Get Involved And Learn The Ropes Of The Stock Market

Your 401 is basically an investment account, and to protect it from a market crash youll need to start by learning everything you can about investing and the stock market. Unfortunately, many people avoid learning how the market works because theyre scared of losing their money if they invest incorrectly. However, you shouldnt let this be your case.

If you want to retire with peace of mind and not have to worry about a new virus wiping out all of your savings without notice, learning the ropes is your first step. There are hundreds of books and resources you can choose from to learn the basics.

Once you have that down, you can move on to practicing trading using a good broker with a demo account that will help you understand things like asset classes, order types, and volatility.

The point is to read and learn about how the markets work to make educated decisions based on what you know.

Choose Your Asset Mix Carefully

Its essential to think about your asset mix, which simply means the different types of investments that go into your portfolio. For example, investing in stocks may help you grow your retirement fund faster, but if they drop substantially, you could also see plenty of losses. Thats why its essential to choose your asset mix wisely and make sure there are different types of investments in your portfolio.

Some tips about how to choose assets are:

Invest more in stocks when youre young.

When deciding how to allocate your funds, a general rule of thumb is that the younger you are, the more you can invest in stocks. This is because stocks offer much higher returns than other assets and have always shown a historical tendency to go up. However, they can also crash the hardest, which is unacceptable for someone who is reaching retirement age.

However, if youre young, you can afford to take on more risk and even some temporary losses because its almost a certainty that stocks will end up climbing again in the future. If you keep a long-term mindset, youre bound to end up winning in the end.

As you get older, choose safer investments.

Investing in low-cost index funds will provide you with an average return without taking on too much risk. But if you really want to reduce risk as much as possible, investing in bonds or bond funds rather than stocks or stock funds is the way to go.

Here’s What To Do When Your 401 Is Losing Money

Generally, the best move to make when you see your 401 balance go down is to do nothing at all.

This advice generally echoes investment experts’ guidance when any of your investments are affected by market downturns. Investing is a long-term game you take the short-term dips in exchange for the potential long-term growth, which, history has shown us, is what happens. Though past performance does not predict future performance, historically, any short-term losses have typically been outweighed by larger long-term gains.

“In the long run, stock prices are the world’s way of appraising the value of the underlying companies,” Winsett explains. “In the short term, prices can be chaotically random but over time, prices are firmly rooted in the real value of real companies whose products and services we use regularly, if not daily.”

Making an impulsive move like panic selling your 401 investments or withdrawing early from your 401 would have serious consequences. If you sell only to later jump back in the market, you may time it incorrectly and miss out on an upswing, or big recovery gains. Staying invested means as the market recovers, so, too, does your account balance. Dipping into your 401 funds before reaching the age of 59½, meanwhile, entails a 10% early withdrawal penalty on top of it being taxed.

Read Also: Does A Solo 401k Need An Ein

What Are The Benefits Of A 401k

401 tax benefits are hard to dispute, as they can offer workers a lot of financial security, including:

-

Employer match

In fact, let’s dig into 401k benefits a little deeper.

401k employer match

Do you like free money? Good, now that we’ve got that out of the way, a company-matched 401k is basically that. Many employers offer to match employee contributions, either dollar for dollar or 50 cents to the dollar, up to a set limit. So, for example, say you make $100,000 a year and your employer offers a 401k matching of 50% up to the first 6% you elect to contribute. If you contribute 6% of your annual earnings , your employer would contribute an additional 50% of that amount. So, 3,000 free dollars.

It’s up to your employer to decide what percentage they will match, but many companies do offer a dollar-for-dollar match.

401k tax breaks

The tax benefits of 401ks are like the triple-crown of finances. First, contributions are pre-tax. You dont pay taxes on the money until you withdraw it when you retire.

Second, your 401k contributions are not counted as income, which could put you in a lower tax bracket. The result: your tax bill will be smaller for your having squirreled away money for your later years.

401k shelter from creditors

If your finances take a turn for the worst, you won’t have to worry about creditors coming for your 401k. Your qualified retirement plan is protected by the Employee Retirement Income Security Act of 1974 from claims by judgment creditors.

Early Withdrawals: The 401 Age 55 Rule

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Nashville: How Do I Invest for Retirement?

Also Check: Can I Move My 401k To Roth Ira

Stocks Lose Money Every Year

Although the markets have generally risen over time, stocks lose money almost every yearat least temporarily.

Since 1979, the U.S. stock market has fallen from its intra-year highs by about 14% every year. Still, the market ended up with positive returns in roughly 83% of those years. Temporary losses in the stock market are an unpleasant aspect of investing for growth, but a downturn doesnt necessarily signal that your investment goals are shattered.

