When Can You Cash Out Your 401

There are two occasions when you can cash out your 401:

The bigger question is should you cash out your 401 in either of these circumstances? Youll want to give it careful thought.

When you leave your old employer, you have the option to cash out your 401. This means youll receive a check in the mail. It wont be the full amount of your vested funds, though. Youll face penalties as well as taxes. You can avoid this by rolling the funds over into another 401 or other qualified retirement plan, such as an IRA.

If you are still working for your employer, you cannot withdraw your 401 funds, even if you turn 59½. This is true unless you meet the requirements for a hardship withdrawal. Some employers offer this option, but not all do. Talk with your HR department to see if your company offers it.

A hardship withdrawal means that you can demonstrate an immediate need for funds, which according to the IRA may occur due to the following:

- Immediate medical care expenses of the employee or qualified dependent.

Recommended Reading: Can Anyone Open A 401k

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Recently enacted legislation made a number of changes to the rules regarding defined contribution, defined benefit, and/or individual retirement plans and 529 plans. Information herein may refer to or be based on certain rules in effect prior to this legislation and current rules may differ. As always, before making any decisions about your retirement planning or withdrawals, you should consult with your personal tax advisor.

The change in the RMD age requirement from 70½ to 72 only applies to individuals who turn 70½ on or after January 1, 2020. Please speak with your tax advisor regarding the impact of this change on future RMDs.

A qualified distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½ or older, disability, qualified first-time home purchase, or death.

Be sure to consider all your available options and the applicable fees and features of each before moving your retirement assets.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Take Distributions From The Old 401

After youve reached 59½, you may withdraw funds from your 401 without paying a 10% penalty.

You may have decided to retire and are considering withdrawing funds from your account. If youre retiring, it may be a good time to start drawing on your savings for income. Youll have to pay tax at your regular rate on any distributions you take out of a traditional 401. Annuities are a reliable tool for spending your 401 without running out of money.

If you have a designated Roth 401, any payments you take after 59 1/2 are tax-free if youve held the account for at least five years. Only the earnings portion of your distributions is taxed if you do not fulfill the five-year requirement.

When you reach age 72, you must begin taking RMDs from your 401 if you leave your employment. The amount of your RMD is determined by your expected life span and 401 account balance.

Also Check: How To Change 401k Contribution Fidelity

Substantially Equal Period Payments

Substantially equal period payments SEPPs) can also be a good option to rely on when you need to cash out some money from your 401, but without paying the penalty fee. These withdrawals cannot be done if you are still working for the employer that sponsors your 401 plan, but if you get the funds out through an IRA, then you can make these withdrawals at any time you want.

If you need money in the short term, the SEPP may not be an ideal choice to go for. Once you start making payments for this kind of withdrawal, you can expect to have to pay for at least five years on it, or until you hit 59 and a half whichever comes first.

If you dont make these payments, the penalty for early withdrawal will apply, and youll also be asked to pay interest on the deferred penalties over the past couple of tax years.

There are two exceptions to this rule. The first exception is when the taxpayer dies, allowing for beneficiary withdrawals. The second exception is when the taxpayer becomes disabled permanently.

The withdrawal and payments will be calculated through methods approved by the IRS. You may get fixed annuitization, fixed amortization, or required minimum distribution. Each will allow you to withdraw different amounts, so you can choose just the one you need.

Leave Your Money With Your Former Employer

For some people, the most plausible option is to leave their investment with their former employer. This option allows you to continue making investments with the money even if you are not working with that employer. In most cases, old employers allow you to leave your investment if you have more than $5,000 in your 401 retirement savings account. If your account holds less than this amount, your previous employer may decide to cash out your plan and send you a check for the balance.

The advantage of this option is that it allows you to leave your 401 with your former employer if they offer good terms. Leaving your retirement account with your previous employer allows you to wait for registration to open with your new employer.

When you leave your 401 savings with your former employer, your access to your money can be limited. Some employers can levy huge maintenance fees, implement restrictions on investment choices and prevent access to your savings until you reach retirement age. Unless you’re about to retire and you know you won’t change jobs often, avoid leaving your 401 with your former employer.

Recommended Reading: How To Rollover Vanguard 401k

Find And Contact The Employer

Its very easy to find people nowadays, and a simple google search will give you details of your previous employer and even their location. Look for them and either visit the premises yourself or use a third party to carry out the initial contact. Even if the company was inherited by another company, they have a legal obligation to pay you your pension. Also, contact former employees of the company, or the union that represented you, in order to find out how you can go about the process of recovering your savings.

