Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Be Sure To Layout A Retirement Budget

Deacon Hayes, Owner & Founder of WellKeptWallet

Everyone’s life and circumstances are unique. Therefore, what works for one person is not going to be a magic formula that works for all. That being said, it’s always better to save more than you need rather than less.

Start by determining the age you would like to retire. Then, create a post-retirement budget to help you determine how much money you will need to save up ahead of time. Don’t forget to include vehicles, insurance, taxes, and other expenses that are not always monthly.

You can use a 401 calculator to assist you in determining how much money you should be investing at any age. However, here is a general guideline :

- At age 30 a minimum of one year’s salary

- At age 35 at least two years salary

- At age 40 three years salary or more

- At age 45 four years salary at minimum

- At age 50 at least five years salary

- At age 55 six years salary if not more

- At age 60 seven times your annual salary

- At age 65 at least eight times your yearly salary

Average 401k Balance At Age 45

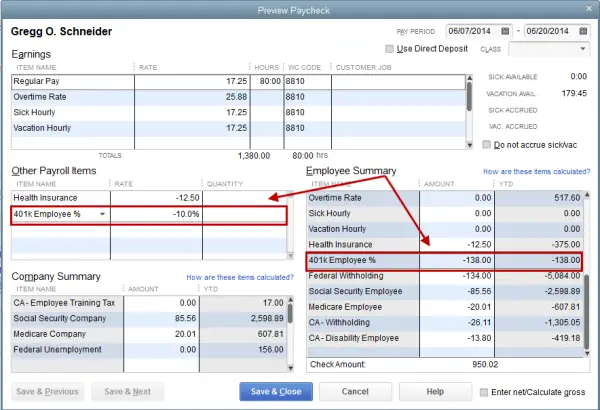

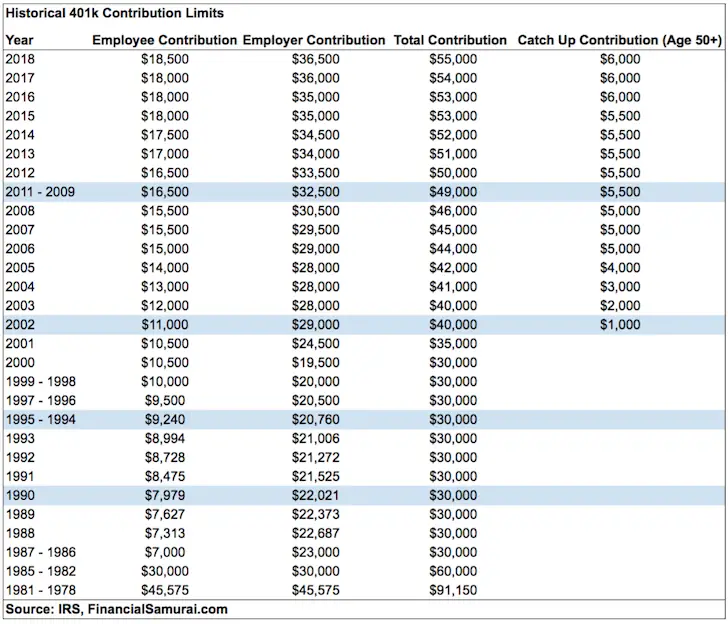

When you hit your 50s, you become eligible to make larger contributions towards retirement accounts. These are called catch-up contributions. Make sure that you take advantage of them! Catch-up contributions are $6,500 in 2021. So if you contribute the annual limit of $19,500 plus your catch-up contribution of $6,500, thats a total of $26,000 tax-deferred dollars you could be saving towards your retirement.

Also Check: How Do You Take A Loan Out Of Your 401k

Make A Budget For Retirement Savings

Customizing your retirement budget is easy with Mint!

Most of us look forward to our retirement years where the money weve worked so hard for is now working for us. A 401k is one way to achieve a nest age, so its important to take advantage of this benefit if your employer offers it. Planning for a comfortable retirement takes time, due diligence, and budgeting. Its important to consider your future lifestyle and know where you stand financially, so you dont have to worry when you reach your golden years. As this material has been prepared for information purposes only, you should consult your tax advisor before making any financial decisions.

Mistake #: Buying Too Much Of Your Companys Stock

If your employer’s stock shares are an investment choice in your 401, you may want to consider keeping your allocation to no more than 10 percent. Youre not being disloyal even the mightiest of companies think Enron and WorldCom can falter. With your salary already tied to your companys fortunes, you dont want a sizable part of your retirement savings to be similarly dependent.

Read Also: When Retiring What To Do With 401k

You Are Leaving The Wells Fargo Website

You are leaving wellsfargo.com and entering a website that Wells Fargo does not control. Wells Fargo has provided this link for your convenience, but does not endorse and is not responsible for the content, links, privacy policy, or security policy of this website.

