The 4% Withdrawal Rule

The 4% rule says that you can withdraw 4% of your savings in the first year, and calculate subsequent yearâs withdrawals on the rate of inflation. This rule is based on the idea that you should withdraw 4% annually, and maintain the financial security in retirement for 30 years. This strategy is preferred because it is simple to compute, and gives retirees a predictable amount of income every year.

For example, if you have $1 million in retirement savings, 4% equals $40,000 in the first year. If the inflation rises by 2.5% in the second year, you should take out an additional 2.5% of the first yearâs withdrawal i.e. $1000. Therefore, the withdrawal for the second year will be $41,000.

Eligibility For Cashing Out A 401 Plan

No advice you receive on how to cash out 401 accounts will matter if your plan doesnt allow it. Yes, some employers wont let you take the money out. Even if your employer does, there could be restrictions on how the money can be withdrawn. You probably have some type of documentation with your 401 that you can check. If not, ask your HR department to provide your policy documents. You can always take money out of plans youre not participating in anymore e.g. a plan at an old employer.

If youre 59 and ½ years old, though, none of that matters. You can take money from your 401 starting at age 59 and ½ without paying a penalty. If you havent yet celebrated your 59th birthday, you may prefer instead to take a loan against your 401 if your employer allows it. This will help get you through your financial situation while still ensuring the money is there when its time to retire.

It’s important to note that the tax man may still come calling, even if you dont pay a penalty. Traditional 401 plans are taxed when you take the money out, while Roth 401 accounts hold funds that youve already paid taxes on. If you have a Traditional 401, youll need to prepare to pay taxes on the money, whether you withdraw it at age 24 or 84. If you have a Roth 401, you can take your contributions out at any time since youve already paid taxes on them, but youll pay taxes on any earnings you withdraw early if youre under 59 and ½.

Purchasing A Distribution Annuity

A 401 distribution annuity is a type of insurance investment offered by a variety of financial institutions. Money is withdrawn from a 401 and used to purchase an annuity that offers a guaranteed income into the future. If the annuity is a qualified retirement plan, the withdrawal will not be taxed. The terms of the annuity determine the amount of monthly income that will be provided. Insurance companies use low-risk investments for annuities, limiting the size of monthly payouts with this type of distribution. Also, retirees should check on the annual fees associated with an annuity making a purchase.

Also Check: When You Quit Your Job What Happens To Your 401k

Avoid 401k Withdrawal Mistakes

Most people are required to start making annual withdrawals from their 401k accounts after they turn 70.5. The IRS provides all the information you need to figure out how much your withdrawals called required minimum distributions should be.

Dont make a costly mistake when it comes to taking your 401k money. Find out today how much your withdrawals should be at what age and keep your money working for you as long as you can.

How To Make An Early Withdrawal From A 401

When you have determined your eligibility and the type of withdrawal you want to make, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but when all the paperwork has been submitted, you will receive a check for the requested funds, hopefully without having to pay the 10% penalty.

Don’t Miss: How To Start 401k On Your Own

What Type Of Situation Qualifies As A Hardship

The following limited number of situations rise to the level of hardship, as defined by Congress:

- Unreimbursed medical expenses for you, your spouse or dependents

- Payments necessary to prevent eviction from your home or foreclosure on a mortgage of principal residence.

- Funeral or burial expenses for a parent, spouse, child or other dependent

- Purchase of a principal residence or to pay for certain expenses for the repair of damage to a principal residence

- Payment of college tuition and related educational costs for the next 12 months for you, your spouse, dependents or non-dependent children

Your plan may or may not limit withdrawals to the employee contributions only. Some plans exclude income earned and or employer matching contributions from being part of a hardship withdrawal.

In addition, IRS rules state that you can only withdraw what you need to cover your hardship situation, though the total amount requested may include any amounts necessary to pay federal, state or local income taxes or penalties reasonably anticipated to result from the distribution.

