What Are The Risks Of Including Bitcoin In Your 401

Cryptocurrency is a risky and speculative asset that has proven its volatility time and time again. Bitcoin hit a high of $20,000 in 2017 before crashing to below $5,000 the next year. In 2021, it surged to around $68,000 per coin at its peak, but is now trading around $38,000. A 10% drop in a day is not uncommon.

The digital asset also isn’t regulated in the same way stocks and bonds are, and that unclear regulatory landscape makes crypto’s future uncertain. Earlier this year, President Joe Biden signed an executive order to establish the first-ever federal U.S. strategy on cryptocurrencies, and that effort is ongoing.

Levine says investors need to understand that there’s a difference between financial experts saying bitcoin doesn’t belong in 401s and saying that you shouldn’t invest in cryptocurrency in general, adding that he’s not “anti-crypto” himself.

It’s one thing to invest at most 5% of your overall investment portfolio in cryptocurrency via a brokerage account or even a self-directed individual retirement account . It’s quite another to invest money you’re relying on for your future in such a speculative asset via your 401.

As mentioned, there are risks to the plan sponsors, too.

What Are The Pros And Cons Of Cashing Out A 401k

- Access to money. The biggest benefit of retiring from your 401 is having money. Everyone would like to have more money in their pocket.

- taxes. Regardless of how you use your 401 withdrawal, you will have to pay withdrawal tax.

- To punish. Even if you qualify to be fired for difficult working conditions before you turn 59 1/2, the IRS will penalize you for doing so.

Best For Real Estate: Rocket Dollar

Rocket Dollar

Rocket Dollar allows you to invest in anything you can pay for with a checkbook. That means you can invest in real estate and other non-traditional assets while enjoying the tax advantages of a solo 401 account.

-

Checkbook control allows you to invest in real estate and other alternatives

-

Support for 401 loans and Roth contributions

-

Option for upgraded account that includes free wire transfers, checks, tax form filing, and other features

-

Basic accounts require $15 monthly fee and $360 setup fee

-

Premium accounts require a $30 monthly fee and $600 setup fee

If you dont want the limitations of traditional financial markets, you may want to consider Rocket Dollar. Instead of stocks, ETFs, mutual funds, and bonds, Rocket Dollar accounts give you the control to buy any asset with your solo 401 that the IRS allows. That can include rental properties, fix-and-flip real estate, or land that you think will appreciate in value. You can invest outside of real estate as well, such as private investments in a startup or precious metals, however, Rocket Dollar’s flexibility makes it the solo 401 that’s best for real estate.

Also Check: How To Transfer Your 401k To Another Company

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

How To Request A Withdrawal Or Loan From The Plan

You may request a withdrawal from your 403 retirement plan by contacting your investment carrier directly. Loans and hardship distributions are only available through Fidelity and can only be taken from the contributions that you put into the plan at Fidelity. Contact Fidelity to request a loan or hardship distribution.

Also Check: How To Protect 401k From Market Crash

Alternatives To Tapping Your 401

If you must tap into retirement savings, it’s better to look at your other accounts firstspecifically IRAsespecially if you’re buying a first home .

Unlike 401s, IRAs have special provisions for first-time homebuyerspeople who haven’t owned a primary residence in the last two years, according to the IRS.

First, look to take a distribution from your IRAif you have one. You may be able to withdraw IRA contributions without penalty due to a qualified financial hardship. You can also withdraw up to $10,000 of earnings tax-free if the money is used for a first-time home purchase. As a first-time homebuyer, you can take a $10,000 distribution without owing the 10% tax penalty, although that $10,000 would be added to your federal and state income taxes. If you take a distribution larger than $10,000, a 10% penalty would be applied to the additional distribution amount. It also would be added to your income taxes.

Make A 401 Withdrawal

Your second option would be to make a direct withdrawal from your 401 account. As mentioned above, this is the less desirable of the two options.

An early withdrawal would be classified as a hardship withdrawal. The IRS considers any emergency removal of funds from a 401 to cover an immediate and heavy financial need as a hardship withdrawal. Whether or not the purchase of a home using your 401 counts as a hardship withdrawal is a determination that falls to your employer, and you will need to present evidence of hardship before the withdrawal can be approved.

Regardless, you will still likely incur the 10% early withdrawal penalty. There are exemptions in place for specific circumstances, including home buying expenses for a principal residence. Qualifying for such exemptions is difficult by design, however. If you possess other assets that could be used for your home purchase, then you likely wont qualify for an exemption. Even if you do, your withdrawal will still be taxed as income.

