Does Your Employer Penalize Aggressive Saving Odds Are Yes

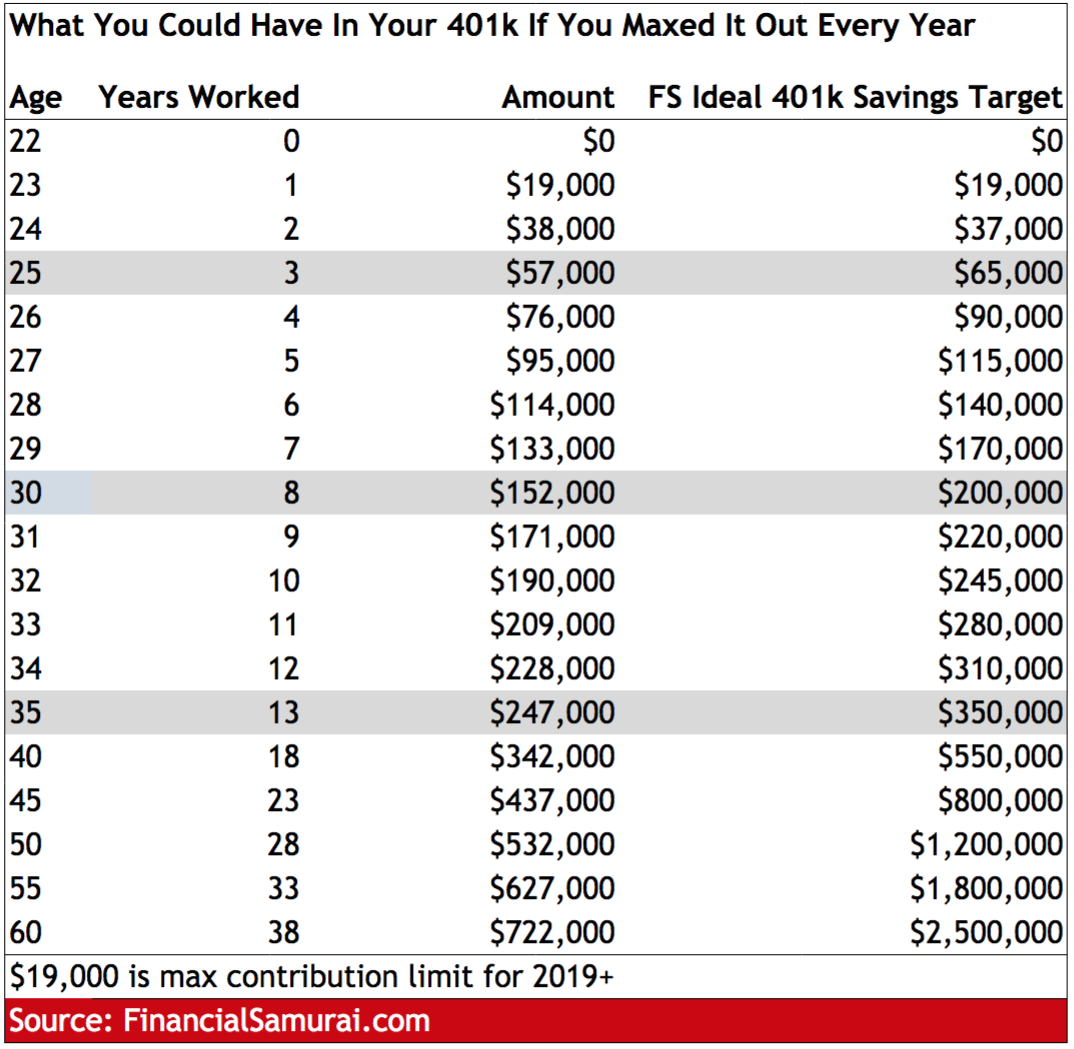

Hats off if youre maximizing your 401k deferrals and reaching the federal employee contribution limit each calendar year: $19,000 in 2019 if youre age 49 or younger or $25,000 in 2019 if youre age 50 or over. Note: these limits have increased to $19,500 and $26,000 respectively for the tax year 2021. Additional congratulations if youre maximizing these deferrals early in the year to really exploit the tax deferral and then shifting your savings to a different account later in the year.

