S Vs Individual Retirement Accounts : What Are The Differences

Individual retirement accounts, or IRAs, are very similar to 401 accounts. Both are used to divert tax-deferred income into an investment account intended to be drawn from during retirement, and both exist in traditional and Roth formats.

IRAs, however, exist totally independent of employers. For this reason, no matching contributions are available. For instance, someone who does not workor a worker whose employer does not offer a 401might open an IRA via a financial institution since they dont have access to a 401 plan.

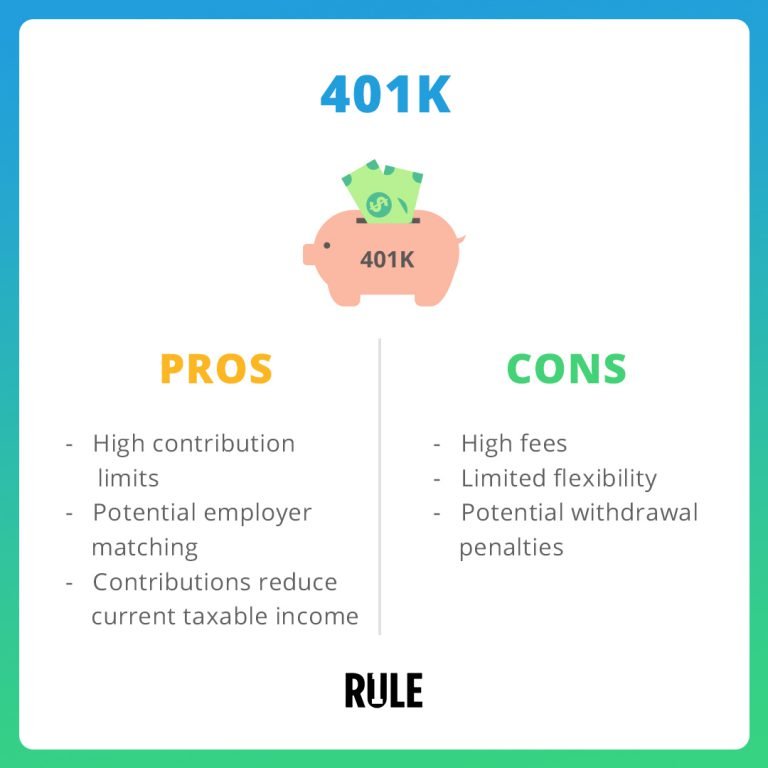

Despite the fact that they dont come with matching contributions, IRAs do have some advantages. Since the 401 options offered by employers are typically limited to whatever plans and service providers the employer has partnered with, someone who opens an IRA has much more freedom to shop around for a provider that offers lower fees and more financial instruments to invest in.

Staying Competitive For Top Talent

The pursuit of hiring great employees often comes down to what you can offer by way of compensation and benefits. Particularly when vying for quality talent with industry competitors, a 401 plan and even better, offering a company match can help your business stand out if candidates are weighing job offers.

Withdrawing Funds From Your 401

Funds saved in a 401 are intended to provide you with income in retirement. IRS rules prevent you from withdrawing funds from a 401 without penalty until you reach age 59 ½. With a few exceptions , early withdrawals before this age are subject to a tax penalty of 10% of the amount withdrawn, plus a 20% mandatory income tax withholding of the amount withdrawn from a traditional 401.

After you turn 59 ½, you can choose to begin taking distributions from your account. You must begin withdrawing funds from your 401 at age 72 , as required minimum distributions .