You May Like: What Will My 401k Be Worth At Retirement

Compare Your Options For Cash Withdrawals And Loans

Following are overviews of your options for making withdrawals or receiving loans from each plan type. For details, see Eligibility and Procedures for Cash Withdrawals and Loans.

| Cash Withdrawals | ||

|---|---|---|

| Not Available | ||

| Former Employee | Employee contributions and earnings at any age, university contributions and earnings at age 55 or older | Not Available |

|

At age 59½ or older hardship disability |

At any age |

| Current Employee | At age 59½ or older one-time withdrawal if account is less than $5,000 when specific conditions are met. See below for details. | At any age |

|---|---|---|

| Fidelity 457 only |

A Note About The Cares Act

Signed into law on March 27, 2020, the $2 trillion dollar Coronavirus Aid, Relief and Economic Security Act emergency stimulus bill was drafted to help those affected by the coronavirus pandemic. Under the act, 401 account owners can make a hardship withdrawal of up to $100,000 without paying the 10% penalty. The bill also grants the account holder 3 years to pay the income tax, rather than it being due within that same year.

Recommended Reading: Do Employers Match Roth 401k

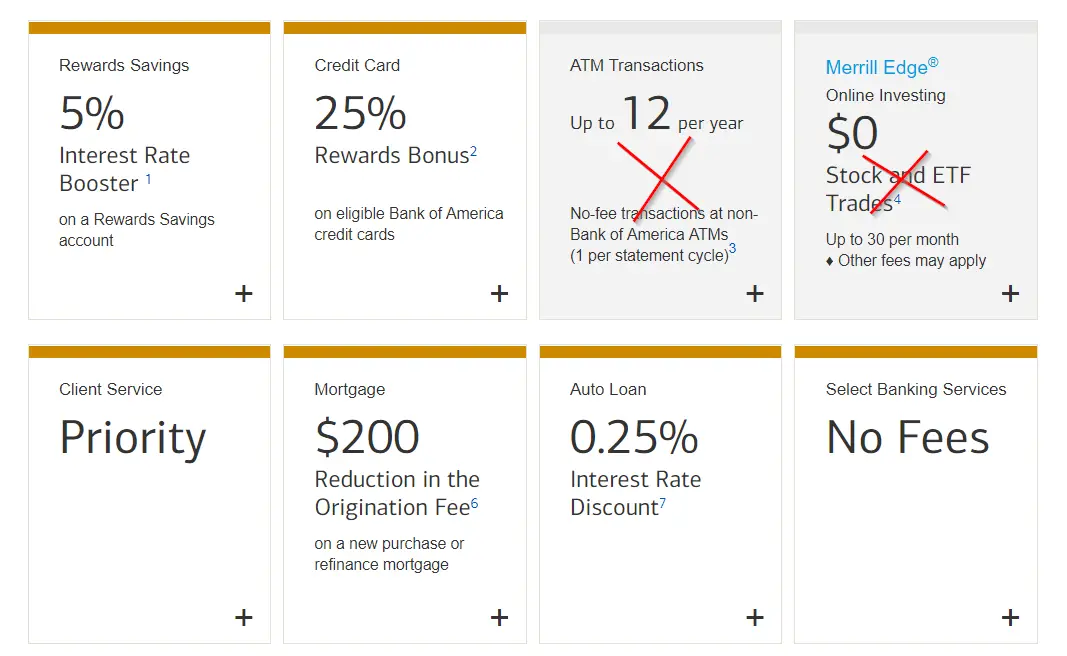

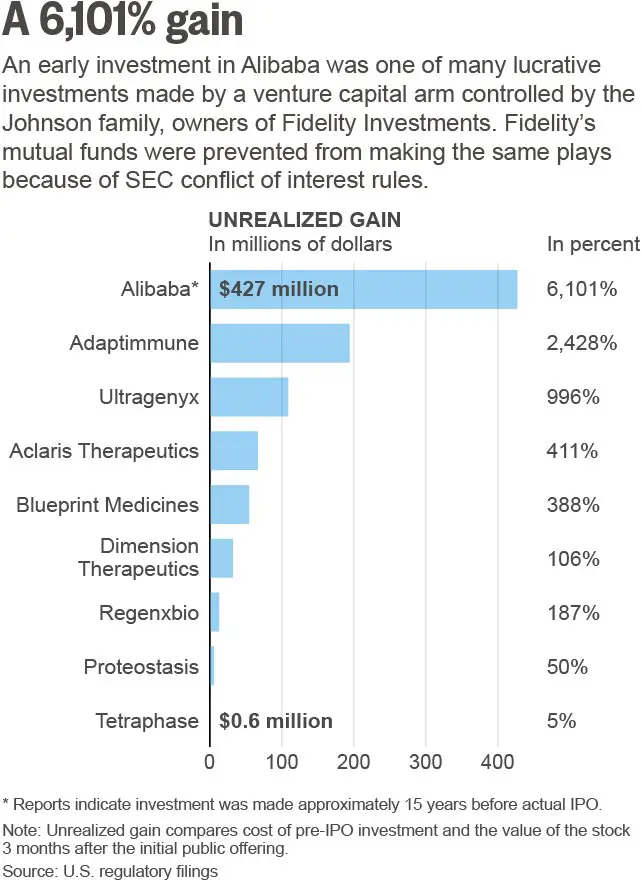

More Companies Likely To Offer Crypto In 401s

With Fidelitys move into Bitcoin for 401s, industry watchers expect other retirement companies to follow suit, at least at the moment.

Because such a big player in the 401 market has taken the step, Im confident we will see more of the providers push towards this offering, says Faron Daugs, CFP, wealth advisor, founder and CEO at Harrison Wallace Financial Group in the greater Chicago area.

This is a great way for Fidelity to show its a responsive, cutting-edge brand thats eager to meet popular demand for its customers, says Barnes. For those reasons, many of Fidelitys competitors are likely to follow suit in short order. That said, I expect at least one brand will buck this trend and use their stand against cryptocurrencies in 401s as a differentiator of their own.

For the industry, it means other 401 providers will have to find a way to offer this option to their investors to stay competitive, says Simpson. I dont know if there will be more of a push for access to crypto in 401 plans, but there will need to be much more oversight, regulation and education about the crypto industry.

What Could Be The Cost Of Missed Retirement Savings