Sadly, financial diligence and front-loaded saving can have a costly drawback if you work for an employer that matches contributions. You read that correctly. Aggressively maximizing your 401k contributions and working for an employer that matches those contributions actually backfires. Often. And in a big, costly way.

Consider the scenario where Dana makes $240,000 per year and gets paid bi-monthly. Her employer matches 100% of the first 6% of income that she defers to the companys 401k plan. Dana is an aggressive saver and elects to defer 25% of her compensation to the 401k plan resulting in contributions of $2,500 each pay period. Her employer kicks in a $600 match each pay period . Dana reaches her 2019 contribution limit of $19,000 on her eighth paycheck at the end of April.

Roth 401 Income Limits

Unlike Roth IRAs who are limited to those who make less than $140,000 individually and $208,000 combined for married couples, Roth 401s arenât limited by the participantâs income levels.

Still limited not to exceed the Roth 401 participantâs total income however, employees can still contribute to a Roth 401 regardless of how much they make annually.

Nice Jobcongratulations On Taking Advantage Of Your Company’s Employer Match To See How Your Money Is Going To Grow Over Time Try Out Our Compounding Calculator

This calculator is intended as an educational tool only. John Hancock will not be liable for any damages arising from the use or misuse of this calculator or from any errors or omission in the same.

Employer match is not available for all plans. See your Summary Plan Description for availability and information about your employer’s vesting schedule.

John Hancock Retirement Plan Services ⢠200 Berkeley Street ⢠Boston, MA 02116

NOT FDIC INSURED. MAY LOSE VALUE. NOT BANK GUARANTEED

Also Check: How To Withdraw Money From Your Fidelity 401k

Definition And Example Of 401 Match

A 401 contribution often represents a percentage of an employee’s salary, and employers who offer matching contributions do so up to a certain percentage. How employers structure their plans can vary. Some may allow employees to choose a flat dollar amount rather than a percentage of earnings, and some matching contributions may be defined as a percentage of the employee’s contribution. For example, an employer might match 50% of what an employee contributes with either a maximum dollar amount or no cap. Some generous employers might even match 100% with no cap.

For example, an employer might agree to match contributions up to 5% of an employee’s salary. In that case, if an employee earning $1,000 per week were to contribute 5% of her salary, and her employer were to match that amount, she’d see her 401’s principal balance grow by $100 per week even though she was having only $50 deducted from her weekly paycheck.

With the benefits of compound returns, your 401 match, along with returns, can make a big impact within a few short years. The $50 per week that your employer chips in adds up to $2,600 per year and $26,000 within 10 yearsand that’s before investment returns. A return of 5% on $26,000 would mean another $25 per week in your account.

