Your Current Income Status

If your annual salary is less than $107,000 or $72,000 , then you should probably choose a Roth IRA.

On the other hand, if your annual salary is higher than either of those values, you might lean towards a 401 because contributions will be taxed when withdrawn and only up to $17,500 can be contributed to a Roth IRA.

Is A 401 An Ira

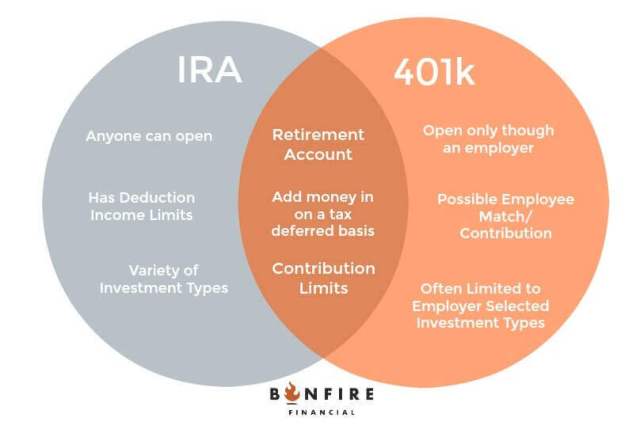

When it comes to saving for retirement, youâve probably heard people throwing out terms like 401 and IRA, and maybe even using them interchangeably. You may also know that both a 401 and an IRA are retirement accounts. But is a 401 an IRA? Simply put, no. While both allow you to take advantage of similar tax benefits, they arenât one in the same.

Hereâs a brief rundown of both 401s and IRAs.

A Roth 401another Option Worth Considering

Whether or not you choose to open an IRA, if your employer offers a Roth 401, you might also consider adding this to your retirement savings strategy. There are no income limits to participate in a Roth 401, and you can have both types of 401 at the same time. Having both doesn’t mean you can contribute more than the total annual 401 contribution limit, but you can split your contributions between the two, giving you a combination of both taxable and tax-free withdrawals come retirement time.

Don’t Miss: How To Move Money From One 401k To Another

Whether Or Not You Want To Withdraw Roth Ira Contributions Or Earnings

The most important factor in your decision should be how much money you are able to contribute to each account because this will determine how soon you can retire.

Since the limit for Roth IRA is lower than that for a 401, if you have the choice of contributing to one or the other, it is usually better to contribute to a Roth IRA because you will not get an immediate tax break and your money can grow without paying taxes.

Rollover To Another 401

If you value the simplicity of having all your retirement funds in one place, are looking to minimize account maintenance fees or want to prepare yourself to take advantage of the Rule of 55, a 401-to-401 rollover can be a good choice. By rolling over an old 401 into a plan with your new employer, you can keep everything in one place. Evaluate investment options carefully, though, to make sure there arent high fees and that the investments available work for you.

Donât Miss: How Much Income Will Your 401k Provide

You May Like: How Can I Get My 401k Money Without Penalty

Add Up The Benefits Of Your Employers 401 Matching Program

An IRA is no match for a typical 401 when it comes to employer contributions. An IRA does not come with an employer-match program, but with the standard 401, your employer is allowed to match a certain percentage of the amount you contribute each year. This benefit can increase your rate of growth exponentially, and its one of the most rapid ways to grow your retirement money.

Difference Between A Savings Account And A Retirement Savings Account

A retirement savings account is like a traditional savings account, but it also comes with some special tax benefits. With a retirement savings account, you can either contribute after-tax funds or make a contribution with after-tax funds and then take them out at retirement. You can also make tax-deductible withdrawals from a retirement savings account and then re-contribute the withdrawn funds. This may be beneficial if you expect to be in a lower tax bracket in retirement and you want to make tax-free contributions. Youll want to make sure you understand which option is best for you individually. Generally, a retirement savings account is more suited for short-term savings while a savings account is more suited for long-term savings. It all depends on your financial situation and risk tolerance.

Read Also: How To Invest With Your 401k

S Offer Higher Contribution Limits

In this category, the 401 is simply objectively better. The employer-sponsored plan allows you to add much more to your retirement savings than an IRA.

For 2021, a 401 plan allows you to contribute up to $19,500. Participants age 50 and older can add an additional $6,500, for a total of $26,000.

In contrast, an IRA limits contributions to $6,000 for 2021. Participants age 50 and older can add an additional $1,000, for a total of $7,000.

Thats a clear advantage for the 401.

Can I Rollover My 401k If I Am Still Employed

Most people roll over 401 savings into an IRA when they change jobs or retire. But, the majority of 401 plans allow employees to roll over funds while they are still working. A 401 rollover into an IRA may offer the opportunity for more control, more diversified investments and flexible beneficiary options.

Recommended Reading: Can I Roll Part Of My 401k To An Ira

Which Is Better For Taxes A Roth Ira Or 401

Weve talked briefly about the different tax implications of a 401 and Roth IRA, but lets dive a bit further into them here. As we mentioned, a 401 and a Roth IRA have different tax advantages.

