Fidelity Bond Coverage Amounts

The fidelity bond must provide coverage for each relevant individual of at least 10% of the funds handled by that person in the previous year. The bond cant be less than $1,000 and is generally not required to be more than $500,000 for each plan year. The maximum is $1,000,000 if the plan holds certain illiquid assets like company stock. Of course, coverage can always be purchased for amounts greater than the required minimums.

What Is A 401 Fidelity Bond

A fidelity bond, or ERISA bond, is an insurance policy that provides a 401 plan with protection from losses caused by any fraudulent behavior such as embezzlement, theft, larceny and misappropriation by those who have access to the plans funds. The fidelity bond will step in to counteract any losses due to such fraudulent activity.

A fidelity bond is different from fiduciary liability insurance, sometimes referred to as a fiduciary bond. Fiduciary liability insurance insures plan officials against losses caused by breaches of fiduciary responsibility. However, fiduciary liability insurance is not required, while a fidelity or ERISA bond is required at the start of a 401 plan.

Explore more about Fiduciary Services Roles & Responsibilities

How Much Fidelity Bond Coverage Is Required

At the beginning of each plan year, the coverage amount of the bond must be at least ten percent of the amount of funds handled. The minimum bond amount is $1,000 and, in most cases, is not required to be more than $500,000. The plan can purchase a bond for a higher coverage amount, if appropriate. For new plans, estimated plan contributions are used to determine the bond amount but will be at least $1,000. A fidelity bond should be in place by the time plan is set up.

Don’t Miss: When Can You Rollover A 401k Into An Ira

Consider Mobile Check Deposit

If youre already a Vanguard client and youre registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. Its faster than mailing a check!

When youre logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

Fidelity Investments 401 Review 2021

Fidelity Investments is a multinational company based in Boston. The company ranks among the largest financial asset managers, operating a brokerage firm, a large offering of mutual funds, retirement services, wealth management and life insurance. Fidelity can serve as a full-service firm to small businesses that wish to do more than just administer a 401 plan through Fidelity.

Also Check: Can You Self Manage Your 401k

Recommended Reading: How To Change Your 401k Investments

Is There A Penalty If My Fidelity Bond Coverage Is Too Low

Although maintaining a sufficient bond is a regulatory requirement, there is no penalty when coverage falls below the minimum amount. However, plans that are consistently under-bonded may raise red flags with government agencies that could result in an investigation to ensure there are no other problems.

Is Your Employee Benefit Plan Adequately Covered By An Erisa Fidelity Bond

Section 412 of the Employee Retirement Income Security Act of 1974 requires every person who handles funds or other property of a plan to be bonded . Such persons include plan fiduciaries but may also include any director, officer or employee of the fiduciary. This is referred to as ERISAs bonding requirement. The ERISA fidelity bond, also known as an employee dishonesty bond, is a legal requirement arising from ERISA to protect plans against losses resulting from an act of fraud or dishonesty by persons handling a plans assets.

The Department of Labor notes that: In a typical ERISA fidelity bond, the plan is the named insured and a surety company is the party that provides the bond. The persons covered by the bond are the persons who handle funds or other property of the plan.1It is important to note that the plan must be named as the insured party in the bond. In certain cases, the insured party is named as plan sponsor, and it is worthwhile to note that there should be a provision that covers any ERISA plan sponsored by the insured. As an insured party, the plan can make a claim on the bond if a plan official causes a covered loss to the plan due to fraud or dishonesty.

Generally, a fidelity bonds term cannot be less than one year. However, bonds with a longer period are permissible.

You May Like: How To Pull Out Of 401k

How Do We Review Robo

NerdWalletâs comprehensive review process evaluates and ranks the largest U.S. robo-advisors by assets under management, along with emerging industry players, using a multifaceted and iterative approach. Our aim is to provide an independent assessment of providers to help arm you with information to make sound, informed judgements on which ones will best meet your needs.

DATA COLLECTION AND REVIEW PROCESS

We collect data directly from providers, and conduct first-hand testing and observation through provider demonstrations. Our process starts by sending detailed questionnaires to providers to complete. The questionnaires are structured to equally elicit both favorable and unfavorable responses from providers. They are not designed or prepared to produce any predetermined results. The questionnaire answers, combined with product demonstrations, interviews of personnel at the providers and our specialistsâ hands-on research, fuel our proprietary assessment process that scores each providerâs performance across more than 20 factors. The final output produces star ratings from poor to excellent . Ratings are rounded to the nearest half-star.

RATING FACTORS

FACTOR WEIGHTINGS

INFORMATION UPDATES

Writers and editors conduct our broker reviews on an annual basis but continually make updates throughout the year. We maintain frequent contact with providers and highlight any changes in offerings.

THE REVIEW TEAM

Dont Miss: What Is The Max Percentage For 401k

Fidelity Bond Requirements For Plan Sponsors

If you sponsor a company retirement plan as a benefit for your employees, you may be required to maintain a type of insurance called a fidelity bond. The purpose of a fidelity bond, also known as a surety bond, is to protect a company-sponsored retirement plan from losses due to potential fraud or dishonesty by those responsible for handling the plan funds. This may include staff or vendors who process payroll, the plan trustee and any others who regularly work hands-on with the plans assets.