Recommended Reading: What To Do With 401k When Laid Off

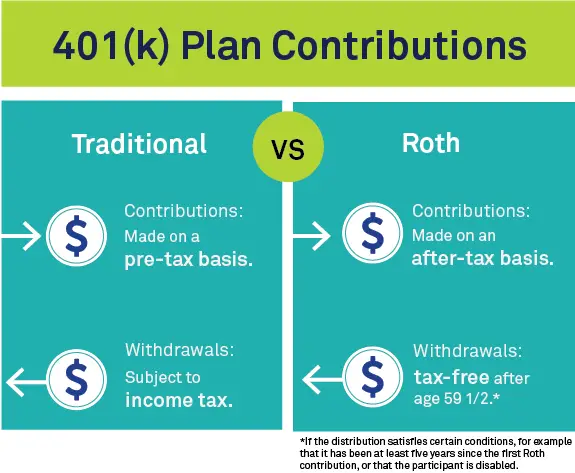

Contributing To Both A Traditional And Roth 401

If their employer offers both types of 401 plans, employees can split their contributions, putting some money into a traditional 401 and some into a Roth 401.

However, their total contribution to the two types of accounts can’t exceed the limit for one account .

Employer contributions can only go into a traditional 401 account where they will be subject to tax upon withdrawal, not into a Roth.

Insuranceopedia Explains Retirement Benefits

Retirement benefits ensure that employees can still have an income even after they are no longer employed. The law, moreover, insists that every employee should eventually receive these benefits as compensation for their work, in addition to their salaries.

There are a variety of retirement benefits. The most common one is a fixed monthly income for someone after retirement. Funds can also be set aside for investment and the retiree can collect the returns from them.

Aside from money, a retiree may also avail themselves of a health plan such as Medicare to take care of most of their medical or health needs.

Recommended Reading: How Much Can You Put Into 401k Per Year

What Are Alternatives

Because withdrawing or borrowing from your 401 has drawbacks, it’s a good idea to look at other options and only use your retirement savings as a last resort.

A few possible alternatives to consider include:

- Using HSA savings, if it’s a qualified medical expense

- Tapping into emergency savings

- Transferring higher interest credit card balances to a new lower interest credit card

- Using other non-retirement savings, such as checking, savings, and brokerage accounts

- Using a home equity line of credit or a personal loan3

- Withdrawing from a Roth IRAthese withdrawals are usually tax- and penalty-free

What Is 401 Matching

401 matching is when your employer makes contributions to your 401 on your behalf. It is called matching because the contributions your employer makes are based on employee contributions i.e. the contributions you make.

For example, you employer can offer a 100% match on up to 5% of your income. That means, for every dollar you contribute to your 401, up to 5% of your paycheck, your employer will also contribute one dollar.

100% Match on 4% of income at $50,000 salary.

| Your contribution | |

| $5,000 | $2,000 |

Once you contribute up to the matching limit, which in this example is 5% of your income, your employer stops contributing, but you can continue to contribute. That means that you want to contribute up to the matching limit if at all possible, to get the most value out of the match.

Employer matching plans can get complicated depending on your employer. Some employers offer graduated matching tiers, such as 100% match on the first 4% of income and a 50% match on the next 4%, giving you a 6% contribution if you make an 8% contribution.

100% Match on 3% and a 50% match on the next 3% of income at $50,000 salary.

| Your contribution |

| $2,250 |

Read the specifics of your plan to learn exactly how much your employer will contribute and how much you need to contribute to max out the benefit.

Recommended Reading: How Do I Take My Money Out Of My 401k

Sign Up For Automatic 401 Contributions

Enroll in automatic payroll deductions, so contributions are deposited in your 401 each pay period without any further action by you.

One of the advantages of these plans is the power of payroll deduction, said Young. You pay yourself first, automatically, every paycheck, making retirement savings easy.

Use Vanguards plan savings calculator to find out how a given level of contributions will impact your paycheck, and how much you could be earning for your retirement with an employers match.

What Is A 401 Plan And Who Is Eligible

A 401 plan is an investment account offered by your employer that allows you to save for retirement. If your company offers a 401 plan, it will have certain eligibility requirements. While these requirements vary by company, you can typically participate if you are at least 21 years of age, work full-time and have accrued a year of service. Although, not all employers make employees wait a full year before enrolling. There shouldnt be an income limit to participate.