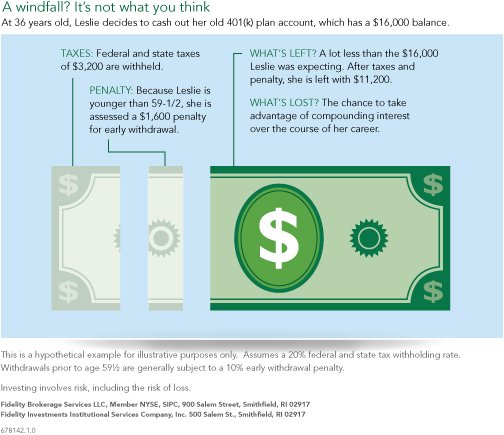

Penalties And Taxes On Cashing Out A 401k

When you complete a 401k cash out, you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. The 401k early withdrawal penalty is 10% of the amount that you withdraw. You will also be taxed at your normal income rate on the amount that you withdraw. Most plans will withhold 20% of the amount that you withdraw and send it to the IRS to help cover the costs and will send you a 1099-R form. If your tax rate is higher than 10%, then you will need to be prepared to pay additional money when you file your taxes. It is important to be prepared for this possibility.

Also Check: When Can You Access 401k

Rollover Your Old 401k Money Into A New Ira

Known as a rollover IRA, this type of IRA is designed to accept the transfer of assets from a former employers 401k. If your new employer doesnt offer a 401k or youre not pleased with the plans costs or investment options, this is probably your best option because it will give you the most flexibility and control to stay on track with your retirement savings goals. In fact, this is what we generally recommend to our clients who have old 401ks. IRAs generally have more investment options, no plan fees, and greater withdrawal flexibility.

In order to execute a rollover IRA, your first step is to open a new IRA with an investment advisor or financial institution. The rollover process is similar to the one described above except that you will instruct the administrator of your former employers 401k to transfer plan assets directly into your new rollover IRA.

Conversely, you can have a check sent directly to you, but make sure that the check is made payable to your IRA custodian for benefit of your name. The former plan administrator will withhold 20% of the amount for the payment of taxes and you will have 60 days to deposit the full balance, including the 20% withheld, into your rollover IRA. Failure to deposit the entire amount into your new IRA could result in current tax liabilities plus a 10 percent penalty if youre under age 59½.

Retirement Funds Are Different

They are not turned over to the state, which means, its possible that nothing will happen to your money until something happens with your company ).

A common scenario is when you leave a company and move, perhaps you even change your email address.

Perhaps months or even years have gone by, or youve moved to the other side of the country. Then something happens with your employer and they need to contact you for instructions of what to do with your account.

You May Like: Can I Rollover My 401k To An Existing Ira

Read Also: Can I Take Money Out Of My 401k

Borrowing Money From My 401k

It may seem like an easy way to get out of debt to borrow from your retirement accounts for DIY debt consolidation, but you can only borrow $50,000 or half the vested balance in your account, if its less than $50,000. You wont face a tax penalty for doing so, like you would with an out-right withdrawal, but youll still have to pay the money back.

And unlike a home equity loan where payments can be drawn out over a 10-to-30-year period, most 401k loans need to be paid back on a shorter time table like five years. This can take a huge chunk out of your paycheck, causing you even further financial distress. Borrowing money from your 401k also limits the ability of your invested dollars to grow.

Paying off some of your debt with a 401k loan could help improve your debt-to-income ratio, a calculation lenders make to determine how much debt you can handle. If youre almost able to qualify for a consolidation or home equity loan, but your DTI ratio is too high, a small loan from your retirement account, amortized over 5 years at a low interest rate may make the difference.

Recommended Reading: Should I Pay Someone To Manage My 401k

See If You Qualify For An Exception To The 10% Tax Penalty

Generally, the IRS will waive it if any of these situations apply to you:

-

You choose to receive substantially equal periodic payments. Basically, you agree to take a series of equal payments from your account. They begin after you stop working, continue for life and generally have to stay the same for at least five years or until you hit 59½ . A lot of rules apply to this option, so be sure to check with a qualified financial advisor first.

-

You leave your job. This works only if it happens in the year you turn 55 or later .

-

You have to divvy up a 401 in a divorce. If the courts qualified domestic relations order in your divorce requires cashing out a 401 to split with your ex, the withdrawal to do that might be penalty-free.

-

You need to pay for COVID-related issues. Section 2022 of the CARES Act says people can take up to $100,000 from their retirement plan, including a 401 penalty free as long as it’s for issues relating to COVID.