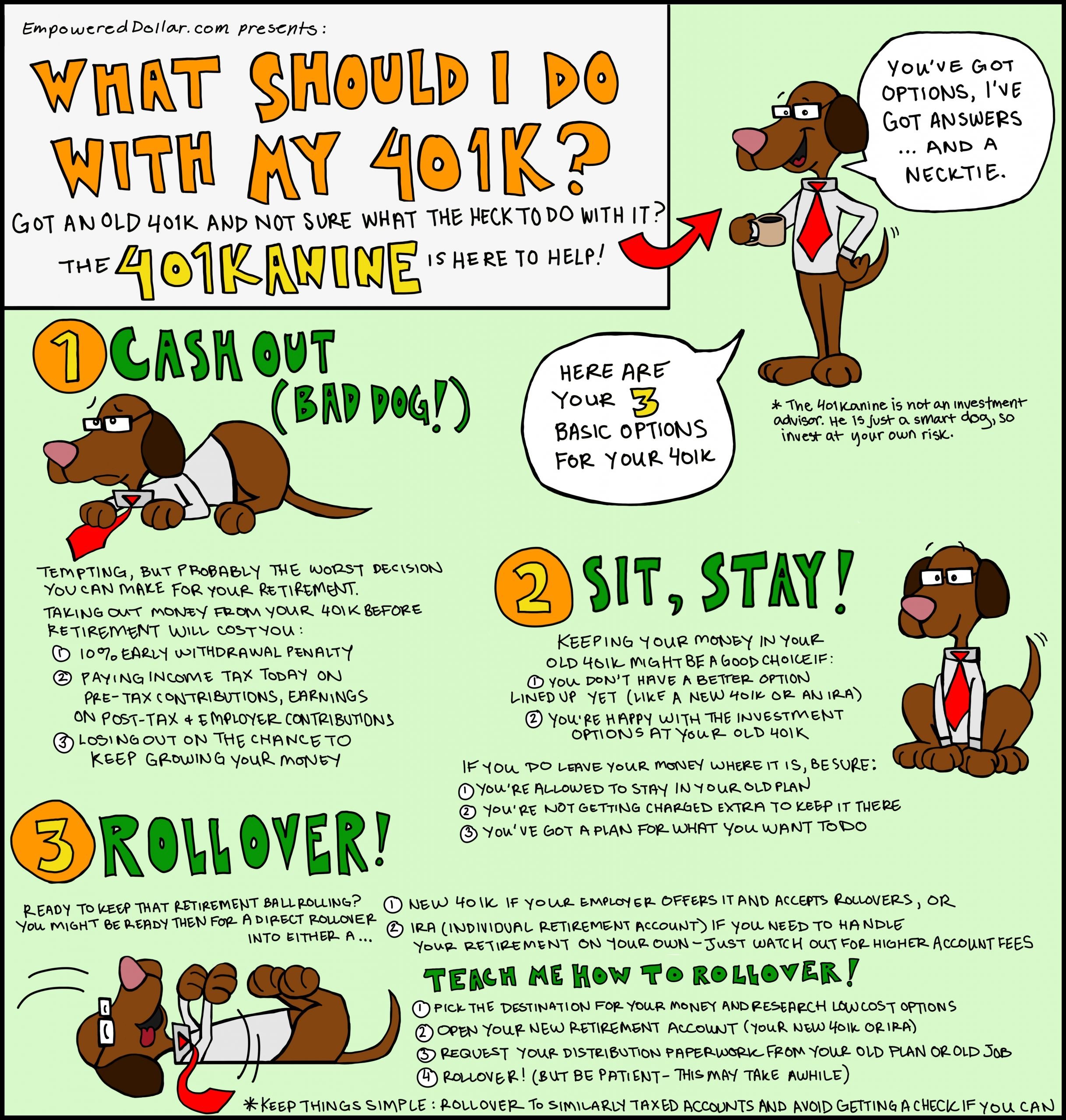

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

You May Like: Can You Roll Over Your 401k To An Ira

How To Assess Your 401 Options

The first step, if you suspect your company’s 401 is subpar, is to see if you’re right. Initially, focus on the fees you are paying. Fees can make a huge difference in how much money you’ll have accumulated in your plan by the time you’re ready to retire.

In addition to any administrative fees that your plan charges, each of your investments will carry their own fees. These fees are expressed as an expense ratio and can be found on your annual account statements. If you are paying more than 1% a year, especially for standard types of investments like large-cap stock mutual funds, you may have a high-cost plan.

You should also look at the range of investment choices that your plan offers. Employers are wary of including too many high-risk options in their 401 plans, but some take this too far. If your plan is lacking solid options for standard types of investments, this can also be an indication that your plan is not as good as it could be.

If, after completing this research, you find that your plan is not up to scratch, your first step should be to talk with your employer or HR department. Be as specific as possible with your criticisms of your 401, and ask them to address your concerns. Some employers are open to feedback like this, and it may improve the plan for everyone.

Oil Prices Surge To Three

Williams: This reaction is understandable. What do you tell them?

O’Donnell: With the uncertainty, emotions are a significant driver behind decision making for 401 investors. This might sound simple, but we try to tell them that before they make any changes, it is important to step back and consider personal needs rather than emotional reactions. We also advise investors to consider their time horizon and the resources available to them.

