Dave Anthony President And Portfolio Manager

ROTHROTHROTH. Look, if you have any substantial amount of money saved up , then you need to convert your monies over to tax free accounts while you still can.

Our country is $19 trillion in debtBaby Boomers are retiring at 10,000/day and are putting an enormous strain on Social security and Medicare plans. The government has already passed the legislation to come ofter those affluent boomersthose that make over $44k/year in retirement, and they will be the ones paying for these out of control programs. Youll be one of them as well unless you strategically allocate your money into the five accounts that dont count toward SS taxation and Medicare surcharge penalties.

Both of these programs are means based, if you follow the old-school train of though and defer, defer, defer your retirement income into all IRA/401 plans, youll be in for a world of hurt once you hit 70 1/2 and are required to take distributions.This will cause a triple whammy of ordinary income tax, Social security tax, and probably Medicare penalty premium tax. OUCH!

Pay taxes now, at some of the lowest rates in a long time, and go tax free.

Concerned about your tax hit? Work with a Wallet Hub advisor to run to numbers to eliminate or reduce your ROTH conversion tax through strategic deductions that you can take to off-set this ordinary income.

Kirk

Complete The Rollover Before Earnings Accrue

You want to roll over your money as soon as possible because you want to minimize the likelihood your funds see any investment returns as these will be taxed in the conversion.

If your after-tax contributions do end up generating investment growth, the IRS allows you to split up the funds, rolling the after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Recommended Reading: How To Transfer 401k After Leaving Job

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

What Should I Do With An Old 401

You might have an old 401or severallying around from previous employers. Transferring the money from a 401 to your new employers Roth 401 might seem like an appealing option. But just remember, youll get smacked with a tax bill if you go that route.

Rolling your old 401 into a traditional IRA is another way to go. Youll have more control over your investments and will be able to choose from thousands of funds with the help of your financial advisor. Plus, you wont face any tax consequences since youre moving from one pretax account to another.

If you arent able to transfer your money into your new employers plan but think a Roth is for you, you could go with a Roth IRA. But just like with a 401 conversion, youll pay taxes on the amount youre putting in. If you have the cash available to cover it, then the Roth IRA might be a good option because of the tax-free growth and retirement withdrawals.

Read Also: How To Check Your 401k Account

Can I Keep The Same Funds I Have In My Retirement Plan

This depends on your plan. First, youâll want to reach out to your provider to determine if moving the assets over âin-kindâ or âas isâ could be an option for you.

If it is an option, then youâll want to contact us at 877-662-7447 . One of our rollover specialists can help determine if we can hold your current investments here at Vanguard.

If it isnât an option, donât worrywe can still help you choose new investments once your assets have arrived here at Vanguard.

Before Converting There Are A Few Things To Consider:

- You cannot recharacterize. Understand your tax situation and ability to pay for the conversion because a Roth conversion cannot be recharacterized.

- The availability of funds to pay income taxes. The benefits of a conversion are increased if the income taxes due can be paid out of non-retirement assets.

- To help manage your tax liability, you may choose to convert just a portion of your assets. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years.

Recommended Reading: Where Do I Go To Borrow From My 401k

Next Steps To Consider

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

For a Traditional IRA, for 2021, full deductibility of a contribution is available to active participants whose 2021 Modified Adjusted Gross Income is $105,000 or less and $66,000 or less partial deductibility is available for MAGI up to $125,000 and $76,000 . In addition, full deductibility of a contribution is available for working or nonworking spouses of plan participants whose MAGI is less than $198,00 and who are not personally covered by an employer-sponsored plan, and partial deductibility is available for MAGI up to $208,000. If neither you nor your spouse participates in a workplace plan, then your Traditional IRA contribution is always tax deductible, regardless of your income.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Roth 401 To Roth Ira Conversions

If your 401 plan was a Roth account, then it can only be rolled over to a Roth IRA. The rollover process is straightforward. The transferred funds have the same tax basis, composed of after-tax dollars. This is not, to use IRS parlance, a taxable event.

You should check how to handle any employer matching contributions, because those will be in a companion regular 401 account and taxes may be due on them. You can establish a new Roth IRA for your 401 funds or roll them over into an existing Roth.

You May Like: How Can I Get Money From My 401k

How Do I Complete A Rollover

Recommended Reading: What Is A Solo 401k Plan

How Long Do You Have To Roll Over A 401

If a distribution is made directly to you from your retirement plan, you have 60 days from the date you receive a retirement plan distribution to roll it over into another plan or an IRA, according to the IRS.

But if you have more than $5,000 in a 401 at your previous employer and youre not rolling it over to your new employers plan or to an IRA there generally isnt a time limit on making this decision.

