Taking The Cash Distribution May Cost You

Avoiding cash distributions can save you from taxes and penalties, because any amount you fail to roll over will be treated as a taxable distribution. As a result, it would also be subject to the 10% penalty if you are under age 59 1/2.

Since the taxable portion of a distribution will be added to any other taxable income you have during the year, you could move into a higher tax bracket.

Using the previous example, if a single taxpayer with $50,000 of taxable income were to decide not to roll over any portion of the $100,000 distribution, they would report $150,000 of taxable income for the year. That would put them in a higher tax bracket. They also would have to report $10,000 in additional penalty tax, if they were under the age of 59 1/2.

Only use cash distributions as a last resort. That means extreme cases of financial hardship. These hardships may include facing foreclosure, eviction, or repossession. If you have to go this route, only take out funds needed to cover the hardship, plus any taxes and penalties you will owe.

The CARES Act, enacted on March 27, 2020, provided some relief for those who need to make withdrawals from a retirement plan. It lifted penalties for withdrawals made through December 2020 and provides three years to pay back any early withdrawals.

Is There Any Portion Of A Distribution Thats Tax

Yes, if the distribution includes after-tax contributions or Roth contributions. Non-Roth after-tax contributions can be distributed tax-free, but earnings are taxable. Qualified distributions from Roth 401 or Roth 403 accounts are tax-free. However, the earnings portion of nonqualified Roth distributions is taxable.

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

Recommended Reading: How To Cash Out Nationwide 401k

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Transferring Dividend Stocks From Td Ameritrade To Fidelity

My retirement accounts are now completely transferred from Vanguard to Fidelity. But I still have additional taxable accounts with TD Ameritrade and the no-fee broker, M1 Finance. These two accounts are the focus of my .

At this stage, I am planning to transfer the TD Ameritrade account to Fidelity when Im ready.

My TD Ameritrade dividend growth portfolio has also grown to a six-figure account. But Im not an active trader. I buy stocks and collect dividends. Then I reinvest the dividends into more dividend-paying stocks. Ive almost always been happy with them.

I dont need a fancy trading platform. My priority now is to simplify my life a bit. Fidelity is an equally capable online brokerage for my needs, so it makes sense to move my money there.

Fidelity charges $4.95 per stock trade while TD Ameritrade charges $6.95 is now commission-free as of October 2019!

The only hesitation I have is the cost basis data on record at TD Ameritrade. When I transferred my decades-old DRIPs , I had to update the cost basis from my records. Since these were DRIPs, there were dozens of transactions for each.

Im afraid that when I transfer my holdings, the cost basis will not be transferred correctly or at all. Ive seen this screwed up many times. I will back up my cost basis very carefully in case I have to resubmit the data.