A report from the National Institute on Retirement Security found that 95% of millennials arent saving enough for retirement. And a 2017 study from Wells Fargo shows that other generations arent faring much better. So if youve been trying to beat the odds and put aside adequate savings for retirement, taking out a 401 loan can be a triple whammy.

First, some plans dont allow participants to make plan contributions while they have an outstanding loan. If it takes five years for you to repay your loan, that could mean five years without adding to your 401 account. During that time, you may be failing to grow your nest egg and youll miss out on the tax benefits of contributing to a 401.

Next, if your employer offers matching contributions, youll miss out those during any years you arent contributing to the plan. Loan repayments arent considered contributions, so if the employer contribution is dependent upon your participation in the plan, you may be out of luck if you cant make contributions while you repay the loan.

And finally, your account will miss out on investment returns on the money youve borrowed. Although you do earn interest on the loan, in a low-interest-rate environment you could potentially earn a much better rate of return if the money was invested in your 401.

What are the tax benefits of 401s?

Recommended Reading: When Leaving A Job What To Do With 401k

Advantages Of Borrowing From A 401

Borrowing from your 401 isnt ideal, but it does have some advantages especially when compared to an early withdrawal.

A loan allows you to avoid paying the taxes and penalties that come with taking an early withdrawal. Additionally, the interest you pay on the loan will go back into your retirement account, although on a post-tax basis.

401 loans also wont require a credit check or be listed as debt on your credit report. If youre forced to default on the loan, you wont have to worry about it damaging your credit score because the default wont be reported to credit bureaus.

Those Who Can Pay Themselves Back

Its not free money. You have to pay it back or risk getting hit with a hefty tax bill, says Jeff Levine, of Nerds Eye View, an online news source that caters to financial planners.

Someone who may not be able to pay it back should think a little harder about whether they should tap into their retirement assets or not, Pfau says.

Another thing to keep in mind is how close you are to retirement. For many people, this could force them into an early retirement. Borrowing from their 401 may just be a way of actually starting to take distributions for retirement earlier, Pfau says. You just have to recognize the trade-offs, like not having as much money for retirement down the road.