Read Also: How To Roll 401k Into New Job

Can I Take Money Out Of My Ira Before I Reach Retirement

Yes. And you don’t have to pay it back like you would with a loan from your employer-sponsored plan.

However, withdrawals you make before age 59½ may have consequences:

- Roth IRA: There’s a 10% federal penalty tax on withdrawals of earnings before age 59½. Withdrawals of your contributions are always penalty-free.

- Traditional IRA: There’s a 10% federal penalty tax on withdrawals of contributions and earnings before age 59½.

There are some exceptions** to the 10% penalty, so be sure to check the IRS website for details.

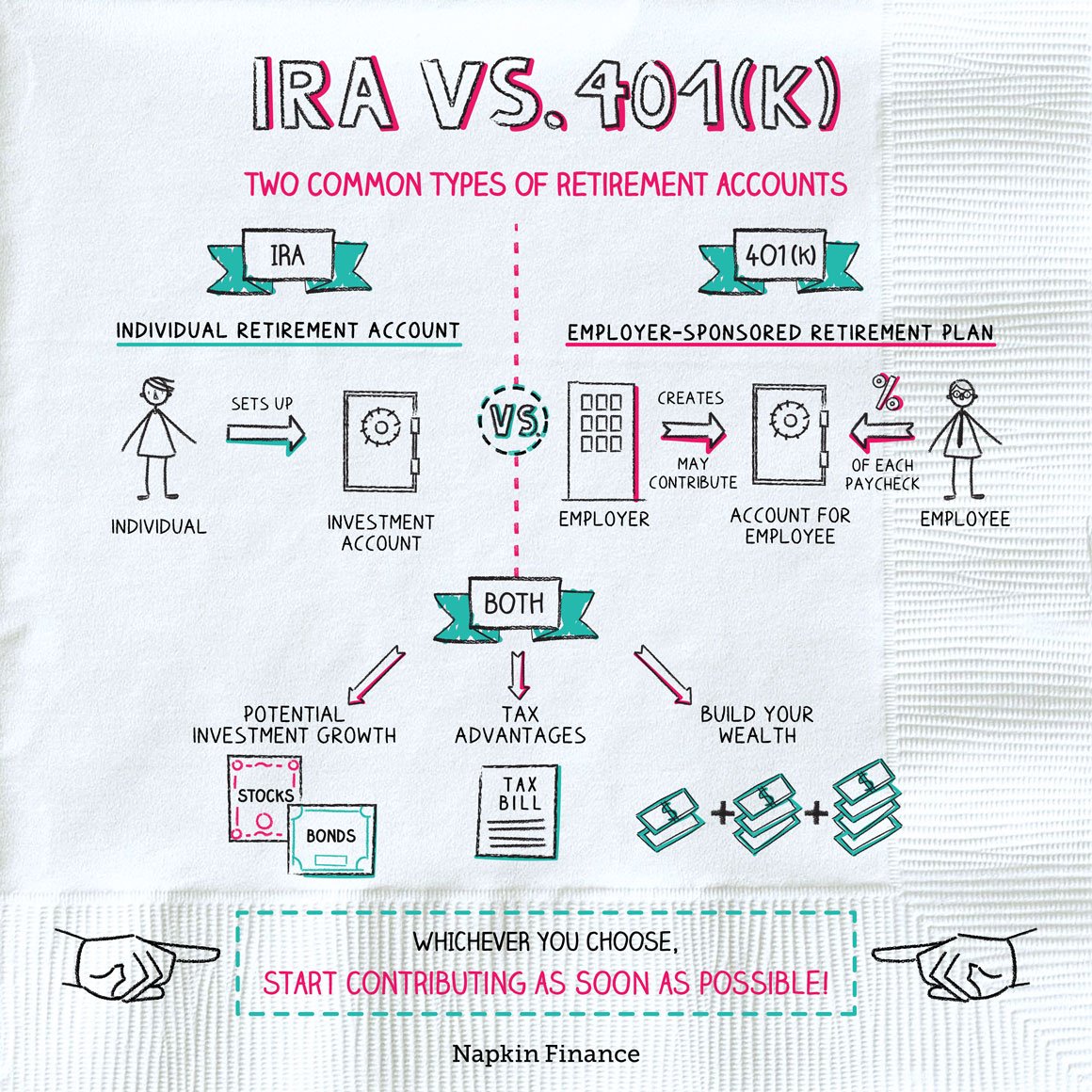

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Read Also: How To Get Money From 401k After Retirement

Rollover 401 To Roth Ira Tax Consequences

If you intend to roll over your 401 to a Roth IRA, you must first pay the taxes to progress. Rolling over your 401 to standard and Roth IRA, on the other hand, enhances your chances of tax diversification. This is particularly typical among individuals who are potentially unpredictable for the future.

