How Does A 401k Work

A 401k plan is a benefit commonly offered by employers to ensure employees have dedicated retirement funds. A set percentage the employee chooses is automatically taken out of each paycheck and invested in a 401k account. They are made up of investments that the employee can pick themselves.

Depending on the details of the plan, the money invested may be tax-free and matching contributions may be made by the employer. If either of those benefits are included in your 401k plan, financial experts recommend contributing the maximum amount each year, or as close to it as you can manage.

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employer’s plan. As with an IRA rollover, this maintains the account’s tax-deferred status and avoids immediate taxes.

It could be a wise move if the employee isn’t comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plan’s administrator.

Learn From Your 401 Balance

Although learning about the average 401 balance by age might help you understand where you stand compared to others, it wont help you analyze your retirement situation altogether. Since everyone has different finances, lifestyles, and unexpected emergencies, its important not to use 401 balance by age as your only benchmark.

Instead, you can use it as a way to motivate yourself to start making better financial decisions and contribute more each year. A good way to benchmark your savings is by using a retirement calculator that will give you more information on how much you will have saved by a certain age and how much you should be saving monthly to achieve your retirement goals. Bottom line: Saving early can set you up to be more prosperous later in life.

Recommended Reading: How Do I Collect My 401k

What To Do When You Find An Old 401

Once youve reconnected with your old 401, its time to decide what to do with it:

- Leave it with your old employer. If you contributed at least $5,000 to your old 401, you might consider leaving it where it is. But this may only be worthwhile if the account has competitive fees or offers access to unique investments. Otherwise, itll be yet another account to keep track of come retirement, and you may be better off rolling it over.

- New 401 rollover. Has your new employer offered you a 401? Consider consolidating your retirement funds by rolling your old retirement account into a new 401.

- IRA rollover. If you dont have a new 401 to move your old retirement funds into, consider rolling over into an individual retirement account. That way, your funds retain their tax-advantaged status.

- Cash it out. Consider this a last resort because cashing out a 401 ahead of schedule can result in major penalties.

- If youre older than 59 ½, you can access funds without penalty.

- If youre under 59 ½, withdrawals are subject to a 10% tax penalty and other fees.

Search Form 5500 Directory

All employers that provide 401 plans to their employees are required to fill out a 5500 form every year with the DOL. Websites like FreeERISA* allow users to search by company name to locate the correct Form 5500. Another option is to search the DOLs 5500 database. Both simple searches will provide you with additional contact information.

For further assistance in finding lost 401 plans, the U.S. Department of Labor has an Abandoned Plan Search, which helps participants and others find out whether a particular plan is in the process of beingor already has beenterminated. The name of the Qualified Termination Administrator responsible for the termination will be listed as well, giving you a good idea of who to contact .

But beware: some companies, even legitimate ones, can acquire your information about unclaimed retirement accounts and offer to assist you with your search, often with a percentage fee for their services.

When it comes to planning and saving for retirement, its vital to have all your assets accounted for. Locating an old 401 plan is like finding cash in the pocket of an old pair of jeans. Its money you forgot you had but are happy you found. So if you know youve contributed funds to a 401 account but cant figure out where those funds are, the resources listed above may help you find past retirement accounts that may have been lost along your employment journey.

Also Check: How To Put 401k Into Ira

How To Locate A 401 From A Previous Job

If youre trying to locate an old 401 plan from a previous job, youre not alone. Not by a long shot. Roughly $850 million in plan assets owned by 33,000 employees are orphaned each year, held by a financial institution without an employer to oversee the plan . Thats a lot of money being left on the tableroughly two percent of all 401 plan assets.

The good news is that the Department of Labor has established rules for protecting money put into a 401, so the money isnt necessarily lostjust waiting for someone to claim it. However, that doesnt mean your old 401 account will always be easy to track down. It may take some digging, but there are a variety of ways you can find it.