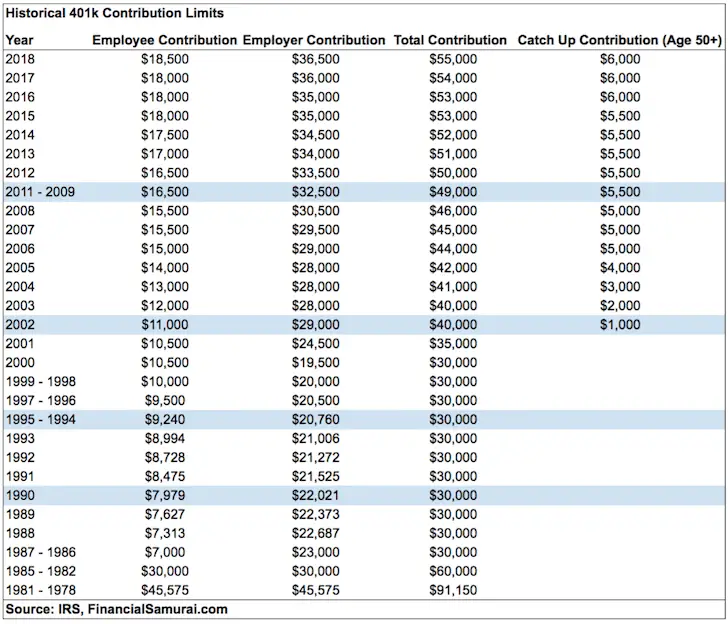

What Are The Maximum 401 Company Match Limits For 2021

Although the first 6% rule is expected to remain about average in 2021, some employers can be especially generous. To account for inflation, retirement plan contribution limits can change. Although inflation projected to increase in 2021 vs. 2020, contribution maximums will hold steady at $19,500 per employee. For those aged 50 and up, the catch up contribution limit will hover around $6,500.

In 2021, the employer and employee contribution limits will increase slightly and come to a grand total of $58,000. If you are a highly compensated employee , your minimum contribution in 2020 will remain at $130,000 in 2021.

In 2021, the employer and employee contribution limits will increase slightly and come to a grand total of $58,000. If you are a highly compensated employee , your minimum contribution in 2020 will remain at $130,000 in 2021.

Also Check: Can You Use 401k To Buy A Home

What Is A Partial 401 Match

With a partial 401 match, an employers contribution is a fraction of an employees contribution, and the employers total contribution is capped as a percentage of the employees salary. According to Jean Young, a senior research associate with Vanguard Investment Strategy Group, partial matching is the most commonly used matching formula in Vanguard 401 plans.

Matching structures vary by plan, said Young. In fact, we keep records on over 150 unique match formulas. But the most commonly offered match is $0.50 on the dollar, on the first 6% of pay. About one in five Vanguard plans provided this exact matching formula in 2018.

Lets say you earn $40,000 per year and contribute $2,400 to your 4016% of your salary. If your employer offers to match $0.50 of each dollar you contribute up to 6% of your pay, they would add $1,200 each year to your 401 account, boosting your total annual contributions to $3,600.

Maximize Your 401k Returns And Fees

Are you getting the most for your fees? Most people dont know what theyre paying in 401k fees. By some estimates, the average fees for 401k plans are between 1% and 2%, but some outliers can have up to 3.5%. Fees add upeven if your employer is potentially paying the fees, youll have to pay them if you leave the job and keep the 401k.

Essentially, if an investor has $100,000 in a 401 and pays $1,000 or more in fees, the fees could add up to thousands of dollars. Any fees you have to pay can chip away at your retirement savings and reduce your returns.

Its important to ensure youre getting the most for your money in order to maximize your retirement savings. If you are currently working for the company, you could discuss high fees with your HR team. One of the easiest ways to lower your costs is to find more affordable investment options. Typically, the biggest bargains can be index funds, which often charge just 0.3% to 0.5 %

If your employers plan offers an assortment of low-cost index funds or institutional funds, you can invest in these funds to build a diversified portfolio.

If you have a 401 account from a previous employer, you might consider moving your old 401k into a lower fee plan. Its also worth examining what kind of fund youre invested in and if its meeting your financial goals and risk tolerance.

Also Check: How Do I Transfer 401k To New Employer

Tax Deductible Ira Contributions If I Have A Solo 401k Question:

My question: As my wife and I are *not* contributing to our solo401k plan, does that mean that we are not active participants and IRA contributions are tax deductible?

Good question. Yes, you are still considered covered by a retirement plan at work even if you are not making solo 401k contributions.

While you can still contribute to a traditional IRA, your traditional IRA contribution deductions will be reduced if your AGI is a certain amount.

For 2021, if you are covered by a retirement plan, your deduction for contributions to a traditional IRA is reduced if your AGI is:

- More than $104,000 but less than $124,000 for a married couple filing a joint return or a qualifying widow,

- More than $65,000 but less than $75,000 for a single individual or head of household, or

- Less than $10,000 for a married individual filing a separate return.

Take Advantage Of The Maximum Allocation

The biggest number on the chart above for each year is in the Maximum Allocation column. That is the maximum amount of money that you can contribute to all tax-sheltered retirement plans that you have available to you. Its actually a more important factor than most people realize.

