Increase The Amount You Contribute To Your 401 Over Time

If youve saved an emergency fund, Clark strongly advocates contributing to your companys 401 plan, even if its a small amount.

Get started. Then work toward contributing more.

Every six months, I want you to increase your contributions by one cent for every dollar you earn, Clark says. Youre not going to miss that one additional cent, but youll steadily increase the amount of money youre putting aside for your future.

Choosing An Account For High

With the potential for huge compounded growth, in tandem with the benefit of this money being untaxed, the Roth 401k could be a great choice for high-income earners. As stated previously, there are no required minimum distributions, which means that the money can stay within the account and grow for as long as you keep it in the account. These two factors combine make this account an attractive choice for those with well-established incomes.

Especially for individuals with successful careers, it is not unlikely that income could increase in the future with promotions or job changes. Taxing your income on the front end could be beneficial to remain in a lower bracket. With higher contributions to your retirement savings account, it is not unlikely that your tax bracket in retirement could be quite high, in combination with the growth of the money that occurred over its lifetime within the account.

An additional hindrance comes into play with Traditional 401ks when required minimum distributions kick in, which may force your taxable income into higher tax brackets, even if you dont need to access the money. This also eliminates the possibility of continued compounding growth on the account.

A Traditional 401 Has The Advantage Of More Options Later On But A Roth May Be The Smarter Choice For Big Savers

- Print icon

- Resize icon

One of the most-asked questions in personal finance is whether to sign up for a 401 or a Roth 401 retirement plan through your employer. For those with less familiarity, a traditional 401 is funded with pretax money while a Roth 401 is funded with post-tax money. The only difference between these account types is when you decide to pay your taxes.

Before I explain why I think the traditional 401 is usually the better option for most people, lets do a simple walkthrough of how each of these accounts work.

Traditional 401 vs. Roth 401 walkthrough

Traditional 401: Kate earns $100 which she contributes directly into her traditional 401 without paying any income taxes. Over the next 30 years lets assume that the $100 triples to $300. In retirement, Kate withdraws the $300 but has to pay 30% of it in income taxes. The final money that she can spend in retirement is $210 .

$210 = x70%

Roth 401: Kevin earns $100 and pays a 30% tax rate on it to have $70 after-tax. He contributes the $70 directly into his Roth 401 where, over the next 30 years, it triples to become $210. In retirement, Kevin is able to spend all $210 without having to pay any additional income taxes.

$210 = x3

3x2x1 = 1x2x3

Or in Kate and Kevins case:

x70% = x3

Simplifying the traditional vs. Roth decision

Will your income tax rate be higher now or later ?

How to think about future tax rates

When the traditional 401 is better

Recommended Reading: What Is The Best 401k Match

When A Roth May Be Right For You

Here are three situations where a Roth probably makes the most sense:

1. You are currently in a lower tax bracket, but you expect that to change. Lets say you are a young professional who is anticipating salary increases, which will put you in a higher tax bracket down the road. Contributing to a Roth IRA or Roth 401 means you pay the relatively low rate on taxable income now. Once youve retired, you will not pay any taxes on qualified distributions from the plan.

2. You are close to retirement and are concerned about RMDs. If youve been a disciplined saver and have contributed a healthy percentage of your income to Traditional accounts for many years, eventually youve got to pay the piper, says Young. Beginning in the year you reach age 72,* you must begin taking required minimum distributions from Traditional IRAs and from 401sincluding Roth 401sthe later of age 72* or once youre retired. As the name suggests, these withdrawals are required, even if you dont need the income at the time.

RMDs could bump you to a higher tax bracket. Qualified distributions from a Roth 401 or Roth IRA, on the other hand, would not create taxable income or increase your tax rate. Therefore, a Roth contribution may be preferable in order to limit the RMD income taxed at a higher rate.

– Roger Young, CFP®, Senior Retirement Insights Manager

– Roger Young, CFP®, Senior Retirement Insights Manager

How A Roth 401 Works

A Roth 401 is similar to a traditional 401 in several ways. These plans can be offered by employers alongside or in place of traditional 401 plans.