Usually, retirement plans governed by ERISA, such as 401, profit sharing and defined benefit plans are required to have a fidelity bond. In fact, without a fidelity bond, the plan would be considered out of compliance with ERISA.

Fidelity bond insurance must cover, or bond, every person who handles plan assets or property what ERISA deems handling funds. Someone is considered to be handling funds when there is a risk that their duties or activities could result in losses to the plan and its participants if that person were to misuse or misappropriate plan assets.

More specifically, a person is defined as handling plan funds if they have:

At a minimum, the coverage amount required for a fidelity bond is the greater of:

- 10% of plan assets .

There are some exceptions:

You May Like: How To Invest In 401k Without Employer

Fidelity Bonds For Your Retirement Plan

Under the Department of Labor regulations, your retirement plan will need to maintain an ERISA Fidelity Bond. A fidelity bond protects the assets in the plan from misuse or misappropriation by the plan fiduciaries. Plan fiduciaries include the plan trustees and any person who has control over the management of the plan and its assets.

Required ERISA Fidelity Bond Amount

At the very least, the bond must be equal to 10% of the value of the total plan assets, with a minimum bond value of $1,000 and a maximum bond value of $500,000. For the first year, the bond amount will be based on the estimated amount of assets that will be handled by the plan for the year.

If you have non-qualifying assets more than 5% of the total plan assets, additional requirements apply. Non-qualifying assets are those assets not readily tradable on a recognized exchange. These may include limited partnerships, artwork, collectibles, mortgages, real estate, securities of closely-held companies and other assets held outside of regulated institutions such as a bank an insurance company a registered broker-dealer or other organization authorized to act as custodian for retirement accounts. Non-qualifying assets require additional bond coverage equal to 100% of these assets or could subject a plan to obtain a full-scope audit, where an independent CPA physically confirms the existence of the assets at the start and end of each Plan Year.

Why do I need an Erisa Fidelity Bond?

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

You May Like: Who Offers Roth Solo 401k

Fidelity Bonds Vs Surety Bonds

Surety bonds are similar to fidelity bonds, but they are a promise to be liable for someone elses debt, default, or failure. A surety bond includes three parties:

- The surety party, which guarantees the performance or obligation of

- The principal, the second party, to

- The obligee or owner, the third party who buys the bond.

Some types of surety bonds are court bonds, notary bonds, license and permit bonds, and public official bonds.

**fretting Over Fidelity Bonds And Other Fiduciary Tasks **

If you are running your plans 401 then you know setting up and managing a retirement plan takes a lot of work and attention to get right. But there is no need to become a 401 expert if you dont want to. Small business owners can delegate much of their day-to-day responsibilities to third party 401 fiduciaries. Delegating to experts not only reduces your legal liability, but also takes tedious work off your plate.

A good 401 fiduciary can make sure that the investment options are good, the 401 rules are being followed and check to make sure fees are reasonable. Most importantly, a fiduciary needs to act solely in the interest of plan participants. And that means making sure your plan has the appropriate fidelity bond.

If you have questions about your plans fidelity bond or are looking for help administering your companys retirement plan, talk to ForUsAll today!

You May Like: Can You Cash Out Your 401k

It’s Not Your Entire Portfolio

Everyone has a different risk tolerance. My husband and I take a few more risks than the average person, not only because we want to get caught up, but because we both want to continue working past the time most of our friends retire.

And because we do take some risks, I want to make sure we maintain a percentage of risk-free investments. I can see recommending that people lay off I bonds if their entire portfolio is made up of low-risk/low-reward investments. But since they make up a small portion of our portfolio, I’m not giving them up every time the rate dips.

The Cost Of A Fidelity Bond Depends On Its Size

The cost of a fidelity bond is usually a small percentage of the bond’s total amount of coverage. That’s why the coverage size of the bond is the biggest factor in determining its cost.

For example, the median cost of a $1 million fidelity bond, our most popular option, is $1,054 per year, or less than $90 per month. A fidelity bond with $100,000 of coverage costs only $280 per year, or less than $25 per month.

A surety company would charge more for a larger bond sum, but the fidelity bond would also provide greater coverage for employee theft, embezzlement, and other dishonest acts by employees that cause financial loss.

The graph below shows how much bonding companies charge for fidelity bonds with an increasing amount of coverage.

Don’t Miss: What Percentage Should I Put In My 401k

Things To Consider When Applying For An Erisa Bond

Bonds must be obtained from a surety that is named on the Department of the Treasurys Listing of Approved Sureties.

Every fiduciary of an employee benefit plan, as well as every person who handles the funds of such a plan, needs to be bonded in an amount equal to 10% of the funds handled. However, when the plan includes non-qualifying assets, the bond amount is either 10% of plan assets being handled or the value of the non-qualifying assets, whichever is greater.

- Qualifying assets include items held by a financial institution such as a bank, insurance company, mutual funds, etc.