Despite the increasing 401 contribution limits, the average person isnt coming close to maximize their potential contributions to retirement plans of all types. The 2021 maximum allocation for all plans is a very generous $57,000, or $63,500 for workers 50 and older.

Thats the amount of money that you can contribute even beyond your 401 plan. You may be able to make tax-deductible contributions to a traditional IRA, or non-tax-deductible contributions to a Roth IRA, if your income is within the limits for either plan.

Also Check: How To Locate Lost 401k

Are There Separate Limits For Roth 401s

No. Roth 401s have the same contribution limit as regular 401s. For 2021, that limit is $19,500. For 2022, that limit is $20,500. You can contribute to both a traditional 401 and a Roth 401 account in the same year, as long as your total contributions dont exceed that amount. If youre choosing between the two, learn about the differences between a Roth and traditional 401.

|

no promotion available at this time |

Promotioncareer counseling plus loan discounts with qualifying deposit |

Promotionof free management with a qualifying deposit |

Does Your Employer Penalize Aggressive Saving

There are a few different ways that employers make matching 401k contributions and, as demonstrated above, the implications can be enormous for anyone who maximizes 401k contributions.

Payroll Matching The most common matching formula is payroll matching where the employer contributes the match with each paycheck. If you contribute to the 401k plan during the payroll period and your employer uses payroll matching, you get the matching contribution for that pay period. If you dont make a contribution during the payroll period, then there is no match. Will and Danas employer made matching contributions using this method.

Lump Sum Matching Some employers simply match once a year as a lump sum, usually after the calendar year has ended. In this situation, it does not matter when you contribute to the 401k. As long as you contributed to the plan during the year, you get your full match regardless of how many pay periods in which you contributed.

As long as your employer uses lump sum matching or a true-up feature, there is no downside to front-loading 401k contributions early in the year. Since most employers use the payroll matching formula with no true-up, employees in these companies who wish to maximize their annual contributions have to be careful about their contribution timing.

Alternatively, another large employer that uses payroll matching with a true-up provides an explanation in their benefit materials of the true-up:

Recommended Reading: How Often Can I Change My 401k Investments Fidelity

How Does Employer Match Count Toward 401 Limits

Some employers offer a 401 employer matching plan, which means they match the amount of pay an employee contributes toward their 401. The amount an employer matches can vary, depending on the company and IRS limits. Some employers match a portion of the employees contribution, while others match the full amount.

You can make the same contribution for all employees, or it can vary according to much each employee makes and change annually based on their earnings. For example, if an employee receives a raise at the end of the year, their employer may also increase their match amount. The most popular matching plan employers use is matching up to 6% of their employees annual income.

What Is The Standard 401k Employer Contribution

Short answer There is no standard 401k employer contribution as companies can decide for themselves how much they will add to an employees plan. That said, market trends are emerging, and the data below can give you a sneak peek into how your contributions compare with those of your competitors. The Low Down on Contribution

No account yet? Register

Short answer

There is no standard 401k employer contribution as companies can decide for themselves how much they will add to an employees plan. That said, market trends are emerging, and the data below can give you a sneak peek into how your contributions compare with those of your competitors.

Also Check: Who Has The Best 401k Match

Do 401 Contribution Limits Include The Employer Match

Employees are allowed to contribute a maximum of $19,500 to their 401 in 2020, or $26,000 if youre over 50 years of age. The good news is employer contributions do not count towards the $19,500 limit. Instead, employer matching contributions are subject to the lesser known $57,000 limit on all contributions made to a 401 account .

Your 401 can receive no more than $57,000 in contributions in a single year, whether those contributions are made by you or by your employer. That limit is three times the contribution limit for employees, so your employer would need to offer a 200% 401 employer match on all contributions you make for you to reach the limit.

The $57,000 limit mostly affects small business owners and the self-employed who pay themselves and make retirement contributions as both the employee and the employer. Most people who work for regular companies will never have to worry about the $57,000 overall limit.

Maximum Employer 401k Contributions

Id like to clear up a very common 401K misconception surrounding maximum contribution limits.

