The Pattern Day Trader Rule

At issue here are rules related to margin requirements for pattern day traders. Created by the Financial Industry Regulatory Authority after the tech bubble popped back in the early 2000s, the updated margin rules effectively hold pattern day traders using margin accounts to higher standards than people investing with cash accounts by requiring them to keep larger amounts of cash and/or securities in their accounts. It works like this:

If a trader makes four or more day trades, buying or selling the same security within a single day, over the course of any five business days in a margin account, and those trades account for more than 6% of their account activity over the period, the traders account will be flagged as a pattern day trader account.

If this happens, even inadvertently, the trader will have to maintain a minimum balance of $25,000 in the flagged accounton a permanent basis. If a pattern day trader account holds less than the $25,000 minimum at the close of a business day, the trader will be limited on the following day to making liquidating trades only.

Not every trader wants to maintain $25,000 in their account, so its important to pay close attention to your trades to make sure you dont end up with a flagged account. That said, Schwab does allow a one-time exception to clients who may have been flagged as day traders, so long as they commit not using the account for pattern day trading going forward.

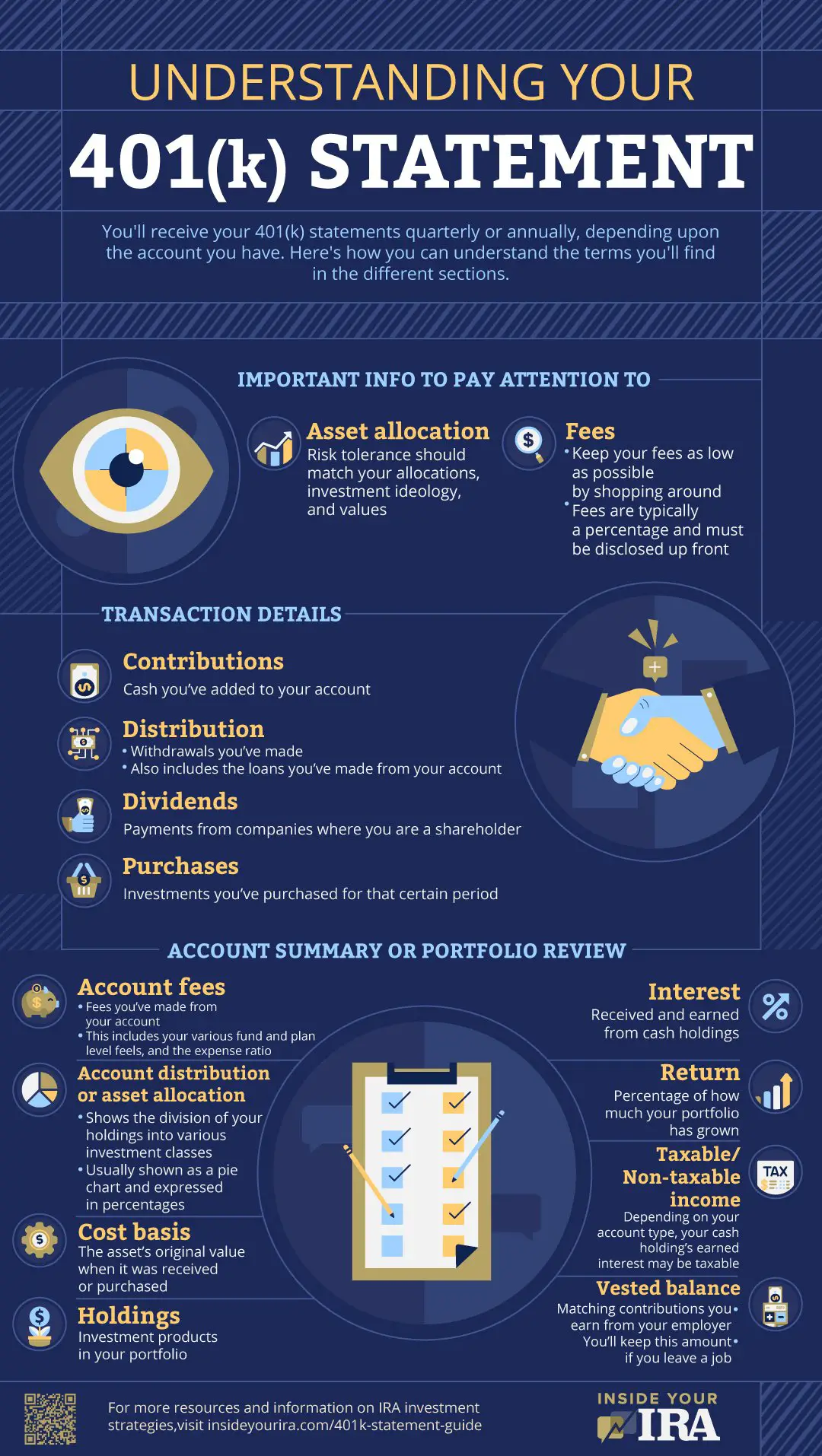

How Often Can You Change 401 Investment

According to the Department of Labor, employers must allow plan participants to change their investments at least quarterly. If your employer follows these guidelines, you may be allowed to change your investments at least every quarter, or more frequently. Generally, how often you can change the securities you have invested in depends on the company policy.

The employer must provide written documentation to plan participants on how the plan operates. You can check the summary plan description to know how often your employer allows investment changes. If you donât have a copy of the document, you can request a copy from the company’s human resource department.

You can also change your investments when the employer is valuing 401 accounts. During the valuation process, the employer evaluates the current account balance, account growth, and losses incurred. Account valuations may occur monthly or quarterly, and sometimes even daily. You can take advantage of the valuation period to change your investment allocations.

Tags

You Can Trade Actively In A Roth Ira

Some investors may be concerned that they cant actively trade in a Roth IRA. But theres no rule from the IRS that says you cant do so. So you wont get in legal trouble if you do.

But there may be some extra fees if you trade certain kinds of investments. For example, while brokers wont charge you if you trade in and out of stocks and most ETFs on a short-term basis, many mutual fund companies will charge you an early redemption fee if you sell the fund. This fee is usually assessed only if youve owned the fund for fewer than 30 days.

Recommended Reading: Can I Start A 401k For My Child

Can You Day Trade On Fidelity

Yes, but should you? Lets talk about Fidelitys Active Trader Pro . ATP is Fidelitys easy to use, premium trading platform offering.

