Can I Use My 401 To Buy A House

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, there are some factors and drawbacks that you might want to consider.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Also Check: Can I Cancel My 401k And Cash Out

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

What Is The Covid

Youll generally have to pay a 10% early withdrawal penalty if you take the cash out before you reach 59 1/2 years old.

You also have to pay normal income taxes on the withdrawn funds.

However, last March, former President Donald Trump signed an emergency stimulus bill that lets those affected by Covid withdraw up to $100,000 without the penalty, even if theyre younger than 59 1/2.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year.

Alternatively, you can repay the withdrawal to a 401k and avoid owing any tax.

To qualify for the exemption, you, your spouse or a dependent mustve been diagnosed with Covid-19.

Alternatively, you must have experienced adverse financial consequences due to Covid, which could include a lay-off or reduced income.

There are also other exceptions to the penalty, such as using the funds to pay for your medical insurance premium after a job loss.

Plus, you can take penalty-free withdrawals if you either retire, quit, or get fired anytime during or after the year of your 55th birthday.

This is known as the IRS Rule of 55.

Also Check: How Do You Access Your 401k

Will Other Retirement Plan Providers Follow Suit

The good news for Bitcoin investors and supporters is that Fidelitys willingness to embrace cryptocurrency in its retirement plan offerings helps to legitimize cryptocurrency as a long-term investment further and raise its profile as an emerging asset class.

Joe Sweeney, managing partner at Cornerstone Wealth, says Fidelitys stamp of approval holds a lot of value in the world of finance.

The goal of a 401 is to enable participants to save for a secure retirement, Sweeney says. That said, yes, the imprimatur of Fidelity will absolutely raise the standing of cryptocurrency among some significant number of Americans.

Sweeney says Fidelitys decision will put pressure on other major retirement plan providers, such as Vanguard and Charles Schwab, to offer Bitcoin options for retirement investors as well. However, Cox says other providers may not necessarily be too eager to follow Fidelitys lead.

I think most will take the you first approach to see if Fidelity lands itself in the regulatory and litigation abyss before adding crypto to their plan options, Cox says.

Automatic Enrollment And Aip

As an eligible associate, youâre automatically enrolled in the 401 on the first of the month coincident with or following 60 days of employment at a contribution rate of 3% of eligible pay. As part of automatic enrollment, youâre also enrolled in the automatic annual increase program , which increases your contribution by 1% each year until you reach 6%.

- If you want to change the automatic contribution elections before they begin, visit NetBenefits.com or call Fidelity at 1-800-635-4015 before 60 days of employment and make your own choices.

- If you donât actively enroll and choose investment funds for your account, Syscoâs contributions will be invested in the Vanguard Target Retirement Fund thatâs closest to your projected retirement date .

If you wish to contribute to the Plan before you are automatically enrolled or to opt out of automatic enrollment, log in to NetBenefits.com or call Fidelity at 1-800-635-4015. Note that youâll need to sign up for AIP if you choose to actively enroll. To do so, log in to NetBenefits.com and click Contribution Amount.

Read Also: What Is An Ira Vs 401k

How To Make Contribution And Investment Changes

Fidelity is the Master Administrator for the Plan this means that you have the streamlined ability to enroll in the Plan and make contribution changes, whether you contribute to Fidelity, TIAA, or both. In order to contribute to TIAA, you need to have an RIT TIAA account. By offering one consolidated plan, RIT is able to avoid unnecessary fees and keep costs to employees as low as possible.

- View and/or change your contribution percentage

- View and/or change the split between your pre-tax and Roth contribution percentage

- Join the annual increase program to automatically increase your contribution each September 1

- Change your record keeper election between Fidelity and TIAA

Log in at . You can set up a login if you do not have one by clicking on Register Now at the top of the page and follow the prompts.

Step 1:Once logged in, click on the drop down arrow to the right of Quick Links and choose Contribution Amount. If you are already logged in, click on the Contributions tab.

Step 2:There are three choices:

- Contribution Amount to view and change your contribution percentage and/or the split between pre-tax and after-tax Roth contributions

- Annual Increase Program to enroll or change participation in the program to automatically increase your contribution effective each September 1

- Retirement Providers to view and change the allocation for your future contributions between the two record keepers, Fidelity and TIAA

You May Like: Should I Rollover 401k To New Employer

What Is An Early Distribution

A distribution from a traditional IRA prior to the age 59 1/2 is generally considered to be an early withdrawal. An early withdrawal from an IRA is potentially subject to a 10% excise tax penalty unless the distribution is rolled over or converted to another IRA within 60 days. When the early withdrawal is due to disability, or if you are the beneficiary on a deceased individual’s IRA, distribution by death, the penalty may be waived. For more information, access Fidelity’s online Retirement Investing Center and consult a tax advisor about your particular situation.