You make contributions to the plan, which your employer can match. The biggest difference, however, is that youre putting after-tax dollars into a Roth 401, versus pre-tax dollars with a traditional 401.

What that means for you from a tax perspective is that once you begin taking qualified distributions from your Roth account, those withdrawals would be 100% tax-free. So while you dont get to reduce your taxable income in the year you make the contribution, you get to enjoy tax-free growth and withdrawals in retirement. Thats particularly beneficial to you if you anticipate being in a higher tax bracket at retirement and want to minimize your tax liability on your retirement income.

Employer contributions made on your behalf would still be directed into a pre-tax account.

You May Like: Is An Annuity A 401k

Do You Want To Pay Taxes Now Or Later

Trying to navigate the complicated income tax code in the U.S. can make the Roth vs. traditional 401 decision-making process seem complicated. But it all comes down to whether you want to pay taxes now or when you withdraw the money . Deciding on the better option for you requires a little retirement planning to determine when you think you will be in a higher marginal tax bracket.

If you are in the early stages of your career and are currently in a lower income tax bracket, the Roth option is appealing. You can lock in known income tax rates today that could be lower than your future income tax bracket during retirement, when you will need your savings.

However, it likely makes more sense to take the tax breaks today with a pre-tax traditional 401 contribution if you’re in your peak earning years and nearing retirement. You might find yourself in a lower tax bracket during retirement than immediately before leaving the workforce, depending on whether you have other assets or income sources and how much taxable income they provide.

Significant assets held within your 401 can increase your taxable income in retirement as well.

Which Is Better For A Client A Traditional 401 Or A Roth 401

For some clients, the combination of a traditional and Roth 401 option can open a lot of planning avenues.

Roger WohlnerThinkAdvisor

Saving for retirement is a key concern for most of your clients. Helping them make the best choices for where to direct their retirement savings is an important component of the advice that you provide to them. One such choice is whether to contribute to a traditional 401 account or to a Roth 401 option.

Read Also: Where Do I Find My 401k

Heres When A Traditional 401 Makes Sense

If you think you are in a higher tax bracket today than you will be in the future, then a traditional 401 is more advantageous. By using pretax contributions now while youre in a high tax bracket, you effectively save on taxes in the long run by deferring them until you are in retirement at a lower bracket.

Lets say you are an individual approaching retirement and plan on contributing $10,000 to either the traditional or Roth portion of your 401. You have $200,000 of taxable income, placing you in the 32% tax bracket however, you expect you will never exceed the 24% tax bracket while in retirement. Since you would pay 8% more in taxes on the $10,000 contribution now compared to an equal distribution taken in retirement, it makes more sense to defer taxes today by making traditional 401 contributions.

Another scenario where a traditional 401 could be chosen is if a person plans to later convert some or all of the money in their traditional 401 to a Roth IRA. When the conversion occurs, taxes are paid on the amount converted at the individuals ordinary tax rate.

