Your 2021 Guide To Employer Match And 401 Contribution Limits

Offering a matching 401 plan to your team is a great way to attract high-quality employees to your company. An employer-matched 401 can also help reduce employee churn as individuals recognize the financial significance of this benefit.

Many companies now opt for a 401 employer match program, rather than the traditional pension plan. Employer-matched 401 contributions allow for tax deductions for the employer. For this reason, there are 401 matching limits for how much employers can contribute to their employees 401 savings plans.

Learn more about what a 401 plan is, how employer matching works and the max 401 contribution company match limits over the past few years, including 2021 limits.

Are you a job seeker? Find jobs.

Knowing These Rules Can Save You A Lot Of Trouble With The Irs

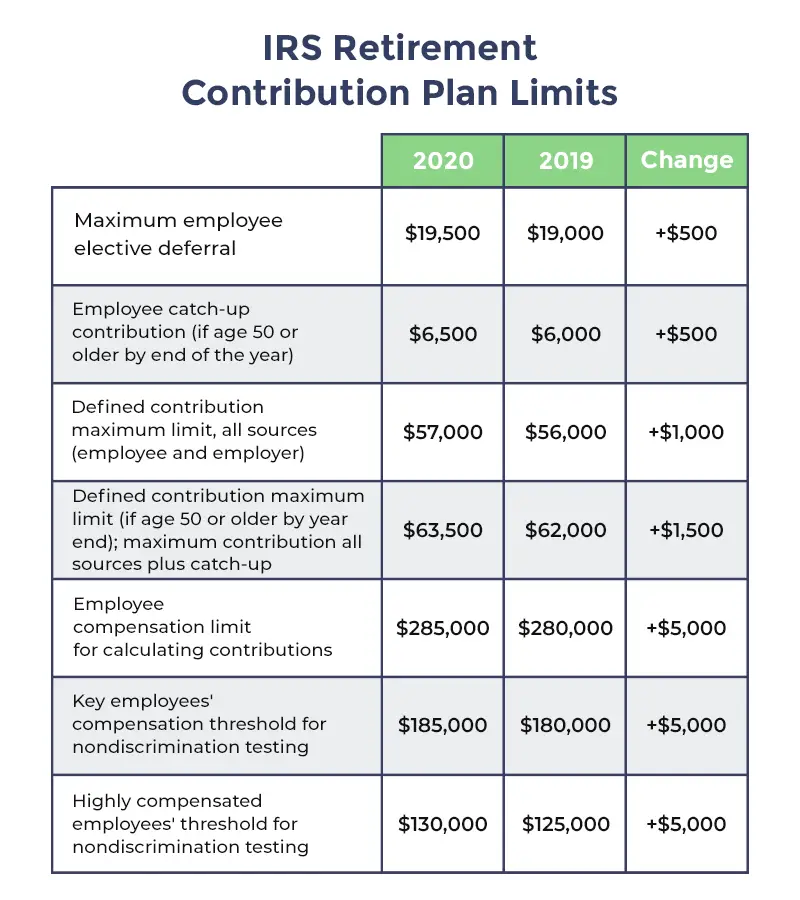

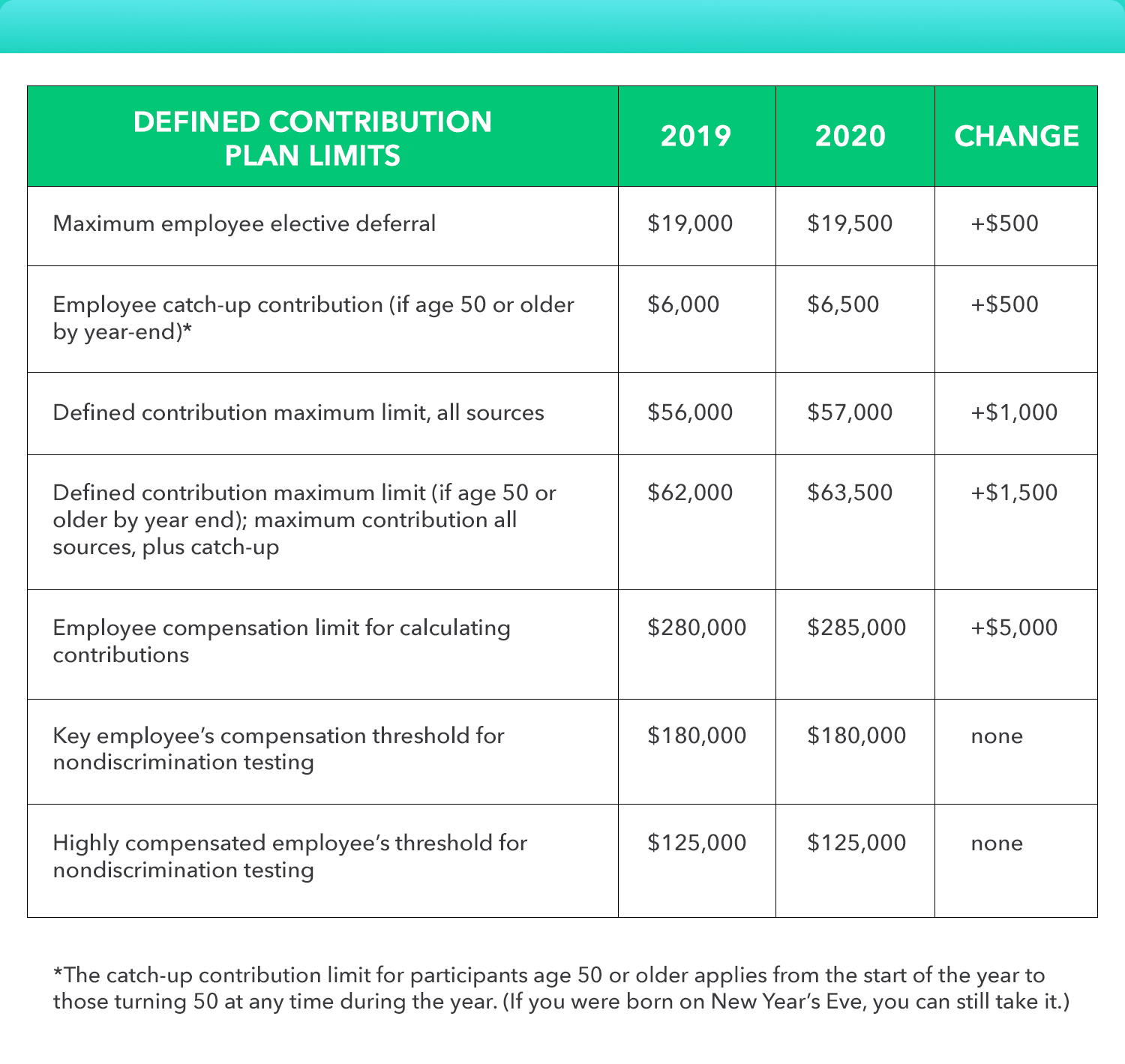

A 401 is a tax-advantaged retirement account, so the government sets limits on how much you can contribute every year. But it also understands that inflation makes retirement more expensive over time, so it reevaluates its limits every year and sometimes raises them. Here’s an overview of all of the contribution limits the government imposes on 401s in 2020 and 2021.

Contribution Limits Over Time

Contribution limits are reviewed each year, and adjustments are made when necessary to keep up with the cost of living.

| 2020 |

Wealthfront Advisers LLC is an SEC-registered investment adviser and a wholly owned subsidiary of Wealthfront Corporation . Please see our Full Disclosure for important details.

By using this website, you understand the information being presented is provided for informational purposes only and agree to our Terms of Use and Privacy Policy. Wealthfront Advisers relies on information from various sources believed to be reliable, including clients and third parties, but cannot guarantee the accuracy and completeness of that information. Nothing in this communication should be construed as an offer, recommendation, or solicitation to buy or sell any security. Additionally, Wealthfront Advisers does not provide tax advice and investors are encouraged to consult with their personal tax advisors.

Wealthfront Software LLC provides a financial planning service tool designed to aid Wealthfront Advisers’ clients in preparing for their financial futures by allowing them to personalize their assumptions for their financial planning goals. Wealthfront is a wholly owned subsidiary of Wealthfront Corporation, and an affiliate of Wealthfront Advisers.