In most cases, 401 contributions are made pre-tax, meaning they reduce your taxable income and, therefore, your tax burden in the current year. The money grows tax-deferred while its in your account, and youll pay taxes on your 401 withdrawals at your ordinary income tax rate at retirement.

A Roth IRA, on the other hand, allows you to make your contributions after taxes. While theres no tax advantage in the current year, your money grows tax-free in the account and you can withdraw both your contributions and earnings tax-free during retirement.

So which tax advantage is better? Traditional 401 contributions are generally more beneficial for taxpayers with a high income today who expect to have a lower income during retirement. In other words, you can get a tax break today if your tax rate is high, and then defer those taxes until youre in a lower tax rate. And vice versa.

A Roth IRA is better for taxpayers who expect to be in a higher tax bracket during retirement. You can pay the taxes today while your tax rate is lower, and then enjoy tax-free withdrawals while your tax rate is higher during retirement.

What Is A Gold Ira

A gold IRA is an IRA that invests in gold. You can establish one through any financial institution that offers IRA services. There are no requirements as to what type of gold you should buy for your IRA. The Internal Revenue Service has ruled that gold, silver, and platinum are all acceptable investments for an IRA account. Investors can use their gold IRA to make certain tax-free distributions at retirement age. Its important to note that a gold IRA isnt meant to be a long-term investment. All of the benefits of an IRA come with very few financial risks. If you want to safely save some money for retirement, a gold IRA is the way to do it.

Read Also: Is It A Good Idea To Borrow From Your 401k

If Your Employer Offers A 401 Match

1. Contribute enough to earn the full match. Check your employee benefits handbook. If you see that your employer matches any portion of the money you contribute to the company 401 plan, do not bypass this opportunity to collect your free money.

A company matching program is one of the biggest benefits of a 401. It means that your employer contributes money to your account based on the amount of money you save, up to a limit. A common arrangement is for an employer to match a portion of the amount you save up to the first 6% of your earnings.

Even if a 401 has limited investment choices or higher-than-average fees, carve out enough money from your paycheck to get the full company match, as its effectively a guaranteed return on those dollars. Also note that employer contributions dont count toward the 401 annual contribution limit.

2. Next, contribute as much as youre allowed to an IRA. Depending on which type of IRA you choose Roth or traditional you can get your tax break now or down the road when you start withdrawing funds for retirement.

-

A traditional IRA is ideal for those who favor an immediate tax break. Contributions may be deductible that means your taxable income for the year will be reduced by the amount of your contribution. But, if you’re also covered by a 401, your deduction may be reduced or eliminated based on income. If you has a workplace retirement plan, check out the IRA limits.

You Can Take A Loan On A 401

Generally if you take out cash from an IRA or a 401, youll likely be charged taxes and penalties. But the 401 may allow you to take out a loan, depending on how your employers plan is structured.

Another clear advantage is that you can take loans from a 401 and continue to contribute to your 401, says Lackwood.

Like a normal loan, youll have to pay interest, and youll have a repayment period, not more than five years. But the rules differ from plan to plan, says Lackwood, so youll have to check on your specific 401 rules to see what youll need to do.

You can also take cash from a 401 for a hardship withdrawal, and you can do so from an IRA, too. But the terms in each case are strict.

401s allow for emergency withdrawals, but most plans offered through employers are very rigid and dont have much flexibility, says David Wilson, CFP and founder of Planning to Wealth.

But taking a non-retirement withdrawal can drastically set back your retirement plans.

Also Check: Can I Cash In My 401k

How Do I Open A 401

In many cases, your 401 account will be opened automatically upon starting employment. In other cases, you might have to opt in to your employers plan. Simply contact your Human Resources department, and they can guide you on the proper steps to get your account opened. Once your account is established, you can decide how much money to contribute and which investments to select. The money will be automatically withdrawn from your paycheck, so making the contributions is easy on your part.

Will I Pay Taxes When Rolling Over A Former Employer

Generally, there are no tax implications if you move your savings directly from your employer-sponsored plan into an IRA of the same tax type to a Roth IRA).

If you choose to convert some or all of your pretax retirement plan savings directly to a Roth IRA, the conversion would be subject to ordinary income tax.

Dont Miss: Which Investments Should I Choose For My 401k

Recommended Reading: Can A Spouse Get Your 401k In Divorce

Contributions Are Always Tax

Another key advantage for the traditional 401 is that contributions are always tax-deductible, regardless of your income. If you add to your 401, you make those contributions with pre-tax money.

Any pre-tax contributions will lower an individuals tax amount for the year, says Burke. There is no phase-out at any level of income.

In contrast, contributions to an IRA may or may not be tax-deductible, depending on your income and whether youre already covered by a 401 plan at work. The deductibility of contributions phases out as your income increases.

Which Is Right For Me

One thing to keep in mind is that you can open both a 401 and an IRA.

If youre eligible for both, then its a good idea to take advantage of both Roth IRA and Roth 401, especially if your employer offers matching contributions.

Common advice is to contribute to your 401 to max out your employers match. After that, you can contribute to your IRA where you have more flexibility to choose what you invest in. If you max out your IRA and want to keep saving, you can then return to contributing to your 401.

