Contribute Up To The Employer Match

You have enough saved up to cover your expenses. You emergency fund is there in case you need it. Now youre starting to think about 401 contributions. Where do you you start?

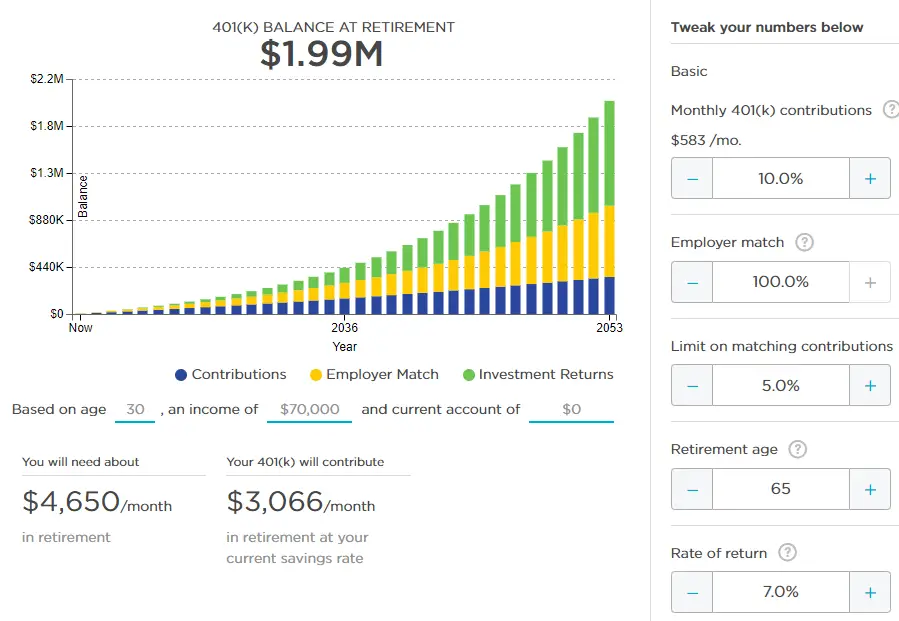

The first thing you should figure out is if you have an employer matching program with your 401. With an employer match, your employer will match your 401 contributions up to a certain percentage of your gross salary. Say your employer offers 100% match on the first 5% you contribute. That means if you contribute 5% of your gross salary to your 401, your employer will contribute an amount equal to 5% of your gross salary. The total contribution to your 401 would then equal 10% of your gross salary.

An employer match allows you to increase your contribution, and you should always take advantage of matching programs. Unfortunately, many people pass up free money by not contributing up to their employer match.

How Much Should You Contribute To Your 401 Rule Of Thumb

As a rule of thumb, experts advise that you to save between 10% and 20% of your gross salary toward retirement. That could be in a 401 or in another kind of retirement account. No matter where you save it, you want to save as much for retirement as you can while still living comfortably.

Its important to say that this is just a general rule. The actual amount you should save depends on your individual situation. For example, if you are 50 years old and dont have any retirement savings, you should save more than 20% of your gross annual salary. If youre 30 years old and already have $100,000 in retirement savings, you could probably decrease your contributions for a bit in order to pay off a mortgage or loan. Its difficult to create a one-size-fits-all plan, because everyone is in a different place with his or her finances.

Saving 10% to 20% of your salary every year might sound like a lot. Luckily, you dont have to do it all at once. You can spread your contributions out throughout the year and you can contribute more or less some years. You also dont have to save all that money through your 401. Lets take a step back and talk about other factors you should consider when you think about how much to contribute to your 401.

How Much You Can Afford To Contribute

Despite contribution limits, often times employees will contribute what they can afford to set aside for retirement. Financial experts generally recommend that everyone contribute 10% of their paycheck to a 401, but this may not be doable for all. Plus, often times we think about other ways we’ll need to use that money now.

Your life expenses can play a role in how much of your paycheck you feel comfortable contributing to your 401. If you tend to have high monthly costs or someone who relies on your financial support, you may feel like contributing a higher percentage to your 401 may mean having less in your paycheck to meet your monthly expenses.

If attempting to max out your 401 means putting yourself in a financially stressful situation, it’s okay to just contribute what you feel comfortable with.

In this case, a good rule of thumb that still has a profound positive impact on your retirement savings is to contribute just enough to receive the full employer match. So if your employer will match up to 7% of your contributions, only contribute 7% so you can take full advantage of that extra money. Your employer match is essentially “free money” so you don’t want to leave any sitting on the table.

Don’t Miss: What To Do With 401k When Laid Off

How Much Can You Contribute To Your 401

The Internal Revenue Service sets the contribution limit for 401s annually. This limit varies based on your age, but for 2022, most Americans can contribute up to $20,500 across the entire year. If you’re 50 or older, the limit goes up to $27,000 .

That is just your personal contribution limit, though. You can technically exceed these amounts – up to 100% of your compensation or $61,000, whichever is lower – if your employer also contributes to the account. Some employers offer a matching contribution, meaning for each dollar you contribute to your account, they’ll contribute a matching amount up to a certain threshold.

