Does Roth Ira Count Towards 401k Limit

You make designated Roth contributions into a separate Roth account from your 401 plan. Read also : We have answers to tax filing questions on stimulus, deductions, and more. They are counting on the limit.

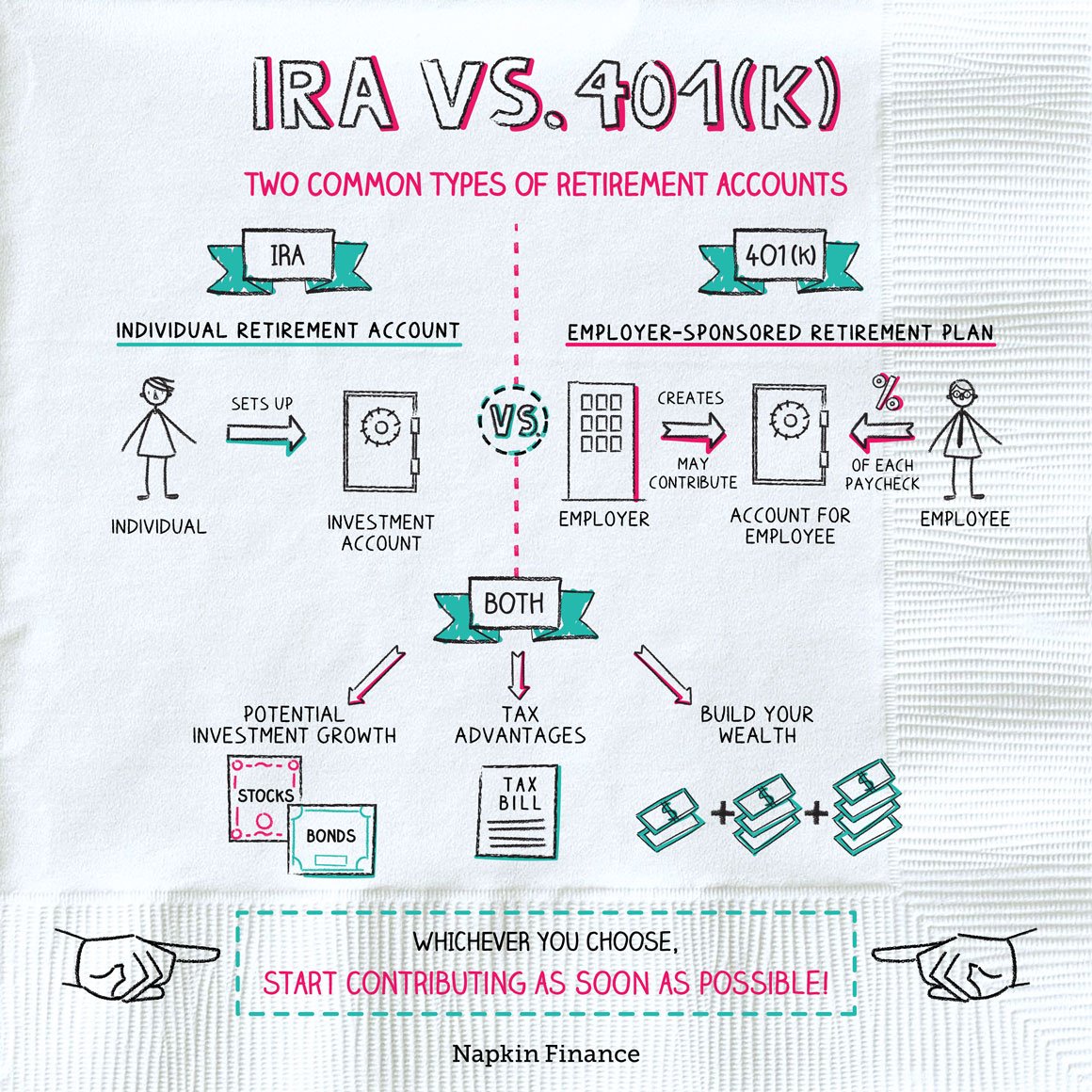

Can you have both a Roth IRA and a 401k? The quick answer is yes, you can have both a 401 and an individual retirement account at the same time. These plans share similarities in that they provide the opportunity for tax savings or Roth IRA, also tax-free income).

