A Roth Conversion Will Trigger A Tax Bill But This Year’s Stock Market Volatility May Work In Your Favor

If you’ve been thinking about converting money from a traditional individual retirement account to a Roth IRA, this may be a prime time to bust a move.

Last Monday, the Dow Jones Industrial Averageplunged 876 points following a stomach-churning inflation report. The S& P 500 stepped into bear-market territory after dropping 3.9%, or 151.23 points. On top of that, the Federal Reserve raised interest rates by 75 basis points during June’s Federal Open Market Committee meeting.

The recent market moves may not be good for your portfolio, but it could be a potential win if you decide to do a Roth conversion. Here are a few items to consider before you shift funds from a traditional to a Roth IRA.

Before Converting There Are A Few Things To Consider:

- You cannot recharacterize. Understand your tax situation and ability to pay for the conversion because a Roth conversion cannot be recharacterized.

- The availability of funds to pay income taxes. The benefits of a conversion are increased if the income taxes due can be paid out of non-retirement assets.

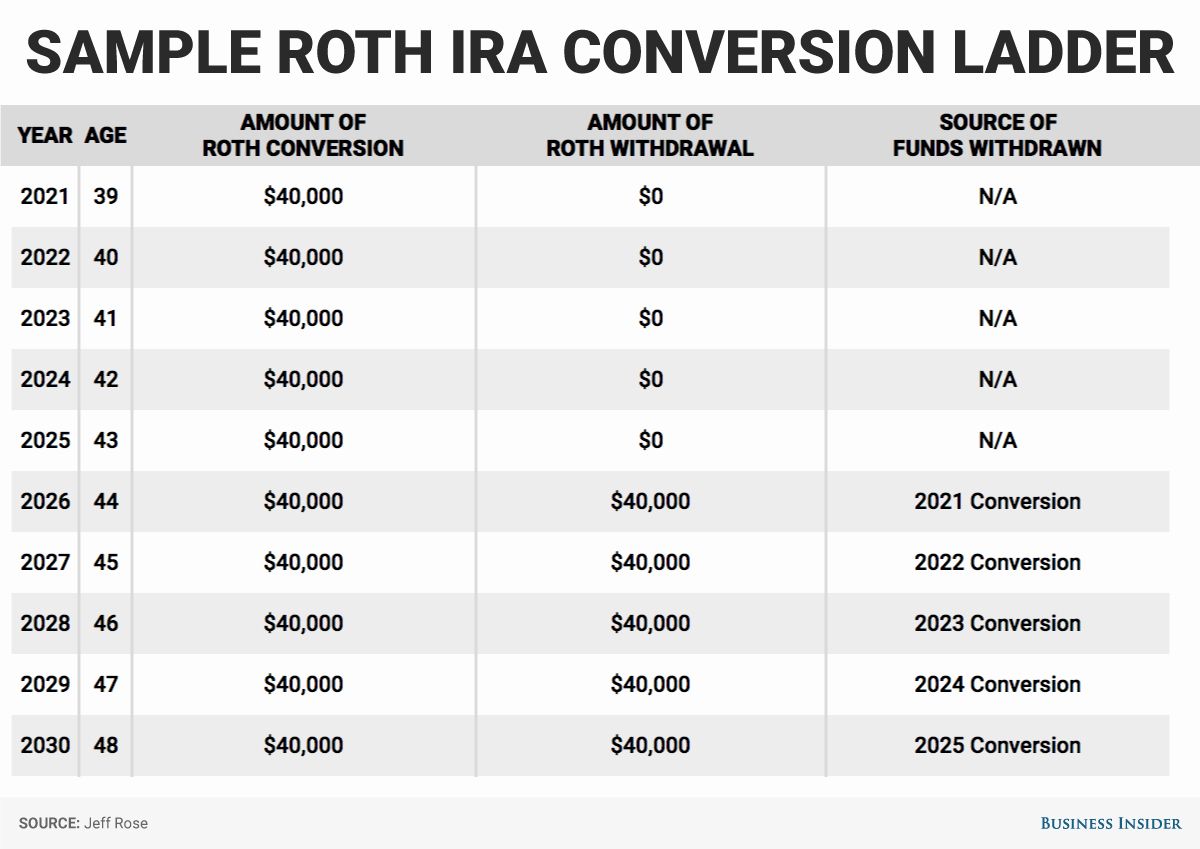

- To help manage your tax liability, you may choose to convert just a portion of your assets. There is no limit to the number of conversions you can do, so you may convert smaller amounts over several years.