If you believe your future or retirement plans will change from your current situation, you should diversify your investment portfolio so that you have two options when it comes to taxes. You retain your entire investment with a Roth IRA and may get substantial dividends. Youll also be able to gain certain tax benefits with a Traditional IRA or 401 plan.

Transferring Your 401 To Your Bank Account

You can also skip the IRA and just transfer your 401 savings to a bank account. For example, you might prefer to move funds directly to a checking or savings account with your bank or credit union. Thats typically an option when you stop working, but be aware that moving money to your checking or savings account may be considered a taxable distribution. As a result, you could owe income taxes, additional penalty taxes, and other complications could arise.

IRA first? If you need to spend all of the money soon, transferring from your 401 to a bank account could make sense. But theres another option: Move the funds to an IRA, and then transfer only what you need to your bank account. The transfer to an IRA is generally not a taxable event, and banks often offer IRAs, although the investment options may be limited. If you only need to spend a portion of your savings, you can leave the rest of your retirement money in the IRA, and you only pay taxes on the amount you distribute .

Again, moving funds directly to a checking or savings account typically means you pay 20% mandatory tax withholding. That might be more than you need or want. Most IRAs, even if theyre not at your bank, allow you to establish an electronic link and transfer funds to your bank easily.

You May Like: Can I Switch My 401k To A Roth Ira

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

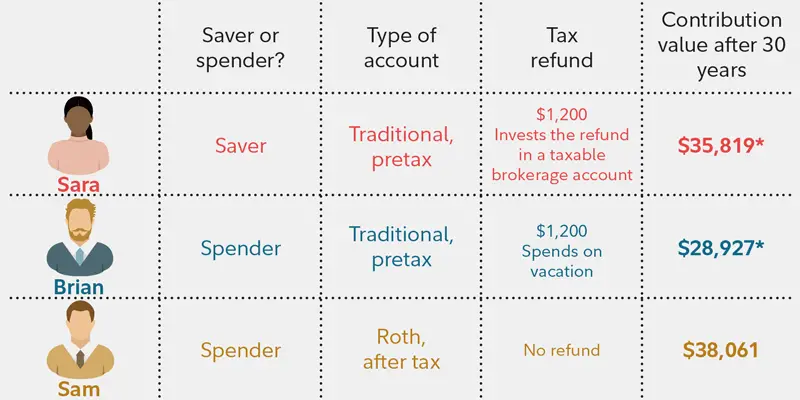

Rolling Into A Traditional Ira

Choosing to roll your traditional 401 to a traditional IRA preserves your tax-free money. In this case, your total account would be transferred over to an IRA and no taxes would be due until its time to withdraw. This can be a better solution if you anticipate having a lower tax rate in the future.

Read Also: How To Pay Off 401k Loan

Considerations For Owners Of Roth Iras

Distributions from a Roth IRA are qualified, and thus tax-free and penalty-free, provided that the 5-year aging requirement has been satisfied and at least one of the following conditions has been met:

- You reach age 59½

- You pass away

- You are disabled

- You make a qualified first-time home purchase

All other distributions are non-qualified. Non-qualified distributions of converted balances are not taxed again , but they may be subjected to a 10% penalty unless it’s been at least five years since the beginning of the year of your conversion, you’ve reached age 59½, or one of the other exceptions applies.

RMDs are not required during the lifetime of the original owner of a Roth IRA. RMD amounts are not eligible to be converted to a Roth IRA.

Make Sure You Understand These Rules Before Converting Your 401 Funds To A Roth Ira

A 401 is a smart place to keep your retirement savings, especially if your company offers a matching contribution. But as some people look toward retirement, they find the Roth IRA’s tax-free distributions more appealing. Contributing funds to a Roth IRA is always an option, but you could also do a 401 to Roth IRA conversion with your existing savings.

This lets you reclassify your 401 funds as Roth savings by paying taxes on the amount you’d like to convert. Here’s a closer look at how 401 to Roth IRA conversions work and how to decide if they’re right for you.

Recommended Reading: What Happens To Your 401k If You Quit Your Job

Why Roll Your 401 Into A Roth Ira

We assure you that we agree with your rationale if youve opted to rollover your current 401 plan to a Roth IRA. With Roth IRA funds, you must pay taxes now rather than at the withdrawal time. If youre not sure why a 401 rollover is beneficial, it will depend on your present situation and future intentions.

If you will be taxed at a high rate when you retire, it is critical that you pay the taxes now rather than whenever you retire. You must pay taxes on withdrawals from a Roth IRA, which appears to be a pretty honest positive point. Here are some of the most compelling reasons to choose a 401 rollover.