Contributing To An Ira After Maxing Out 401

If youre wondering how to contribute to an IRA after making the maximum contribution to your 401, there are two primary ways to do this. Plus, you can put in up to $6,000 every year and $7,000 if youre 50+ years. To contribute to an IRA, you can either fund a traditional IRA or fund a Roth IRA.

Ill discuss each of the options.

Keeping Your Current 401 Plan

First off: Whatever you do, dont take the cash out. This means cashing out your 401 and depositing that amount into your checking account and using it toward other expenses. This is a bad idea. If you do, youll get hit with a penalty from the IRS, and the money will count as income that increases your federal taxes for the year. Although it may be tempting, try other options instead.

One of the easiest things you can do instead is simply leave your current 401 balance where it is, even though you wont be able to make any additional contributions.

This option might be right for someone who is happy with the fees and performance of their current 401 plan and who doesnt have another retirement account to move the balance to.

But this option may not be the best because in a decade or two, you may have a handful of 401 plans sitting with previous employers, making them easy to lose track of and difficult to manage.

Also, not every employer allows you to keep your 401 open after you leave. Some might have a minimum balance requirement or require that you rehome your retirement funds into a new account with the same investment manager.

Recommended Reading: How To Set Up A Solo 401k Account

Questions About How Much To Contribute

Once employees learn that they are allowed to contribute more than the company match, they may wonder: How much should I contribute? Funds in either type of retirement investment account ) have a high potential to grow through compound interest over time, especially the longer theyre given to grow. Employees can benefit from knowing that even small amounts saved early have a bigger impact than the same amount saved later. Thanks to compound interest, just $35 a week can add up to $100,000 in 20 years and close to a million in 40. Heres where your 401 service provider or recordkeeper can help outthey likely have a retirement calculator that your employees can use to help them understand how much to save today for the type of retirement they want in the future.

Your employees can change the amount they save in the 401 account as often as they’d like. Generally, for employees its a good idea to save 5% early in your career, then to increase to 10% with raises and finally 15% as you get closer to retirement.

How To Know If You Qualify To Make 401 Contributions

Generally, if you’re employed and your employer sponsors a retirement plan, you can make contributions to a 401. But there are a few qualifying factors for participating in a 401:

- Meet the 401 plan entry rules: 401 plan rules commonly require individuals to be at least 21 years old. In some cases, employees may have to be employed for a certain amount of time before they can enroll in the plan and make contributions.

- 401 income limit: Fortunately, unlike IRAs, 401 plans have no income limits for making contributions. Therefore, anyone can contribute. However, there are potential rules such as discrimination tests for highly compensated employees that could limit your contribution amount below the general IRS limit of $19,500 per year, or $26,000 if you’re 50 or older, in 2021.

Don’t Miss: Should I Transfer 401k To New Employer

How Do I Recharacterize A Regular Ira Contribution

To recharacterize a regular IRA contribution, you tell the trustee of the financial institution holding your IRA to transfer the amount of the contribution plus earnings to a different type of IRA in a trustee-to-trustee transfer or to a different type of IRA with the same trustee. If this is done by the due date for filing your tax return , you can treat the contribution as made to the second IRA for that year .

The Rules You Need To Knowplus A Pitfall You’ll Want To Avoid

Eric is currently a duly licensed Independent Insurance Broker licensed in Life, Health, Property, and Casualty insurance. He has worked more than 13 years in both public and private accounting jobs and more than four years licensed as an insurance producer. His background in tax accounting has served as a solid base supporting his current book of business.

You can still contribute to a Roth IRA and/or traditional IRA even if you participate in a 401 plan at workas long as you meet the IRA’s eligibility requirements. You might not be able to take a tax deduction for your traditional IRA contributions if you also have a 401, but that will not affect the amount you are allowed to contribute. which is up to $6,000, or $7,000 with a catch-up contribution for those 50 and over, for 2021 and 2022.

It usually makes sense to contribute enough to your 401 account to get the maximum matching contribution from your employer. But adding an IRA to your retirement mix after that can provide you with more investment options and possibly lower fees than your 401 charges. A Roth IRA will also give you a source of tax-free income in retirement. Here are the rules you’ll need to know.

