How Do I Log In To My Fidelity Account

You can get to the homepage by clicking on the Fidelity logo in the top left. Here you will be asked to enter the username and password you created. If this is the first time you are logging into your account online, you will need to click on the Register for online access button which is also in the top right hand corner of the homepage.

How To Find An Old : 7 Ways

People prone to leaving things behind usually don’t lose a 401 account, but it happens more often than you think – especially if you don’t have a great deal of cash stashed away in a 401.

Data from Plan Sponsor Council of America shows that 58% of 401 transfer balances are between $1,000 and $5,000 when a career professional leaves an employer. That’s not an insignificant range of money, but it’s money you could have working for you, if you could only find it.

Additionally, the U.S. Government Accountability Office states that over 25 million Americans with cash in a 401 or other employer retirement plan left that money behind when they moved on to greener career pastures.

People leave old 401 accounts behind for many reasons. The account holder may have engaged in a string of job-hopping experiences and lost an old retirement account in the shuffle. Or, the 401 account holder’s company merged with another firm, was bought out, or went bankrupt.

You might even automatically have been enrolled in an old 401 company by a firm you only spent a year or so working at, didn’t realize it, and completely missed bringing the 401 account along with you to your next job.

If that sounds vaguely familiar, how do you find the money you lost in an old 401 account and what do you do with it when you get it back?

There are plenty of ways to get the job done. Let’s take a closer look.

What Is The Purpose Of The My Notes Feature On The Statements And Trade Confirmation Pages Within Fidelitycom

The “My Notes” feature on your Statement and Trade Confirm pages allows you to associate your own notes regarding your account or confirmation statements. By clicking on “Add” or “Edit” within the My Notes column for the Statement/Trade Confirmation date chosen. You may enter a note of up to 100 characters. Each note is associated to a specific statement or trade confirmation. While these notes are not intended to be communications to Fidelity, they are covered under Fidelity’s Privacy Policy, and you should not include any notes that are confidential, personal or contain sensitive information. All questions or inquiry to Fidelity, should be addressed to Contact Us.

Read Also: Can I Rollover My 401k To A Roth Ira

Standard Deposits To Individual And Ira Accounts

- For most check deposits to individual brokerage accounts as well as to most IRA accounts , checks must be made payable to one of these:

- Fidelity Investments.

- National Financial Services, LLC.

- Account holder exactly as it appears on the Brokerage Account Registration. Checks payable to the account holder must be endorsed by the account holder to prevent paying bank from returning the check to Fidelity.

Dont Miss: How Do I Transfer 401k To New Employer

Other Ways To Find Lost Money

If you are hoping to find lost money, you might want to start by creating a comprehensive and detailed retirement plan. This enables you to:

- Document what you have right now.

- Take stock and think about what might be missing.

- Learning about what you need for a secure retirement is a great way organize your financial life.

- Discover opportunities to make more out of what you have. People who use the NewRetirement retirement planner typically improve their plans by thousands of dollars in their first session with the tool.

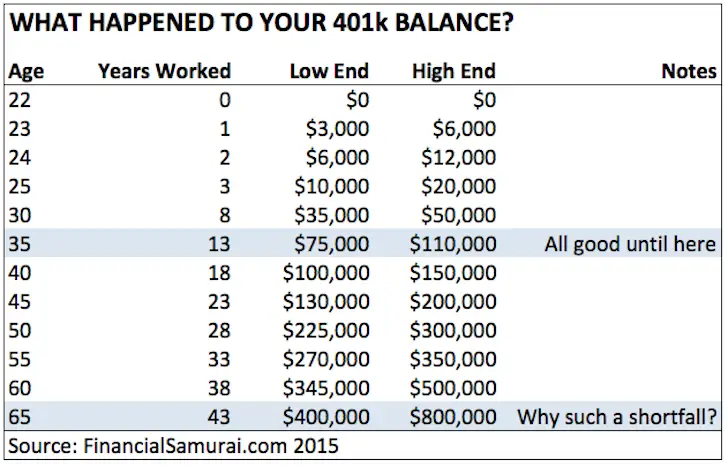

Don’t Miss: What Happens To Your 401k When You Quit A Job

How Can I Access My 401k Early

If none of the above exceptions fit your individual circumstances, you can begin taking distributions from your IRA or 401k without penalty at any age before 59 ½ by taking a 72t early distribution. It is named for the tax code which describes it and allows you to take a series of specified payments every year.