Recommended Reading: Where Do I Go To Borrow From My 401k

Ask Your 401 Plan For A Direct Rollover Or Remember The 60

These two words “direct rollover” are important: They mean the 401 plan cuts a check directly to your new IRA account, not to you personally.

Here are the basic instructions:

Contact your former employers plan administrator, complete a few forms, and ask it to send a check or wire for your account balance to your new account provider.

The new account provider gives you instructions for how the check or wire should be made out, what information to include and where it should be sent. You can opt for an indirect 401 rollover instead, which essentially means you withdraw the money and give it to the IRA provider yourself, but that can create tax complexities. We generally recommend a direct rollover.

If you do an indirect rollover, the plan administrator may withhold 20% from your check to pay taxes on your distribution. To get that money back, you must deposit into your IRA the complete account balance including whatever was withheld for taxes within 60 days of the date you received the distribution. .)

For example, say your total 401 account balance was $20,000 and your former employer sends you a check for $16,000 . Assuming youre not planning to go the Roth route, you’d need to come up with $4,000 so that you can deposit the full $20,000 into your IRA.

At tax time, the IRS will see you rolled over the entire retirement account and will refund you the amount that was withheld in taxes.

Recommended Reading: What Happens To Your 401k When You Leave A Company

Direct 401 Rollover Or 401 Transfer Rules

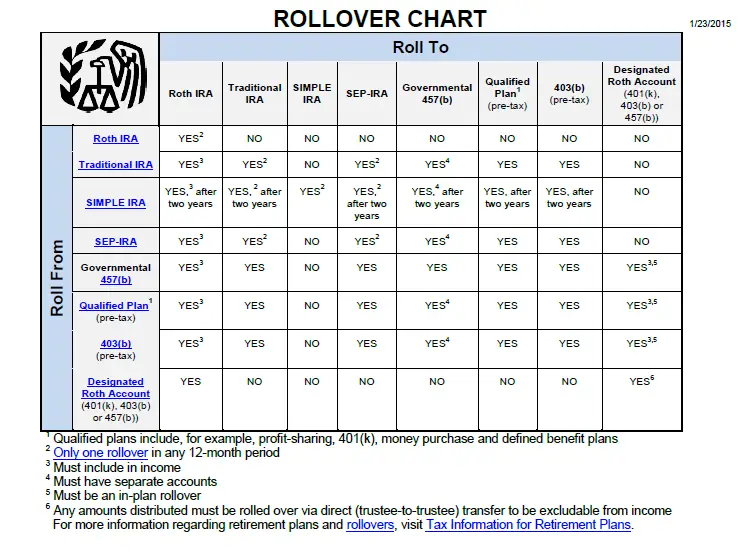

You will be able to transfer funds straight from your 401 plan to a Roth IRA here. When people change employment or if their previous employer does not provide a 401 plan, they regularly perform a rollover. Can you roll a 401k into an IRA without penalty? the answer to this question will be a direct rollover. You will be able to transfer funds straight from your 401 plan to a Roth IRA here.

Employers create 401s, which may or may not be to your taste, so you may simply roll over your existing 401 fund to your IRA or, in this example, to a Roth IRA.

Here we are including some steps for you to roll over your existing 401 to a Roth IRA.

Choose a Brokerage Firm or an Administrator or IRA Provider: The first step in the direct IRA rollover will be to choose a brokerage firm. On the market, there are several well-known brokerage firms. The IRA company you select should be able to provide the following benefits: The rollover procedure should be free of charge.

As a result, that administrator firm should be able to offer the free rollover. Usability, necessary tools for keeping IRA and investment accounts, customer service, investment availability, and so on should be your primary concerns.

Paperwork: The next step will be to complete the following paperwork so your IRA rollover process can succeed. With a direct IRA, you give complete freedom to the administrators to transfer your funds. You should choose benefactors and avoid too much trading in one account.

Complete The Rollover Before Earnings Accrue

You want to roll over your money as soon as possible because you want to minimize the likelihood your funds see any investment returns as these will be taxed in the conversion.

If your after-tax contributions do end up generating investment growth, the IRS allows you to split up the funds, rolling the after-tax contributions into a Roth IRA and the investment earnings into a traditional IRA.

Read Also: Can You Take From 401k To Buy A House

Should You Convert Your Traditional 401 Into A Roth 401

7 Minute Read | December 14, 2021

Over the past few years, you might have received an email from your companys human resources department introducing a new retirement savings plan option: the Roth 401.