The easy-to-use Active Trader Pro for desktop is clean and offers a plethora of features along with powerful research resources.

Unquestionably, Fidelitys no Thinkorswim, but it has fantastic charting. With over 60 interactive and customizable charts, 22 different drawing tools, 166 optional studies, its useful for longer-term traders.

How Your 401 Contributions Are Invested

Every company organizes its 401 plan for the best interest of the company and employees, so as a result, every 401 plan is structured a little differently. However, there are many similarities among 401 plans in general. For example, most 401 plans are managed by a fund manager who selects the investments for the plan. Although some 401 plans are structured where employees have a few more investing options available to them, it is rare to have a plan structured where you can select individual stocks. Roughly 20 percent of employers offer self-directed 401 accounts.

401 plans are usually very diversified, meaning their assets are held in several different types of investments including stocks, bonds and mutual funds. But, you typically wont have a hand in selecting the investments your 401 contributions are going to ultimately buy. On the other hand, if your employer has structured its 401 to give employees greater control over investments they want, then you should familiarize yourself with your individual 401 plan and contact the plans manager for more information regarding its self-directed brokerage window.

Don’t Miss: How To Sell 401k Plans

Is There Day Trading With Fidelity

- Fidelity is known for its investments. But what about day trading with Fidelity? Day trading is such a popular style that people want to be able to invest and day trade on the same platform. How does Fidelity stack up to that?

Make sure to check out our penny stocks list if you want day trading ideas.

How A 401 Self

Employers who offer brokerage accounts in their 401s must pick a specific firm to use, such as E*TRADE or Charles Schwab, and list this account along with the other investment choices in the plan. In some cases, participants may have a specified window of time each year to move money from their general omnibus account in the plan into the brokerage account.

Plan participants can then buy and sell stocks, bonds, ETFs, and mutual funds in the normal manner, albeit with no tax consequences. However, some types of higher-risk trades are prohibited, such as trading on margin and buying put or call options or futures contracts. Covered call writing is permissible unless the plans charter forbids it.

As of 2015, 40% of U.S. employers offered brokerage windows in their 401 account, according to a study by HR consulting firm Aon Hewitt. Some 19% of the plans Vanguard administers offer a brokerage window, according to the mutual fund companys How America Saves 2020 Report.

The Plan Sponsor Council of Americas 60th Annual Survey of Profit Sharing and 401 Plans, released in 2018,indicated that about a quarter of the plans offered by 590 plan sponsors featured a brokerage window. Some 403 plans now also offer this feature.

Vanguard reports that 19% of its 401 accounts offer a brokerage window, but only 1% of participants take advantage of it.

