in a 401 brokerage account might encourage less experienced investors to sell off stocks during a market downturn and buy them again when the markets have recovered.

Letting the light in

The opportunity to choose among a larger universe of mutual funds or to trade stocks and bonds in your 401 account is sometimes described as a brokerage window.

They argue that this approach which they sometimes describe as a knee jerk reaction to market fluctuations is a bad idea. It means you pay higher prices when you repurchase shares, on top of sustaining losses, if you sell when prices have declined dramatically precisely the point at which panic tends to set in.

There is statistical evidence to show that past investors who stayed in the market through thick and thin came out ahead of investors who moved in and out but there are no guarantees that will be the case in the future.

Wishing you a great week!

Don’t Miss: Why Roll 401k Into Ira

Types Of Investments In A Self

A self-directed IRA will broaden the types of IRA investments that you can have in your 401k. Most 401k plans give you a limited number of 401ks to choose from when you are investing. This limits your choices, and ultimately takes away some of the control that you could have over your retirement accounts. There are a wide variety of options within the self-directed 401k.

Mutual Funds: You have the option to invest in mutual funds with your self-directed 401k. The benefit of choosing a self-directed over the traditional option is that you get choose the mutual funds. You can find funds that out per form the funds that are currently offered in your companys 401k.

Individual Stocks: If you like to invest in individual stocks, you can do it inside of this account. However, you need to pay close attention to the market, and monitor the companies that you include. You should never only own one type or one companys individual stock. You need to spread the risk around.

Precious Metals: You have the opportunity to purchase from an approved list of precious metals. This includes certain gold and silver coins.

Property: You can purchase property as part of your investment. This needs to be investment property and cannot be your primary residence or even a vacation home.