Retirement may seem a long way off and far removed from your day-to-day concerns. And yet, this is actually the best time to start planning and saving that is, when you still have time to accumulate the money youll need.

Here are some common mistakes that throw people off course in their retirement planning. Knowing these pitfalls should help you steer clear and save more.

It Pays To Pay Yourself First

McHale suggests that regardless of the amount of debt you have, it’s important to pay yourself first by taking 10 percent off of the top of your paycheck for a retirement fund. “Starting to save early allows your savings to grow faster, thanks to compound interest over time,” he says.

“Ultimately, you reach your goals faster because you are getting interest on interest.” He also recommends that you take full advantage of any matching-funds programs your employer offers, like 401 investment plans.

Read Also: What Is A 401k For

Average Current Retirement Savings Balance

Unfortunately, many people are woefully under-prepared for retirement from a financial standpoint.

Here are some statistics on the median current retirement savings balances of Americans based on their age.

| Families Between |

|---|

| 70+ | 12.3% |

Workers save more for retirement as they get older and pay off other debts like student loans and a home mortgage.

At a minimum, many experts recommend saving at least 10% of your income for retirement. Dave Ramseys Baby Steps recommend saving at least 15% into retirement accounts after getting out of debt and building an emergency fund.

You can use a retirement calculator like NewRetirement to review your personal progress and project how long your nest egg will last. This tool is free but paid plans are available too.

Read our NewRetirement review to learn more about this interactive retirement planner.

When Should You Max Out Your 401

In 2020 and 2021, the most you can contribute to a 401 plan is $19,500 each year . If you can easily afford to max out your contribution based on the yearly limits, without it causing a large impact to your budget, you might want to do so.

Some personal finance experts suggest saving at least 15% of your annual income for retirement in your working career. If youre making at least $130,000 in 2021, and if you have a good handle on your current finances, chances are you could likely max out comfortably at the $19,500 limit.

This advice is general, so when planning for your own retirement, think about when you might retire, how much you have saved, what your lifestyle might look like during retirement, and how much youll need each month to sustain that lifestyle. Once you have a rough target, work backward to figure out how much you should contribute to a retirement fund. What is your current budget like? Can you live comfortably if you contribute the max amount?

One other common best practice is to contribute at least the minimum required to capture your employers 401 match, if one is provided. That way, youre gaining the full benefit of the match without losing a penny.

You May Like: Can You Use 401k To Buy A Home

Heres An Example Of How You Could Have A Years Worth Of Salary Saved In Your 401 By Age 30

Here are our assumptions:

- You start work at 22

- You can immediately contribute to a 401

- Your employer will match 50% of your contributions up to a maximum of 6% of your salary

- Your investments get an 8% average return

- You get annual raises of 3%

With these assumptions, youll need to contribute about 9% of your salary every year to reach this goal. Here are year-by-year totals:

Company Matching Aka Free Money

Because many companies offer their employees a dollar-to-dollar match on 401 contributions up to a certain amount, many employees choose to max out their 401 contributions for the year first, then contribute to another retirement account, such as an IRA. At a minimum, you should aim to contribute enough to take full advantage of your employer match, if they offer one, says Jason DallAcqua, a CFP and president of Crest Wealth Advisors LLC. .

Read Also: What Is A 403 B Plan Vs 401k

How Much Should I Have In My 401k Based On My Age

There are a few different schools of thought on how much a person should have saved in their 401k based on their age.

Every financial expert has a different opinion. When deciding what the right number is for you, I think one thing to keep in mind is that its better to have more saved than less.

Creating a potential post-retirement budget as a guideline will help you determine how much money youll spend after youre retired.

In an ideal world, you will be completely debt free by the time you retire and have minimal housing and other expenses.

Youll want to be prepare for these costs:

- Utility bills

- Travel

- Taxes

A persons income and expenses can make a difference when it comes to how much they should have saved at each interval age, but here are some general guidelines.

Use these guidelines in conjunction with your projected post-retirement budget to find out if you should have more or less saved by the time you retire than what is suggest ed here.

Do you have a 401k from an old employer that you need to rollover? Check out Capitalize which is free and will help take out the hassle of rolling over your 401k!

The Average 401k Balance By Age

401k plans are one of the most common investment vehicles that Americans use to save for retirement.

To help you maximize your retirement dollars, the 401k is an employer-sponsored plan that allows you to save for retirement in a tax-sheltered way. You can contribute up to $19,500 in 2021 and $20,500 in 2022.

If your employer offers a 401k and you are not utilizing it, you may be leaving money on the table especially if your employer matches your contributions.

While the 401k is one of the best available retirement saving options for many people, only 32% of Americans are investing in one, according to the U.S. Census Bureau. That is staggering given the number of employees who have access to one: 59% of employed Americans.

