How Early Retirement Plan Withdrawals Work Under Normal Circumstances

When there isnt a global pandemic impacting the livelihoods of the entire nation, withdrawing money early from a retirement plan is a serious decision. Thats because it carries with it some pretty serious consequences: namely, a 10% penalty paid on all of the money you withdraw, in addition to paying normal taxes. This, of course, assumes it is not a Roth plan, where the money has already been taxed.

Even if youre willing to pay the penalty, you have get approval from your plan beforehand. This is typically known as a hardship withdrawal. Some plan sponsors may not be willing to grant them, so make sure you check with your HR department before you plan on making one. Acceptable reasons for a hardship withdrawal include:

- Paying certain medical bills for you or family members

- Avoiding foreclosure on or to buy a primary residence

- Covering educational expenses for you or family members

- Paying for family funeral expenses

- Paying for some home repairs, such as those necessary after a natural disaster

Note that these reasons still carry the 10% penalties, in addition to taxes. There are a few instances where the penalty is waived:

How To Take Money Out Of Your 401

There are many different ways to take money out of a 401, including:

- Withdrawing money when you retire: These are withdrawals made after age 59 1/2.

- Making an early withdrawal: These are withdrawals made prior to age 59 1/2. You may be subject to a 10% penalty unless your situation qualifies as an exception.

- Making a hardship withdrawal: These are early withdrawals made because of immediate financial need. You may be still be penalized for them.

- Taking out a 401 loan: You can borrow against your 401 and will not incur penalties as long as you repay the loan on schedule.

- Rolling over a 401: If you leave your job, you can move your 401 into another 401 or IRA without penalty as long as the funds are moved over within 60 days of your distribution.

Find The Mortgage Option Thats Right For You

Your 401 account may seem tempting as an untapped source of cash, especially if youre struggling to come up with the money for a down payment on your new home. While this is a viable option, and there are ways to mitigate the penalties, it should only be used as a last resort. Consider applying for a low down-payment loan like an FHA or VA loan, or, if you have one, making a withdrawal from your IRA.

Whatever you decide, make sure you consult with a mortgage specialist before committing to an option. Rocket Mortgage® has experts waiting to help you navigate the tricky waters of home loans. If youre ready to take that next step toward a mortgage, then get started with our experts today.

Take the first step toward the right mortgage.

Apply online for expert recommendations with real interest rates and payments.

You May Like: How To Cash Out 401k From Fidelity

How To Cash Out A 401 From A Former Employer

Cashing out a 401k from a former employer is not a difficult task. In most cases, you contact the plan administrator for the appropriate paper work, fill it out, send it to the financial institution that manages the 401k, and wait for the check to come in the mail or for the electronic transfer.

Tips

-

In order to cash out a 401 from a former employer, you will likely have to contact the plan administrator at your former place of employment and request access to the paperwork needed to withdraw your funds.

And Ira Withdrawals For Covid Reasons

The CARES Act had many provisions that received attention, especially the Paycheck Protection Plan loans and the individual relief checks that went to a majority of Americans. One less-noticed part of the bill, though, changes the way that pre-retirement withdrawals from retirement plans work.

Section 2022 of the CARES Act allows people to take up to $100,000 out of a retirement plan without incurring the 10% penalty. This includes both workplace plans, like a 401 or 403, and individual plans, like an IRA. This provision is contingent on the withdrawal being for COVID-related issues. The following reasons are permitted for making these special withdrawals:

- You have been diagnosed with COVID-19

- Your spouse or a dependent has been diagnosed with COVID-19

- You have financial issues because of being quarantined, furloughed or laid off due to COVID-19

- You have financial issues because you cant work due to a lack of childcare caused by COVID-19

- Youre experiencing financial hardship because the business you own or operate had to close or reduce hours

This is obviously a fairly broad set of circumstances. Essentially, if youre having a hard time financially because of circumstances caused by the pandemic, youre likely to qualify for these early withdrawals.