Don’t Miss: How To Sign Up For 401k At Work

How Often Can You Trade A 401

Some investors prefer to take a hands-off approach to their retirement funds by choosing a 401 plan offered by their employer, and letting their contributions accumulate untouched. Others prefer a more proactive approach and trade funds within the umbrella offered by their funds. Although the Internal Revenue Service doesnt place limits on how often an investor can make trades within a 401 plan, it allows plan administrators to place rules that can restrict the frequency of in-plan trades.

Read More:After Liquidating an IRA, Can It Be Reinvested Elsewhere to Avoid Taxes?

A Solution To Consider

Traders looking to actively day trade should consider TD Ameritrades ThinkorSwim platform. ThinkorSwim has advanced functionality and speed day traders and scalpers need. I can quickly enter a new stock and have an opening order submitted within a second if I want. In my opinion, we must practice before we put real money on the table. To do this, we practice in a simulator. What I like about the ThinkorSwim demo account is that it has all the softwares normal functions.

Even though Active Trader Pro has a demo mode, many features are disabled in it. Specifically, futures and currencies both can be bought and sold on ThinkorSwim, but not on Fidelitys platform. Compare this with Robinhood, which has no demo account!

Also Check: Is There A Limit On 401k Contributions

Day Trading Rules And Risks

The Securities and Exchange Commission makes it clear: Day trading is not investing. Investing involves a fundamental analysis of stocks to determine good long-term prospects. Day traders, on the other hand, use expensive, state-of-the-art technology and technical analysis to spot intraday trends they may be able to capitalize on. The Financial Industry Regulatory Authority has written rules to regulate this fast-moving practice and to educate investors about the potential for significant losses.

How Do I Start Day Trading

The first step is to ask yourself: Am I truly cut out for this? Day trading requires intense focus and is not for the faint of heart. It’s also not something you want to risk your retirement savings on.

Consider opening a practice account at a suitable brokerage before committing any real money to day trading.

One critical tip: Open a practice account at a suitable brokerage and give it a go before committing any real money to day trading. Many brokerage accounts offer practice modes or stock market simulators, in which you can make hypothetical trades and observe the results.

Also Check: Can I Use My 401k To Purchase A Home

Why Do I Have To Maintain Minimum Equity Of $25000

Day trading can be extremely riskyboth for the day trader and for the brokerage firm that clears the day traders transactions. Even if you end the day with no open positions, the trades you made while day trading most likely have not yet settled. The day trading margin requirements provide firms with a cushion to meet any deficiencies in your account resulting from day trading.

Most margin requirements are calculated based on a customer’s securities positions at the end of the trading day. A customer who only day trades does not have a security position at the end of the day upon which a margin calculation would otherwise result in a margin call. Nevertheless, the same customer has generated financial risk throughout the day. These rules address this risk by imposing a margin requirement for day trading calculated based on a traders largest open position during the day rather than on open positions at the end of the day.

Firms are free to impose a higher equity requirement than the minimum specified in the rules, and many of them do. These higher minimum requirements are often referred to as “house” requirements.

Why Day Trading Is Controversial

The profit potential of day trading is an oft-debated topic on Wall Street. Internet day-trading scams have lured amateurs by promising enormous returns in a short period of time.

Some people day-trade without sufficient knowledge. But there are day traders who make a successful living despiteor perhaps because ofthe risks.

Many professional money managers and financial advisors shy away from day trading. They argue that, in most cases, the reward does not justify the risk. Moreover, many economists and financial practitioners argue that active trading strategies of any kind tend to underperform a more basic passive index strategy over time especially after fees and taxes are taken into account.

Profiting from day trading is possible, but the success rate is inherently lower because it is risky and requires considerable skill. And dont underestimate the role that luck and good timing play. A stroke of bad luck can sink even the most experienced day trader.

Also Check: Can I Cash In My 401k

# 8 Techniques Stop Working

A bigger dilemma with day trading is that you may stumble onto a technique that works. The problem is there are millions of other people out there looking for techniques that work. So if you find a technique that works, for heaven’s sake don’t tell anyone about it. And don’t go out and teach a course about it. Once the word is out, the profits will be arbitraged away by all the other people doing it. Thus you should not expect any technique you learned in a trading course to continue to work. When this technique you found stops working, what are the odds that the next one you find is also a winner? Not very good.