Other exceptions might get you out of the 10% penalty if you’re cashing out a 401 or making a 401 early withdrawal:

-

You become or are disabled.

-

You rolled the account over to another retirement plan .

-

Payments were made to your beneficiary or estate after you died.

-

You gave birth to a child or adopted a child during the year .

-

The money paid an IRS levy.

-

You were a victim of a disaster for which the IRS granted relief.

-

You overcontributed or were auto-enrolled in a 401 and want out .

-

You were a military reservist called to active duty.

Recommended Reading: Can You Move A 401k Into A Roth Ira

How To Explain To An Employer Why You Quit Your Job

Rehearse your answer to the question, Why did you leave your job? to make sure youre padding the negatives with positivity. If you take the time to create an answer and practice it, you will be able to answer the question with confidence and ease. My boss and I were both committed to the success of the company, but

Also Check: How Do I Find My Old 401k

Option : Roll Over Your Old 401 Into An Individual Retirement Account

Still another option is to roll over your old 401 into an IRA. The primary benefit of an IRA rollover is having access to a wider range of investment options, since youll be in control of your retirement savings rather than a participant in an employers plan. Depending on what you invest in, a rollover can also save you money from management and administrative fees, costs that can eat into investment returns over time. If you decide to roll over an old 401 into an IRA, you will have several options, each of which has different tax implications.

Also Check: Can I Open A 401k For Myself

Read Also: How To Check My 401k

How To Cash Out A 401 After Quitting

You may follow this type of action plan for your 401 when you quit your job:

If your new employer offers a 401 plan, check your eligibility and enroll yourself.

Once enrolled, get the funds and investments in your old account directly transferred to your new account. You can opt for a direct administrator-to-administrator transfer through simple documentation to avoid potential taxes and penalties.

Instead of direct transfer, you can also cash out your old account and deposit the proceeds in your new account within 60 days of cashing out. That way, you dont have to pay income tax on the amount of the withdrawal .

You must start taking 401 distributions after you turn 70 ½ years old and you are not working anymore. However, unlike traditional plans, in a new retirement plan with your current employer, you cannot be forced to take the required minimum distributions even after you reach the age of 70 ½.

If your new employer does not have a 401 plan or you do not like the plan your new employer has, you may roll over your old 401 account to an IRA. The rollover process is like the process of rolling over to a new account. You can either get it done directly through your plan administrator or take out the proceedings and deposit them in your IRA within 60 days.

Consider All Of Your Financial Options

When you need cash in a crunch, ideally you have options: using money saved, dipping into emergency savings, getting a loan, or possibly as a last resort withdrawing money saved for retirement. Consider the relief available if youve been impacted by a FEMA declared disaster , and talk to your plan sponsor and/or retirement services provider before taking any next steps.

You May Like: What Is 401k In Usa

Don’t Miss: Can You Transfer Your 401k

How To Find An Old 401 And What To Do With It

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandheres how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

There are billions of dollars sitting unclaimed in ghosted workplace retirement plans. And some of it might be yours if youve ever left a job and forgotten to take your vested retirement savings with you.

But no matter how long the cobwebs have been forming on your old 401, that money is still yours. All you have to do is find it.

Transfer The Money To Your New Employer’s 401

If your new employer’s plan allows it, you may transfer your old 401 savings into your new 401 plan.

In Lester’s view, “rolling your old account into your new employer’s 401 plan should be your default unless there’s a good reason not to.”

But you’ll only want to do that if the new plan offers solid, low-cost investments or at the very least, low-cost target date funds.

The benefit of consolidating your retirement savings into one employer-sponsored plan is that it will be easier for you to track and manage the money.

Read Also: How To Rollover My Fidelity 401k

Dont Roll Over Employer Stock

There is one big exception to all of this. If you hold your company stock in your 401, it may make sense notto roll over this portion of the account. The reason is net unrealized appreciation , which is the difference between the value of the stock when it went into your account and its value when you take the distribution.

Youre only taxed on the NUA when you take a distribution of the stock and opt notto defer the NUA. By paying tax on the NUA now, it becomes your tax basis in the stock, so when you sell it , your taxable gain is the increase over this amount.

Any increase in value over the NUA becomes a capital gain. You can even sell the stock immediately and get capital gains treatment. The usual more-than-one-year holding period requirement for capital gain treatment does not apply if you dont defer tax on the NUA when the stock is distributed to you.

In contrast, if you roll over the stock to a traditional IRA, you wont pay tax on the NUA now, but all of the stocks value to date, plus appreciation, will be treated as ordinary income when distributions are taken.