Recommended Reading: How Do You Transfer Your 401k

What Is The Difference Between An Ira Rollover And An Ira Transfer

The difference between an IRA transfer and any type of rollover is that the transfer rears its ugly head between the same type of retirement accounts, while the rollover is two different types of unsecured retirement debt. For example, moving a loan from one IRA account to an IRA account in another is a transfer.

How To Roll Over A Pension Into An Ira

Private sector employers that once offered workers traditional pensions, typically defined benefit plans, have been encouraging people to roll over their pensions into tax-advantaged plans like individual retirement accounts and 401s. If youre considering such a move, its important to understand your options, the pros and cons of each option and the tax-related rules about such a move. Before you do anything, though, consider working with a financial advisor who can help you make the best choices.

During the 1980s, 60% of private-sector companies offered their workers traditional pension plans, which were usually defined benefit plans. As the years have passed and employees stopped staying with the same company for life, the defined benefit plan is going the way of the dinosaur. Today, only 4% of private companies offer defined benefit plans.

As private-sector companies have discontinued their traditional pension plans, they have encouraged workers to launch a pension rollover to an IRA. Some have replaced the defined benefit plan with a 401, a defined contribution plan. They have encouraged their workers to either roll over their pension money to the new 401 or initiate a pension rollover to an IRA.

Also Check: What Happens If I Quit My Job With A 401k

How To Do A Backdoor Roth Ira Conversion

The backdoor Roth IRA method is pretty easy. The general steps are:

If you have a lot of traditional IRA funds you want to convert, but you don’t want to pay the taxes all at once, most brokerages will allow you to make the conversion over a period of several years.

How Does A 401 Work

While both accounts are tax-advantaged and intended to help individuals save for retirement, there are some big differences between them.

A 401 is employer-sponsored, which means you can only open an account if it’s offered by the company you work for. You typically can’t sign up for one independently. Any contributions to a 401 account are made using pretax dollars that come straight out of your paycheck.

With a 401, or other employer-sponsored account like a 403, you don’t pay taxes on the money until you begin taking out distributions for retirement. How much that money gets taxed depends on the tax bracket you’re in at the time of the withdrawal, and pulling from your 401 prior to the age of 59½ could result in a penalty.

A major perk with 401 plans is that employers often offer a “contribution match.” This is also sometimes referred to as an “employer match” or “company match,” but typically it means your company contributes the same amount to your 401 as you do, up to a certain percent.

For example, if you earn $55,000 a year plus a 4% match, you’ll need to contribute 4% in order to get the full employer match of $2,200. If you only put in $1,000, your employer will as well, which means you’re missing out on $1,200 of essentially free money that could be growing in the market.

In the U.S., the average company 401 match is 4.7%, according to retirement plan provider Fidelity.

You May Like: What Happens With My 401k When I Quit

Having A Traditional Ira And A Retirement Plan At Work

Now that you understand the retirement account contribution limits and the main differences between traditional and Roth accounts, lets cover the downside of contributing to a workplace and individual retirement account in the same year.

Suppose you or a spouse participate in a retirement plan at work. In that case, your tax deduction for traditional IRA contributions may be reduced or eliminated, depending on your modified adjusted gross income as follows for 2022:

Single taxpayers get a full deduction when your MAGI is up to $68,000 and a partial deduction up to $78,000. You receive no deduction at or above $78,000.

So, if Justin is single with an income thats less than $68,000, he could get a full deduction for his traditional IRA contributions. But if he earns more than $78,000, hes out of luck. And if Justin is a married guy who files taxes with a spouse, hes unable to claim a deduction if their household income tops $129,000.

If Justin is single with an income thats less than $68,000, he could get a full deduction for his traditional IRA contributions. But if he earns more than $78,000, hes out of luck.

In other words, if your income is below these thresholds for your tax filing status and you want an additional tax deduction for the year, then contributing to both a traditional workplace plan and a traditional IRA is a great option.

If youre not covered by a retirement plan at work, but your spouse is, here are the rules for 2022:

If My Ira Invests In Gold Or Other Bullion Can I Store The Bullion In My Home

Gold and other bullion are “collectibles” under the IRA statutes, and the law discourages the holding of collectibles in IRAs. There is an exception for certain highly refined bullion provided it is in the physical possession of a bank or an IRS-approved nonbank trustee. This rule also applies to an indirect acquisition, such as having an IRA-owned Limited Liability Company buy the bullion. IRA investments in other unconventional assets, such as closely held companies and real estate, run the risk of disqualifying the IRA because of the prohibited transaction rules against self-dealing.

