The Devil In The Details

Normally, if you were to take money from your retirement plan, you would be subject to a 10% penalty if you’re under age 59½, along with income taxes on the amount you’re withdrawing.

The relief bill gives you the opportunity to pay the taxes over the course of three years. You can also replenish the amount that you pulled from your retirement account over that time.

These distributions may be taken by people who themselves are diagnosed with coronavirus, or whose spouse or dependent has been diagnosed with COVID-19, or who experience adverse financial consequences from being quarantined, laid off or furloughed.

How To Boost Your Retirement Savings

DON’T know where to start? Here are some tips on how to get going.

- Understand where you start: Before you consider your plans for tomorrow, you’ll need to understand where you stand today. Look into your current pension savings and research when youll be eligible for social security benefits, if at all.

- Take advantage of a 401k: The 401k plans are tax-effective accounts put you in a better place financially for your retirement. If you save, your employer may too.

- Take advantage of online planning tools: Financial provider Western & Southern Financial Group and comparison site Bankrate have tools that give you an idea of what your retirement income will be based on how much you’re saving.

- Find out if your workplace offers advice: Some employers offer sessions with financial advisers to help you plan for your future retirement.

With a Roth, employees make contributions with post-tax income but can make withdrawals tax-free.

Most employees can currently put in $19,500 a year of their own money in a 401k account, excluding employer contributions.

However, workers who are older than 50-years-old are eligible for an extra catch-up contribution of $6,500 in 2020 and 2021.

Alternatives To Using Your 401 To Buy A House

Many homebuyers assume they need a 20%down payment, which can make it seem nearly impossible to save enough cash tobuy a house.

But home buyers no longer need 20%down.

In fact, theres a long list of low- and no-down payment home loans that can lower the barrier to homeownership.

Some of the most popular low-downpayment mortgages are:

- FHAloans allow as little as 3.5% down andonly require a 580 credit score

- Conventional97 loans start at 3% down and require a 620+credit score

- VAloans available to veterans and servicemembers with 0% down

- USDAloans can be used in certain rural areaswith 0% down

- HomeReady and Home Possible loans only require 3% down and have flexible requirementsfor first time home buyers who have little cash

But what if you dont have a 3%down payment? After all, 3% of $300,000 is $9,000 thats still a lot ofmoney.

If you need help making your downpayment, there are other places to turn before your 401. For example:

Most of these programs are specifically designed for first-time, lower-income, or lower-credit home buyers. So if youre having trouble saving for a down payment for any of these reasons, theres a good chance you could qualify.

You May Like: How To Borrow Money From 401k Fidelity

How To Use A 401 Loan To Buy A House

A 401 loan is the preferredmethod if you need to cash out some of your 401 retirementfunds tobuy a house. Thats because theres a much lower cost associated with a 401loan comparedto a 401 withdrawal.

You should also know:

- A 401 loan is usually not counted in your debt-to-income ratio, so it wont hurt your chances of mortgage qualifying

- 401 loans are not reported to credit bureaus, so applying for one wont harm your credit score

Can I use my 401k to buy a house without penalty?

Unlike a 401 withdrawal, a401 loan is not subject to a 10% early withdrawal penalty from the IRS. Andthe money you receive will not be taxed as income.

The rules for using a 401 loanto buy a house are as follows:

- Your employer must allow 401loans as part of its retirement plan

- The maximum loan amount is 50% ofyour 401svested balance or $50,000, whichever is less

- The loan must be paid back withinterest , on a schedule agreed to by youand your 401 provider

- Typically,you cannot make 401 contributions while you have an outstanding 401 loan

401 loans typically need to bepaid back over five years.

However, when the money is used topurchase a home, youre usually allowed to pay it back over a longer period oftime. Rules vary by 401 company, so check with yours to learn more.

Drawbacks to 401 loans for home buying

While youre paying back the 401 loan, you usually cant make new contributions to your retirement account. And that means your employer wont be matching contributions, either.

Next Steps To Consider

This information is intended to be educational and is not tailored to the investment needs of any specific investor.