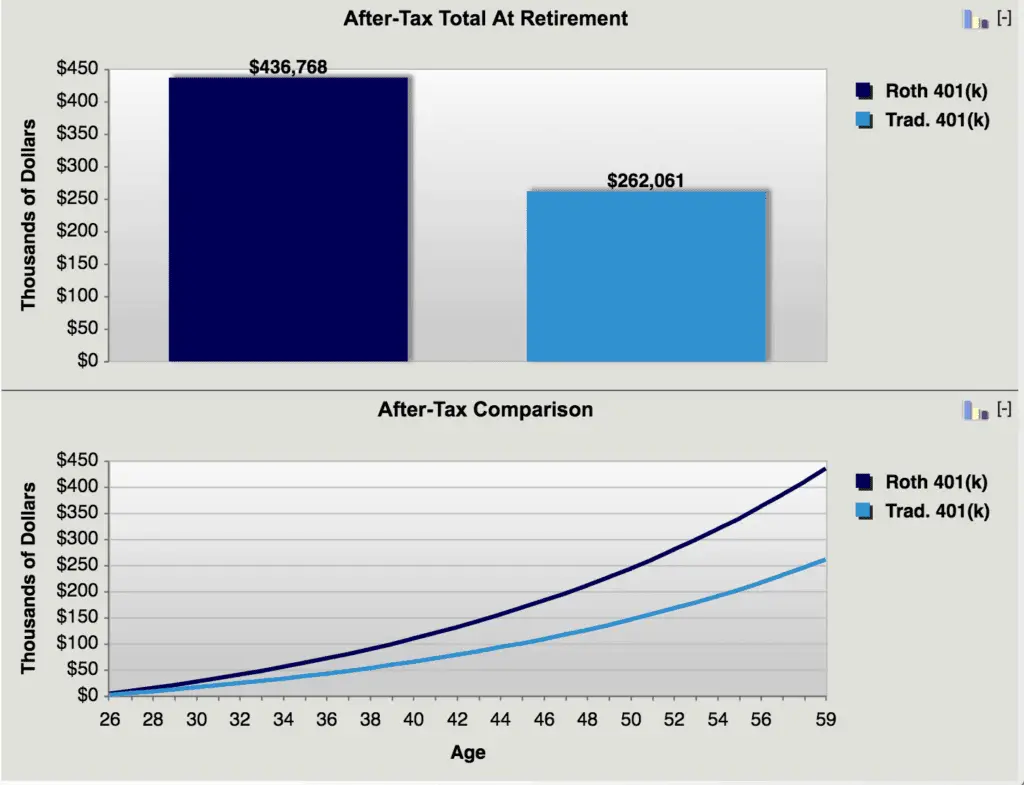

The Debate: Roth Vs Traditional

So, a colleague at work and I were debating which strategy was better. His personal strategy is to put 100% of his contributions into a Roth 401K so that he will be taxed less in retirement. His strategy works great if your plan includes working until you are 60 years old, putting more of your after-tax income towards long-term investments, dont have the discipline to invest your extra tax savings, or you are simply not contributing quite as much towards retirement altogether.

I enjoy financial debate because it allows you to see different perspectives and consider alternatives to your current strategies. Really, there was no winner in this debate because our two strategies were completely different and based more on life philosophy than anything else. However, I wanted to take it to the next level and run some numbers to see what kind of financial shape each of the two paths would take you on.