Recommended Reading: How To Transfer Roth 401k To Roth Ira

What Is A Solo 401k

According to the IRSs own website, a Solo 401k is simply a one participant 401k plan. It is no different than any other 401k, except that it only covers the owner and maybe also, his or her spouse. Its key that the sponsoring business compensates the spouse. These plans follow all of the same rules as any other 401k plan. Except no full time W2 employees are allowed in a Solo 401k.

Solo 401ks, just like other 401k plans are designed to help you save for retirement. In a Solo 401k, you play multiple roles, including, employee and employer. As such, you get additional benefits and control compared to a large group 401k plan. In the Solo 401k you have very high contribution limits and multiple ways to contribute. With certain Solo 401k providers, you also have full control over your retirement assets and investments. This means you can invest in stocks, bonds, gold & silver, ETFs, private companies, mortgage notes, and bitcoin. All inside your Solo 401k plan.

Next Steps To Consider

A distribution from a Roth IRA is tax-free and penalty-free, provided the 5-year aging requirement has been satisfied and one of the following conditions is met: age 59½, disability, qualified first-time home purchase, or death.

Fidelity does not provide legal or tax advice. The information herein is general and educational in nature and should not be considered legal or tax advice. Tax laws and regulations are complex and subject to change, which can materially impact investment results. Fidelity cannot guarantee that the information herein is accurate, complete, or timely. Fidelity makes no warranties with regard to such information or results obtained by its use, and disclaims any liability arising out of your use of, or any tax position taken in reliance on, such information. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Also Check: When Can I Withdraw From My 401k

The Maximum You Can Put Into A 401 In 2021 And 2022

-

If youre under age 50, your maximum 401 contribution iso $19,500 in 2021 and $20,500 in 2022.

-

If youre 50 or older, your maximum 401 contribution is $26,000 in 2021 , because you’re allowed $6,500 in catch-up contributions.

For 2021, your total 401 contributions from yourself and your employer cannot exceed $58,000 or 100% of your compensation, whichever is less. For 2022, that number rises to $61,000.

Employers who match employees’ 401 contributions often do so between 3% and 6% of the employee’s salary. So if you make $50,000 and contribute 5% of your salary and your employer matches that full 5%, you’ll add $5,000 to your balance each year.

Solo 401 Establishment Deadline:

For 2021, in order to make employee contributions for 2021, the self-employed business owner had to establish the solo 401k plan by December 31, 2021. However, if the plan was established on January 1, 2022 or after by your business tax return due date including the business tax return extension, then you cam make employer profit sharing contributions for 2021 but cannot make employee contributions. For example, an employer operating the plan on a calendar-year basis had to complete the solo 401k plan documentation no later than .

For makin 2021 solo 401k plan contributions, the solo 401k has to be adopted by December 31, 2021 for self-employed businesses operating the plan on a calendar-year basis in order to preserve the right to make both employee and employer contributions in 2022 for 2021 by the business tax return including business tax return extensions. Otherwise, if the solo 401k plan is adopted on January 1, 2022 or after but by your business tax return due date including extensions, you will only be allowed to make employer contributions not employee contributions to the solo 401k plan. To learn more about the December 31, 2021 plan adoption/establishment deadline VISIT HERE.

Also Check: Can You Move Money From Ira To 401k

Solo 401k Contribution Deadlines

If you’re looking at this contribution limits for a solo 401k, it’s important to note that you also are required to contribute by certain deadlines.

The solo 401k has two sets of deadlines: the deadline for the employee contribution , and the deadline for the employer matching contribution .

For your employee elective contribution, you must make your contribution by December 31, usually. If you’re an S-Corp and on payroll, you must elect to make this contribution and have it paid by December 31. If you’re a sole proprietorship or single-member LLC, you must still elect to make your contribution by December 31, but your contribution can be made up to the personal tax filing deadline . Sound strange? It is a bit strange, but the nuance is due to the type of tax return you file .

For your employer contribution, you must make your contribution by the tax filing deadline of your corporation . This could be March 15 or September 15 for S-Corps, or April 15 or October 15 for those filing on a personal return.

Note: Due to the coronavirus pandemic, the tax filing deadline was delayed until 7/15/2020. What this means is that you have a little more time to make your solo 401k contributions if needed. The IRS hasn’t issued formal guidelines for this, but given the law says “tax filing deadline”, it’s safe to assume this is the case unless further guidelines clarify this.