So, dear reader, while it is not impossible to beat the market day trading, nor is it impossible to quit your job as a nephrologist and make more sitting in front of your computer putting in trades, the odds are not only against you, but overwhelmingly against you. If the match rate for your medical school were only 3%, nobody would spend four years of their life studying there, much less borrowing hundreds of thousands of dollars to do it. Yet those same doctors are willing to bet similar amounts of money on a < 3% chance of successful day trading. Good luck.

What do you think? Do you think day trading is a smart thing to do? Do you think most of our nation’s doctors should leave medicine to day trade? Why or why not?

Why Investors Like Fidelity

Fidelity Investments is a well-known name in the investing world. And this is for a good reason. Low trading costs and no minimum to open an account.

Also, Fidelity operates as both a fund manager and full-service brokerage offering a variety of ETFs and mutual funds.

Use our real time stock alerts for any long term investments or swing trades.

Read Also: How To Find 401k Account Number

Access To A Trading Desk

This is usually reserved for traders who work for larger institutions or those who manage large amounts of money.

The trading or dealing desk provides these traders with instantaneous order execution, which is crucial. For example, when an acquisition is announced, day traders looking at merger arbitrage can place their orders before the rest of the market is able to take advantage of the price differential.

Trading Securities Using A 401 Brokerage Account

Until recently, investment options provided in a 401 were mainly mutual funds, annuity contracts, guaranteed accounts, and company stock. However, some plans now allow plan participants to buy and sell securities using a 401 brokerage account, also known as a self-directed brokerage account.

A 401 self-directed brokerage account allows investors to take big risks with retirement savings. Usually, employers who offer 401 brokerage accounts must list the 401 with specific investment firms that offer brokerage services. Participants are then allowed a specified window when they can move funds from their 401 account into the brokerage account. Once the transfer is made, participants can trade various securities such as stocks, mutual funds, and ETFs tax-free. In some cases, investors can take greater risks such as trading on margin and trading call and put options.

Also Check: Can You Roll A 401k Into A 403b

Trade Stocks In A Solo 401k Plan

Now you have an understanding of how convenient it is holding a stock brokerage account inside of your Solo 401k. With that, youre going to want to know about strategies available inside the brokerage account. Coming soon is Part 2 of this blog that will cover more in-depth topics including:

- How do I trade options?

- Can I buy futures in my retirement plan?

- How do I short stocks in a Solo 401k?

- Can you do uncovered calls in a retirement plan?

- Can I buy LEAPS in a retirement plan?

Perhaps you are currently most comfortable investing in stocks and bonds. In the future it may be worth expanding your vision to learn about alternative investments like real estate or bitcoin. Or perhaps youre already highly experienced with alternative investments. For diversification, youd like to cast an even wider net for your portfolio that includes a brokerage account. A Solo 401k is the one account that puts you in full control of when, where, and how you want to invest.

How Long Do 401k Trades Take

If you use your 401 to trade, the investment options you choose will take different periods to settle. Find out how long 401 trades take.

If you are using your 401 to trade, you will be required to pick the investments from a list of pre-selected investment options. The average 401 plan offers 8 to 12 investment options, which may include stocks, mutual funds, company stock, variable annuities, and guaranteed investment contracts. These investments take different durations to settle.

If you trade stocks in your 401, the trade can take two business days to settle after the day when the trade is executed. For example, if the trade is executed on Monday, the stocks will settle on Wednesday. If you hold mutual funds in your 401, the funds will settle on the next business day after the trade is executed. Some investments may have a provision that requires investors to allow more time to settle trades.

You May Like: How To Pull Out Of Your 401k

Winners And Losers With 401 Brokerage Accounts

It is easy to see who could come out ahead by trading securities in a 401 brokerage account. Highly educated investors, such as medical professionals and specialists, engineers, accountantsand those with previous trading and investing experiencecan use these accounts to achieve returns far beyond what they might be able to achieve using traditional plan options, such as mutual funds.

But lower-income participantsfactory workers, retail or food-service employees, and others who work in jobs that dont require such skillslikely will not have the same education and expertise. And plenty of people with higher incomes and more education don’t know much about investing, either. Employees without adequate knowledge and guidance could easily be enticed into making foolhardy choices, such as buying and selling mutual funds with front- or back-end sales charges or choosing investment options that contain risks they do not understand.

So far most studies and data released on this subject seem to indicate that a relatively small percentage of employees choose to invest material amounts of their plan savings into brokerage accounts. Only about 3% to 4% of those with access to a 401 brokerage window use it, the Aon Hewitt study found the PSCA survey reported that only 1.3% of total plan assets are accounted for by investments through brokerage windows.