What Is A Gold Ira

Made possible by the Taxpayer Relief Act of 1997, a gold IRA is a type of long-term retirement account in which a custodian holds precious metals for the account owner. Although gold IRA is the most common name, that doesnt mean you can only purchase gold with the plan. You can also hold certain types of silver, platinum and palladium. Gold IRA plans are typically self-directed IRAs, which allow more diverse investments than a traditional IRA.

One important thing to note: you cant simply collect anything made of those four materials. The IRS has a list of specific fineness requirements all precious metals must satisfy before you can have them in your gold IRA.

How To Switch A 401k To A Self Directed Ira

When you convert your 401k into an SDIRA you unlock your retirement fund and gain complete control of how the account is managed and invested. Rolling over your 401k to an IRA is actually a pretty simple process. The first thing you need to do is open a new IRA account. When this is done, rollover your 401k funds into the new account and youre good to go.For cryptocurrency options on your new IRA, you need to make sure you open a Self Directed IRA account. This is the only IRA account that allows for investing in crypto technologies. The term self-directed means you have full control over which investments are made and how much of your funds you wish to invest in any given asset. So, first things first, you need to identify a custodian to manage your account and then begin the process of opening a new self-directed IRA. See below for the steps involved in opening a new IRA account.

Can I Convert 401 To Ira Without Leaving Job

You can transfer or roll over your 401 funds to a self-directed IRA if you separate from your employer due to retirement, termination, or simply quitting your job. You can transfer the funds just like you would to another 401 or a traditional IRA. The difference is, you use a specialized IRA, which allows you to invest in instruments other than stocks, bonds and mutual funds.

Also Check: How Can I Get My 401k Money Without Paying Taxes

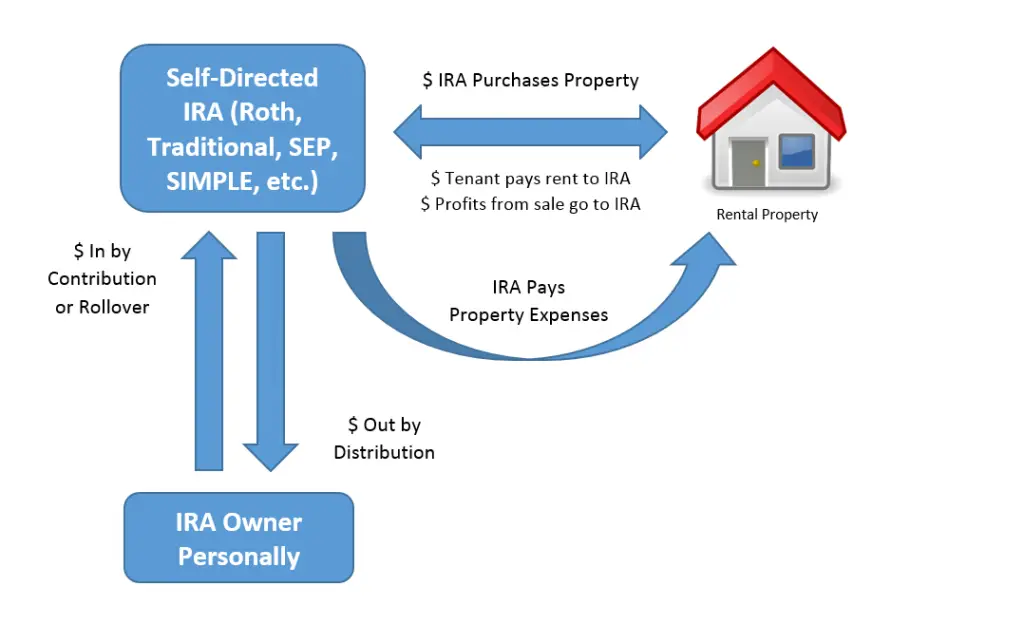

Investment Options With Self

Once the rollover is complete, you will be ready to start making some new investment choices. With the wealth already accumulated through your former 401, you can invest in many options with a Self-Directed IRA, such as:

- Real estate, including apartments, single family homes, commercial properties, or undeveloped land

- Limited Liability Companies

- Equipment leasing

- Other investments options

With such a varied list of alternative investments, you can build a strong, versatile portfolio that will utilize the funds you accumulated with your previous employer 401 while also enjoying the benefits of a Self-Directed IRA. To learn more about how to set up a new Self-Directed IRA, contact us for a free consultation today.

Can You Move Your Managed 401k

The short answer is yes. However, you need to consider if its the right move for you. Remember to learn how a self-directed IRA works, who can benefit from one, and all pertinent details.

A self-directed IRA could be a great move for you. To learn more about how to get started investing with a self-directed IRA, schedule a 1-on-1 consultation with an IRA Specialist by clicking HERE.