Example : A 401 And A Simple Ira

Robert is 40 years old and covered by both a SIMPLE IRA plan and a regular 401 plan. He earns W-2 income of $70,000 and $90,000 respectively. In 2020 and 2021, the maximum Robert can contribute to both plans at the individual level is $19,500. This amount can be divided between both plans, but Robert cannot exceed the lesser annual contribution limit of $13,500 in his SIMPLE IRA in 2020 and 2021.

You May Like: Is An Annuity A 401k

When A Withdrawal Penalty Applies

While you can take money out of your 401 without penalty for a few reasons, you’ll typically still pay income taxes on it. What if you just want to take the money out to do some shopping before you’ve reached age 59 1/2, or before age 55 if the Rule of 55 applies to you? Well, the IRS will hit you with a 10% penalty on top of taxes. That means that expenses such as a new car or a vacation don’t count as reasons to take out your 401 savings.

Employer 401 Contribution Limits For 2020

While the IRS doesnât directly limit employersâ 401 matching contributions, there is a limit to how much they can contribute.

Falling back on the total 401 contribution amount, the limit for employer matching contributions canât exceed $57,000 minus the employeeâs contributions in 2020.

If the employee maxes out their 2020 contribution limit of $19,500, the maximum amount an employer can contribute towards their 401 is $37,500.

Since the average employer 401 match is 3.5% of employeesâ salaries, itâs unlikely an employer would contribute that much.

Recommended Reading: How To Lower 401k Contribution Fidelity

Don’t Miss: How To Offer 401k To Employees

K Withdrawal Rules And 401k Contribution Limits

401k plans are great savings vehicles for retirement. Many plans offer matches from employers and they all provide tax free growth of capital for account holders. While 401ks are a really useful tool, they do have their limitations. Here are a few of the 401k withdrawal rules and 401k contribution limits.

Are There Income Limits For 401s

While there’s not a universal income limit on 401 contributions, in some cases the IRS does impose contribution limits on “highly compensated employees” when a company encounters disproportionate contribution levels among its workers. The IRS has a test that helps employers who sponsor 401 plans assess whether employees are participating in their plan at levels proportionate to their compensation.

If the test determines that people across compensation levels aren’t participating in a manner the IRS deems proportionate, employee contribution levels for highly compensated employees can be lowered. In these cases, your employer may need to return some of your excess contributions.

The IRS defines a highly compensated employee in one of two ways:

An individual who either owned more than 5% of the interest in a business at any time during the year or the preceding year, no matter how much they were paid.

An individual who received over $130,000 from the business in the preceding year in 2021 and, if the employer ranks employees by compensation, was in the top 20%.

Read Also: How Can I Borrow From My 401k Without Penalty

What Percent Should I Contribute To A 401

Brewer suggests that your contributions should be based on a percentage of your income, depending on your age. She recommends that you stash away between 10 percent and 15 percent of your gross income if youre in your 20s and 30s, or if you started saving during those years. If youre behind in retirement savings in your 40s and 50s, Brewer encourages you to set aside between 15 percent and 25 percent of your income.

If youre not saving anything for retirement right now and want to get started, start with at least 3 percent to get going, Brewer says. Increase your contribution by at least 2 percent each year and do a larger increase in years where you get a big raise until you hit your target savings percentage.

How To Open A Solo 401k

The next step is to set up your Solo 401k with Nabers Group. After you complete our short online application we will get your documents back to you within 2-4 hours. Next you can set up your holding accounts at the bank and/or brokerage of your choice. Then make new contributions and/or roll over funds from other qualified plans and IRAs. Select your investments and simply invest your funds how you want.

Read Also: How To Know If You Have A 401k

Withdrawals From A 401k Plan

As 401 contributions are not taxed as income in the year that the contribution is made , withdrawals are taxed instead.

The tax rate that will apply to these withdrawals is the income tax rate that applies to the account owner during the year of withdrawal. This is generally considered advantageous because most people will have lower taxable income during their retirement years than when they worked, meaning their effective tax rate on the amount withdrawn will be lower.

Owners of 401s must be at least 59½ or be completely and permanently disabled to withdraw the funds in their account without tax penalties.