Don’t Miss: Should I Manage My Own 401k

How Much You Can Afford To Save

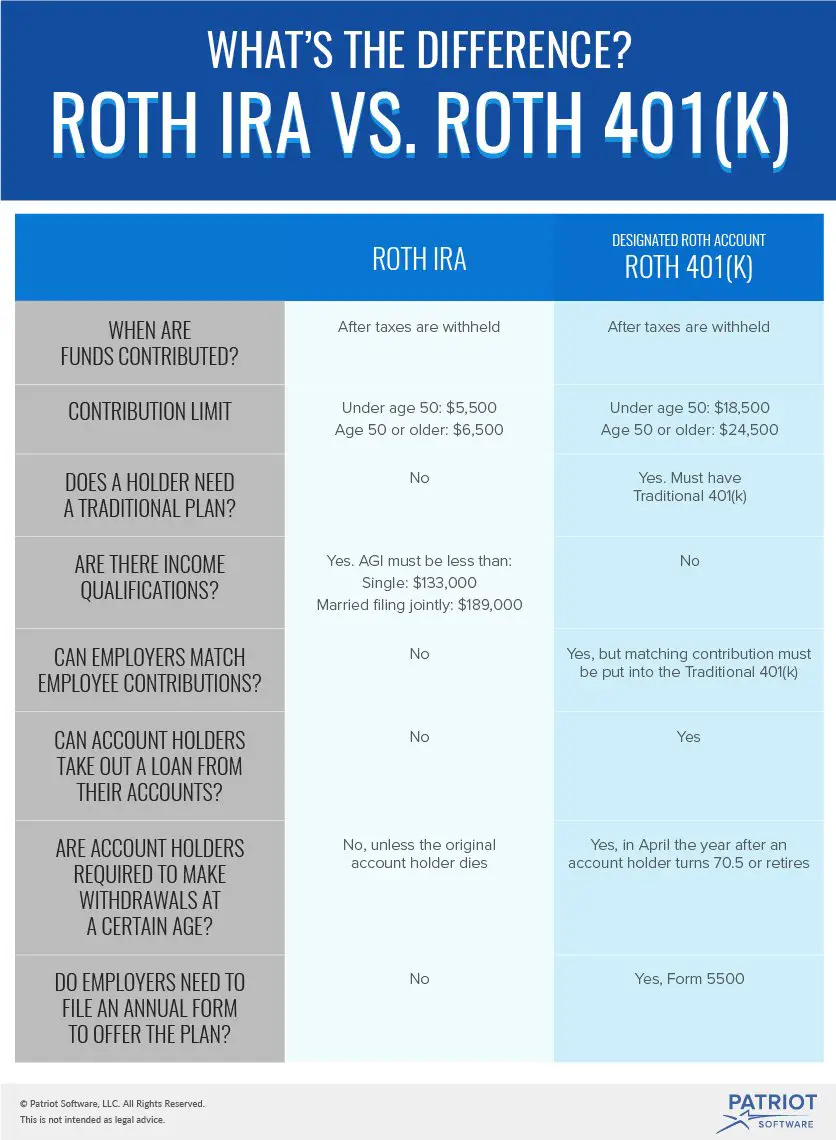

In 2021, the annual contribution limit for both traditional and Roth 401s is $19,500, plus an additional $6,500 catch-up contribution for participants age 50 or over.

This is much more than allowed with a Roth IRA, where contributions are limited to $6,000, plus an additional $1,000 for participants age 50 or over. That could make Roth 401s an attractive option for people who want to save more post-tax.

But it’s important to note that even if you choose a Roth 401, all company matches will go into a traditional 401. That means that you will owe income tax on any employer contributions, and the earnings on those contributions, when you withdraw the money during retirement.

A few other things to know: With both types of 401s, you’re required to begin taking minimum distributions at age 72. And early withdrawals made before you turn 59½ are typically subject to an additional 10% penalty.

Its Not Only About Taxes

Taxes are important, and they’re the primary factor in this debate. But there are other points to consider:

-

Whether youre eligible for a Roth IRA.Roth IRAs have income limits Roth 401s do not. If you earn too much to be eligible for the Roth IRA, the Roth 401 is a chance to get access to the Roths tax-free investment growth.

-

Certain income thresholds in retirement. Taking some of your retirement income from a Roth can lower your gross income in the eyes of the IRS, which may in turn lower your retirement expenses. A lower income in retirement may reduce the taxes you pay on your Social Security benefits and the cost of your Medicare premiums that are tied to income.

-

Access to your retirement money. Unfortunately, the Roth 401 doesnt have the flexibility of a Roth IRA you can’t remove contributions at any time. In fact, in some ways its less flexible than a traditional 401, due to that five-year rule: Even if you hit age 59½, your distribution wont be qualified unless youve also held the account at least five years. Thats something to keep in mind if youre getting a late start.

-

Required minimum distributions in retirement. Both accounts require account owners to begin taking distributions at age 72, but money in a Roth 401 can easily be rolled into a Roth IRA, which will then allow you to avoid those distributions and even pass that money on to heirs.

You May Like: Can I Roll My 401k Into An Ira

Pay Taxes Today Or Pay Taxes In The Future

The choice between a traditional 401k vs Roth 401k boils down to your preference to pay taxes now or in the future. The Roth 401k gives you more control over your tax liabilities in the future because you are paying your tax bill upfront.