Also Check: How Much Does A 401k Cost A Small Business

I’m Enrolled In The Fidelity Electronic Delivery Program Why Do I Still Receive Statements In The Mail

If you’ve signed up for the electronic delivery program for statements, trade confirmations, prospectuses, financial reports, or other documents, and you are still receiving documentation in the mail, it may be because:

- The e-mail address Fidelity has on file may be incorrect. You must maintain a valid e-mail address with Fidelity as a condition of participating in the electronic delivery program. You may update your e-mail address under Related Links on the Statements, Trade Confirmations or Prospectuses/Reports page.

- Your statement is consolidated with a statement which cannot be delivered via the electronic delivery program.

- Your account is not eligible for the program. Ineligible accounts include business accounts retirement plans for which Fidelity is not the trustee, sponsor, or record keeper Fidelity 401k, 403b, and 457 accounts and workplace savings plans that provide a corresponding self-directed brokerage account.

- Your permanent address is a foreign address. Due to regulations governing electronic delivery of documents, customers who have a foreign permanent address cannot participate in the program.

- When purchasing certain new securities like municipal securities , government sponsored entities , initial public offerings , and non-Fidelity funds, we are currently required to mail the prospectus, reports, and any trade confirmations to your address of record.

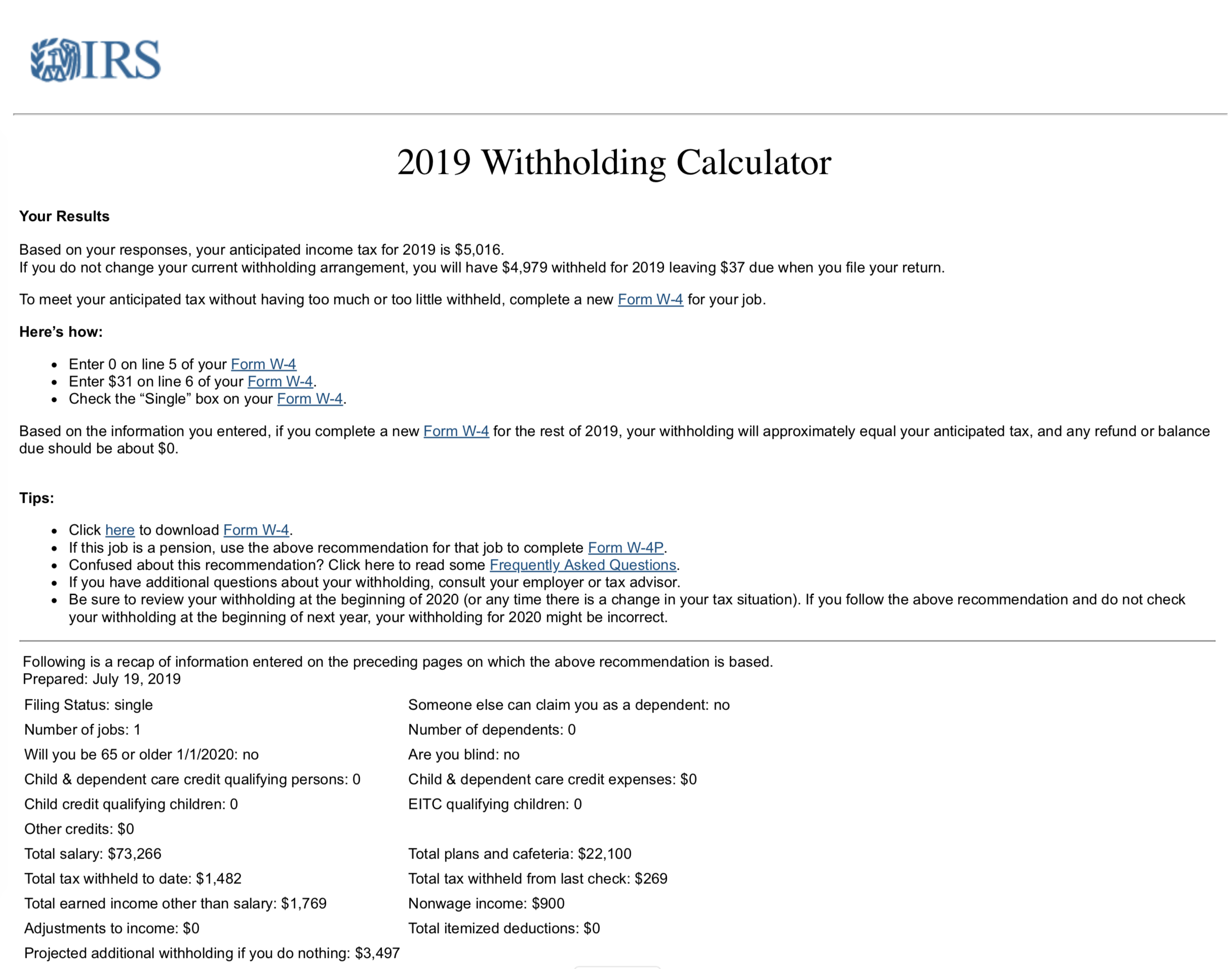

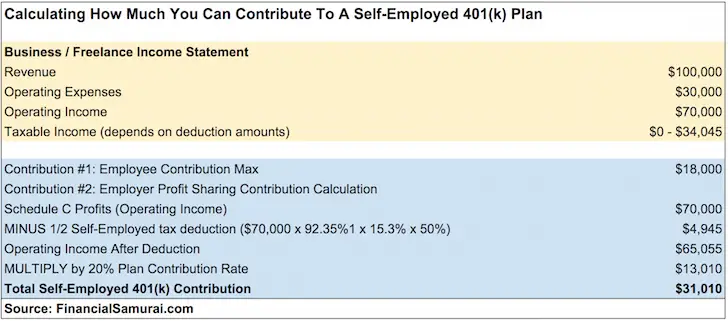

Don’t Miss: How To Calculate Max 401k Contribution

What Is A Benchmark And How Does It Affect My Investments

A benchmark is an index that represents a segment of the stock or bond market. Benchmarks are used as a standard against which to compare fund performance. You may be familiar with the Dow Jones Industrial Average or the S& P 500 index, two well-known indexes. The S& P 500, a common benchmark, is made up of the common stocks of 500 leading U.S. companies and is generally considered representative of the U.S. stock market. A relevant benchmark must be provided in the comparative chart for each investment in your plans lineup. Different benchmarks will be listed for different types of investments, so you can compare how funds in a similar category did compared to one standard .

Ways Of Finding My Old 401ks Including Using Ssn

If youâve ever left a job and wondered âWhere is my 401?â, youâre not alone. Locating 401âs is complicated. Thus, billions of dollars are left behind each year. Beagle can help track down your money.

Contributing to an employer-sponsored 401 plan is a great way to build wealth for retirement especially if youâre receiving a match from your company. The problem is they are tied to an individual employer. We forget about them, leave that company, and one day we realize âOh yeah! Where is my 401?â