Also Check: What Age Do You Have To Draw From 401k

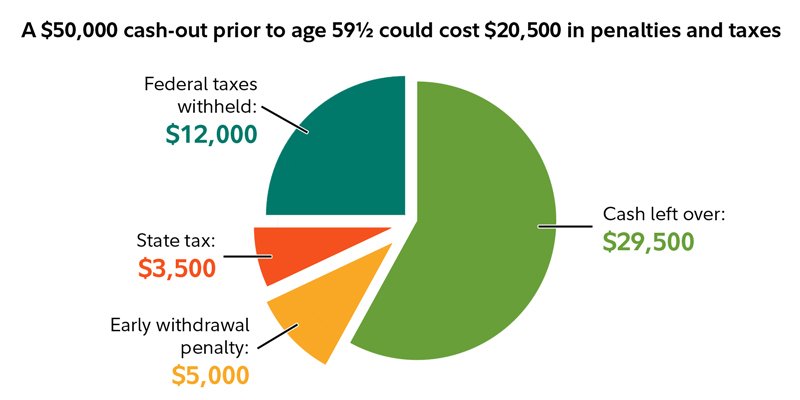

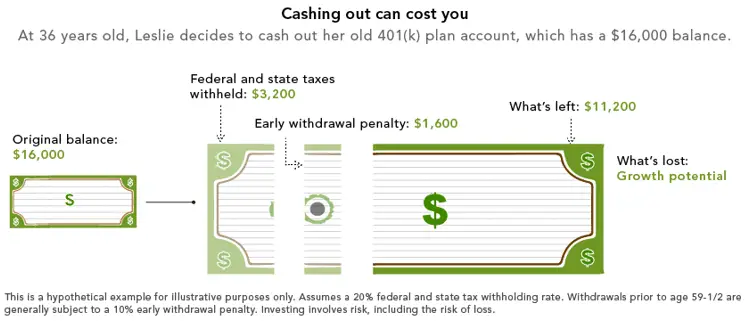

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

What Are The Consequences Of Taking A Hardship Distribution

Whether youre a Millennial or Baby Boomer, a hardship withdrawal could have a significant impact on your retirement outcome. As a Baby Boomer, your years of catching up will be shorter. In some cases, you may never entirely catch up to where you once were prior to the withdrawal. It could also mean you may need to postpone your retirement until you are financially more stable, dramatically setting you back on your retirement goals.

As a Millennial, things arent quite as bleak. While a hardship disbursement will certainly set you back, you will have many more years in the workplace to make up the difference. However, they are still costly in the short term when you pay taxes, and participants that are not 59 ½ or older may be subject to a 10 percent penalty tax.

Heres the bottom line: the decision to take a hardship distribution is truly a personal one and is often surrounded by extenuating circumstances. Because of the impact on funds for retirement, hardship distributions should be your absolute last resort for withdrawing funds from your 401 retirement fund.

Also Check: How Should I Roll Over My 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Also Check: Does Employer Match Count Towards 401k Limit

Those Who Truly Need It

It really comes down to need. If you need to withdraw your money, then withdraw your money. Thats really the essence of the CARES Act. It simply makes a need-based withdrawal less harmful. If you dont need to, then dont, says Brandon Renfro, a financial advisor and assistant professor of finance at East Texas Baptist University.

Its important to consider what things will be like after you take a withdrawal and once things are back to a new normal. Under the CARES Act, you have to repay your withdrawal within three years. If you just need a withdrawal to get you through the next few months before you start earning regular paychecks again, it could be a good option.

Withdraw Money Penalty Free From Your 401k 403 Tsp 457 Plan Or Ira Early Using Irs Rule 72

Next, we have another wonderful section of the IRS code that is referred to as a 72 distribution, or Substantially Equal Periodic Payments.

Its an exception to the 10% early withdrawal penalty so you can take money out of your 401 or IRA before age 59 1/2. Unlike the Rule of 55, rule 72 doesnt care how old you are or when you leave your employer.

Also Check: How Much Can I Convert From 401k To Roth Ira

What Are The Penalty

The IRS permits withdrawals without a penalty for certain specific uses, including to cover college tuition and to pay the down payment on a first home. It terms these “exceptions,” but they also are exemptions from the penalty it imposes on most early withdrawals.

It also allows hardship withdrawals to cover an immediate and pressing need.

There is currently one more permissible hardship withdrawal, and that is for costs directly related to the COVID-19 pandemic.

You’ll still owe regular income taxes on the money withdrawn but you won’t get slapped with the 10% early withdrawal penalty.

Youll Still Need To Be Mindful Of Taxes

Youll still owe income tax on your distribution from any tax-deferred retirement account. However, if you pay the distribution back within three years, you can file for a refund of the taxes you paid on that distribution.

Also worth noting: The income can be claimed all at once in 2020 for tax purposes, or spread evenly over the next three years. In many cases, dividing it evenly over three years may result in a better tax situation, as its less likely to bump you into a higher tax bracket in any single year.

If your income is expected to be lower in 2020 than the subsequent two years, though, it could make sense to claim all of the income on your 2020 tax return. Not only might this minimize the effective tax rate you pay on this income, but youll also have two years to pay back the distribution and ultimately get a refund.

Keep in mind that if you have a Roth IRA, it may still be a better choice for withdrawals than your 401 or IRA. Thats because savers can always withdraw contributions from their Roth IRA penalty- and tax-free.

