What To Know About Fidelity Online Trading Services

Usage of Fidelitys online trading services constitutes agreement of the Electronic Services Customer Agreement and License Agreement. Before investing, consider the funds investment objectives, risks, charges, and expenses. Contact Fidelity for a prospectus or, if available, a summary prospectus containing this information. Read it carefully.

Recognize The Tax Advantages

In addition to potentially offering free money through a match, employer-sponsored retirement plans can give you significant tax advantages.

Contributions to tax-advantaged retirement accounts, such as a 401, are made with pre-tax dollars. That means the money goes into your retirement account before it gets taxed.* Plus, your contributions, any match your employer provides and any earnings in the account are all tax-deferred. That means you dont owe any income tax until you withdraw from your account, typically after you retire.

With pre-tax contributions, every dollar you save will reduce your current taxable income by an equal amount, which means you will owe less in income taxes for the year. But your take-home pay will go down by less than a dollar.

You May Like: How Do I Stop My 401k

What Are Your Options For Old Retirement Plans

You generally have four options for dealing with money thats in an employer-sponsored retirement account when youre no longer working at the company:

- Leave the money where it is: Although you might not be able to contribute to the account any longer, you may be able to leave the money in your former employers plan. Sometimes, you may need to meet a minimum account balance to qualify, such as $200 for a TSP or $5,000 for some 401s.

- Transfer funds to a new employer-sponsored plan: If you have a new job with a company that sponsors a retirement plan, you may be able to roll over the money into your new employers plan. When this is an option, compare the previous and new plans fees, terms, and investment options to see which is best.

- Roll over to an individual retirement account: You can also move the money into an individual retirement account . An IRA may give you more control as you can choose where to open the account and invest in a wider range of funds. Its also fairly easy to move from one IRA to another as the account isnt tied to your employer. However, IRAs could have more fees, especially if you dont have a lot of assets and dont qualify for lower-cost investment funds.

- Cash out: You can also take the money out of retirement accounts completely. But unless youre 59½ or older , you may need to pay a 10 percent early withdrawal penalty in addition to income taxes on the money.

Recommended Reading: Can I Borrow Against My 401k

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

What Is A 401 Plan And How Does It Work

A 401 Plan is a retirement savings vehicle that allows employees to have a portion of each paycheck directly paid into a long-term investment account. The employer may contribute some money as well.

There are immediate tax advantages for the employee if the account is a traditional 401 and tax advantages after retiring if it is a Roth 401.

In either case, the money earned in the account will not be taxed until it is withdrawn during retirement if it is a traditional 401. If it is a Roth 401, no taxes will be due when the money is withdrawn.

Recommended Reading: How Do I Find Previous 401k Accounts

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

You May Like: What To Ask 401k Advisor

How Much Of My Salary Can I Contribute To A 401 Plan

The amount that employees can contribute to their 401 Plan is adjusted each year to keep pace with inflation. In 2021, the limit is $19,500 per year for workers under age 50 and $26,000 for those aged 50 and above. In 2022, the limit is $20,500 per year for workers under age 50 and $26,500 for those aged 50 and above.If the employee also benefits from matching contributions from their employer, the combined contribution from both the employee and the employer is capped at the lesser of $58,000 in 2021 or 100% of the employees compensation for the year .

A Special Note For Pennsylvania Residents

If you live in Pennsylvania, you should start your search sooner rather than later.

In most states, lost or abandoned money, including checking and savings accounts, must be turned over to the states unclaimed property fund. Every state has unclaimed property programs that are meant to protect consumers by ensuring that money owed to them is returned to the consumer rather than remaining with financial institutions and other companies. Typically, retirement accounts have been excluded from unclaimed property laws.

However, Pennsylvania recently changed their laws to require that unclaimed IRAs and Roth IRAs be handed over to the states fund if the account has been dormant for three years or more.

If your account is liquidated and turned over to the state before the age of 59.5, you could only learn about the account when you receive a notice from the IRS saying you owe tax on a distribution!

Company 401k plans are excluded from the law unless theyve been converted to an IRA. If you know you have an account in Pennsylvania, be sure to log onto your account online periodically. You can also check the states website at patreasury.gov to see if you have any unclaimed property.

Also Check: How To Find Out What You Have In Your 401k

Locate Where Your 401s Are

Before you can check how much is in your 401 account, you need to know where your 401s are.

The first place to look is the company with whom you’re currently working. Many companies have implemented auto-enrollment into their 401 plans, ensuring that most of their employees contribute to their retirement. Otherwise, participation may drop because they simply forgot or didn’t know it was available.

Contact your human resources department to get information on if you’re contributing to their 401 and your account information.