More and more companiesespecially large onesare adding Roth options to their 401 plans. In fact, seven out of 10 employers now offer this option to their employees.1 If the Roth 401 is on the table at your workplace, thats great news for you!

But if you now have a Roth 401 option, youre probably wondering what to do with your existing 401. Is converting an existing 401 to a Roth the way to go? Or should you just leave it alone?

There are some things to keep in mind before you make this decision, so lets dive in.

Investments Declining Maybe Its A Good Time To Convert A Traditional Ira Or 401 To A Roth Ira

getty

Instead of fretting about falling markets, consider whether they are an opportunity to convert all or part of a traditional IRA or 401 plan to a Roth IRA.

Lower investment prices can reduce the cost of converting assets into tax-free Roth IRA assets. When all or part of a traditional IRA or 401 is converted to a Roth IRA, the amount converted is included in gross income as ordinary income. You pay taxes at your regular rate on the converted amount.

When a portfolio declines, you can convert more of it for the same tax cost that would have been incurred before the market decline. Or you can convert the same amount of the investment for a lower tax cost. If the investments recover, youve turned more wealth into tax-free wealth than you could have before. Thats also the case if you sell the losing assets before or after the conversion and reinvest in better-performing assets in the Roth IRA.

A conversion that didnt make sense before the market decline might be attractive to you after the decline. Or a conversion that looked attractive before might be more attractive now.

Most IRA custodians will allow you to convert specific holdings of an IRA. For example, if you have some stocks with lower values, you can transfer those shares to a Roth IRA as a conversion.

Don’t Miss: How To Get Your 401k

Can You Rollover A Roth 401 To A Roth Ira

Dear Carrie,

I’m 56 and have both a traditional and a Roth 401. Right now I contribute the maximum to my Roth each year. I plan to roll the Roth 401 into a Roth IRA before 72 to avoid having to take an RMD. Two questions: Do I need to open a Roth IRA five years prior to the rollover to meet the 5-year rule? And can I contribute to a Roth IRA even though I max out my Roth 401?

A Reader

Dear Reader,

I rarely get questions regarding a Roth 401 rollover, but as this type of retirement plan becomes more widely available, I’m sure more and more people will be looking for similar answers. So thanks for asking.

I think you’re right on target with your basic idea. With a Roth 401unlike a Roth IRAyou must take a required minimum distribution beginning at age 72 if youre retired. So the idea of rolling your Roth 401 money into a Roth IRA before that magic age makes a lot of sense. With your money in a Roth IRA, rather than being required to take a certain amount out of your retirement savings each year, you can choose how much, whenor if everyou want to make withdrawals.

But as you suggest, there are certain things you need to be aware of to make sure you can take full advantage of all the Roth IRA benefits.

Can You Convert A Roth 401k To A Roth Ira

Asked by: Guiseppe Lang

A Roth 401 can be rolled over to a new or existing Roth IRA or Roth 401. As a rule, a transfer to a Roth IRA is most desirable, since it facilitates a wider range of investment options. If you plan to withdraw the transferred funds soon, moving them to another Roth 401 may provide favorable tax treatment.

You May Like: When Retiring What To Do With 401k

You Need To Make Withdrawals Within 5 Years Of Opening Your 401

Unlike a Roth IRA, a Roth 401 is actually less flexible when it comes to the timing of withdrawals than its traditional 401 counterpart.

You can begin making withdrawals from a traditional 401 penalty-free at age 59 ½. However, with a Roth 401, you’ll need to wait at least five years from opening your account, regardless of how old you are, to avoid taxes and penalties . So if you open the account at age 58, you won’t be able to make tax-free withdrawals until you reach age 63.

For twenty- and thirty-something workers, this won’t be a concern. But if you’re getting a late start on retirement savings or you’ve started working for a new employer near age 59½, you may want to stick with a traditional 401 to avoid this 5-year rule.

Benefits Of A Roth 401 Conversion

A recent study by Willis Towers Watson revealed a new trend among employer sponsored retirement benefits Roth 401s. In fact, seven out of ten employers now offer Roth 401s to their employees. If you already invest in a traditional 401, theres no need to worry. You can convert your existing 401 to a Roth and reap the benefits!

What is a Roth 401?