How To Check 401k Balance

Knowing how to check how much is your 401 can help calculate your net worth. Additionally, checking your 401 balance ensures your investments are performing, helping you reach your retirement goals.

Monitoring your finances should be cemented in your overall personal finance strategy. Whether it be your budget, credit profile, or retirement accounts, knowing where you stand is essential in determining your financial health. Some, like your bank accounts and credit, are relatively easy to monitor. However, figuring out how to check 401 balances can be more difficult.

Like your car, your 401 needs regular maintenance. Without it, it may not perform as well or will no longer fit your overall investment strategy anymore.

You can find your 401 balance by logging into your 401 plans online portal and check how your 401 is performing. If you donât have access to your account online, contact your HR department and make sure your quarterly statements are being sent to the correct address.

Checking your 401 too frequently can cause overwhelm and panic when the market isn’t performing well. Dips and peaks are typical for any long-term retirement investment. Checking your 401 balances at least once a year will help you gauge how it fits in your retirement strategy.

Letâs look into how to check how much is in your 401, what to look for, and how often you should be checking.

Read Also: Can I Roll Over 401k Into Ira

What Are The Rules For A Roth Ira

Roth IRAs are only available to people making less than $129,000 a year as an individual, or $191,000 for married couples. They have contribution limits of $5,500 a year, or $6,500 for those over 50. Unlike 401ks and traditional IRAs though, there’s no penalty for withdrawing part of your contribution early.

Roll Your 401 Into An Ira

The IRS has relatively strict rules on rollovers and how they need to be accomplished, and running afoul of them is costly. Typically, the financial institution that is in line to receive the money will be more than happy to help with the process and avoid any missteps.

Funds withdrawn from your 401 must be rolled over to another retirement account within 60 days to avoid taxes and penalties.

Also Check: Can I Open A 401k Without An Employer

Contact Your Old Employer About Your Old 401

Employers will try to track down a departed employee who left money behind in an old 401, but their efforts are only as good as the information they have on file. Beyond providing 30 to 60 days notice of their intentions, there are no laws that say how hard they have to look or for how long.

If its been a while since youve heard from your former company, or if youve moved or misplaced the notices they sent, start by contacting your former companys human resources department or find an old 401 account statement and contact the plan administrator, the financial firm that held the account and sent you updates.

You may be allowed to leave your money in your old plan, but you might not want to.

If there was more than $5,000 in your retirement account when you left, theres a good chance that your money is still in your workplace account. You may be allowed to leave it there for as long as you like until youre age 72, when the IRS requires you to start taking distributions, but you might not want to. Heres how to decide whether to keep your money in an old 401.

The good news if a new IRA was opened for the rollover: Your money retains its tax-protected status. The bad: You have to find the new trustee.

How To Find Old 401 Accounts

To corral all your accounts, you first must locate all your retirement plans. This is often the most time-consuming step in the process of organizing and streamlining your retirement portfolio, as youll sometimes have to do a bit of legwork to identify and find your old plans. The more jobs youve held, the more work youll need to do if you havent already rolled over those plans into other retirement accounts.

These suggestions can help you figure out how to find your 401k.