Other exceptions exist for early distributions due to:

- A series ofsubstantially equal periodic payments based on the owner’s life expectancy

- Deductible medical expenses in excess of 7.5% of adjustedgross income

- Qualified first-time home buyer expenses

- Qualified higher education expenses

- An IRS levy against the account

Please call a Retirement Specialist at 800-544-6666 for more information.

Don’t Miss: How Do I Withdraw Money From My 401k Fidelity

When To Cash Out Your 401k To Pay Off Debt

The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans. Withdrawing the 401k plan early can cost money. The decision to withdraw 401k will depend on your financial situation. If debts are stressful on a daily basis, you should consider serious debt payment plans.

Continued Growth Vs Inflation

Remember that your retirement savings accounts dont grind to a halt when you begin retirement. That money still has a chance to grow, even as you withdraw it from your 401 or other accounts after retirement to help pay for your living expenses. But the rate at which it will grow naturally declines as you make withdrawals because youll have less invested. Balancing the withdrawal rate with the growth rate is part of the science of investing for income.

You also need to take inflation into account. This increase in the cost of things we purchase typically comes out to about 2% to 3% a year, and it can significantly affect your retirement moneys purchasing power.

Read Also: Am I Able To Withdraw Money From My 401k

Recommended Reading: How Many Loans Can I Take From My 401k

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Regulators Skeptical Of Bitcoin For Retirement Legal Risks For Employers

The U.S. Labor Department, which regulates company sponsored retirement plans, said that Fidelitys could threaten the retirement security of Americans.

We have grave concerns with what Fidelity has done, Ali Khawar, acting assistant secretary of the Employee Benefits Security Administration, told The Wall Street Journal. The regulator is discussing its concerns with Fidelity, especially the 20% threshold.

Charles Field, managing partner of the San Diego office of Sanford Heisler Sharp and chair of the firms financial services group, says the SEC and Labor Departments warnings could provide support to any claimants in potential future litigation against companies and their fiduciaries.

Bitcoin still is experiencing growing pains, and with the next market upheaval will come claims that fiduciaries who approved Bitcoin breached their fiduciary duty of prudence, Field says. At this stage, there may not be enough disclosure out there that would protect employers from such claims. Employers who offer Bitcoin in their 401k plans do so at their own peril.

In addition to the potential legal risks to employers, its unclear just how appropriate of a retirement investment Bitcoin is. Bitcoin has been a tremendous investing success story up to this point, but many retirement investors are hoping to build wealth over several decades.

Recommended Reading: How To Transfer 401k Balance To New Employer

Opting For Direct Deposit

Choosing direct deposit doesnt change the way you initiate your 401 withdrawal, nor does it speed up the application processing time you would have to follow the same procedure as you would for receiving your funds by check in the mail. However, in case you need your funds a little faster, then you should select direct deposit if that option is available to you.

You will still need to wait for your withdrawal application to process which takes five to seven days on average before the funds are released into your account. Once the money is released, it could post as early as the same day, or within 48 hours, depending upon your banking institution.

Early Money: Take Advantage Of The Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an individual retirement account .

If your account is between $1,000 and $5,000, your company is required to roll the funds into an IRA if it forces you out of the plan.

Don’t Miss: What Happens To My 401k If I Leave My Job

Should You Take A Distribution From Your 401 Or Ira

Like the CARES Act, the Consolidated Appropriations Act allows you to withdraw funds from both a 401 and an IRA, as long as the amount is up to $100,000 across all accounts. If you are deciding whether to take a distribution from either your IRA or a 401, think about factors such as each of the accounts typical rules around penalties and taxes. F

Finding The Right Withdrawal Strategy

Let’s start with a key question that many retirees ask: How long will my money last in my retirement?

As a starting point, Fidelity suggests you consider withdrawing no more than 4-5% from your savings in the first year of retirement, and then increase that first year’s dollar amount annually by the inflation rate. But from which accounts should you be taking that money?

Traditionally, many advisors have suggested withdrawing first from taxable accounts, then tax-deferred accounts, and finally Roth accounts where withdrawals are tax-free. The goal is to allow tax-deferred assets to grow longer and faster.