The Roth 401 is a workplace retirement savings account that combines the benefits of a 401 and Roth IRA. In a traditional 401 all contributions are made pre-tax. This means you arent taxed for income invested in your 401. Those taxes will be deferred until you take withdrawals in retirement. With a Roth 401 though, contributions are made after tax. This means you pay income tax on the money before investing it, but you wont have to pay any taxes during retirement. Like a traditional 401, Roth 401s can be matched by an employer and carry the same contribution limits. Its worth nothing that only your contributions to a Roth 401 are made after tax, so any company matching funds in your account will be subject to taxation in retirement.

Benefits of a Conversion

Who Should do a Roth 401 Conversion?

How to Convert

Here is a step-by-step guide to convert a traditional 401 to a Roth 401:

Speak with a Marietta Wealth financial professional to determine if a Roth 401 conversion is the right move for you.

Also Check: How Can I Take Money From My 401k

Roth 401 Vs Traditional : Which Plan Is Best For You

The most important question to ask yourself when comparing Roth and traditional 401 plans is “Do I expect my tax bracket to be higher or lower after I retire?”

If the answer is “lower,” then a traditional 401 would make more sense. But if you expect to have a higher tax rate in retirement, a Roth 401 could be the better choice.

Two main factors could affect your tax rate after you’ve stopped working. The first is your target annual retirement income. If this figure is significantly less than your income during your earning years, that could strengthen the case for the traditional 401. But the opposite would be true if you think you might actually be enjoying a greater income in retirement.

The second factor to consider is future changes in income tax rates. Of course, that’s out of your control, and in the hands of the IRS and the political powers-that-be. But, as Rob Williams, managing director of the Schwab Center for Financial Research says, current “tax rates are close to historical lows.” Some economists and financial analysts predict that they are destined to rise in ensuing years.

So it might be better to invest via a Roth 401 and take the tax hit now especially if your retirement days are decades away. By going the Roth route, you know exactly what your tax liability will be now instead of hoping they stay low in the years to come.

How Do You Convert To A Roth Ira

The actual process for converting a 401 or traditional IRA to a Roth IRA is simple. In fact, its so straightforward that you can create problems before youre aware that youve done so.

Here are the three basic steps to convert your retirement account to a Roth IRA:

If you manage your own funds, you should be able to find steps to do a Roth conversion on your investment platforms site, says Kerry Keihn, financial advisor at Earth Equity Advisors in the Asheville area, noting that each institution has a slightly different process or forms.

Within a couple weeks and often sooner the conversion to the Roth IRA will be made.

When it comes time to file taxes for the year you made the conversion, youll need to submit Form 8606 to notify the IRS that youve converted an account to a Roth IRA.

Don’t Miss: Is A 401k A Defined Contribution Plan

What Do You Do With Your 401 When You Leave Your Job

You may change jobs several times throughout your career, which means you could end up with several retirement accounts. Some options you have for an old 401 include:

-

Doing a 401 rollover into an individual retirement account or a ROTH IRA at an online brokerage or a robo-advisor.

-

Rolling over your old 401 into a new employer’s 401 plan.

-

Keeping it with your former employer.

» Can you have a Roth IRA and a 401? Yes, but there’s more to it than that.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Recommended Reading: How Do I Cancel My 401k With Fidelity

What Is A Roth Conversion

A Roth conversion involves taking money from a tax-deferred account and moving it into a Roth account, where it will grow tax-free. Taxes will come due on the amount you move into a Roth in that tax year, just as they would if you took the funds out in retirement.

The IRS doesnt care whether youre reinvesting the tax-deferred account distribution or youre spending it on your retirement pleasures, when its withdrawn from your traditional IRA. That money wasnt taxed at the time you made contributions, so its taxable now.

The tax is due for the tax year in which the distribution is taken. For example, you would report the income on your 2021 tax return filed in 2022 if you take the conversion withdrawal any time from Jan. 1 through Dec. 31, 2021.

What Is A 401 Rollover

If you have an employer-sponsored plan, you can rollover your present savings to a new account, particularly in an IRA. The rollover typically occurs when an individual changes employment or approaches retirement. Rolling over an old 401 is advisable if you have one.

A rollover 401 meaning will be withdrawing the funds from one individual retirement savings and depositing them in another. And, like with the preceding IRA, the new account will provide tax advantages, and in general, you can move money from a 401k to an IRA or into a Roth IRA.

This is not always obligatory to roll over your 401 to an IRA you can just pick a new 401 at your new workplace. However, there are loads of options for 401 rollovers, the most well-known of which is the rollover of a 401 to a Roth IRA. We have included all of the relevant information concerning the rollover procedure and the implications of rollover in this article.

Also Check: How Can I Find My 401k