You May Like: Should I Invest My 401k

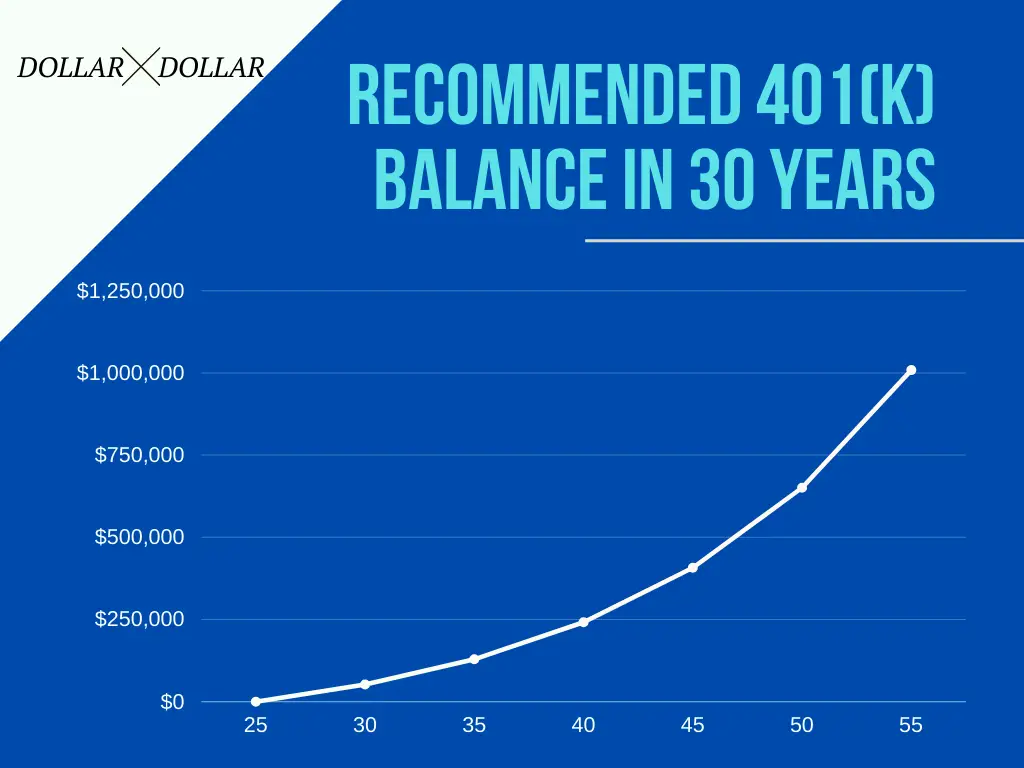

$1 Million Has Long Been The Recommended Goal For Retirement Savings Some Even Suggest That Number Should Be Upgraded To $2 Million For Millennials And Gen Z

If these numbers are starting to give you anxiety, youll be happy to hear that theyre reachable. According to Fidelity, the number of 401 plans with a balance of $1 million or more jumped to a record 168,000 in the second quarter of 2018, up from 119,000 a year earlier. Thats a 41 percent surge!

One of the top ways to make a $1 million 401 a reality is to take full advantage of your employer match. Thats when an employer contributes an amount to your retirement savings plan in addition to what you contribute. The rules for matches vary by company, and often depend on the amount that you contribute yourself.

Lets break down how employer matching works, the key rules to review, and how to maximize contributions to your workplace retirement plan.

Also Check: How To Find Out If Someone Has A 401k

How To Find Out If I Have A 401

The best way to make sure you donât lose track of your 401 is to periodically keep tabs on it. Although, checking your retirement accounts too frequently can lead to overkill and alarm if the market takes a dive. Aim for quarterly or semi-annual checks of your funds to make sure everything is in order.

Actively managing your 401 is a good habit to get into. Making sure your retirement accounts are being properly funded and youâre on track to meet your retirement goals should be etched into your overall personal finance plan.

However, if youâve let it slip for the past couple of years, no need to worry. Contact your human resources department to get information on how you can monitor your account.

You may be given access to an online portal for you to log in and manage your account.

Verify your statements are being sent to the correct address. Bookmark the account information so you always know where to log into your account from. Also, consider updating your login and password to make sure your account is more secure.

Read Also: How To Find 401k Account

When Can You Withdraw From Your 401k Without A Penalty

Wondering when can you withdraw from 401k? 59 and 1/2 is the current age when you can take money out of your 401k without incurring a penalty. However, the money you take out is still taxed as income. At the age of 70, you will be forced by the IRS to start taking distributions from your retirement accounts.