You May Like: How To Open A Solo 401k

Recommended Reading: How Much Income Will Your 401k Provide

Other Things To Look Out For

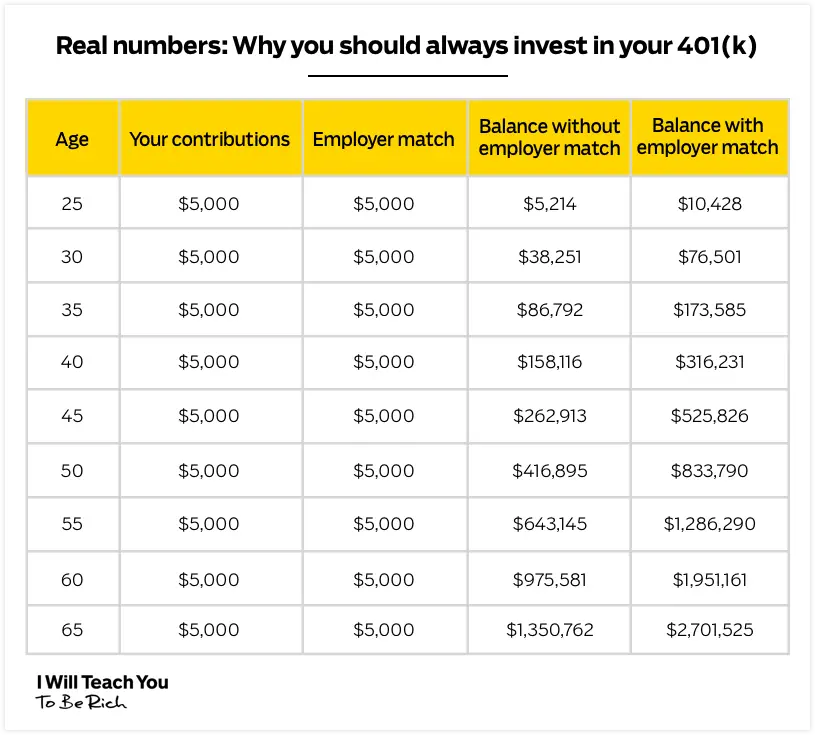

When rolling over assets to a 401 or IRA, there are a couple of things to keep in mind. First, no amount is too small. Sharma stresses that even a small 401 account can make a big impact.

A small amount of money today can grow into a sizable sum with the power of long-term investing and compounding, particularly because money in an IRA can grow tax-free. For example, $3,000 in assets today could turn into over $40,000 at retirement if invested appropriately.

Kenny Senour, a certified financial planner for Millennial Wealth Management, cautions to keep an eye on investment options and their fees. He says, Your 401 plan may have access to a low-cost institutional share class with a high investment minimum. In this example, you may end up paying higher costs for an investment through a higher expense ratio for a comparable investment option in an IRA.

This means the same investment could be more expensive in a 401 than in an IRA.

Find: Why You Should Invest In a 401 at Your First Job

Do I Have To Take My Retirement Plan Assets When I Change Jobs

Company retirement plan rules can vary, but most follow the same basic guidelines. If your account balance is less than or equal to $1,000, your plan might cash you out. If your balance is greater than $1,000 and less than or equal to $5,000, your plan might roll over your balance into an IRA selected by your former employer. If your balance is greater than $5,000, you will generally be permitted to leave your balance in the plan however, you will not be able to contribute to the account and will be subject to any restrictions and rules of the plan.

Don’t Miss: What Is A Good Percentage To Contribute To 401k

You Can Invest With A Wider Choice Of Funds Tailored To Your Goals Interests And Risk Appetite

Unlike the typical 401, an IRA comes with the ability to select asset typesand possibly additional investment guidance individually. A broader range of available assets and types may include individual stocks and bonds, CDs, index funds, target-date funds, goal-specific mutual funds, and real-estate investment trusts . “Pick what types of investments make sense for you and your future, says Markwell.

Begin The Rollover Process

Youll have to fill out paperwork to conduct your rollover and it may require some back-and-forth conversations with your providers. You have several options to actually move the money from the old provider to the new one, but your best option is a direct rollover.

In a direct rollover, the funds are sent straight from your 401 into your new account without you touching the funds. Its important that you specify a direct rollover so that you dont have the check made payable to you. You could trigger a mandatory 20 percent withholding for taxes, and the IRS charges a 10 percent bonus penalty on withdrawals made before age 59 1/2.

Recommended Reading: Is Roth Better Than 401k

Why Do I Have To Designate A Financial Professional For My American Funds Ira

American Funds are sold only through financial professionals because we believe that their expertise and guidance are essential to successful financial planning. Financial professionals are there to answer your questions and help you through the decision-making process. If you would like a referral to a professional in your area who is familiar with our funds and services, please call us at .

Rollover Your 401 Into An M1 Ira

1. Open an M1 IRA account.

2. Contact your current 401 administrator

Tell them that you would like to initiate a rollover.

If you dont know who your administrator is, you can check your last statement or reach out to your former employer.