If youre considering a job offer, be sure to ask about the companys retirement plan, including any waiting period.

Recommended Reading: How To Choose A 401k Provider

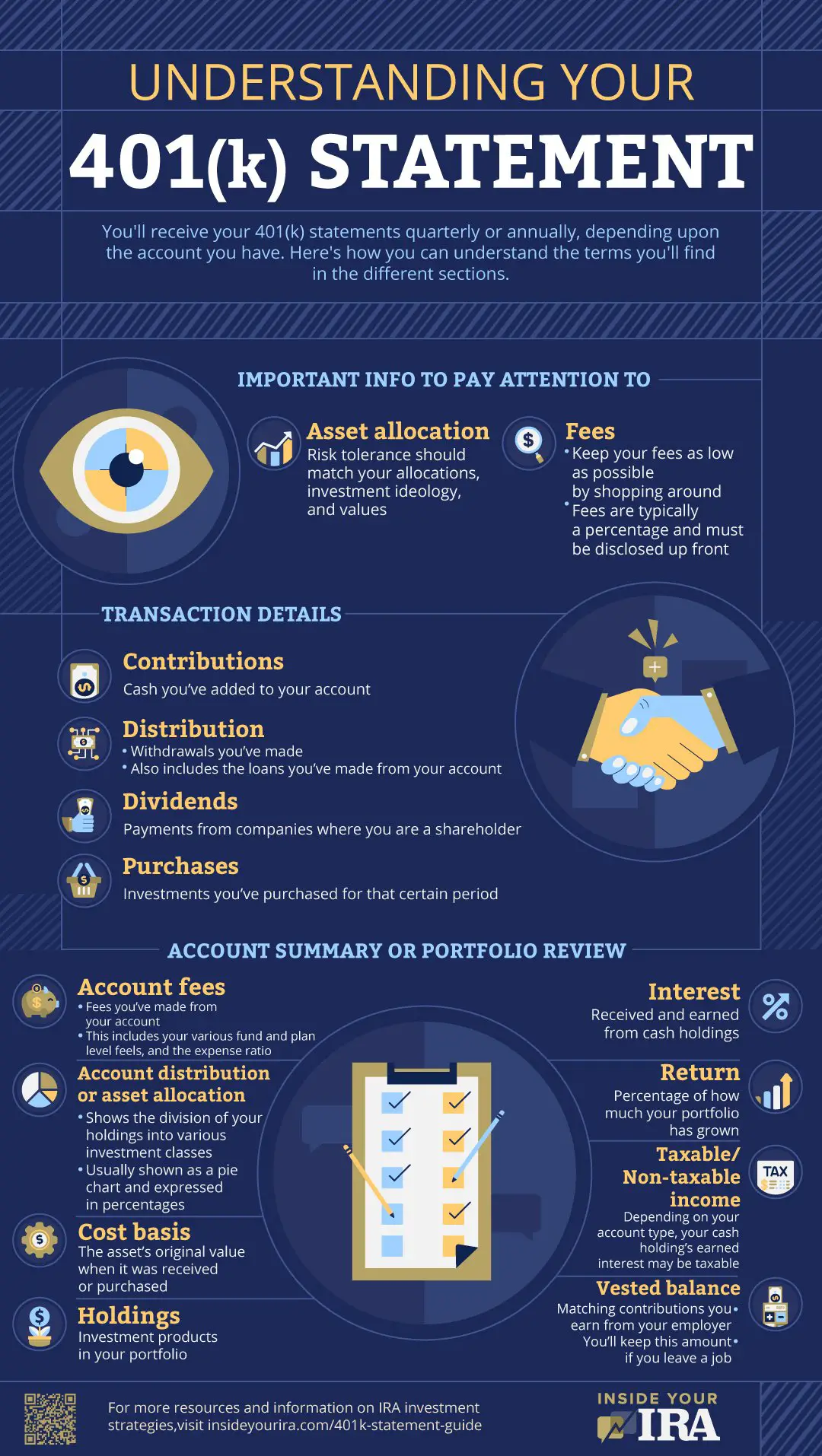

What Sorts Of Fees Do 401 Accounts Charge

Fees vary significantly between different 401 accounts and providers, but most charge some sort of administration fee, which covers the costs associated with the ongoing operation of the planthis includes things like record-keeping and accounting costs, office expenses, and the wages of customer service associates, among other things. In some cases, administration fees are covered by employers, while in others, they are deducted from each account holders investment returns.