Read Also: How To Claim 401k Money

Rolling Over To A New 401

If your new employer allows immediate rollovers into its 401 plan, this move has its merits. You may be used to the ease of having a plan administrator manage your money and to the discipline of automatic payroll contributions. You can also contribute a lot more annually to a 401 than you can to an IRA.

Another reason to take this step: If you plan to continue to work after age 72, you should be able to delay taking RMDs on funds that are in your current employer’s 401 plan, including that roll over money from your previous account. Remember that RMDs began at 70½ prior to the new law.

The benefits should be similar to keeping your 401 with your previous employer. The difference is that you will be able to make further investments in the new plan and receive company matches as long as you remain in your new job.

But you should make sure your new plan is excellent. If the investment options are limited or have high fees, or there’s no company match, the new 401 may not be the best move.

If your new employer is more of a young, entrepreneurial outfit, the company may offer a Simplified Employee Pension IRA or SIMPLE IRAqualified workplace plans that are geared toward small businesses plans). The Internal Revenue Service does allow rollovers of 401s to these, but there may be waiting periods and other conditions.

Is It Better To Open An Ira With A Bank Or Brokerage Firm

Most retirement savers should open an IRA with a broker

Because youre investing your retirement cash for the long-term and hoping to eventually have enough to comfortably stop working you need higher returns than youll get at a bank. This is why you probably want to open an IRA at a brokerage.

You May Like: What Is A Simple 401k

Roll It Over To An Ira

This option makes sense if you want to roll over your 401 and you want to avoid a taxable event. If you have an existing IRA, you may be able to consolidate all of your IRAs in one place. And an IRA gives you many investment options, including low-cost mutual funds and ETFs.

There are plenty of mutual fund companies and brokerages that offer no-load mutual funds and commission-free ETFs, says Greg McBride, CFA, Bankrate chief financial analyst.

You also want to just make sure that youre satisfying any account minimums so that you dont get dinged for an account maintenance fee for having a low balance, McBride says. Index funds will have the lowest expense ratios. So theres a way that you can really cut out a lot of the unnecessary fees.

Check with your IRA institution first to ensure that it will accept the kind of rollover that you would like to make.

The letter of the law says it is OK . But in practice, your 401 plan may not allow it, says Michael Landsberg, CPA/PFS, member of the American Institute of CPAs Personal Financial Planning Executive Committee.

How The Rollover Process Works

If you decide to roll over a previous employer 401 to a Self-Directed IRA, the process is really pretty simple. One important thing to remember is that all activities related to the rollover should be compliant with IRS procedures to avoid any tax penalties. With a direct rollover, you will initiate the rollover with your previous employer custodian and complete the required paperwork. Then, you will direct your previous custodian to roll over your funds to the new custodian to create your new Self-Directed IRA.

You May Like: How To Invest In Stocks Using 401k

Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Contact Your Current Custodian

Once your rollover form is complete, contact your current custodian to withdraw funds from your account. Follow your current custodians withdrawal actions and adhere to the steps below for a Direct or Indirect Rollover to send your funds to Entrust.

Direct:

Have your current custodian make the check payable to:

The Entrust Group, Inc. FBO Account #

Example: The Entrust Group, Inc. FBO John Smith Account #12345

Mail check directly to The Entrust Group at:

The Entrust Group, 555 12th Street, Suite 900, Oakland, CA 94607

You will receive a confirmation email after we receive the funds from your current custodian. If you dont receive a confirmation email within 7-10 business days of reaching out, contact your current custodians for the status of your rollover.

Indirect/60-day rollover:

After receiving the check from your custodian, endorse the back portion and send it to The Entrust Group at:

The Entrust Group, Inc. FBO Account #

Example: The Entrust Group, Inc. FBO John Smith Account #12345

You will receive a confirmation email after we receive your check and deposit it into your account. If you dont receive a confirmation email within 7-10 business days of sending the check, please contact us for an update.

Set up a complimentary consultation with one of our IRA specialists today if you have additional questions or require more information about the process.

Recommended Reading: How Do You Withdraw From 401k

What Are The Advantages Of Rolling Over A 401 To An Ira

Doing a 401 rollover to an IRA offers perks that can include more diverse investment selections than a typical 401 plan, perhaps cheaper investments and lower account fees. It’s also a way to keep your retirement funds organized and ensure you have easy access to them. And while some 401 plans pass account management fees along to the employees, many IRAs charge no account fees.

In summary, it’s a good way to save money, stay organized and make your money work harder.

How To Transfer A Sep Ira To A Self

You receive a retirement tax professional to achieve a Self-Directed SEP IRA. He or she will work with you to establish your new Self-Directed IRA account at a new FDIC and IRS approved IRA custodian.

Then, the new custodian will request the transfer of your SEP IRA assets from the existing IRA custodian. Of course, they will only do this after your consent. The transfer will be tax-free and penalty-free.

Once the transfer of IRA funds is either complete by wire or check tax-free to the new IRA custodian, the new custodian will be able to invest the IRA assets into the new IRA LLC checkbook control structure. With the newly funded IRA LLC, you become manager of the LLC. This provides you with checkbook control over your retirement funds and investments.