Read Also: When Should I Start My 401k

Traditional Approach: Withdrawals From One Account At A Time

To help get a clearer picture of how this could work, lets take a look at a hypothetical example: Joe is 62 and single. He has $200,000 in taxable accounts, $250,000 in traditional 401 accounts and IRAs, and $50,000 in a Roth IRA. He receives $25,000 per year in Social Security and has a total after-tax income need of $60,000 per year. Lets assume a 5% annual return.

If Joe takes a traditional approach, withdrawing from one account at a time, starting with taxable, then traditional and finally Roth, his savings will last slightly more than 22 years and he will pay an estimated $69,000 in taxes throughout his retirement.

Withdrawing from one account at a time can produce a tax bump midway in retirement

Note that with the traditional approach, Joe hits an abrupt tax bump in year 8 where he pays over $5,000 in taxes for 11 years while paying nothing for the first 7 years and nothing when he starts to withdraw from his Roth account.

In this scenario, a proportional withdrawal strategy in retirement cuts taxes by almost 40%

Read Also: How To Take Out 401k Money For House

What Is The Covid

Youll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if theyre younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent mustve been diagnosed with Covid-19.

Alternatively, you must have experienced adverse financial consequences due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

Recommended Reading: Can I Do A 401k On My Own

How Much Can I Borrow On Margin

While margin can provide flexibility by not locking you into a fixed monthly principal repayment plan, it’s important to understand the amount available to borrow is dependent on the type of and value of your eligible securities, which may fluctuate over time. And of course, even without scheduled principal repayments there will still be interest assessed on the loan, so you’ll need to be sure that you have sufficient funds available to cover this interest expense.

Should You Take A Loan Or Hardship Distribution

Loans are generally a better way to fund a financial need than a straight distribution, depending on why you need this money.

To clear debt, explore all alternatives before borrowing from your 401. If you owe on credit cards, for example, look to negotiate your interest rate with your credit card company.

If youre facing severe debt issues and on the brink of bankruptcy, the last thing you want to do is use this money to pay off debt, says Kelley Long, certified public accountant in Chicago. Your 401 money is protected in bankruptcy.

A 401 loan only makes sense once youve worked with a credit counselor and exhausted all the alternatives and have a plan to solve budgeting issues.

Tapping your retirement account is a last resort for medical bills.First, try to negotiate with the hospital or medical billing company, which wont affect your credit unless the bills go into collections. Consider a 401 loan only if youre unable to negotiate and cant afford the bills.

College tuition might seem a worthy reason to borrow from your 401 but there are other ways to pay and save for college. A 529 plan, for example, is a very attractive vehicle designed to help people save for education. You retain control of the funds in the plan and also receive a tax benefit.

Like people say, You can borrow for school, but you cant borrow for retirement.

Read Also: How To Find Out Where Your 401k Is

Early Withdrawal Calculator Terms & Definitions:

- 401k â A tax-qualified, defined-contribution pension account as defined in subsection 401 of the Internal Revenue Taxation Code.

- Federal Income Tax Bracket â The division at which tax rates change in the federal income tax system .

- State Income Tax Rate â The percentage of taxes an individual has to pay on their income according to the laws of their state.

- Lump-sum Distribution â The withdrawal of funds from a 401k.

- Rollover â Moving the 401k contribution to another retirement fund option, often an IRA.

- Penalties â The payment demanded for not adhering to set rules.

- Future Value Before Taxes â The value of oneâs asset at the end of the term before taxes are paid.

- Future Taxes to be Paid â The taxes that are required to be paid at the end of the term.

- Future Net Available â The amount left after taxes and penalties are deducted.

- Annual Rate of Return â The percentage earned every year by having funds in an account.

How Much Can Be Borrowed From A 401 Loan

It depends on how much you have in your account. You can borrow up to 50% of your vested account balance, but you cant borrow more than $50,000. Even if you have a balance of $200,000, the IRS wont let you touch more than $50,000 of it.

The only time you can borrow more than 50% is when you have a balance of less than $20,000. In that case, you can borrow up to $10,000, even if you only have $10,000 stashed away.

Don’t Miss: How To Get Money From My 401k Plan

Making A Fidelity 401k Withdrawal

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

From there, you can download the appropriate withdrawal request form and then mail it to the address listed on the form. Fidelity will have your check for you in five to seven business days after receiving your request. There are no fees for requesting a check, but if you liquidate any holdings, there could be commissions or mutual fund fees associated with that.

Borrowing From Your 401k: What You Need to Know