According to a report from investment management group Vanguard, most employers with matching benefits will contribute 50 cents on the dollar for up to 6% of the employee’s pay. So if you made $50,000, your employer would contribute up to $1,500 per year, provided you contributed at least $3,000 yourself .

How Much Can You Contribute To A 401

The most you can contribute to a 401 is $20,500 in 2022 . Employer contributions are on top of that limit. These limits are set by the IRS and subject to adjustment each year.

That limit dictates how much you can contribute, but it doesnt tell you how much you should contribute. To figure that out, consider the following.

Don’t Miss: What Is A 401k Vs Roth Ira

Taxable Investment Portfolio Is Key

The only thing you can count on is after-tax money youve invested or saved. This is why after maxing out your 401k, its good to open up an after-tax brokerage account. Consistently contribute a percentage of your paycheck each mont into your taxable investment portfolio. I recommend at least 20%.

Your goal should be to then build as many passive income streams as possible. The more passive income streams and active income streams you have, the more financially free you will be.

Challenge yourself to raise your after-tax and 401k contribution savings percent to possibly 50%. It wont be easy. But if you practice raising your savings rate by 1% a month until it hurts, youll find it easier than you think.

A straightforward way to maximum savings is to make your 401 maximum contribution automatic. Save every other paycheck for the rest of your working life.

Max out your 401k and save over 50% of your after-tax income for at least 10 years in a row. If you do, you will be financially free to do whatever you want!

Diversify Plans If Possible

Matthew Yu, Loan Originator for Socotra Capital

Some employers have small matches, but some match dollar for dollar on your first 3-5 percent. Thats 100 percent ROI at the end of each year for your 3-5 percent contribution!

For those with less generous employee matches and limited investment funds, you should carefully gauge your companys 401 plan to see if you could get better returns investing in a Self-Directed IRA. The amount you put into the 401 is just as important as the type of investment that your 401 is invested in.

For best diversification, I would recommend those new to the workforce to split up their retirement savings into their 401 and Roth IRAs. Set aside an investment budget that stings, but isnt too painful. Your 401 will be automatically withdrawn every month. Money that doesnt hit your pocket is much easier to invest than the money that comes out of it. Investing early pays dividends.

You May Like: What Is The Difference Between A Pension And A 401k

You Should Be Contributing At Least 20% To Your 401

As an investment advisor who has worked with the retirement plans of Apple, IBM and AT& T, I often receive questions from participants about how much they should contribute. I typically respond by saying, “At least 20%.” They usually laugh and say, “No, really.” And I repeat, “Really, at least 20%.”

What the experts advise

Many experts, including Vanguard, suggest that most of us need to add 12% to 15% of our compensation to our 401 plan accounts every year we work. Money magazine indicates that the average 401 participant adds 10.9% to 12.9% to a 401 account each year . That seems to be right on track. However, if we look at the way most of us normally contribute, that range is way too low.

How most of us normally contribute

In real life, many of us don’t contribute in a uniform way to our 401 plans. Early in our careers, when we are just getting started, we tend to battle with competing saving and spending priorities. We are trying to pay off student loans, buy a car or save for a down payment on a home. Or, surprise, we may end up having kids!

As a result, during that first 10 years of our 40-year careers, most of us contribute very little to our 401 plans. At that time in our lives, retirement seems pretty far off anyway and those student loans look pretty scary. We often change jobs frequently as we try to figure out what we want to do with our lives and, unfortunately, many of us end up taking distributions of our 401 balances rather than rolling them over.

Figure Out The Ratio Youre The Most Comfortable Withbut Keep Upping Your Savings

There are lots of ratios out there recommending how to divide up your income. Some are as simple as spend 50%, save 50%. Although an admirable goal, most people will have a hard time with this. Especially in your twenties. I like 75/20/5.

- Spend 75%

- Save 20%

- Give 5%

But figure out the ratio youre comfortable with. You may want to defer charitable giving until youre debt-free. If you need most of your income to eat, it might be spend 90, save 10 or even 95/5. Thats okay. But you should reevaluate this as your financial situation changes and aim to get to at least 80/20.

In this example , if you earn $40,000, you would spend $30,000 or $2,500 a month, save $8,000 a year, or $667 a month, andif you wantset aside $2,000 a year for your chosen causes. Note that were working off of before-tax income, so that $2,500 a month for spending might be more like $2,000 after taxes).

Working backwards from this, lets say your employer will match up to half of a 6% contribution to your 401. So 6% of your pre-tax income is $3,000. Your employer throws in $1,500. You put that in, and you have $3,500 left in your savings budget.

If you dont have a fully funded emergency fund, this comes next. Open a simple online savings accounttheyre boring, but safeand load it with cash.

Read Also: How To Select 401k Funds

The Effect Of A Few Percentage Points Over Time

When determining what to contribute, dont set your sights too low: A couple of percentage points can make a big difference.

Even if you start small, its important to start saving as early as you can and let time do the work of accumulating interest for you. Make a goal to increase your contribution each year and stick to it.