Read Also: What Do You Do With 401k When You Retire

Who Wants A Self

The self-directed IRA might appeal to an investor for any of several reasons:

- It could be a way to diversify a portfolio by splitting retirement savings between a conventional IRA account and a self-directed IRA.

- It could be an option for someone who got burned in the 2008 financial crisis and has no faith in the stock or bond markets.

- It may appeal to an investor with a strong interest and expertise in a particular type of investment, such as cryptocurrencies or precious metals.

In any case, a self-directed IRA has the same tax advantages as any other IRA. Investors who have a strong interest in precious metals can invest pre-tax money long-term in a traditional IRA and pay the taxes due only after retiring.

The self-directed aspect may appeal to the independent investor, but it’s not completely self-directed. That is, the investor personally handles the decisions on buying and selling, but a qualified custodian or trustee must be named as administrator. Otherwise, it’s not an IRA as the IRS defines it.

The administrator is usually a brokerage or an investment firm.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Don’t Miss: Are Part Time Employees Eligible For 401k

Beware 401 Balance Minimums

If your account balance is less than $5,000 and youve left the company, your former employer may require you to move it. In this case, consider rolling it over to your new employers plan or to an IRA.

If your previous 401 has a balance of less than $1,000, your employer has the option to cash out your accounts, according to FINRA.

Always keep track of your hard-earned 401 money and make sure that it is invested or maintained in an account that makes sense for you.

Pick An Ira Provider For Your 401 Rollover

Before you transfer your cash, consider the services, investment offerings and fees of several investment companies who might serve as your IRA provider. For instance, to buy assets beyond stocks, bonds, mutual funds or ETFs, youll need a custodian that allows you to open a self-directed IRA you can find a list of self-directed IRA custodians online to start your research.

Read More: Differences Between IRA and Non-IRA Accounts

You May Like: How Do I Get 401k Money Out

Can I Rollover Or Transfer Myexisting Retirement Account To Aself

|

Transfer/Rollover |

|

|---|---|

|

I have a 401 account with a former employer. |

Yes, you can rollover to a self directed IRA. If it is a Traditional 401, it will be a self-directed IRA. If it is a Roth 401, it will be a self-directed Roth IRA. |

|

I have a 403 account with a former employer |

Yes, you can roll-over to a traditional self-directed IRA. |

|

I have a Traditional IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed IRA. |

|

I have a Roth IRA with a bank or brokerage. |

Yes, you can transfer to a self-directed Roth IRA. |

|

I dont have any retirement accounts but want to establish a new self-directed IRA. |

Yes, Yes, you can establish a new Traditional or Roth self-directed IRA, and can make new contributions according to the contribution limits and rules found in IRS Publication 590. |

|

I have a 401 or other company plan with a current employer. |

No, in most instances your current employers plan will restrict you from rolling funds out of that plan. However, some plans do allow for an in-service withdrawal if you are at retirement age. |

Benefits Of Rolling Over Your 401

Don’t Miss: How Do I Stop My 401k

How To Transfer Your Sep Ira To A Self

Is your retirement account not working out for you the way you hoped? Or maybe you’re just ready to kick it up a notch and have already heard about the amazing benefits of having a Self-Directed IRA LLC. The rumors are true: Self-Directed IRA LLCs let you take total control in your financial future and may give you the most investment flexibility and diversity of all the retirement options currently on the market.

Whatever your motivations, this article will tell you everything you need to know about SEP IRA transfers to a Self-Directed IRA LLC. We’ll break the process down step by step, and also point out where you’re going to want some help from the pros. Let’s get moving.

Moving The Funds From The Solo 401k To The Self

If by Check:

- Make the FULL transfer check from the PRETAX solo 401k account payable in the name of the new IRA custodian F.B.O. your name.

- List the IRA account number and write Full Solo 401k Direct Rollover to Pretax IRA on the memo section of the check.

If Electronically:

- You may also have the bank or brokerage form holding the solo 401k funds move the funds electronically such as by wire to your Pretax IRA.

If an alternative investment such as real estate is being transferred from the solo 401k to your pretax IRA, make sure to first get the property valued /appraised to ensure the correct amount transfer amount is reported on Form 1099-R to the IRS, and you will need to have the property assigned/deeded from the solo 401k to the IRA. If real estate, You will need to contact the county recorder to have this done.

About Mark Nolan

Each day I speak with energetic entrepreneurs looking to take the plunge into a new venture and small business owners eager to take control of their retirement savings. I am passionate about helping others find their financial independence. Having worked for over 20 years with some of the top retirement account custodian and insurance companies I have a deep and extensive knowledge of the complexities of self-directed 401ks and IRAs as well as retirement plan regulations. Learn more about Mark Nolan and My Solo 401k Financial > >

Also Check: How To Find Where Your 401k Is