Additionally, if you’ve changed jobs a few times in your career, you may have old 401 outstanding in different places. Locating old 401s can be a tricky process as it requires much coordination and hunting down various entities and contacts.

If you’re unsure if you have outstanding 401s with old companies, we can help. Beagle will find any old 401s you have, identify any hidden fees, and provide options to consolidate into one, easy-to-manage account. Sign-up only takes a couple of minutes and Beagle will help you find all your 401 accounts!

Even misplacing one 401 from a previous employer could cost you thousands in potential retirement funds.

How Does Money Get Left Behind

Very few people stay at one employer the entire length of their career.

But unlike your bank account which you may have from job to job, a 401 account is linked to your employer. It is up to you to do something about it.

When you leave your employer, the money may stay in the account for an indefinite amount of time.

However, if the company closes the 401 plan, files for bankruptcy, goes out of business or is acquired by another company, you may be forced to decide, within a short period of time.

Its possible that years will go by after you parted ways with your old job, and then youll get a letter notifying you that you need to move your 401 account, or take a distribution.

If this happens, youre much better off rolling the money into an IRA account, or transferring the money into your current companys 401 plan.

Read Also: What Is The Tax Rate On 401k After 65

What Is A Routing Number

Youll find your bank routing number on the lower left-hand corner of your checks, right next to your account number. The first two digits in the routing numbers represent one of 12 Federal Reserve Bank districts the bank is located in. The next two digits are the Federal Reserve Bank district branch that covers your bank.

Bank Regionally, Get Perks: Fidelity Savings Account Review

Standard Deposits To Individual And Ira Accounts

- For most check deposits to individual brokerage accounts as well as to most IRA accounts , checks must be made payable to one of these:

- Fidelity Investments.

- National Financial Services, LLC.

- Account holder exactly as it appears on the Brokerage Account Registration. Checks payable to the account holder must be endorsed by the account holder to prevent paying bank from returning the check to Fidelity.

Dont Miss: How Do I Transfer 401k To New Employer

Don’t Miss: What Is The Contribution Limit For 401k

What Happens To My 401 If I Quit My Job

You have several choices. You can leave your 401 with your former employer or roll it into a new employers plan. You can also roll over your 401 into an individual retirement account . Another option is to cash out your 401, but that may result in an early withdrawal penalty, plus youll have to pay taxes on the full amount.

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Don’t Miss: How Can I Lookup My 401k

Option : Move The Money To Your New 401

If you have a new job with a new 401, your current employer may permit you to roll over your old 401 funds into your new account. However, not all plans allow this, so check with your company’s HR department or plan administrator to see if it’s an option for you.

If it is and you decide it’s your best move, you must choose between a direct and an indirect rollover. Direct rollovers are the better choice because you don’t handle the money at all. You just fill out a form telling your old plan administrator where to send the funds and they take care of it for you.

With an indirect rollover, the plan administrator cuts you a check for the funds in your account and you place that money into your new account. But if you fail to do this within 60 days of cashing out your old account, the government considers it a distribution and taxes you on that money for the year.

Before you decide to move your money to your new 401, make sure you like your investment options and are comfortable with the fees your new 401 charges. Many employers don’t allow you to transfer money out of your 401 if you’re a current employee, so once you transfer your old 401 funds to your new account, they could be stuck there, at least until you leave your current job.

Search The National Registry

Still not having any luck? Past employers may list you as a missing participant if you no longer work for the company but left your 401 behind. The National Registry of Unclaimed Retirement Benefits is a nationwide, secure database listing retirement plan account balances that have been left unclaimed .

You May Like: How Much 401k Should I Have At 35

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

How Many Lost 401ks And Other Retirement Accounts Are Forgotten

Think lost and forgotten retirement accounts amount to chump change? Although no one keeps data on how much retirement money gets lost or forgotten, in an interview with Bloomberg, Terry Dunne of Millennium Trust Co., made an educated guess based on government and industry data that more than 900,000 workers lose track of 401k-style, defined-contribution plans each year.

That figure doesnt include pensions. According to the Pension Benefit Guaranty Corporation, an independent agency of the U.S. government tasked with protecting pension benefits in private-sector defined benefit plans, there are more than 38,000 people in the U.S. who havent claimed pension benefits they are owed. Those unclaimed pensions total over $300 million dollars, with one individual being owed almost $1 million dollars!

Could that money belong to you?