How Much Should I Invest

If you are many years from retirement and struggling with the here-and-now, you may think a 401 plan just isn’t a priority. But the combination of an employer match and a tax benefit make it irresistible.

When starting out, the achievable goal might be a minimum contribution to your 401 plan. That minimum should be the amount that qualifies you for the full match from your employer. To get the full tax savings, you need to contribute the maximum yearly contribution.

Don’t Miss: What To Do With 401k When You Leave Your Job

Call Your Old Employer

If you suspect you have missing 401 funds or even if you’re not sure, it’s still a good idea to contact old employers and ask them to check if they’re holding your old account. Your former company will have records of you actually participating in a 401 plan.

You’ll either need to provide or confirm your Social Security number and the dates of your employment, but if you can, you’ll have found the fastest way to dig up a missing 401.

Use Additional Government Document Recovery Tools

Lots of folks say the federal government is beholden to excessive paperwork and, in many ways, those people are right. But your hunt for an old 401 isn’t a good example of that mindset.

Exhibit “A” is the U.S. Department of Labor’s Abandoned Plan Database. The database can tell you if your company’s old 401 plan is still up and running, has been deep-sixed, or is being held by an outside administrator who can steer you to your old 401 account.

When using the website, the more information you can provide, the better. Your best bets include using the plan’s name, the name of your old employer, the city and state where the company resided, and the appropriate zip code.

Recommended Reading: How Do You Take Money Out Of 401k

How Long Will You Live In Retirement

Based on current estimates, a 65 year old man can expect to live approximately 18 years in retirement, and a 65 year old woman can expect to live about 20 years, but many people live longer. Planning to live well into your 90s can help you avoid outliving your income.

The worksheet takes into account some factors that impact your retirement savings. First, investing – because it involves risk. Second, inflation – because todays dollars will usually buy less each year as the cost of living rises. Your target savings rate includes any contributions your employer makes to a retirement savings plan for you, such as an employer matching contribution. If, for example, you are in a 401 plan in which you contribute 4 percent of your salary and your employer also contributes 4 percent, your saving rate would be 8 percent of your salary.

If you are not currently saving this amount, dont be discouraged. The important thing is to start saving even a small amount and increase that amount when you can. Come back and update this worksheet from time to time to reflect changes and track your progress.

Here are a few tips on how to save smart for retirement:

To track other resources you may have in retirement, start by getting your Social Security statement and an estimate of your retirement benefits on the Social Security Administrations website, www.socialsecurity.gov/mystatement.

Get started today for a secure financial future!

Looked For Unclaimed Money

“Ghosted” 401 money certainly qualifies as missing money, and it could be uncovered on digital money-funder platforms like missingmoney.com.

The site, run by the National Association of Unclaimed Property Administrators, runs free searches for not just retirement funds, but for money in old bank accounts, safe deposit boxes, escrow accounts, and insurance policies. According to the website’s directions, if you get a “hit” on the site, just claim the property and fill out the requested details, then submit and you will receive instructions on the next steps from the state where you made the claim.

Don’t Miss: Can I Start A 401k

What Is A 401 Account

A 401 plan, named for the section of tax code that governs it, is a retirement plan sponsored by an employer, allowing employees to save a portion of their paycheck for retirement.

The advantage to employees of saving with a 401 plan is they are able to save funds they have earned, before taxes are deducted from a paycheck.

Many employers offer a company match meaning whatever the employee contributes, the company matches.

Although 401 plans were originally born as a supplement to pension plans, they are now often the sole retirement plans offered at companies.

You Found Your 401 Plan Now What

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money with the purpose of building a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

Rolling over your 401 into an IRA is a relatively simple process. First, you need to open an IRA, which you can do though most banks, brokerage firms and robo-advisors. The funds from your old 401 then can be sent directly to your new IRA. If you prefer to keep all your investments in one place and your current employer offers a decent 401, then you may want to consider rolling over the funds into that account .

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Also Check: Can I Roll My 401k Into Another 401k