Transferring A 401 Plan And Ira To A Canadian Rrsp

Investment Insight

If youve been living and working in the United States, youd have likely accumulated retirement savings while employed. Now that youve returned to Canada, youre probably considering transferring the retirement savings you accumulated abroad to a Canadian registered retirement savings plan ¹ but are concerned about the tax implications and the logistics associated with such a transfer.

What Do You Do With Your 401 When You Leave Your Job

You may change jobs several times throughout your career, which means you could end up with several retirement accounts. Some options you have for an old 401 include:

-

Doing a 401 rollover into an individual retirement account or a ROTH IRA at an online brokerage or a robo-advisor.

-

Rolling over your old 401 into a new employer’s 401 plan.

-

Keeping it with your former employer.

» Can you have a Roth IRA and a 401? Yes, but there’s more to it than that.

What Is A 401k Rollover

If you lose or leave your job, your 401k retirement savings can come with you. When this happens there are options for your 401k funds and one is to conduct a rollover into an Individual Retirement Account . The IRS allows you to direct the rollover to another plan or IRA. Having a financial advisor to assist you in clarifying your options and in the decision making is sometimes helpful.

Read Also: Can You Rollover A 401k To Another 401 K

Changing Jobs The Ins And Outs Of A 401 Rollover

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

If you’ve decided to leave your current job for another, you will need to decide what to do with the money that you have invested in your current company’s 401 plan. Options typically include leaving it where it is, rolling it over to a new employer’s plan, or opting for an IRA rollover.

If you are about to change jobs, here’s what you need to know about rolling over your funds into a new employer’s 401 plan and the ins and outs of other options.

Reasons You May Want To Wait To Roll Over Your 401

- Temporary ban on contributions. Some plan sponsors impose a temporary ban on further 401 contributions for employees who withdraw funds before leaving the company. You’ll want to determine if the gap in contributions will significantly impact your retirement savings.

- Early retirement. Most 401s allow penalty-free withdrawals after age 55 for early retirees. With an IRA, you must wait until 59 ½ to avoid paying a 10% penalty.

- Increased fees. IRA investors may pay more fees than they would in employer-sponsored plans. One reason: The range of more sophisticated investment options you may choose can be more expensive than 401 investments. Your advisor can help identify what extra cost a rollover may incur and if the benefits of the rollover justify those additional costs.

- Can take loans out. Your 401 may permit you to take out a loan from the account, but this is typically only for active employees. And you may have to pay in full any outstanding loan balances when you leave the company. You cannot take loans from IRAs.

Also Check: Can I Have A 401k And An Ira

Can A 401k Loan Be Transferred

If you quit your job with an outstanding 401 loan, you may consider transferring the loan to another retirement account. Find out if this is possible.

If you are paying a 401 loan and you lose your job, you could be wondering what to do with the loan. Do you leave it with the soon-to-be former employer or do you transfer it to your new retirement account? Usually, when you quit or leave your job, you will have to pay off the loan before the tax deadline. If you are unable to pay the 401 loan, any outstanding balance will be considered an early distribution, which triggers income taxes and a 10% penalty tax.

Normally, a 401 loan cannot be transferred to another retirement account. If a plan allows partial rollovers, you may be able to rollover the 401 balance minus any outstanding 401 loan balance. Some employers do not allow partial rollovers, and you may be required to pay off the 401 loan fully before you can rollover the 401 balance. However, if the company is acquired or sold, you may be allowed to rollover the 401 account, including the outstanding 401 loan, to a new employerâs 401 plan.

You May Like: How Much Should I Have In My 401k At 60

Open Your Rollover Ira In 3 Easy Steps Were Here To Help You Along The Way Too

Investment, insurance and annuity products are not FDIC insured, are not bank guaranteed, are not deposits, are not insured by any federal government agency, are not a condition to any banking service or activity, and may lose value.

Consumer and commercial deposit and lending products and services are provided by TIAA Bank®, a division of TIAA, FSB. Member FDIC. Equal Housing Lender.

The TIAA group of companies does not provide legal or tax advice. Please consult your tax or legal advisor to address your specific circumstances.

TIAA-CREF Individual & Institutional Services, LLC, Member FINRA and SIPC , distributes securities products. SIPC only protects customers securities and cash held in brokerage accounts. Annuity contracts and certificates are issued by Teachers Insurance and Annuity Association of America and College Retirement Equities Fund , New York, NY. Each is solely responsible for its own financial condition and contractual obligations.