Most 401 plans also charge investment fees, which pay for the management of the plans investments. These are typically deducted from returns as well, so they are already factored into the net return an employee sees on their account statement for a period.

Many 401s also charge service fees to individuals who choose to use various elective services offered by their plan, like taking out a loan against their balance. Going deeper, certain mutual funds charge fees like sales loads and commission fees, so if your 401 portfolio includes these sorts of investments, there may be additional costs to look out for.

According to an analysis by TD Ameritrade of user data from their 401 fee-analyzer tool, 401 fees averaged about 0.45% of the total account balance. Other studies using different samples have placed the average at 1% and even 2.2%.

How Do I Get A Prb

You dont need to apply for a PRB you will automatically receive it the year following your year of contributions. Your PRB is effective in January but you may not receive the payment until April or May, with a retroactive payment to January.

The PRB will be added to your monthly CPP pension, even if you are already receiving the maximum CPP retirement amount. The PRB payments will continue for the rest of your life. They are indexed to the cost of living, the same as the regular CPP retirement pension.

Each additional year that you continue working and contributing after you start collecting CPP will earn you a new PRB that will be added to your monthly CPP benefit the following year.

Also Check: What To Do With Your 401k

Q: What Is A 401k Matching Example

A: Suppose an employee earns $50,000 annually and decides to contribute 10% of his pay to his 401k account, or $5,000 per year. Now suppose his employer matches 100% of employee contributions up to 6% of salary. The employer would make a matching contribution of $3,000. If the employer made a 50% match, the match amount would be $2,500.

Is It Worth Having A 401 Plan

Generally speaking, 401 plans are a great way for employees to save for retirement. They make it easy to save because the money is automatically deducted. They have tax advantages for the saver. And, some employers match the contributions made by the employees.

All else being equal, employees have more to gain from participating in a 401 plan if their employer offers a contribution match.

Don’t Miss: How To Get The Money From Your 401k

Where Can I Retire On $3000 A Month

5 Awesome Places to Retire on $3,000 a Month or Less

- If You Want to Be Near the Beach: Gulfport, Fla.

- If You Desire Access to Arts and Culture: Duluth, Ga.

- If You Want to Be Close to a Transportation Hub: Alton, Ill.

- If You Crave the Outdoors: Coeur d’Alene, Ind.

- If You Want to Live Someplace Totally Foreign: Malta.

Move Your 401 Into Your New Employers Plan

In some cases you can roll your old 401 balance over into your new employers plan, although not all plans allow this. Find out from your new employer whether they accept a trustee-to-trustee transfer of funds and how to handle the move. Make sure you understand the tax treatment of your 401 balances. Make sure that traditional 401 funds are rolled into a traditional 401 and Roth funds end up in a Roth account.

Recommended Reading: Can I Rollover My 401k

How Is An Ira Different From 401k

401K accounts are associated with your employment, as contributions are taken out of your wages before taxes. A traditional IRA is similar to a 401k in that contributions aren’t taxed , but the key difference is that they are independent of your employer. A Roth IRA is also independent, but contributions are made after taxes. Withdrawals from your Roth IRA are tax-free, which makes them a smart choice if you think taxes will be higher in the future.

Required Distributions For Some Former Employees

A 401 plan may have a provision in its plan documents to close the account of former employees who have low account balances. Almost 90% of 401 plans have such a provision. As of March 2005, a 401 plan may require the closing of a former employee’s account if and only if the former employee’s account has less than $1,000 of vested assets.