A 401 can be in a few different places. Most commonly it could be with your previous employers, an IRA they transferred your funds to after you left, or mailed to the address they had on file.

Believe it or not, Americans unknowingly abandoned $100 billion worth of unclaimed 401 accounts. According to a US Labor Department study, the average worker will have had about 12 different jobs before they turn 40. So itâs easy to see how we can lose track of so much 401 money.

To find your old 401s, you can contact your former employers, locate an old 401 statement, search unclaimed asset database in different states, query 401 providers using your social security number or better yet, get some help to find your 401 accounts from companies like Beagle.

Read Also: How Can I Pull Money From My 401k

Prevent Losing Your 401s In The Future

Having a plan is the best way to prevent you from losing your 401s in the future. You should actively manage a 401 plan to ensure you’re on pace to meet your retirement goals.

Yearly or semi-yearly checkups are best. It’ll prevent you from analyzing your account’s performance and help you keep tabs on your account.

Having your 401 in the back of your mind, you more likely to remember to bring it with you when you leave your job.

Tags

Your 401 Plan When You Change Employers

Your employer can remove money from your 401 after you leave the company, but only under certain circumstances, as the Internal Revenue Service explains.

If your balance is less than $1,000, your employer can cut you a check for the balance. Should this happen, rush to move your money into an individual retirement account . You typically have just 60 days to do so or it will be considered a withdrawal and you will have to pay penalties and taxes on it. Note that the check will already have taxes taken out. You can reimburse your account when you reopen it.

If your balance is $1,000 to $5,000, your employer can move the money into an IRA of the companys choice.

Also Check: What Happens To 401k When You Die

Recommended Reading: How To Start A 401k For My Company

How To Measure Twice & Keep Finance Personal

To fully understand your employers 401 plan, ask your plan administrator for a copy of the Summary Plan Description . This document details your plans eligibility requirements, contributions/rollovers, vesting, and in-service distribution rules .

Ask your plan administrator if there is a dedicated investment advisor to help you align your risk tolerance with your risk capacity when choosing your funds. The plan administrator and investment advisor have a fiduciary responsibility to act in the best interest of the plan participants, so do not hesitate to ask questions or request more information about your retirement plan.

Review your retirement accounts individually but also together as a total portfolio, ensuring that each account is playing a different role but collaboratively aligned with your familys unique objectives and desired outcomes.