A 401 plan even if it allows for hardship withdrawals can require that the employee exhaust all other financial resources, including the availability of 401 loans, before permitting a hardship withdrawal, says Paul Porretta, a compensation and benefits attorney at Troutman Pepper in New York.

Taxes On 401 Retirement Distributions

Any retirement distribution you take from a 401 is treated as taxable income by the IRS and will be subject to taxation at your current rate, even if its a required minimum distribution. Federal taxes will be withheld from your distribution at your current tax rate. You may be able to get some of this refunded by rolling any excess distribution into another qualified retirement account, but you might not want to do that if you need the distribution for retirement living expenses. Also, you are excluded by law from rolling over the amount of a required minimum distribution and claiming a tax refund.

References

Tips

- 401 withdrawals can sometimes come with unexpected rules or penalties. Consult a financial adviser for more information on the options available to you.

- You are required to make 401 withdrawals once you reach age 70 1/2 or when you retire, whichever occurs later.

Warnings

- If you are withdrawing before the age of 59 1/2, your withdrawal will be taxed an additional 10 percent unless you meet certain IRS exceptions.

Writer Bio

Catie Watson spent three decades in the corporate world before becoming a freelance writer. She has an English degree from UC Berkeley and specializes in topics related to personal finance, careers and business.

Recommended Reading: When Can I Take 401k

Employers Have Options Under Latest Law

Although the Consolidated Appropriations Act temporarily relaxes rules for eligible individuals to access their retirement funds, businesses dont necessarily have to include these provisions in their plan provisions. Businesses that had to layoff workers due to business slowdowns also have more time to restore their workforce to at least 80 percent to avoid partial plan termination rules relating to their retirement plan. The partial retirement plan termination rule would be relaxed during a plan year that includes the period between March 13, 2020, and March 31, 2021, deferring assessments until March 2021.

Recommended Reading: When Can I Withdraw From My 401k

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

Recommended Reading: How To Close Your 401k Early

What If You Only Need The Money Short Term

Although there are other qualifying exceptions to withdraw IRA or 401k assets penalty-free, those listed above are the major ones. But suppose youre not interested in paying any taxes at all. You can still use your 401k to borrow money via a loan. The interest goes to you, the loan isnt taxable, and it wouldnt show up on your credit report. Heres how it works.

Traditional Ira Vs Roth Ira

Like traditional 401 distributions, withdrawals from a traditional IRA are subject to your normal income tax rate in the year when you take the distribution.

Withdrawals from Roth IRAs, on the other hand, are completely tax free if they are taken after you reach age 59½ and see out a five-year holding period. However, if you decide to roll over the assets in a traditional 401 to a Roth IRA, you will owe income tax on the full amount of the rolloverwith Roth IRAs, you pay taxes up front.

Traditional IRAs are subject to the same RMD regulations as 401s and other employer-sponsored retirement plans. However, there is no RMD requirement for a Roth IRA, which can be a significant advantage during retirement.