When a former employee’s account is closed, the former employee can either roll over the funds to an individual retirement account, roll over the funds to another 401 plan, or receive a cash distribution, less required income taxes and possibly a penalty for a cash withdrawal before the age of 59+1â2.

Recommended Reading: Can A Sole Proprietor Have A Solo 401k

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

Don’t Miss: Can I Get A 401k

What Is A Good 401k Match

401k matching policies amongst different employers can be very inconsistent.

According to the BLS, only 56% of employers even offer 401 plans, and among those 49% match 0%, 41% will offer a match equivalent to 0-6% of the employees salary, and 10% will offer a match of 6% or more.

So if you have a employer that matches 6% or more of your 401 contribution, that is extremely good! You should make sure to take advantage of this opportunity to pad your retirement savings.

How Much Is A Good Pension

What is a good pension amount? Some advisers recommend that you save up 10 times your average working-life salary by the time you retire. So if your average salary is £30,000 you should aim for a pension pot of around £300,000. Another top tip is that you should save 12.5 per cent of your monthly salary.

Recommended Reading: What Is 401k Roth Ira

How Do Employer 401 Matching Contributions Work

Some employers offer to match their employees 401 contributions, up to a certain percentage of their salary. One common approach involves an employer matching employee contributions dollar-for-dollar up to a total amount equal to 3 percent of their salary. Another popular formula is a $0.50 employer match for every dollar an employee contributes, up to a total of 5 percent of their salary.

Continuing our example from above, consider the impact on your 401 savings of a dollar-for-dollar employer match, up to 3 percent of your salary. If you contribute 5 percent of your annual pay and receive $2,000 every pay period, with each paycheck you would be contributing $100 and your employer would contribute $60.

When starting a new job, find out whether your employer provides matching 401 contributions, and how much you need to contribute to maximize the match. If they do, you should at a minimum set your 401 contribution level to obtain the full match, otherwise youre leaving free money on the table.

The State Of The Debate

To date, the story is as follows. The CPS studies confirm that participation and contributions are related positively to income, age, education, and job tenure.17 The evidence also suggests that participation and contributions are negatively related to the presence and generosity of a defined benefit plan. None of the studies has a comprehensive measure of household wealth or any measure of a taste for saving.

All of the studies suggest that employees respond positively to the presence of an employer match. There is no consensus, however, as to whether employees respond to the size of the match. Kusko, Poterba, and Wilcox found little change in either participation or contributions in response to large changes in employer matches over time. Bassett, Fleming, and Rodrigues uncovered no evidence that participation rises with the match rate. Papke showed that participation increases with the match rate, with smaller marginal effects at higher match rates moreover, contributions increase markedly when employers offer a match, though the effect on contributions was negative at very high match rates. Papke and Poterba concluded that participation increases with the match rate, but they found no significant effect on contributions. Clark and Schieber observed a positive effect of the match rate on both participation and contributions, but their sample contained no firms without a match rate.18

You May Like: How Can I Check My 401k Online

How Much Does Oas Pay Per Month

OAS monthly payments vary based on personal circumstances. For example, amounts are worked out based on factors such as how long youve lived in Canada after the age of 18, your household annual income at retirement, and your marital status. Currently, the maximum OAS payment is $618.45 a month.3Footnote 3

-

A key thing to keep in mind about this government pension is the OAS clawback. If your income exceeds a certain limit, you may be asked to repay some or all of your OAS pension. There are some ways you can reduce clawback amounts, such as using your TFSA, or splitting your OAS with your spouse.

How Does Shepp Pension Work

SHEPP is a defined benefit plan, which means your pension is determined by a formula based on your highest average contributory earnings and years of participation in the Plan, or credited service. This means as your average contributory earnings and years of credited service grow, so does your pension.

Recommended Reading: Can You Get A Loan Using Your 401k As Collateral