Teachers Insurance and Annuity Association of America is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 3092.

TIAA-CREF Life Insurance Company is domiciled in New York, NY, with its principal place of business in New York, NY. Its California Certificate of Authority number is 6992.

Also Check: How To Withdraw Money From My Fidelity 401k

Don’t Miss: When Can I Take 401k

You Prefer Convenience Over Control

Perhaps you opened an IRA with the intention of putting together a diverse portfolio and actively managing your investments. However, youre now finding that you dont have the time or energy to devote to your portfolio and feel that youre in over your head. Rolling over your IRA to a 401 and giving up some control may better fit your needs as an investor.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

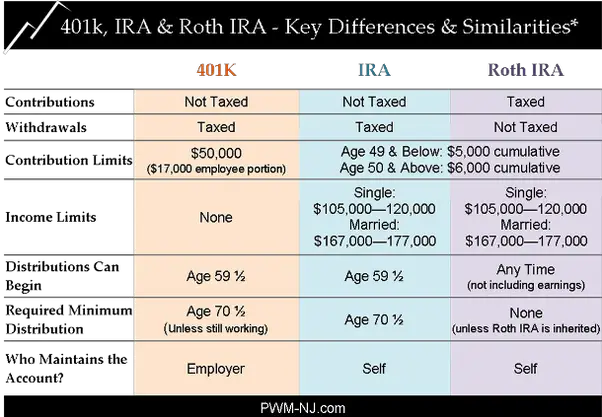

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

You May Like: How Do I Transfer My 401k To A Roth Ira

Con: Delayed Access To Funds

Withdrawals from 401 accounts before the age of 59 1/2 are subject to a 10% penalty. There is one exception to this rule: if you retire at the age of 55, you can remove money from your 401 account without penalty. This exception does not apply to IRA accounts, so youll have to wait until youre 59 1/2 to take money out without penalty.

What Happens If I Dont Make Any Election Regarding My Retirement Plan Distribution

The plan administrator must give you a written explanation of your rollover options for the distribution, including your right to have the distribution transferred directly to another retirement plan or to an IRA.

If youre no longer employed by the employer maintaining your retirement plan and your plan account is between $1,000 and $5,000, the plan administrator may deposit the money into an IRA in your name if you dont elect to receive the money or roll it over. If your plan account is $1,000 or less, the plan administrator may pay it to you, less, in most cases, 20% income tax withholding, without your consent. You can still roll over the distribution within 60 days.

You May Like: When Can You Access 401k

Recommended Reading: How To Choose 401k Investment Options

Why Choose Irar For Your Self

The answer is clear and simple!

Your account will be serviced by an experienced team of Certified IRA Services Professionals with expertise in self-directed IRAs. Our knowledge and experience in self-directed IRA rules, regulations, and recent trends, will assist you in making smart educated decisions.

Youll also be able to save over 50% compared to fees charged by other industry providers. We believe in maintaining lower fees because were committed to helping you build long-lasting retirement wealth.

At IRAR we see many cases in which IRA owners transfer their existing self-directed IRA to IRAR because theyve grown unhappy with their current provider account fees were too high, poor service, or the provider has gone out of business or changed in management.

Regardless of the reason, we want to help.

Can You Transfer A 401 To An Ira While Youre Still Employed

Thousands of Americans wonder the same thing: Can I transfer my 401 to an IRA if Im still with my current employer? Yes, theres a good chance you can.

While most people think about transferring their 401 after they leave a job, its actually something you might be able to do while youre still in that joband doing so could offer some attractive asset options. Learn when it makes sense to roll some of your 401 into an IRA while still employed, along with the advantages.

Don’t Miss: How To Opt Out Of Fidelity 401k

Why It Works To Move Your Retirement Plan To A Self

There are numerous reasons people choose to transfer and/or rollover their retirement account to a self-directed IRA. The main reason is to protect their savings from a volatile stock market or unpredictable changes in the economy. By diversifying their investments, they have a greater opportunity to stay on track with their retirement goals.

Self-directed IRAs are also known to perform much better than stocks and bonds. A recent examination of self-directed investments held at IRAR suggests that investments held for 3 years had an ROI of over 23%. This is why most investors are self-directing their retirement.

How To Roll Your 401k Into An Ira While You’re Still Working

The so-called In-Service Distribution can help those near retirement gain more control over their money.