Read Also: How To Pay Off 401k Loan Early

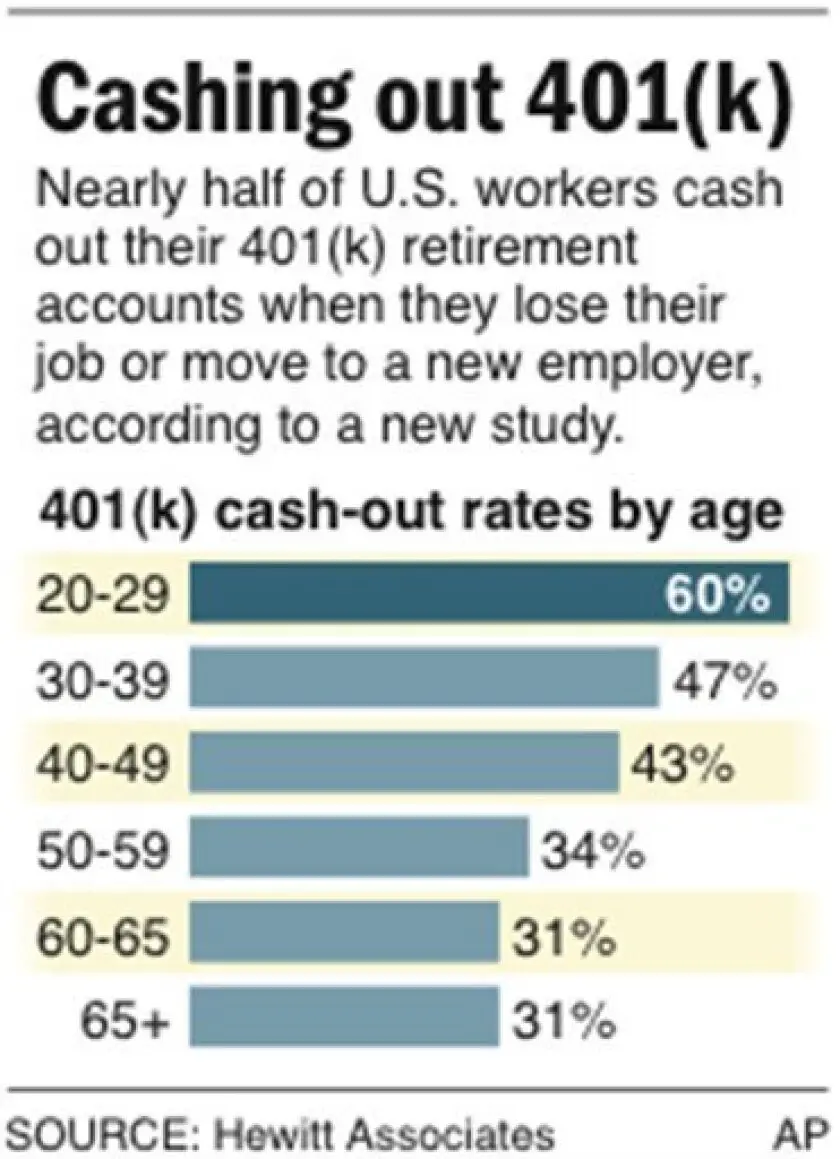

Cashing Out A : What A 401 Early Withdrawal Really Costs

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

Contributing to a 401 can be a Hotel California kind of experience: Its easy to get your money in, but its hard to get your money out. That is, unless youre at least 59½ years old thats when the door swings wide open for a 401 withdrawal. But try cashing out a 401 with an early withdrawal before that magical age and you could pay a steep price if you dont proceed with caution.

How Long Does It Take To Get 401k Money After Termination

The amount of time it can take for your 401 k payout to come to you varies depending on the type of retirement plan you have. If your situation is uncomplicated, you can expect to receive the check within days. However, a more complex case might mean it takes up to 60 days if you request to receive the money via check.

Read Also: How Much Can A Business Owner Contribute To A 401k

Penalties And Taxes On Cashing Out A 401k

When you complete a 401k cash out, you will need to pay an early withdrawal penalty and 401k taxes on your withdrawal. The 401k early withdrawal penalty is 10% of the amount that you withdraw. You will also be taxed at your normal income rate on the amount that you withdraw. Most plans will withhold 20% of the amount that you withdraw and send it to the IRS to help cover the costs and will send you a 1099-R form. If your tax rate is higher than 10%, then you will need to be prepared to pay additional money when you file your taxes. It is important to be prepared for this possibility.

How To Withdraw Retirement Savings Plans In Canada

A Registered Retirement Savings Plan can be a powerful investment tool for your money. Canadians contributed over $36.8 billion to their RRSPs per year and that number continues to rise according to Statistics Canada.

Its popularity is based on the fact that the money you contribute to the plan is deducted from your income and remains nontaxable until it is withdrawn.

However, once you decide to withdraw the funds, in most circumstances, the money will be included as part of your annual income and will be subject to income tax.