Don’t Miss: How Do I Find If I Have A 401k

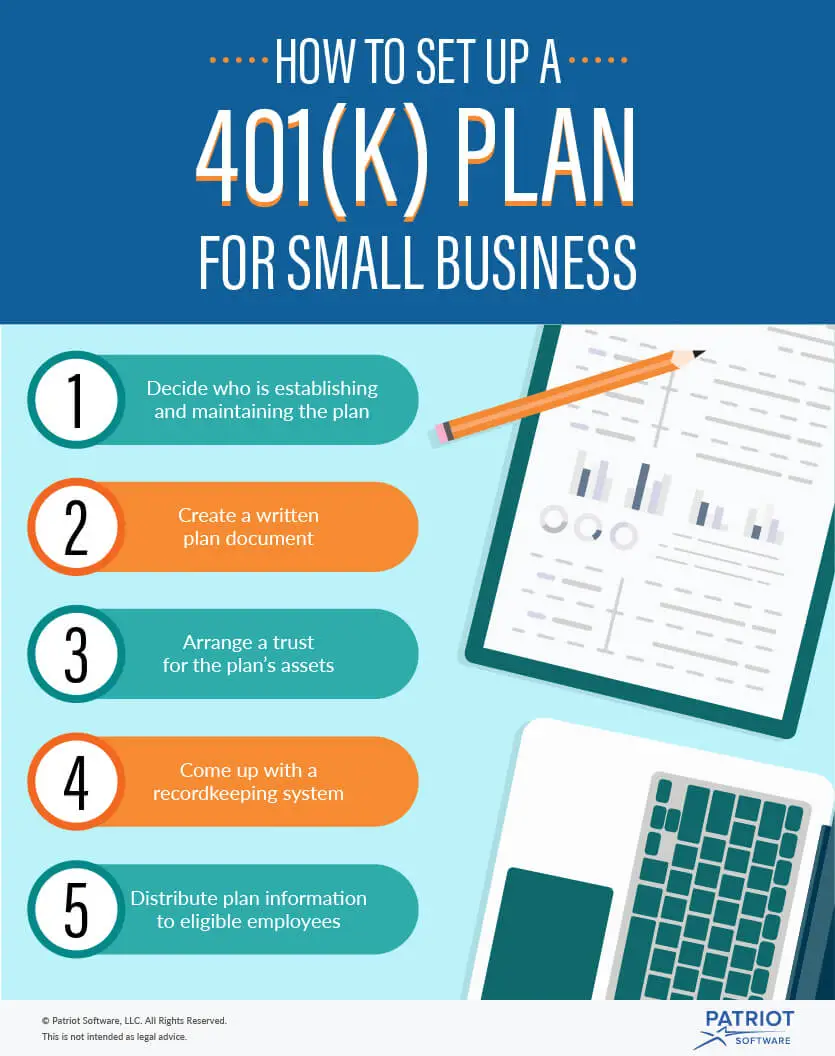

What Does A 401 Plan Administrator Do

The 401 plan administrator is typically an outsourced third party who is tasked with handling all day-to-day responsibilities, including:

- Consulting the employer on initial plan design, employee matching program, and profit-sharing options

- Preparing the Summary Plan Description for participants and beneficiaries

- Determining employee eligibility and enrolling participants

- Approving all loans and distributions, as well as employee status changes

- Monitoring IRS compliance and regulatory changes affecting the plan

- Conducting audits and nondiscrimination testing

- Filing Form 5500, Safe Harbor notices, and Form 1099-Rs with the IRS

- Fixing compliance problems that may arise

- Helping employers get through mergers and bankruptcies

- Generating annual participant censuses, and

- Communicating plan updates, changes, or benefits to employees.

Plan For Your Retirement Over Your Career

Remember that retirement planning is not a singular event, but rather something you do over the course of your career.

Keep this mindset and continually review your retirement planning progress and account balances. If you havent started to save for retirement, its never too late.

Talk to your HR department about retirement planning options, or open up an IRA, or even basic savings account to get started putting money aside for your future.

Thursday, 21 Oct 2021 11:13 PM

Advertiser Disclosure: Many of the offers appearing on this site are from advertisers from which this website receives compensation for being listed here. This compensation may impact how and where products appear on this site . These offers do not represent all account options available.

Editorial Disclosure: This content is not provided or commissioned by the bank advertiser. Opinions expressed here are authors alone, not those of the bank advertiser, and have not been reviewed, approved or otherwise endorsed by the bank advertiser. This site may be compensated through the bank advertiser Affiliate Program.

User Generated Content Disclosure: These responses are not provided or commissioned by the bank advertiser. Responses have not been reviewed, approved or otherwise endorsed by the bank advertiser. It is not the bank advertiser’s responsibility to ensure all posts and/or questions are answered.

You May Like: Can I Invest My 401k