For example, this graph shows how much someone earning $60,000 annually would save after 30 years, investing at different levels. In this example, a couple of percentage points can be worth more than $150,000 in the end.

Potential value after 30 years

$ thousands

Example is for illustration purposes only. Assumes $60,000 salary, bi-weekly contributions, 3% annual pay increase, and a 7% rate of return. Investments will fluctuate and when redeemed, may be worth more or less than originally invested. Balances shown are pre-tax and are subject to income taxes upon distribution. Values do not account for fees and expenses.

This information is a general discussion of the relevant federal tax laws provided to promote ideas that may benefit a taxpayer. It is not intended for, nor can it be used by any taxpayer for the purpose of avoiding federal tax penalties. Taxpayers should seek the advice of their own advisors regarding any tax and legal issues specific to their situation.

How Much You Invest Makes A Huge Difference

The U.S. Census Bureau says the median household income is around $69,000.1 Fifteen percent of that would be $10,350 a year, or $862.50 a month. Over 30 years, that could grow to over $1.9 million, assuming a 1012% return. Sounds awesome, right? Who doesnt want to be a millionaire?

But what if you only invested 10% of that gross income? That would be $6,900 a year, or roughly $575 a month. Invested over 30 years at the same rate of return, that percentage could get you to about $1.3 million. Youve lost out on $600,000 you could be using to fund your retirement dream.

Just as an example, what about if you dropped that 15% down to 5.5%the average personal savings rate in the U.S., including retirement savings and emergency funds? At that percentage, youre investing $3,795 a year, or around $315 a month. Over 30 years, assuming that same rate of return, you could be looking at about $715,000.

We know thats a lot of numbers. If youre a little more visual, heres a breakdown for you:

Dont Miss: How To Do A 401k Rollover

Read Also: How To Save For Retirement Without A 401k

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Build Your Emergency Fund

You want to save as much as you can for retirement, but you shouldnt put all of your savings toward retirement. You should always have enough cash reserves to cover necessary expenses like food and rent. Its also a good idea to create an emergency fund.

An emergency fund will protect you from unexpected expenses or difficult financial situations. What would you do if you lost your job or didnt have a regular salary for a month? What if a family member got sick and you had medical bills to pay? A strong emergency fund allows you to get through tough times. Withdrawing money from your retirement accounts should be an absolute last resort. Just as importantly, an emergency fund will ease your mind by providing a sense of security. Its always nice to know that you have a backup plan in case something goes wrong.

Again, there is no perfect answer for how much you should have in an emergency fund. It depends on your situation. In general though, you want enough to cover at least a few months of expenses. That may sound like a lot if currently have no emergency fund, but you can build your fund over time by adding a little each week or month.

You May Like: How Do I Borrow Money From My 401k

What Is A 401k

A 401k is a powerful type of retirement account that many companies offer to their employees as a perk. With each pay period, you put a portion of your paycheck into the account. It happens automatically so you dont have to do anything special and there are a ton of benefits.

A 401k is called a retirement account because it gives you huge tax advantages if you dont touch your money until you reach the minimum retirement age of 59 1/2 years. While you will have to pay a penalty if you touch your 401k savings before you reach retirement age, the benefits far outweigh the risk.

Here is a snapshot of the benefits of having a 401k:

It Never Hurts To Save More

Twenty percent is a great goal, but some retirement experts actually suggest saving more like 25% or even 30. Why?

You know that saying, Past returns are no guarantee of future performance? Thats why. Its true that the annual average return of the S& P 500 between 1928 and 2014 was 10%. But that doesnt mean well get that average return over the next 86 years.

Jack Bogle, the father of index funds and founder of Vanguard, says that investors should plan on lower returns in the coming decade and other commenters suggest lower yields even beyond that.

We have no way of knowing what future returns will bethey could be 8%, they could be 4%. But the only way to hedge against an uncertain future is to save more money. The more you have, the less you need jaw-dropping returns to meet your goals.

Don’t Miss: How Do I Transfer My 401k To Another Company

There Are Reasons Why You Shouldnt Stop 401 Contribution When The Market Is Down

In a market downturn, you may see a large drop in your 401 balance. In such a situation, you may go into panic mode and try to reduce your exposure to markets as much as you can. However, a down market can present a great opportunity to buy the dip in some high-quality stocks. For example, Warren Buffett has used the downturn to purchase some great stocks like Apple and Chevron on the cheap.

If you see the market going down, just stay calm. The market has its cycles, so you can expect a rebound after a crash. For example, markets crashed across the board in the early stages of the COVID-19 pandemic. The trend later reversed and many stocks went on to hit record highs. Investors who kept the faith and bought the dip reaped huge benefits.

Buying the dip for a retirement account in a down market may not be for everyone. The strategy could be more rewarding for people with more years to work than those nearing retirement. In fact, its advisable that those approaching retirement shift their funds to less risky investments such as blue-chip stocks with dividends and bonds. Index funds are also a great fit for retirement accounts nearing distribution.