If they are younger than this age, they will pay a 10% penalty tax on the amount withdrawn in addition to owing normal income tax on the amount.

There are several limited exceptions to this 10% penalty, including the employee’s death, qualified domestic court orders, and unreimbursed medical expenses that exceed 7.5% of the employee’s Adjusted Gross Income.

Finally, account owners must begin making at least required minimum withdrawals, which are set by the IRS using a life expectancy table, when the account owner turns 70½, unless he or she is still employed.

A 50% penalty is applied on the minimum withdrawal if it is not taken for that tax year.

How To Maximize Your 401 Retirement Savings

A workplace 401 account can be a powerful tool to help build your retirement savings. To maximize your 401 benefits, follow these tips:

1. Set your contribution level to take full advantage of your employers 401 match. If your company matches a certain percentage of your contributions, set your contribution level to take maximum advantage of the match. Otherwise, youre leaving money on the table.

2. Start contributing to your 401 immediately.

3. Take advantage of target-date funds. If youre overwhelmed by the investment options offered by your 401 plan, choose a target-date fund aligned with your anticipated year of retirement. Target date funds are optimized for your retirement timeline, making them great options for beginners or more hands-off investors.

4. Increase your 401 contribution percentage regularly. Each year, increase your 401 contribution rate by at least one additional percentage point. Gradual small increases have a minor impact on your take-home pay and a major impact on your retirement nest egg over time. In addition, if you receive any raises or bonuses, dedicate at least a portion of them to your savings.

Also Check: Should You Roll Over Your 401k

How Much You Should Contribute With The New Contribution Limits

The IRS determines whether or not to increase its contribution limits based on an annual basis. Sometimes changes in the Consumer Price Index have been very small, like on the order of 2% per year. Congress prefers to increase contributions in increments of at least $500, which they did this year.

With the ability to increase your contributions by $500 in 2020, you may be wondering if you should. My answer is a resounding yes.

If you divide that amount into monthly contributions, youre making only slightly smaller payments which will benefit you in the long run. Continuing to max out your 401k at this level is an ideal strategy,

Highly Compensated Employees In 2021

If you havent set up a 401 Safe Harbor plan yet, you may be considering one if youve failed nondiscrimination testing in the past or if you have a lot of highly compensated employees who want to maximize their retirement savings without reprisal.

For 2021 the same as 2020 a Highly Compensated Employee is defined as someone making more than $130,000 a yearor owning more than 5% of the business in the previous year. If the average employee puts 4% of their income into the retirement plan, a highly compensated employee generally cannot put more than 6% of their income in. Key employees must own less than 60% of the total assets in the plan, so the plan is not considered top-heavy.

To pass the IRS fairness testing easily, business owners may adopt a safe harbor plan and agree to make contributions on behalf of all employees. The deadline to adopt a new Safe Harbor 401 plan in 2021 is . The deadline to adopt the amendment necessary to convert a traditional 401 plan into a 3% nonelective safe harbor plan for 2021 is .

Also Check: Can Self Employed Get 401k

What Are The 401 Contribution Limits For 2021 And 2022

8 Minute Read | December 17, 2021

What if you had access to the same type of investing account millionaires use to build their wealth? Youd jump on the chance, right? Well, you do! Believe it or not, millionaires dont roll the dice on flashy investment trends. Nope! More than anything else, they invest money in their humble, unflashy 401 plan at work.

Thats right! According to The National Study of Millionaires, eight out of 10 millionaires invested in their companys 401 plan. They put money into their accounts month after month, year after year, until one day they looked up and their net worth was in the seven figures. And if they can do it, you can too!

Your 401 is an easy and effective way to put thousands of dollars away each year for retirement. So if youre one of the millions of Americans with access to a 401, dont take it for granted!

But just how much can you put into your 401 in 2021 and 2022? Lets take a look.

401 Contribution Limits For 2021

|

The 401 contribution limit is $19,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $58,000. |

|

The 401 compensation limit is $290,000.1 |

401 Contribution Limits For 2022

|

The 401 contribution limit is $20,500. |

|

The 401 catch-up contribution limit for those age 50 and older is $6,500. |

|

The limit for employer and employee contributions combined is $61,000. |

|

The 401 compensation limit is $305,000.2 |