Why Transfer Your 401 To An Ira

Why would you move savings from an old 401 plan to an IRA? The main reason is to keep control of your money. In an IRA, you get to decide what happens with the funds: You choose where to invest and how much you pay in fees, and you dont need anybodys permission to take money out of the account.

More Control

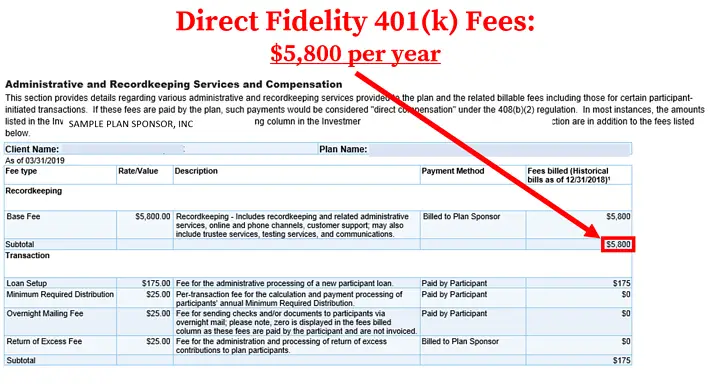

Cost and providers: In your 401, your employer controls almost everything. Employers choose vendors for the plan, which determines the investment lineup available. Those might not be investments you like, and they might be more expensive than you want. If you want to practice socially-responsible investing, the 401 may lack options for that.

Timing: 401 plans also require extra steps when you want to withdraw funds: An administrator needs to verify that you are eligible to access your money before youre allowed to take a distribution. Plus, some 401 plans dont allow partial withdrawalsyou might need to take your full balance.

Easy Withdrawals

If you need access to your 401 savings for any reason, its easier when the money is in an IRA. In most cases, you call your IRA provider or request a withdrawal online. Depending on what you own in your account, the funds might go out as soon as the next business day. But 401 plans might need a few extra days for everybody to sign off on the distribution.

Complicated Situations

Control Tax Withholding

Is It Better To Take A Lump Sum Pension Or Monthly Payments

If you take a lump sum available to about a quarter of private-industry employees covered by a pension you run the risk of running out of money during retirement. But if you choose monthly payments and you die unexpectedly early, you and your heirs will have received far less than the lump-sum alternative.

What To Consider When Choosing A Broker

If youre planning to roll over your 401 into an IRA, youll likely be most concerned with a broker that can do the following things best. Most brokers do offer an IRA, but some popular ones do not, but the brokers above all offer IRAs. We also considered the following factors when selecting the top places for your 401 rollover.

- Price: Trading commissions for stocks and ETFs have fallen to $0 at most online brokers, and thats great for investors. But there are other costs, too, perhaps most notably account fees, such as fees for transferring out of your account.

- No-transaction-fee mutual funds: The brokers in the list above offer thousands of mutual funds without a transaction fee. If youre rolling over your 401 and you like the mutual funds you have already, these brokers may allow you to buy and sell the same one without a fee.

- Investing strategy: While a 401 may limit your investing options to a pre-selected group of mutual funds, an IRA gives you the ability to invest in almost anything trading in the market. So we considered how each broker might fit an investors needs.

Recommended Reading: How Do You Take Out 401k Money

Look Out For Your Check In The Mail And Deposit Into Your New Account

ADP will only distribute your 401 funds directly to you, using the mailing address they have on file for your account. Once you get the check, its then up to you to deposit that check with your new IRA provider.

There are a few ways you can deposit your check depending on the provider:

- Mobile deposit the easiest option is to check your providers mobile app to see if they have a mobile deposit option. Not all providers provide this option but its worth checking. Mobile deposits are the quickest option and typically take 3-5 business days to show up in your account.

- Deposit in person at a local branch if your provider has a physical branch near by, you can also deposit the check in person. Checks deposited in person typically take 3-5 business days to show up in your account.

- Send the check by mail you can also send the check by mail to the provider using the address you previously looked up. Funds that are mailed can take up to 15 business days to show up in your account.

Who Is The Owner Of The Empower Retirement Fund Reviews

Empower Retirement is a retirement plan registration company based in Denver, Colorado. It is part of GreatWest Life & Annuity Insurance Company and is an indirect wholly owned subsidiary of GreatWest Lifeco. Empower is chaired by President Edmund F. Murphy III, who reports to Robert L. Reynolds, CEO and President of GreatWest Financial.