Don’t Miss: How Do I Start A Solo 401k

How Covid Retirement Plan Withdrawals Affect Your Taxes

Though you dont have to pay the 10% penalty on these withdrawals, youll still owe taxes on the money you withdraw. To make things a bit easier, though, the CARES Act allows you to spread the income over three different tax years.

For example, if you borrowed $30,000, you can apply $10,000 to your 2020 taxable income, $10,000 in 2021 and the last $10,000 in 2022. You must take at least one-third of the money in each year, though. You can also opt to take more in any year, including up to all of the money if you so choose.

If, in a later year, youve made back the money you withdrew, that is allowed. Youll have to file an amended return for any years with withdrawal money to get a refund. Again, the same rules apply for IRAs and 401s.

How To Withdraw From A 401 At Age 55

Under the right circumstances, you can withdraw from a 401 at age 55 . If you retire, quit or get fired between age 55 and 59, you can withdraw without penalty from your 401. See IRS Publication 575

The tax doesnt apply to distributions that are: From a qualified retirement plan after your separation from service in or after the year you reached age 55

What is separation from service? Heres how the IRS defines it:

To meet the requirements for the first exception in the list above, you must have separated from service in or after the year in which you reach age 55 . You cant separate from service before that year, wait until you are age 55 , and take a distribution.

If you leave your job before age 55 you cant take a distribution without paying the 10% penalty. If you wait until after you turn 55 you can take a distribution without paying the 10% penalty.

See page 34 of the publication.

There are several important points to know about the Rule of 55.

Read Also: How To Move Your 401k To A New Job

Also Check: Can I Withdraw From My Fidelity 401k

How To Withdraw From Your 401 With An Existing Employer:

Whether its for personal reasons or an emergency, making an early 401 withdrawal doesnt have favorable terms. If youre still working for the company that sponsors your 401 plan, you can apply for an Early 401 Distribution. This is subject to a 10 percent penalty, and youll still be taxed for the amount withdrawn.

You Agree To Substantially Equal Periodic Payments

Some people choose to retire early once they reach 50. By agreeing to substantially equal periodic payments under Internal Revenue Code Section 72, you can withdraw money from your 401 once a year for a minimum of five years or until you reach age 59.5 whichever period is longer.

You may use one of three methods to calculate your payments:

You May Like: How Much To Invest In 401k To Be A Millionaire

Why He Doesn’t Recommend You Do An Early Withdrawal

Looking back, Nitzsche says that liquidating his 401 to pay off credit card debtis something he wouldn’t do again.

“It is so detrimental to your long-term financial health and your retirement,” he says.

Many experts agree that tapping into your retirement savings early can have long-term effects. It can put you at risk later on in life when you are older, not working and would otherwise need to rely on those funds.

There are also short-term effects from making an early withdrawal from your 401 as well: It doesn’t come free. Doing so has costly consequences, including both a penalty fee and taxes. For borrowers 59½ years old and younger, there is generally an early withdrawal penalty of 10%, plus taxes, which can be anywhere from 20% to 25% depending on your income and tax bracket.

If you are someone who is cash-strapped during this time of uncertainty, tapping into your retirement savings is an option of last resort. “That really should not have been touched and not something we would usually advise somebody to do,” Nitzsche says.

How To Withdraw 401k Money

As with any decision involving taxes, consult with your tax professional on considerations and impacts to your specific situation. An Edward Jones financial advisor can partner with them to provide additional financial information that can help in the decision-making process. When considering withdrawing money from your 401 plan, you can withdraw in a lump sum, roll it over or purchase an annuity. Your financial advisor or 401 plan administrator can help you with this.

Don’t Miss: Are Part Time Employees Eligible For 401k

Reasons To Proceed With Caution

Experts suggest moving slowly with any withdrawal. Here are three things to consider.

Hardship withdrawals are still subject to income taxes. Since your savings went into your retirement plan on a pretax basis, youll be paying income taxes on the contributions and earnings withdrawn.

You get a three-year period to pay the taxes to Uncle Sam, said Paul Porretta, partner at Pepper Hamilton LLP in New York.

Plan ahead to cover the tax bill and spread it over that period of time, perhaps out of your cash flow.

Know your 401 plans rules. Be aware that a workplace retirement plan may allow hardship distributions from participants savings, but it isnt required to do so.

Youll need to talk to your human resources department or your plan administrator before you proceed.

A 401 plan or a 403 plan, even if it allows for hardship withdrawals, can require that the employee exhaust other sources of money before taking a withdrawal, said Porretta.

Dont Miss: Can I Start My Own 401k Plan