Of course, if youre only eligible for one of the two accounts due to income limits or not working for an employer that offers a 401, you should take full advantage of it.

Read Also: Should I Take A Loan From My 401k

The Difference Between Roth Ira And 401

Both investments allow tax-free growth, however, 401 contributions are made on a pre-tax basis, while Roth IRA contributions are made with after-tax dollars. So, you will get it back plus the earnings when you withdraw your money.

Also, 401s are established through employers and can only be funded by salary deferrals , whereas Roth IRA contributions can be made through individuals without any income limit or restrictions on how much they contribute.

Keeping Your 401 Plan With Your Former Employer

This option is like keeping your account in the same 401 plan or retirement home. You will continue to defer income taxes on 401 contributions, but 401 contribution limits are now applied to your account.

You can keep your 401 account with your former employer’s plan by notifying the company’s administrator. This request should be made in writing, either by mail or e-mail, and this option is not always available.

Your plan administrator must approve 401 rollovers.

You May Like: How To Cash In My 401k

How Do I Open An Ira

Opening an IRA requires a little more work on your part. You will need to visit your local bank or brokerage firm. Many online brokerage firms allow you to open an IRA easily. You will simply need to decide how much money you will be placing into the IRA and make your investment selections. Once opened, you will receive regular statements to show how your investments are performing. You can deposit additional funds on any schedule you choose up to the maximum contribution amounts each year.

Evaluate The Investment Growth Options

IRAs offer you more control over your investment options than a 401 allows. In a typical 401 plan, youre limited to the investment choices that your employers plan offers.

In an IRA, youre generally free to invest in nearly any investment offered by your broker. You can choose higher growth options with an IRA if your goal is to maximize your money and you have a high tolerance for risk.

Read Also: How To Put 401k Into Ira

Understanding Key Differences Between An Ira And A 401

In an era where many jobs in the private sector no longer offer traditional pension plans, how do you build the savings youll need to retire comfortably? It often makes sense to choose a tax-advantaged retirement plan on your own. There are multiple types of retirement plans which are designed to help you save by offering different tax benefits your choice of plan depends on your unique employment and financial situation.

This article takes a close look at the key differences between two of the most commonly held retirement plans: individual retirement accounts , which are generally available to anyone, and 401s, which are tied to the company an employee works for though not all employers offer them.

What Are Your Options

There are many different types of retirement savings accounts out there, and it can get a bit confusing trying to decide which one is best for you. Here are a few things to consider:

Traditional IRA If your income falls within certain limits , then you can contribute up to $5,500 per year . Contributions may come from either before-tax funds or after-tax funds. If your income falls within certain limits , then you can contribute up to $5,500 per year . Contributions may come from either before-tax funds or after-tax funds.

401 This type of retirement savings account allows you to contribute up to $18,500 per year . Contributions may come from either before-tax funds or after-tax funds. You can also make tax-deductible withdrawals from a retirement savings account and then re-contribute the withdrawn funds. This may be beneficial if you expect to be in a lower tax bracket in retirement and you want to make tax-free contributions.

403 This type of retirement savings account is similar to a 401, but its offered by certain types of nonprofit organizations and public schools.

SIMPLE IRA This type of retirement savings account is similar to a traditional IRA, but its offered by certain types of small businesses. It allows you to contribute up to $12,500 per year . Contributions may come from either before-tax funds or after-tax funds.

Recommended Reading: Can You Use 401k To Pay Off Debt

How To Roll Over Your 401 To A Roth Ira

Rolling over your 401 plan to a Roth IRA is a taxable event. Youll have to pay income tax on your contributions, your employer-match contributions and all earnings. Depending on the size of your account, this could push you into a much higher tax bracket, so you shouldnt proceed before youve done the math. You may also want to consult a financial advisor to make sure this move is the right one for you.

Read Also: What Is The Interest Rate On A 401k

Roth Ira Income Limits

The Roth IRA income limits are different for 2021 versus 2022. How much you can contribute to a Roth IRA depends, in part, on how much you earned in that year. In other words, the contribution amount allowed can be reduced, or phased out, until it’s eliminated, depending on your income and filing status for your taxes .

2021

For individuals with a tax filing status of single, you can make a full contribution if your income is below $125,000. The income phase-out range has been increased to $125,000 to $140,000.

If you’re a married couple filing jointly, for 2021, full contributions are allowed if you make less than $198,000, while the income phase-out range is $198,000 to $208,000.

2022

For individuals filing taxes as single, you can make a full contribution to a Roth if your income is less than $129,000. Your contributions would be reduced or phased out if your income was between $129,000 and $144,000. If you earned more than $144,000, you couldn’t make any contributions to a Roth IRA.

If you were married filing jointly, you could make a full contribution to a Roth if your income was less than $204,000. Your contributions would be reduced or phased out if your income was between $204,000 and $214,000. If you earned more than these IRS-imposed limits, you couldnt contribute to a Roth IRA.

Read Also: How To Find Out If You Have A 401k Account