When you hit retirement, you won’t have as big of a tax bill. That can be a big plus for anyone on a fixed income. The fewer expenses you carry into your retirement, the better. You don’t want to be worrying about making ends meet after you’ve left the workforce for good.

A traditional 401k allows you to defer a part of your tax bill until later in life. Although this might give a bit more breathing room in your budget now, it might make things tighter in retirement.

The strategy you choose will be based on personal preference and what your employer offers. If you are only able to contribute to a traditional 401k, then your choice is simple. Making the effort to save for retirement early can only be rewarded. The option of a Roth 401k may bring even more financial stability in retirement. But funding either account is infinitely better than not saving for retirement at all.

Of course, these strategies are dependent on the tax code. It is completely possible that a changing tax code will affect either of these strategies in a negative way. But you can only work with the information you have available to you now. You can decide to tweak your strategy in the future as necessary.

Tax Differences: Roth 401 Vs Traditional 401

Roth versus traditional 401 is a question of when you pay taxes. You pay taxes before contributing to a Roth 401 you dont pay taxes until after you withdraw from a traditional 401.

Determining which option is better for you likely boils down to your answer to this question: Are you currently paying a lower tax rate than you expect to be in the future? If your answer is Yes, a Roth 401 is a great option.

Clark is on the record saying he expects taxes to rise in the future, so he thinks theres a clear answer to the question of Roth versus traditional 401.

Our tax rates today are unusually low because were running massive budget deficits. Whos going to pay for those? Clark says.

At some point, those tax rates will increase. That means theres a good chance tax rates will be higher when you go to spend your nest egg.

Again, you contribute post-tax dollars to a Roth 401, meaning the money you put in has already been taxed. You wont have to pay taxes on it again when you withdraw funds during your retirement.

You contribute pre-tax dollars to a traditional 401, meaning you put money into your 401 before its taxed. This reduces your taxable income. Youll have to pay taxes on the money when you withdraw during retirement.

When you withdraw from your Roth 401 account once youre retired, heres the tax situation:

- Money you contributed: No taxes

- Money you earned through investments: No taxes

- Money you got through a 401 company match: Taxes owed

You May Like: Can You Leave Money In 401k At Your Old Job

Why You Should Choose A Roth 401

- If you are in a higher tax bracket when you retire, the Roth 401 can offer significant tax savings.

- Roth 401s offer more flexibility than traditional 401s, which can be a major advantage if you need to access your money before retirement.

- Roth 401s can be a great way to save for retirement if you are younger and think you will be in a lower tax bracket when you retire.

- Roth 401s offer tax-free growth and tax-free withdrawals in retirement, which can result in significant savings over the traditional 401.

When The Roth 401 Is Better

Heres when the Roth is probably a better option:

Youre young and in a low tax bracket

I recommend making Roth contributions when someone is in a low bracket and expecting to later be in a higher tax bracket, says Mark Wilson, CFP and founder of MILE Wealth Management in Irvine, California. If you can pay taxes today at 12 percent to avoid paying taxes in the future at 25 percent, this is a good deal.

Wilson defines a low bracket as being taxed at the federal level of 12 percent or less. There are cases where Roths can make sense for folks in higher brackets as long as they are expecting even higher incomes in the future, says Wilson.

Youth is also a big advantage, allowing money to grow tax-free even longer.

The younger a person is, the more advantage a Roth can have for them, because they have a longer time for the money to grow, says Edward J. Snyder, CFP and founder of Oaktree Financial Advisors in Carmel, Indiana. The younger person is also more likely to be in a lower tax bracket than someone who is mid- to late-career.

You expect tax rates to rise

Even if you dont expect to earn more, you might expect tax rates across the country to increase, and such a rise could make the Roth 401 more attractive today.

Of course, theres always uncertainty in any projections, especially predicting the political winds.

You already have a traditional 401

RMDs can have an impact on the taxation of Social Security benefits and Medicare surcharges, says Greenman.

Also Check: How To Liquidate 401k Without Penalty