Also Check: When Leaving A Company What To Do With 401k

Are Distributions From My Roth 401 And Roth 403 Accounts Taxable

Qualified withdrawals from Roth 401 or Roth 403 accounts, including earnings, are tax-free. Only the earnings portion of nonqualified withdrawals from Roth accounts is taxable. Withdrawals from Roth accounts are tax-free if the account was established at least five years before, and if youre at least 59½ years of age or if withdrawals are made because of disability or death. Withdrawals from non-Roth accounts are generally taxable.

You May Like: How To Find Your 401k Account Number

Top Reasons To Consider A Fidelity Ira

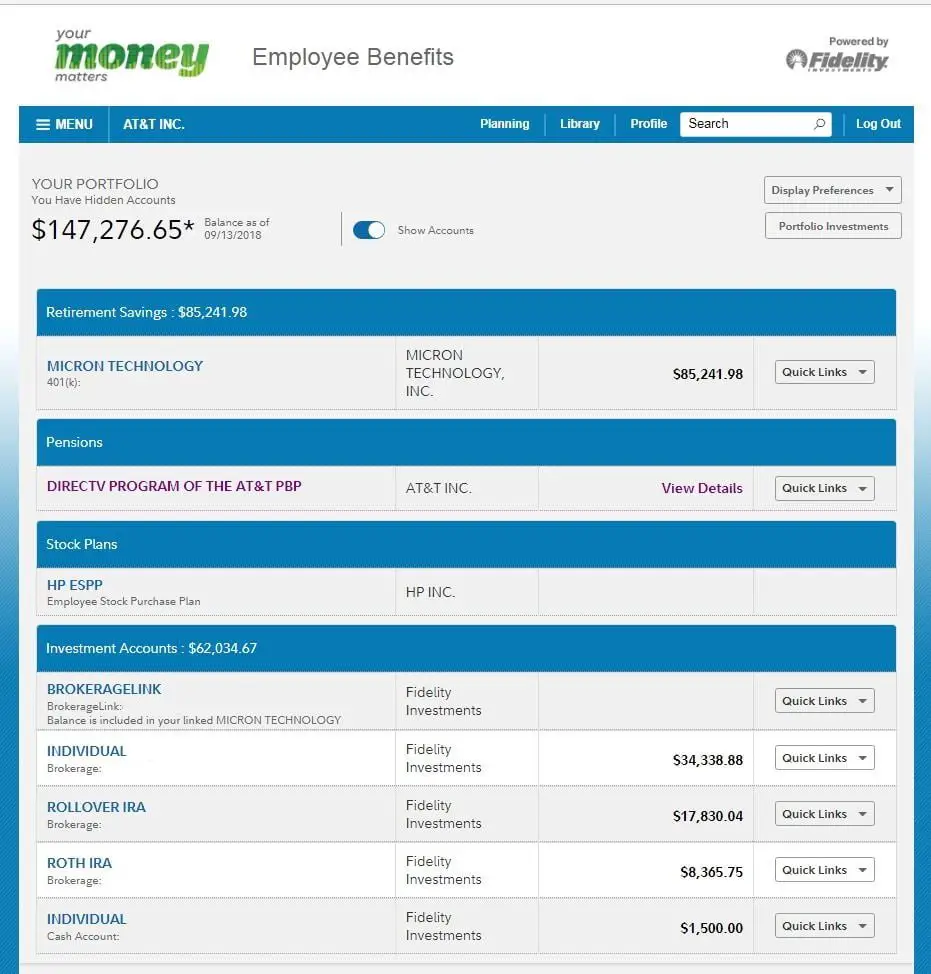

There are several benefits to opening your rollover IRA at Fidelity.

Fidelity investments offer some of the widest range of investment options in its commission-free lineup. Any US stock and ETF can be bought or sold for no transaction fee, and index funds have no internal expenses.

Having plenty of investment options is incredibly valuable. Weve had several clients come to us with heavily concentrated positions of their own company stock in a 401. Weve been able to help them diversify and protect their savings by rolling it into an IRA at Fidelity. One client, in particular, stood to lose nearly half of their savings in a concentrated company stock position!

With over $10 trillion in assets, Fidelity brokerage services LLC has enough depth and stability for you to be comfortable that your money is secure.