- Non-qualifying assets are those not held by any financial institution, including tangibles such as artwork, collectibles, and real estate.

If one obtains a plan that has more than 5% in non-qualifying assets and wants to receive a bigger bond, there are two steps to follow:

- Choose a bond that has a value that is equal to the non-qualifying asset.

- Have your bond audited once a year by a certified public accountant.

Note: A fiduciarys bond amount must be reviewed and updated as a plans assets increase or decrease. If your plans assets have recently changed in value, give us a call at 1 308-4358 to determine whether your coverage also needs to change.

ERISA surety bonds are not required for SEC-registered brokers and dealers subject to fidelity bond mandates from their own regulatory agency or organization.

What Is A Fidelity Bond

First, this is not something issued by Fidelity Investments. Its referencing the true meaning of the word, which I would sum up as faithfulness. The bond is required under ERISA for anyone running a plan. The whole point of it is to protect the plan against fraud, dishonesty, theft, and embezzlement. As a plan administrator, you have access to peoples money. Theoretically, a dishonest person could wire that out of your company holding accounts and into their personal bank account . In this scenario, the bond would cover the plan for losses up to the face amount.

Recommended Reading: What Age Can You Pull From 401k

How Do I Avoid Tax On Ira Withdrawals

Heres how to minimize 401 and IRA withdrawal taxes in retirement:

Who Is Considered A Manager Of A Plan

Since the ERISA Fidelity Bond only applies to fraudulent acts made by people who handle retirement plans, its important to understand what exactly constitutes handling a plan.

Generally, plan managers must meet at least one of the following criteria:

- Physical contact with cash, checks, or similar property, not including clerical workers who come into contact with cash or checks from time to time

- Power to secure physical possession of cash, checks, or similar property through access to safe deposit box, bank accounts, etc.

- Power to transfer plan funds either to oneself or a third party

- Power to disburse funds

- Power to sign or endorse checks

- Supervisory or decision-making authority over plan funds

Example:

- The director of HR has the power to select investment funds for the companys 401 plan. She selects an extremely risky investment fund that offers her a kickback. When the investments fail, the value of the 401 plan falls drastically and impacts the payouts for employees participating in the plan. The losses are covered by a Fidelity Bond under ERISA.

Example:

- Your company hires an investment advisor to invest the funds of your employees 401 plan. The investment advisor, as a service provider that manages the fund, must be covered be an ERISA Fidelity Bond.

What are funds and other property?

Also Check: How Do I Close Out My 401k Account

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnât feature every company or financial product available on the market, weâre proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward â and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

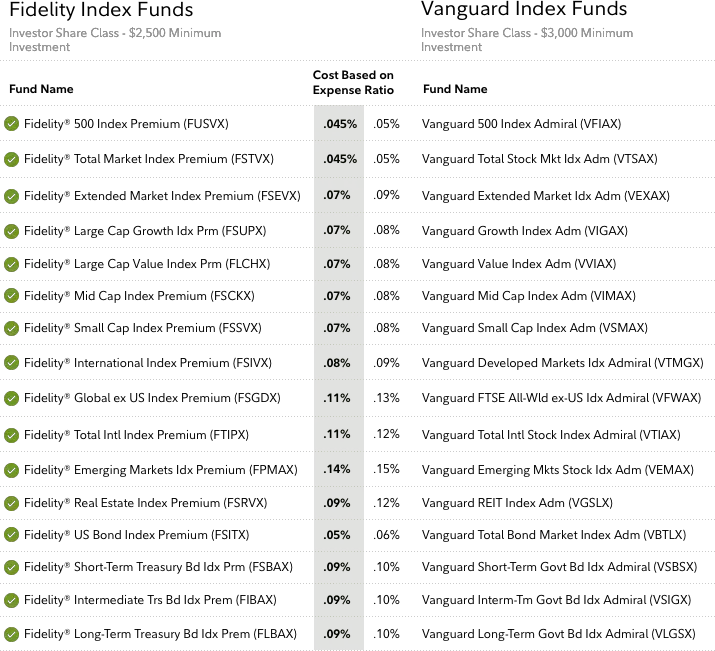

How Much Can High Fees Hurt My Retirement Savings

Compound interest is the eighth wonder of the world. He who understands it, earns it he who doesnt pays it.

This Albert Einstein quote gets bandied about pretty frequently in finance, but in this case, its particularly appropriate. What can be defined simply as interest on interest, compound interest occurs when the interest you earn on a balance is reinvested. If youre in your 20s or 30s, todays contributions to your 401 now will grow for decades before you retire. And anything that eats away at those contributions will have an outsize effect.

An extra 1% in fees can be brutal when it compounds over time. And extra 401 fees add up even more quickly for higher-income workers. A scenario from NerdWallet analyzes a 25-year-old who plans to retire at 65, has $25,000 in retirement savings, saves $10,000 in the account each year, and earns a 7% average annual return. In this example, paying just 1% in fees costs the saver more than $590,000 in sacrificed returns over 40 years of saving.

Also Check: When Can You Start Your 401k