Don’t Miss: When Can You Start Withdrawing From 401k

Yes If You Can Max Out Both Accounts

Heres a simple question to ask yourself: Can I contribute to 401 and IRA plans up to the annual limits, based on my income and spending? If so, this can go a long way in funding your dreams for retirement.

This assumes, of course, that you can realistically afford to contribute $19,500 to a 401 each year along with up to $6,000 to an IRA. If youre trying to pay down debt, save for your childs college expenses, or reach other financial goals, then fully funding multiple retirement accounts may not be realistic.

If you are planning to contribute the maximum to both a traditional IRA and a 401, consider your budget and spending. And youll need to do some research into how that may affect your retirement tax deductions.

Considerations When Contributing To An Ira & A 401

One benefit of contributing to both an IRA and 401 plan is to maximize the power of tax deferral. While every personal financial situation is unique, there are a few general rules to follow for contributing to both an IRA and a 401:

- Maximize the 401 match: If your employer offers a match in your 401 plan, you should likely aim to contribute at least enough to receive the match. For example, if the match is dollar-for-dollar up to 5% of compensation, you may want to contribute at least 5%.

- Maximize IRA contributions: If you’ve already maximized your employer’s 401 match, try to make the maximum allowed IRA contribution, which is $6,000 per year .

- Roth vs traditional contributions: Like IRAs, many 401 plans allow for Roth or traditional contributions. It’s generally wise to make Roth contributions if you expect to be in a higher income tax bracket than you are now when you retire. And if you think you’ll be in a lower tax bracket when making withdrawals from your IRA in retirement, traditional contributions may be better.

Now that you know how you can contribute to a 401 and an IRA, you can rest assured that the IRS won’t penalize you for maintaining both types of retirement accounts, as long as you adhere to the rules and regulations. Ultimately, retirement planning strategies for contributing to a 401 and a IRA will depend on your personal financial situation. For this reason, it can help to consult a financial professional to get specific advice for your retirement goals.

Don’t Miss: When Can You Roll Over 401k To Ira

Disadvantages Of Having A 401 And Ira

Under most circumstances, the IRS permits you to make tax-deductible contributions to your IRA up to the annual limit.

But contributing to a 401 account may lower the amount of your IRA contribution that is tax deductible , depending on your modified adjusted gross income and whether your spouse is covered by an employer-sponsored retirement plan. This might be something youll want to go over with a financial planner or financial advisor.

The tables below explain IRA tax deduction rules depending on different circumstances.

| 2020 IRA Tax Deduction Limits If You Have a Workplace Plan |

| Filing Status |

| No deduction |

You can access more information about IRA contributions and rules by visiting IRS Publication 590-A.

But you can explore the pros and cons of each plan to decide whether you should contribute to both.

Backdoor Roth Ira Taxes

When you convert a traditional IRA to a Roth IRA, any amount that you received a traditional IRA tax deduction on will be considered taxable income.

For example, let’s say that you contributed $5,000 to a traditional IRA in 2021 and claimed it as a deduction on your 2021 tax return. If you then convert the account to a Roth IRA in 2022, the account value at the time of the conversion would be considered taxable income, which you would report on your 2022 tax return.

On the other hand, if you make a nondeductible traditional IRA contribution or if you immediately convert the account after making a traditional IRA contribution, there generally won’t be any taxes due on the conversion.

I say “generally,” because unfortunately, if you have additional traditional IRA assets, then there’s another problem. The IRS won’t let you treat the conversion as coming solely from the non-deductible IRA. Instead you’ll have to include a portion of the conversion in your taxable income, based on the pro-rata value of your nondeductible and other traditional IRA assets. That’s generally not desirable, so if you have extensive retirement assets in deductible traditional IRAs, you should think twice before trying to do a backdoor Roth.

Don’t Miss: Can I Roll A 401k Into A Roth Ira

Can A Qualified Charitable Distribution Satisfy My Required Minimum Distribution From An Ira

Yes, your qualified charitable distributions can satisfy all or part the amount of your required minimum distribution from your IRA. For example, if your 2018 required minimum distribution was $10,000, and you made a $5,000 qualified charitable distribution for 2018, you would have had to withdraw another $5,000 to satisfy your 2018 required minimum distribution.