How Can I Find My Old 401 Account

Ask previous employers whether theyre maintaining any accounts in your name. If the company no longer exists, contact the plan administrator. If you dont know the name of the plan administrator, search the Department of Labor website for the companys Form 5500 , which will list their contact information. You might also check the states unclaimed property database via the National Association of Unclaimed Property Administrators .

Darin Bostic, a Schwab financial planner, points out that the best way to keep track of your funds is not to lose them in the first place. Consolidating similar accounts, such as old and new brokerage or IRAs, can help you keep track of your savings, says Darin.

Whats more, consolidation helps ensure your assets are working in harmony toward your long-term goals. Its difficult to follow a comprehensive investment strategy when your money is spread out all over the place.

Recommended Reading: Can I Roll A Roth Ira Into A 401k

Find 401s With Your Social Security Number

All your 401s are linkedin to your social security number when you enrolled. Theoretically you should be able to find all your 401s with your SSN. However, in practice it’s pretty hard for one to do so. As far as we know, Beagle is the only company that simplifies this process and can conduct a comprehensive 401 search using your SSN. Once they find your 401s, they also help you with the tedious rollover process.

What The Lifetime Allocation Illustration Is On Your 401 Statement

Dziubinski: Christine, there is a new development in 401 plan statements. Many investors are going to be seeing for the first time on this upcoming statement how much income their portfolio value would provide them in retirement. Give us a little bit of background on why investors are now going to be seeing this on their statements and then what they can do with that information.

Benz: This is a new Department of Labor regulation. It’s going into effect for the second quarter of 2022. And I do think the goal is a worthy one. The basic idea is to help participants take their 401 balances, which I think can often seem like an abstraction, and help them figure out whether it’s enough to provide them with the funds that they need in retirement. You’ll see two figures as part of this new metric. The first would be what your current balance would buy in terms of annuity, monthly annuity incomes, to cover your life only as well as your life and a survivor. So, the second number will typically be lower because it’s covering both lifetimes. But I think it’s a good starting point, at least, for helping participants determine whether they’ve saved enough. We often see that people aren’t good judges of whether they’ve in fact saved enough for retirement. This is intended to give them a little bit of a helping hand.

Dziubinski: Then, how should investors use these numbers, Christine?

Benz: Thank you so much, Susan.

Dziubinski: I’m Susan Dziubinski with Morningstar. Thanks for tuning in.

Don’t Miss: What Are The Best 401k Companies

Search Unclaimed Assets Databases

If your search is still coming up empty, your former employer has folded or was bought by another company, youâre not out of luck yet.

It may take a little more effort and research but there are many national databases that can help you track down your old 401 accounts:

- The Department of Laborâs Abandoned Plan database can help you identify what happened to your old plan and the contact information of the current administrator

- The National Registry of Unclaimed Retirement Benefits allows you to do a free search for any unclaimed retirement money using just your Social Security number

- FreeERISA is another free resource to search for any old account information that has been filed with the federal government

- The Securities and Exchange Commissionâs website or your stateâs Secretary of State can provide more information on your previous employer

Start Your Transfer Online

Youll get useful tips along the way, but you can call us if you have a question.

Youll need to:

- Enter the account information requested. Your instructions from that point will depend on the company holding your account and your account information. Not all transfers follow the same process, so well ask only for the information needed to complete your particular type of transfer.

- Enter your personal information, such as your birth date and Social Security number, or if youre already a Vanguard client, confirm the information that weve been able to prefill for you.

- Review your information and click Submit.

Want an idea of how long a transfer could take?

You May Like: How To Take Money Out Of Your 401k Fidelity

Will Walmart Cash 401k Checks

Walmart already cashes payroll, government and tax refund checks. Now, the retailer will cash more types of pre-printed checks including rebate, student loan, 401k, retirement, loan, IRA, pension, expense, insurance and MoneyGram money orders. The designated lanes will be for check and card cashing only.

Read Also: How Does Company Match Work For 401k

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Recommended Reading: How To Cash Out Nationwide 401k

Section 8 And Section 9

Rollover Existing Fidelity Solo 401k/keogh/psp: Question:

Yes your existing solo 401k with Fidelity Investments would get restated to our solo 401k plan which allows for 401k participant loans and investing in alternative investments such as real estate. We would then fill out new Fidelity brokerage account forms so that Fidelity can open a new brokerage account for the self-directed solo 401k that we offer. Note that Fidelity will not simply re-title the existing account. They require new brokerage forms. Subsequently, we would prepare an internal Fidelity transfer form to have Fidelity internally transfer the existing solo 401k equity holdings and cash to the new brokerage account for the self-directed solo 401k. You will then receive a checkbook in the mail from Fidelity for the new solo 401k for placing your alternative investments, and/or you can process the investments via wire.

Don’t Miss: Why Is A 401k Good