Fidelitys interface is incredibly user-friendly too. When you log in, you can easily view your Fidelity account balances and positions, or place trades to rebalance your portfolio. Head on over to fidelity.com to see for yourself. Its straightforward to integrate your Rollover IRA at Fidelity into the rest of your financial plan to maintain the consistency you need to meet your goals.

We can help you as well.

Contact us for a free consultation.

Disclosures:

Read Also: How Often Can I Rollover 401k To Ira

Consider Mobile Check Deposit

If youre already a Vanguard client and youre registered for online access, remember that you can use our mobile check deposit option offered through the Vanguard app. Its faster than mailing a check!

When youre logged on and using the app, just tap the Mobile check option under the main menu and then follow the instructions. Learn more about mobile check deposit

Is A Rollover Ira At Fidelity Right For You

Maybe you’ve got an old 401 and have no idea what to do with it.

Instead of leaving it sitting in your old employer’s account gathering dust, you may consider rolling it over to an IRA account at Fidelity.

When it comes to rollovers, perhaps the most crucial decision you have to make is where to invest your money.

Your investments are an integral component of your retirement plan, after all. You can do your rollover at almost any bank or brokerage firm, but the proper financial custodian can make or break your experience.

As a registered investment advisor, we have the flexibility to use the best custodians for our clients. We often use Fidelity and have been very happy with the platform and quality of service our clients receive.

With so many options, is a Rollover IRA at Fidelity right for you?

Read Also: How Do I Get My Money From My 401k

What Are Your Choices For A Rollover

In general, once you leave a job you have three choices for how to deal with your employer-sponsored retirement plan:

- Leave it with your old employers 401 plan: This approach requires the least amount of work, but may require you to have a minimum amount if you plan to maintain the account there.

- Roll it over into your new employers 401 plan: This approach will require you to file some paperwork, but youll have all your 401 money in one place. This choice can make sense if you like your new employers plan.

- Roll it over into an IRA: This move will require you to file some paperwork, but then youll have the complete freedom to invest the money as you see fit. If you liked the investment options you held in a previous plan, you may still be able to access those via an IRA.

, thats another option for a rollover. But this option is not typical for most individuals.)

If you roll over your 401 into an IRA, youll also want to consider the kind of rollover you need.

- With a Roth 401, youll likely be more interested in a Roth IRA, so that you can maintain the substantial advantages of that plan.

- If you have a traditional 401, then youll probably opt for a traditional IRA.

How To Transfer Money From 401 To Bank Account

Learn how to transfer money from 401 to bank, and the duration it takes to receive the money in your bank account.

When you quit your job or retire, you have to choose what to do with your accumulated 401 retirement savings. Usually, you can leave your retirement money with the former employer, rollover to an IRA, or transfer the money to your bank account. While it is a smart move to keep retirement money in a retirement account, you can cash out if you need money urgently.

To transfer money from a 401 to a bank account, you should send a withdrawal request to the 401 plan administrator. It can take up to seven business days for the withdrawal to be processed, and you can expect to receive your funds shortly thereafter. Usually, direct deposits take a shorter duration to arrive than paper checks.

Don’t Miss: How To Move Your 401k To An Ira

Who Is Charles Schwab Best For

When looking for companies like Charles Schwab, the first comparison that comes to mind is the number of retail locations. Here, even industry titan like Fidelity simply cannot compare.

Namely, Charles Schwab has as many as 360 retail locations, while Fidelity only has around 200. Of course, with a greater number of offices comes better coverage.

Another thing at the top of the pro list for Charles Schwab is that the platforms interface is highly customizable. This allows the user to personalize the dashboard and optimize it for their own use. In other words, it offers more value to intermediate users.

Schwab StreetSmart Edge is another great reason to pick this platform over its competitor. The real-time quotes-and-trading platform provides users with an incredible level of insight. It helps out with research, finding investment opportunities, analysis, placing trades, and even account management.

The platform also offers access to a number of sophisticated analytical tools, which can support your trading quite a bit.

Take Stock Of Unpaid Loans From Your 401

Heres another reason why it doesnt always make sense to take a loan from your 401. If your plan allows you to take a loan, youll generally have up to five years to pay the loan back in full. Participants have until tax day of the following year to repay outstanding loans on their 401. For example, if you are terminated in April 2020, you have until April 15, 2021 to repay a loan.