Fidelity does not provide legal or tax advice. The information herein is general in nature and should not be considered legal or tax advice. Consult an attorney or tax professional regarding your specific situation.

Fidelity Brokerage Services LLC, Member NYSE, SIPC, 900 Salem Street, Smithfield, RI 02917

Recommended Reading: How Does A 401k Make Money

Exceptions To The Penalty

The IRS permits withdrawals without a penalty for certain specific uses. These include a down payment on a first home, qualified educational expenses, and medical bills, among other costs.

As with the hardship withdrawal, you will still owe the income taxes on that money, but you won’t owe a penalty.

Only Withdraw The Minimum Amount

While this approach wont technically help you avoid penalties and taxes, it can help you minimize the impact overall. You should only withdraw the exact amount you need for your emergency.

Dont add an extra 30-50% to cover taxes and penalties if you can afford to replace any amount lost to penalties from your pocket.

Remember, youll stunt your retirement income with every withdrawal. Similarly, you should only ever withdraw from your 401 in a real emergency. Its counter-productive to withdraw from your 401 for a luxury purchase or even to pay off debt.

Recommended Reading: What Type Of Plan Is A 401k

What Happens To My 401k If I Get Laid Off

If you are fired or laid off, you have the right to move the money from your 401k account to an IRA without paying any income taxes on it. This is called a rollover IRA. Make sure your former employer does a direct rollover, meaning that they write a check directly to the company handling your IRA.

Hardship Distributions From 401k Plan

If you are younger than 59 ½, youre going to have to demonstrate that you have an approved financial hardship to get money from your 401k account. And thats only if your employers retirement plan allows it. They are not required to offer hardship distributions, so the first step is to ask the Human Resources department if this is even possible.

If it is, the employer can choose which of the following IRS approved categories it will allow to qualify for hardship distribution:

- Certain medical expenses

- Certain expenses for repairs to a principal residence

The only other way to get access to your funds is to leave your employer.

Also Check: Should I Roll Over 401k From Previous Employer

Key Considerations With 401 Loans

- Some plans permit up to two loans at a time, but most plans allow only one and require it be paid off before requesting another one.

- Your plan may also require that you obtain consent from your spouse/domestic partner.

- You will be required to make regularly scheduled repayments consisting of both principal and interest, typically through payroll deduction.

- Loans must be paid back within five years .

- If you leave your job and have an outstanding 401 balance, youll have to pay the loan back within a certain amount of time or be subject to tax and early withdrawal penalties.

- The money you use to pay yourself back is done with after-tax dollars.

Although getting a loan from your 401 is relatively quick and easy, the benefit of paying yourself back with interest will likely not make up for the return on investment you could have earned if your funds had remained invested.

Another risk: If your financial situation does not improve and you fail to pay the loan back, it will likely result in penalties and interest.

The Costs Of Early 401k Withdrawals

Early withdrawals from an IRA or 401k account can be an expensive proposition because of the hefty penalties they carry under many circumstances.

The IRS allows penalty-free withdrawals from retirement accounts after age 59 ½ and requires withdrawals after age 72 . There are some exceptions to these rules for 401ks and other qualified plans.

Try to think of your retirement savings accounts like a pension. People working towards a pension tend to forget about it until they retire. There is no way they can access it before retirement. While that money is locked up until later in life, it becomes a hugely powerful resource in retirement. The 401k can be a boon to your retirement plan. It gives you flexibility to change jobs without losing your savings. But that all starts to fall apart if you use it like a bank account in the years preceding retirement. Your best bet is usually to consciously avoid tapping any retirement money until youve at least reached the age of 59 ½.

If youre not sure you should take a withdrawal, you can use this calculator to determine how much other people your age have saved.

Recommended Reading: What Is Max Amount To Contribute To 401k

How To Get Money Out Of A 401

posted on

Youve done a good job of saving money, but nobody ever explained the process of taking money out of a 401. If youre like most people, the priority has been adding funds.