For most people with multiple retirement saving accounts and relatively even retirement income year over year, a better approach might be proportional withdrawals. Once a target amount is determined, an investor would withdraw from every account based on that accounts percentage of their overall savings.

The effect is a more stable tax bill over retirement and potentially lower lifetime taxes and higher lifetime after-tax income. To get started, consider these 2 simple strategies that can help you get more out of your retirement savings, depending on your personal situation.

You May Like: How Do I Find If I Have A 401k

Special Rules Resulting From The Coronavirus Pandemic

It should be noted that the CARES Act of 2020 gave employers the option to amend their 401 plans only if they so choose to allow investors who are impacted by the coronavirus to gain access to of their retirement savings without being subject to early withdrawal penalties and with an expanded window for paying the income tax they owe on the amounts they withdraw per The Security and Exchange Commissions Office of Investor Education and Advocacy .

An employer could amend their plan by allowing coronavirus-related distributions but not increasing the 401 loan limit, according to Porretta.

The SECs OIEA guidance on the CARES Act allowed qualified individuals impacted by the coronavirus pandemic to pay back funds withdrawn over a three-year period , and without having the amount recognized as income for tax purposes.

For income taxes already filed for 2020, an amended return can be filed. The 10 percent early withdrawal penalty was also waived for withdrawals made between Jan. 1 and Dec. 31, 2020. It also waived the mandatory 20 percent withholding that typically applied.

The Act also allowed plan participants with outstanding loans taken before the Act was passed but with repayment due dates between March 27 and Dec. 31, 2020 to delay loan repayments for up to one year. .

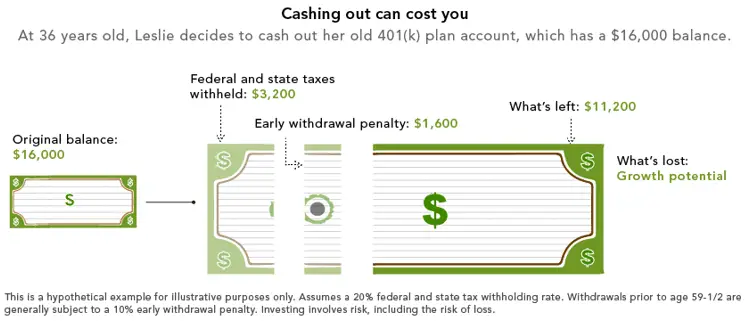

Withdrawing Money From A : Taking Cash Out Early Can Be Costly

An unexpected job loss, illness or other emergencies can wreak havoc on family finances, so its understandable that people may immediately think about taking a withdrawal from their 401. Tread carefully as the decision may have long-range ramifications impacting your dreams of a comfortable retirement.

Taking a withdrawal from your traditional 401 should be your very last resort as any distributions prior to age 59 ½ will be taxed as income by the IRS, plus a 10 percent early withdrawal penalty to the IRS. This penalty was put into place to discourage people from dipping into their retirement accounts early.

Roth contribution withdrawals are generally tax- and penalty-free contribution and youre 59 ½ or older). This is because the dollars you contribute are after tax. Be careful here because the five-year rule supersedes the age 59 ½ rule that applies to traditional 401 distributions. If you didnt start contributing to a Roth until age 60, you would not be able to withdraw funds tax-free for five years, even though you are older than 59 ½.

Read Also: How To Pull Out Of 401k

Can I Take A Distribution From My Account

Traditional Individual Retirement Account Distributions: You can withdraw from your IRA at any time. However, there are tax rules for each type of IRA. Please refer to the distribution guidelines included with the distribution forms for more details.

- Generally you will pay a 10% early withdraw tax penalty if you withdraw from your IRA before you are 59 ½.

Roth IRA Distributions: You can withdraw from your IRA at any time. However, there are tax rules for each type of IRA. To qualify for a tax-free distribution, you must have had a Roth IRA for five years and have met one of the following qualifying events:

- Attainment of age 59 ½,

- Death,

- A qualified first home purchase.

Please refer to the distribution guidelines included with the distribution forms for more details.

403 Plan Distributions: Regulations require that amounts contributed to a 403 Plan may not be distributed to participants or their beneficiaries earlier than that participants attainment of age 59 ½, death, disability, severance from employment, or the occurrence of an applicable hardship. Please refer to the distribution guidelines included with the distribution forms for more details.

If your annuity is part of a 403 or 457 Plan, you should also contact the plan administrator for assistance. Your ability to withdraw funds may be restricted by the applicable Plan rules or IRS regulations.