So how much do people actually have saved in their 401k plans? And how does this stack up against what they could have saved if they were maxing out their 401k every year?

You May Like: Can I Rollover My 401k Into An Existing Ira

The Quality Of Your 401and The Funds In Itmatters A Lot

Although its always better to save more, you cant overlook how youre investing your hard-earned dollars.

All 401 plans are not created equal. And though 401s have a lot of upsideshigh tax-advantaged contribution limits and employer matches they have negatives, too. The biggest complaint about 401 plans is a lack of investment choices.

The companies that administer 401s choose the funds you can invest in. Depending on your employer and your 401 administrator, you may not have many funds to choose from and/or the available funds will have higher fees than you could get if you were investing on your own.

This is the biggest reason we recommend opening an IRA, whether its to:

- Invest funds after taking advantage of your employers match or

- Rollover an old 401 as soon as you leave a job.

In an IRA, you can find more investment options with lower costs.

Related: Best Investment Accounts For Young Investors

Not long ago, you had two options: Give up 1% of your annual assets for a professional wealth manager to handle your investmentsor figure it out on your own.

Fortunately, there are new, powerful tools out there that can give you free insights into whether youre investing in the right areas within your 401 and IRAs. Personal Capital is a free app that creates easy-to-understand visuals of the investments you own in your 401, IRA, and other investment accounts. It then provides recommendations for how to rebalance your portfolio for maximum results and reduce expenses.

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

Also Check: How Do You Withdraw Money From A 401k

An Extra Consideration To Take Into Account When Contributing To Your 401

Many employers offer their employees a 401 plan to help them save for retirement. Since the 401 is a qualified plan, it is subject to rules established by the 1974 Employee Retirement Income Security Act . One rule places restrictions on income to make sure the plan doesn’t unfairly favor higher-wage earners in a company versus lower-wage earners.

These income limit rules won’t affect most people, and the impact on those they do affect is very minimal and shouldn’t detract much from their retirement savings strategy.

Top Contribution Method: Max Your 401k Percentage

If you want maximum funding for your 401k plan, then determining the contribution percentage is straightforward, even without a 401k max contribution calculator. The maximum contribution per year is age based and changes depending on whether you’re age 50 and over, or whether you’re under the age of 50, as set forth below. To calculate the correct percentage to contribute, divide the annual limit by the number of total yearly paychecks. The result should then be divided by your gross salary per paycheck to learn the contribution percentage.

Recommended Reading: Can A Sole Proprietor Have A 401k

Contribute As Much As You Can

You have emergency savings. You met your employers 401 match and then you maxed out a Roth IRA . Then what? How much should you really contribute to your 401 now?

Your goal at this point should be to save as much as you can for retirement while still living comfortably now. For some people, that will mean another 1% of their salary into their 401. For others it will mean maxing out their 401.

The key is to put as much as you can toward retirement. Some people spend their money frivolously and save only a little bit. If youre spending thousands of dollars every month on unnecessary purchases, you should find a way to cut that spending and put it toward retirement instead. It might not sound fun, but remember that the goal is to have financial security when you retire.

What Percent Of Your Salary Should Go Toward Retirement

How much money you need to live financially comfortable during retirement varies widely depending on the individual. There are plenty of proposals on how much retirement savings you should have. Meanwhile, many of the free online calculators will show little agreement with one another. And while its difficult to forecast exactly what youll need during retirement there are benchmarks to aim for.

The ideal savings rate varies by expert or study because making plans for the future depends on many unknown variables, such as not knowing how long youll be working, how well your investments will do, or how long you will live, among other factors.

You May Like: How To Protect 401k From Identity Theft

The Four Levels Of Retirement Savings

The lesson is: Figure out what percentage of your income you can save in total, and allocate it appropriately:

Level 1: Max out your employer match in your 401.

Level 2: Max out your emergency savings .

Level 3: Max out your Roth IRA .

Level 4: Max out your 401 .

This flowchart from my post on creating an automated investing program will also help:

Eventually You Must Withdraw Money From A 401

Uncle Sam won’t let you keep money in the 401 tax shelter forever. As with IRAs, 401s have required minimum distributions. You must take your first RMD by April 1 in the year after you turn 72. You will have to calculate an RMD for each old 401 you own. Once you’ve determined the RMD, the money must then be withdrawn separately from each 401. Note that unlike Roth IRAs, Roth 401s do have mandatory distributions starting at age 72.

If you hit that magic age, you are still working, and you don’t own 5% or more of the company, you don’t have to take an RMD from your current employer’s 401. And if you want to hold off on RMDs from old 401s and IRAs, you could consider rolling all those assets into your current employer’s 401 plan.

Read Also: What Does Rollover Mean In 401k