Your ability to get money out of a 401 depends largely on two factors:

You might want to pull your money out for several reasons, including:

- Youve stopped working at the company and youre going to roll your funds elsewhere

- Youre unhappy with the plan and the investments available

- You need the money for bills, medical expenses, or an emergency

- Youre going to use the funds elsewhere

Your reason for pulling money out of a 401 can be important. With certain optionslike the hardship distribution described belowyou may need to qualify. So keep that in mind as you read through the options.

Those Who Can Stomach The Loss In Stock Value

Because a 401 is an investment account, you should also consider the trade-off of missing the market rebound if you withdraw funds right now. Any money that you borrow from your 401 now wont be there when the market turns around, Renfro says. This would compound the adverse effects of an early 401 withdrawal if you dont truly need one.

Echoing that, Levine says many 401 balances have been hit hard, and taking a loan while theyre down essentially locks in the losses.

Taking an early withdrawal from your 401 can have long-term adverse effects on your financial health. However, so can the ramifications of COVID-19, especially if youve been particularly affected by the disease. The CARES Act gives options to those who need it most. Theres no right answer, but in times of uncertainty and struggle, those options can be a life raft.

Don’t Miss: How To Make A Loan From 401k

Does My Employer Offer These Provisions

The provisions aren’t automatic. The CARES Act loan and distribution provisions require employers to adopt those rules, according to Nelson. So you need to ask whether your employer offers these provisions in your 401 plan.

About 75% to 85% existing 401 workplace plans currently offer some type of hardship or loan provision, Nelson says.

Depending on your needs, you still have options even if your employer doesnt include the new provisions. Prior rules allow Americans to take out a 401 loan of up to 50% of their vested account balance, or a maximum of $50,000.

Can I Cash Out My 401 Without Quitting My Job

You donât need to quit your job to cash out a 401. Most plans allow access to a 401 to their current employees. Knowing your options will help you choose the best one.

Cashing out a 401 may be tempting, especially if youâre facing financial difficulties or a significant medical emergency or repair. Most 401 participants only access their 401s when they leave a job.

Normally you can’t cash out your 401 without quitting your job. However, some plans allow participants to cash out their 401s via a 401 loan or through a hardship withdrawal. A 401 loan will prevent you from having to pay taxes and penalties, but the loan plus interest will need to be repaid into the account. Hardship withdrawals are categorized by the IRS. Youâll still need to pay taxes however, youâll be exempt from the 10% penalty tax.

Retirement accounts are built and intended to help you save a nest egg to last throughout your retirement years. The best advice is to simply leave it to grow. But if you need access to your 401, it may not be necessary for you to quit your job to do so.

Recommended Reading: Can You Do A Partial 401k Rollover

Our Take: When Can You Withdraw From Your 401k Or Ira Penalty

There are a number of ways you can withdraw from your 401k or IRA penalty-free. Still, we recommend not touching your retirement savings until you are actually retired. Compounding is a huge help when it comes to maximizing your retirement savings and extending the life of your portfolio. You lose out on that when you take early distributions. To see how much compounding can affect your 401k account balance, check out our article on the average 401k balance by age.

We understand that its always possible for unforeseen circumstances to arise before you reach retirement. Being aware of the exceptions allows you to make informed decisions and possibly avoid paying extra fees and taxes.

To take control of your finances, a good place to start is by stepping back, getting organized, and looking at your money holistically. Personal Capitals free financial dashboard will allow you to:

The content contained in this blog post is intended for general informational purposes only and is not meant to constitute legal, tax, accounting or investment advice. You should consult a qualified legal or tax professional regarding your specific situation. Keep in mind that investing involves risk. The value of your investment will fluctuate over time and you may gain or lose money.