Question: The individual IRS maximum 401K contribution limit is $19,500 for 2021 and $20,500 for 2022 . But what exactly does this mean? Does this mean that if my employer matches my contribution dollar-for-dollar that I can only contribute half of the maximum?

Answer: No. The IRS maximum 401K contribution is how much you can personally contribute to your 401K during a calendar year. Your employers maximum 401K contribution limit is entirely up to them but the max on total contributions to your 401K is $58,000 in 2021 and $61,000 in 2022 . If age 50+, it goes up to $64,500 in 2021 and $67,500 in 2022, with the catch-up contribution.

Technically, this means that your employer could contribute up to $38,500 in 2021 and $40,500 in 2022, separate from your maximum personal contribution. Most employers do not contribute that much, however, and through after-tax contributions and an after-tax to Roth conversion, or mega backdoor Roth, its possible for you to contribute more than the individual contribution maximum in a given year .

You May Like: What Is A Good Percentage To Put In Your 401k

Getting The Most From Your Employer 401 Match

Getting the most from your 401 plan is one of the best things you can do when planning your retirement. Thatâs because your employer may match the money you put into your account. If you work at a place that offers a 401 match benefit, when you put money from your paycheck into your 401, your employer puts money into the account, too.

If your company offers a match, you may have gotten a notice about it when you started your job. You can ask the 401 plan manager at work whether a 401 match is offered if you havenât already heard about it. Companies want employees to contribute to their 401, so they match the funds as a way to spur on workers to save for their futures.

Think of matching funds as free money you receive from your job after you make pre-tax contributions to your 401 plan from your paycheck. If you fail to put money into your 401, you give up the chance to receive your employerâs matching amount.

Review The Irs Limits For 2022

The IRS has announced the 2022 contribution limits for retirement savings accounts, including contribution limits for 401, 403, and most 457 plans, as well as income limits for IRA contribution deductibility. Contribution limits for Health Savings Accounts have also been announced. Please review an overview of the limits below.

You May Like: What Happens To 401k When You Leave A Company

Employer Match Does Not Count Toward The 401 Limit

There are two sides to your contribution: what you provide as the employee and the match from your employer . You can only contribute a certain amount to your 401 each year. For tax year 2022 that limit stands at $20,500, which is up $1,000 from the 2021 level. This contribution limit includes deferrals that you elect to be withheld from your paycheck and invested in your 401 on a pre-tax basis.

The good news is that this limit does not include employer match contributions. If you contribute, say, $20,500 toward your 401 and your employer adds an additional $5,000, youre still within the IRS limits.

However, there is another limit which applies to overall contributions your employer match contributions are taken into account for this overall contribution limit. For tax year 2022, that limit stands at $61,000 or $67,500 when you include catch-up contributions for workers 50 or older. This means that together, you and your employer can contribute up to $61,000 for your 401. Note, though, that most employers are not this generous with their contributions, so youre likely in little danger of exceeding this limit.

What Is A 401 Retirement Savings Plan

A 401 is a retirement savings plan some employers offer their team as a financial benefit for working at the company. The U.S. government established the 401 to incentivize workers to save for their retirement.

Employees volunteer to have a certain amount deducted from their paychecks each pay period to go toward their 401 savings accounts. While employees usually choose how much theyd like to deduct from their paycheck, they often have a limit on how much theyre allowed to contribute.

Employers can offer one of two plans: a traditional 401 plan or a Roth 401 plan. For traditional plans, 401 withdrawals are taxed at the employees current income tax rate. Roth 401 withdrawals arent taxable if the 401 account is five years old or older and the employee is over 59 years old. There are specific regulations to follow regarding how much and how often an employee can withdraw these funds for their 401.

Many employers use 401s as an employee benefit for working at the company and as an incentive to keep long-term employees. Some employers require employees to work at a company for a certain amount of time before they can start depositing their paycheck money toward a 401.

Employees can choose the specific types of investments from a selection their employer offers. Some of these investment types may include stock and bond mutual funds, target-date funds, guaranteed investment contracts or the employers company stock.

You May Like: How Do I Roll Over My 401k