You May Like: How Do I Rollover My 401k Into An Ira

Exceptions To 401 Early Withdrawal Penalty:

- You stopped working for the employer sponsoring the plan after reaching age 55

- Your former spouse is taking a portion of your 401 under a court order following a divorce

- Your beneficiary is taking a withdrawal after your death

- You are disabled

- You are removing an excess contribution from the 401

- You are taking a series of equal payments that meet certain rules under the tax laws

- You are withdrawing money to pay unreimbursed medical expenses that exceed 10% of your adjusted gross income

Ubiquity is amazing! Always ready to answer questions and never makes me feel ridiculous for asking them. Additionally, she’s wonderful at returning calls and really making her clients feel valued and listened to! I feel 100% secure in all things related to retirement because I know Meli has our back :).

Rollover Money: An Easy Option

If youre still working and you cant get money out of your 401 with any of the techniques above, there might be another approach. If you ever made rollover contributions to your 401 into your existing 401, for example), you might be able to take those funds back out. You wont have access to your entire 401 account balance, but you might get a nice chunk of change outat any time, for any reason. Employers are often unaware of this option, so you may need to ask your employer to do some research with your Plan Administrator.

Again, you may have to pay income taxes and tax penalties, and youre raiding your retirement savings, so only use this option when you have no other choice.

Don’t Miss: How Soon Can I Get My 401k After I Quit

Make Retirement Your Own Merrill Lynch

Insurance and annuity products are offered through Merrill Lynch Life Agency Inc., a licensed insurance agency and wholly owned subsidiary of Bank of America Corporation. Trust, fiduciary and investment management services are provided by Bank of America, N.A. and its agents, Member FDIC, or U.S. Trust Company of Delaware.

Recommended Reading: How To Cash In Your 401k Early

Can I Take Out Money From 401k

The answer is that you likely can take money from your 401k. There is a great deal of information to address on which option is best for you. Another question to consider is if there are options outside of your 401k that are available to you. With so many options and so much information, it doesnt take long to feel discouraged on which option is best for you. The good news is one of our experienced Financial Guides can unpack this information and help make an unbiased decision that works for you.

You May Like: How To Claim 401k Money

Medical Expenses Or Insurance

If you incur unreimbursed medical expenses that are greater than 10% of your adjusted gross income in that year, you are able to pay for them out of an IRA without incurring a penalty.

For a 401k withdrawal, if your unreimbursed medical expenses exceed 7.5% of your adjusted gross income for the year then the penalty will likely be waived.

Retirement Planning With Merrill Edge

For more information on rolling over your IRA, 401 , 403 or SEP IRA, visit our rollover page or call a Merrill rollover specialist at 888.637.3343. Merrill, its affiliates, and financial advisors do not provide legal, tax, or accounting advice. You should consult your legal and/or tax advisors before making any financial decisions.

Read Also: How To Convert Your 401k To A Roth Ira

Withdrawals Before Age 59 1/2

Any withdrawal made from your 401 will be treated as taxable income and subject to income taxes in the year in which you made it, before or after retirement. But you’ll also be subject to a 10% early distribution penalty if you’re younger than age 59 1/2 at the time you take the withdrawal.

These taxes and penalties can add up and can nearly cut the value of your original withdrawal in half in some cases.

You can avoid these taxes and the penalty with a trustee-to-trustee transfer. This involves rolling over some or all of your 401 assets into another qualified account. You might consider a 401 loan if you want to access your account’s assets because of financial hardship.

You can take a penalty-free withdrawal from your 401 before reaching age 59 1/2 for a few reasons, however:

- You pass away, and the account’s balance is withdrawn by your beneficiary.

- You become disabled.

- Your unreimbursed medical expenses are more than 7.5% of your adjusted gross income for the year.

- You begin “substantially equal periodic” withdrawals.

- Your withdrawal is the result of a Qualified Domestic Relations Order after a divorce.

- You’re at least 55 years old and have been laid off, fired, or quit your job, otherwise known as the “Rule of 55.”

Your distributions will still be taxed if you take the money for any of these reasons, but at least you’ll dodge the extra 10% penalty.