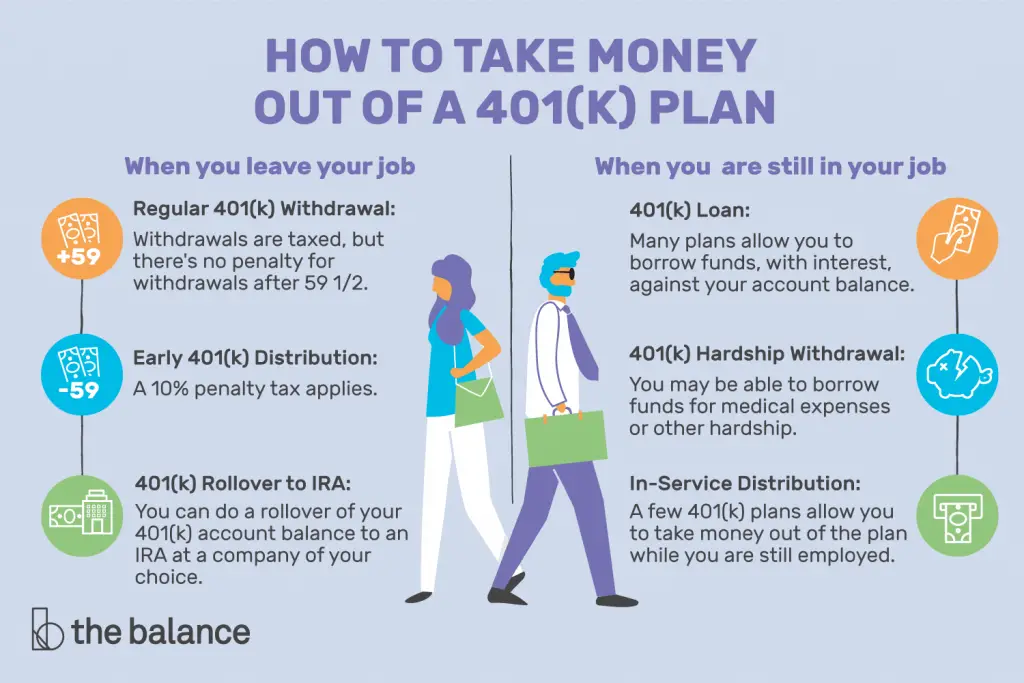

Taking Money Out Of A 401 Once You Leave Your Job

If you no longer work for the company that sponsored your 401 plan, first contact your 401 plan administrator or call the number on your 401 plan statement. Ask them how to take money out of the plan.

Since you no longer work there, you cannot borrow your money in the form of a 401 loan or take a hardship withdrawal. You must either take a distribution or roll your 401 over to an IRA.

Any money you take out of your 401 plan will fall into one of the following three categories, each with different tax rules.

Read Also: How To Take A Loan Out On Your 401k

Impact On Student Debt

The SECURE Act also allows people to withdraw up to $10,000 during their lifetime from their 529 plans, tax-free, in order to pay off their student loan debt. Originally, 529 plans were strictly for post-secondary education expenses, but that has been expanded to include K-12 expenses.

Under the SECURE Act, 529 funds can be used to pay off college debt. That said, not all states may allow the student loan benefit to come out tax-free at the state level.

Can I Withdraw Money From My 401k And Then Put It Back

Remember, once you take the money out of your plan using a hardship withdrawal, you cant put it back in and you lose for life the tax advantage on those funds. Plan loans are not subject to taxes or penalties, and you can continue to contribute to the plan while you repay the loan.

You May Like: What Do You Do With 401k When You Retire

How Much Can You Take Out Of 401k At Age 59 1 2

There is no limit to the number of deductions you can make. After you turn 59 ½, you can withdraw your money without having to pay the first withdrawal penalty.

What is the 59.5 rule?

Most Americans who are fortunate enough to have a retirement savings in the Individual Retirement Account are likely to be aware of the 59.5-year law, where dividends from IRA before that age began not only on tax deductions, but. a 10% penalty on initial distribution.

How much can you withdraw from your 401k at one time?

Generally, you can borrow up to 50% of your closed bar account or $ 50,000, whichever is less. The Senate Bill also doubles the amount you can borrow: $ 100,000. Generally, if you lose your job with a 401 credit book, the loan is treated as a deduction and you are at the tax office.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Don’t Miss: What Is The Penalty For Taking Money Out Of 401k