Helpful tips:

- Have your current administrator make the check payable to Apex Clearing.

- The check should include your name and M1 IRA account number in the memo line.

- Your M1 IRA account number is foundin the account information drop down menu

- If the account number is not on the check, please include a slip of paper with your M1 IRA account number written on it.

3. Have the rollover check sent to:

Apex Clearing c/o BPO

350 North St. Paul Street #1300

Dallas, TX 75201

If the 401 administrator sends your distribution check to you directly, then you will need to send the check to Apex Clearing Corporation at the address above.

If the check is made out to you, please make sure to endorse the check. After the check is sent, please allow 20 days before contacting M1.

Also Check: Where Can I Cash A 401k Check

What Happens With A 401 Loan When I Move To A Different Company

Most 401 retirement plans allow you to take out loans, which usually must be repaid within five years. If you change employers, however, the clock speeds up and a loan you’ve taken out from your 401 may be due in full very quickly. Even worse, you may face serious tax consequences if you can’t repay it.

Confirm A Few Key Details About Your Transamerica 401

First, get together any information you have on your Transamerica 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

Read Also: How To Pay Off 401k Loan Early

The Process Was Dead Simple

This part really surprised me. As I thought about how to start the process, I decided to call Vanguard to see what information about my Rollover IRA I would need to give Fidelity. I already had the IRA account from a rollover six years ago, but had long forgotten the actually steps needed to get the process moving.

My call was routed to a department that does nothing but handle rollovers. The rep walked me through the process, and then offered to call Fidelity with me. So he dialed up Fidelity and did all the talking. I guess Vanguard really wanted my money!

We did hit one snag. According to the Fidelity representative, my old employer still had my status as an active employee. So I had to call my employer to get my status changed. That took a few days, and then the three of us got back on the phone to complete the rollover. It took all of five minutes.

You can check out an even more detailed description of the 401k rollover process here.

What Is A Rollover Ira

A rollover IRA is an individual retirement account often used by those who have changed jobs or retired. A rollover IRA allows individuals to move their employer-sponsored retirement accounts without incurring tax penalties and remain invested tax-deferred. Consolidating multiple employer-sponsored retirement accounts can make it easier to monitor your retirement savings.

*Note: If you have an existing rollover or traditional IRA at Prudential, you can roll your assets into that account.

Read Also: How To Take Money Out Of 401k Without Penalty

Can I Roll My Retirement Assets Directly Into A Roth Ira

Yes. After-tax or Roth contributions from an employers plan can be rolled over directly into a Roth IRA tax free. If you roll over non-Roth assets to a Roth IRA, while you may not be required to withhold taxes, the amount rolled over will be included in your gross income for federal and/or state income tax purposes.

Talk to your financial professional about your options.

Where Should You Transfer Your 401

You have several options on what to do with your 401 savings after retirement or when you change jobs. For example, you can:

The right choice depends on your needs, and thats a choice everybody needs to make after evaluating all of the options.

Want help finding the right place for your retirement savings? Thats exactly what I do. As a fee-only fidicuary advisor, I can provide advice whether you prefer to pay a flat fee or youd like me to handle investment management for you, and I dont earn any commissions. To help with that decision, learn more about me or take a look at the Pricing page to see if it makes sense to talk. Theres no obligation to chat.

Important:The different rules that apply to 401 and IRA accounts are confusing. Discuss any transfers with a professional advisor before you make any decisions. This article is not tax advice, and you need to verify details with a CPA and your employers plan administrator. Likewise, only an attorney authorized to work in your state can provide guidance on legal matters. Approach Financial, Inc. does not provide tax or legal services. This information might not be applicable to your situation, it may be out of date, and it may contain errors and omissions.

Read Also: Can I Keep My 401k After I Leave My Job

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguardâs advisor-assisted, automated investing account has Fidelityâs equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

Also Check: How Much Do I Need In My 401k To Retire