In the event youre unable to pay back the remaining balance, it becomes an early distribution, triggering income taxes and, if under age 59 1/2, a 10% penalty from the IRS. Some states may charge additional income taxes and penalties. And you cant roll over unpaid loans to an IRA or 401, effectively reducing your nest egg.

This is why when doing a cost-benefit analysis of accepting a new job offer, make sure to include the cost of losing a non-vested portion and paying income taxes on early distributions of your nest egg.

Also Check: How To Pay Off 401k Loan

If I Choose A Direct Rollover To An Ira Or A New Plan Will I Receive Any Kind Of Confirmation

You will receive a Form 1099-R from your old plans provider indicating you initiated a direct rollover. Since there is no federal income tax withheld, your entire balance will be rolled over and youll continue benefiting from the tax advantages. If you roll over your money into an IRA, you will receive a Form 5498 and an account confirmation from the IRA trustee or custodian. If you roll over your money into a new plan, ask your employer if you will receive confirmation.

Also Check: How To Open A 401k Plan

Can I Transfer The American Funds Shares Held In My Retirement Plan Account Into An Ira

It depends on your retirement plan. Check your plans SPD to see when youre allowed to take a distribution. If you qualify to take a distribution , you can request a direct rollover to an IRA.

Rollovers from retirement plans to IRAs are tax-reportable, however, direct rollovers are not taxable if completed as direct rollovers.

To determine if you may continue to hold your American Fund shares in the same share class, speak with your financial professional or you may call us at .

Also Check: How Often Can I Change My 401k Investments Fidelity

How To Roll Over A 401

Perhaps youve left your job but still have a 401 or Roth 401 with your former employer youre retiring and are wondering if leaving your money in a 401 is the best option or perhaps you simply want to diversifynow what? The infographic, below, explains four options to consider: leave your assets in a previous employers plan, cash out your 401, initiate a 401 rollover into a new employers plan, or rollover into an IRA .

You May Like: Can Business Owners Have A 401k

If I Make Contributions To My Rollover Ira Can I Still Roll The Ira Into An Employer Plan

You may be able to transfer your IRA balance into your new plan if the new plan accepts rollovers from IRAs. Before rolling your money into a new plan, you should compare the plans investment options and withdrawal rules with those of your IRA. You may give up some flexibility or face stricter requirements if you make the move.

If you rolled after-tax deferrals from an employers plan into a traditional IRA, you may not subsequently roll those after-tax deferrals to another employers retirement plan.

Read Also: What Happens To Your 401k When You Die

You May Like: How To Transfer Your 401k To Another Company

Vanguard Vs Fidelity Iras: The Biggest Differences

When it comes to IRAs, Vanguard and Fidelity are neck and neck in many areas. Both offer traditional IRAs, Roth IRAs, SEP IRAs, SIMPLE IRAs, and many other retirement accounts for individuals and small businesses. The two platforms also give investors the option to manage eligible IRAs on their own or utilize automated portfolios and/or advisor assistance.

Fidelity, however, has a wider range of IRA options. Unlike Vanguard, Fidelity offers a Roth IRA account for minors. The brokerage could also suit those in search of lower costs, mainly because most of its index mutual funds have no minimum requirements .

Vanguards advisor-assisted, automated investing account has Fidelitys equivalent account beat when it comes to advisory fees, but Fidelity is still hard to pass up on the account minimum end.

| Vanguard |

What Happens If I Leave My Employer And I Have An Outstanding Loan From My Plan Account

Keep in mind that most plans require that loans be repaid when you leave. If you roll over your remaining account balance to a new employers plan, you may also be able to roll over the outstanding balance of your loan to your new employers plan. Check with your new employer to find out if the loan will be accepted by the new plan. You cannot roll over your loan to an IRA.

If you cant move the loan to your new plan, and if you dont repay the loan within the time allotted, the outstanding balance will be treated as a withdrawal, subject to federal and applicable state and local taxes. If youre under age 59½, you may also have to pay a 10% early withdrawal penalty unless you qualify for an exception.

Read Also: When Can I Draw From My 401k Without Penalty

Also Check: How Much Does A Solo 401k Cost

Confirm A Few Key Details About Your Fidelity 401

First, get together any information you have on your Fidelity 401. Its okay if you dont have a ton, but any details like an old account statement or an offboarding e-mail from your former HR team can help. 401 paperwork can be confusing, so just focus on identifying the following items:

STEP 2