A client recently walked into my office and placed his 401 statement on my desk. He looked at me, pointed to the document and asked, “Can I bombproof my 401?” We reviewed his statement, investment options and expenses, then considered his ability to lower risk inside the 401.

Unimpressed, his next question was, “Is there anything else I can do?” I hesitated for a moment, then asked him if he’d ever considered an In-Service Distribution. He looked at me with a blank stare that immediately let me know he had no idea what I was talking about.

Many employees diligently focus their energy on accumulating assets into their Employee Retirement Income Security Act 401 or 403 employer plans. But, they don’t take the time to understand all the associated rules specifically, in-service distributions and other options those plans may afford to them as they approach retirement age.

Background

Most employees are aware they have the option to roll their employer plan over to an Individual Retirement Arrangement when they retire. However, very few know that they can take a distribution from the plan while they’re still employed with the company. The employee must be over the age of 59.5 to access the majority of their funds, and the fact that the Employee Retirement Income Security Act of 1974 may allow for such a distribution doesn’t necessarily mean your employer’s plan permits it.

Also Check: Does Max Contribution To 401k Include Employer Match

You Expect To Earn More Money In The Future

If you plan to earn lots of money in the future or earn a high income now you should consider rolling your funds into a Roth IRA instead of a traditional IRA. For single filers in 2016, the maximum income allowable for contributions to a Roth IRA starts at $117,000 and ends at $133,000. Learn more about Roth IRA rules and contribution limits here. For married filers, on the other hand, the ability to contribute to a Roth IRA begins phasing out at $184,000 and halts completely at $194,000 for 2016. The more you earn in the future, the harder it will become to contribute to a Roth IRA and secure the benefits that come with it.

Can I Roll Over A Portion Of My 401

There a few limited circumstances where a partial 401 rollover makes sense.

There are a few different investment options for retirement that most of you are using, such as traditional IRAs, Roth IRAs, and employer-sponsored 401 retirement plans.

These retirement plans allow you to squirrel away pre-tax money. When you take it out after you retire, the money is taxed at your current tax bracket rate, which will be presumably lower than your tax bracket while working .

Not all your retirement savings have to be in the same place and there are certainly tax benefits to mixing your retirement accounts across a mix of pre-tax and post-tax options.

Lots of people ask what they should do with an old 401 when they change jobs. Some people leave the 401 with the previous employer while others choose to move the old 401 to the new employer.

But what if you only want to rollover a portion of the money? Can you do that? Lets find out.

Don’t Miss: How Do You Move Your 401k When You Change Jobs

How Do I Prove Ira Rollover To Irs

Look for Form 1099-R in the mail from your plan administrator at the end of the year. Your rollover is reported as a distribution, even when it is rolled over into another eligible retirement account. Report your gross distribution on line 15a of IRS Form 1040. This amount is shown in Box 1 of the 1099-R.

Background Of The One

Under the basic rollover rule, you dont have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you cant make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

Don’t Miss: Can I Use 401k To Pay Off Credit Card Debt

How Do I Avoid Tax On Ira Withdrawals

How to Pay Less Tax on Retirement Account Withdrawals

Some Reasons To Do A Rollover

There are many reasons to consider a rollover:

1 Simplification through account aggregation and consolidation

If you currently have one or two employers 401, as well as a Traditional and Roth IRA, it may make sense to consolidate the 401s with the IRA for simplification and ease of management. Asset allocation and account performance monitoring and management are more straightforward with fewer accounts .

Also, when you reach age 72 , you will be required by the IRS to take Required Minimum Distributions from your non-Roth accounts. Consolidating your traditional accounts makes it easier to calculate the RMDs and make regular withdrawals.

2 Access to a broader range of investment options

Many employer plans offer a limited menu of investment options. You can invest in literally thousands of stocks, bonds, mutual funds, ETFs, and other securities with an IRA.

3 Lower investment and management fees

Its important to know what your 401 investments are costing you, both in terms of any account management fees and fund fees . These fees can be difficult to identify as they tend to be buried in the minutia of plan and fund documents and disclosures.

If youre a do-it-yourself investor in your IRA and invest in low-cost index funds or ETFs, you can keep your costs in the 20 to 80 basis points range . That means that for every $100,000 of assets, youre paying an average of $50 per year in fees. .

4 More control over asset allocation

5 Account-size benefits

Recommended Reading: How Do You Roll A 401k Into An Ira