Worried girl looking at laptop screen at home.

Getty

Williams: I know that my 401 balance right now would probably make me cry. What can you tell me about how to manage that?

O’Donnell: If you are a long-term investor, following the daily headlines and market predictions can wreak havoc on you. We have noted that some normalcy is returning to markets, but you need to brace yourself for that quarterly statement that is arriving soon. Focusing on your account balance can not only cause you anxiety it can impact your bottom line, too.

Williams: What do you suggest for the investor looking to make changes ASAP?

Williams: Weve covered what not to do, so what proactive steps can investors take regarding their accounts?

Williams: Can you share a few specifics on that?

Williams: What about retirement plan contributions?

Williams: If someone doesnt have a full-time money person, where can they seek advice?

Williams: Thank you for your time.

Read Also: How Do You Roll Over Your 401k

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

What Is The Maximum 401k Contribution For 2021

That depends on your employer’s plan. The maximum the IRS allows for 2021 stayed the same as 2020. Currently, the cap sits at $19,500 but your employer may cap the amount below that. For people over 50 the maximum increases to help them “catch up” before their retirement. They can contribute an additional $6,500 a year.

Read Also: Is A Rollover From A 401k To An Ira Taxable

The Lesson On Market Volatility

The market will always fluctuate, so investors should make the most of it. There are ways to increase 401 funds in both pessimistic and optimistic market sentiments and minimize losses after acrisis.

Its certainly not easy for employees to let their entire life-worth of savings depend on such unpredictable circumstances. Nonetheless, they can efficiently secure a comfortable retirement with the appropriate investment plan and learn a few lessons on market volatility and 401s.

| The market is unpredictable. But both price growth and decline are part of the economic cycle, and investors can turn this to their advantage. |

| The 401 retirement plan depends on individual goals. However, it’s essential to choose the right investment plan to navigate through price fluctuations successfully. For the best results, account holders should consult with a professional. |

| Successful investors don’t let fear and panic take over. Instead, they make logical decisions that can effectively turn losses into gains even in unstable markets. |

| Consistent investments give good results. The market volatility shouldn’t stop employees from investing in their 401s. |

Dont Panic And Withdraw Your Money Early

Surrendering to the fear and panic that a market crash elicits can cost you. Withdrawing money from a 401 before age 59½ can result in a 10% penalty on top of normal income taxes. Its especially important for younger workers to ride out the market lows and reap the rewards of the future recovery.

Even people nearing retirement age may rebound from the crash in time for their first withdrawal. Consider the coronavirus-fueled crash of 2020 as a case study. The Dow Jones Industrial Average, which notched an all-time high of 29,551.42 on Feb. 12, 2020, fell to just above 19,000 by March 15, 2020. Then on April 15, 2021, it posted an intraday high of more than 34,000. Spooked investors who pulled their money from the market in March 2020 missed out on the bull market that pushed the DJIA to record highs by November 2020 just eight months later.

Read Also: Can You Convert A Roth 401k To A Roth Ira

Read Also: When Do You Have To Take 401k Distributions

Option : Transfer The Money From Your Old 401 Plan Into Your New Employers Plan

Moving your old 401 into your new employers qualified retirement plan is also an option when you change jobs. The new plan may have lower fees or investment options that better support your financial goals. Rolling over your old 401 into your new companys plan can also make it easier to track your retirement savings, since youll have everything in one place. Its worthwhile to talk with an Ameriprise advisor who will compare the investments and features of both plans.

Some things to think about if youre considering rolling over a 401 into a new employers plan:

Going Beyond Your 401

As we’ve mentioned, even if your 401 isn’t as good as it could be, you should usually try to contribute enough to maximize your employer’s matching contributions, and do so by using the best investment options available through your plan. However, you may be lucky enough to be able to save more for retirement, and if your 401 is not great, you might want to invest outside of your employer’s plan.

There are several options open to you. The best place to start, for most investors, will be an Individual Retirement Account . An IRA offers similar tax advantages to a 401 plan, but you’ll have much broader options when it comes to choosing your own investments. One drawback is that the contribution limits for IRAs are much lower than those for 401 plans.

The second option could be to fund a Health Savings Account , if you have a high-deductible health plan. HSAs have similar tax advantages to 401s and IRAs, and while the money must be used for qualified health expenses, you don’t have to spend it right away and can use it to cover your health-related costs in retirement.

Finally, you might consider saving for retirement via a regular mutual fund or brokerage account. The disadvantage of this route is that you’ll lose many of the tax advantages of a 401, IRA, or HSA. The advantageif your 401 is badis that you might pay far lower fees. You’ll also have an almost limitless number of investment options.

Read Also: When Retiring What To Do With 401k

Tip #: Dont Bet Too Much On Your Employer

To reduce the chances of getting in the unfortunate situation where your company stock has a severe drop or actually becomes worthless, do your homework and learn some things about your companys financial condition before you buy company stock in your 401.

Even if you conclude that the company you work for is in good financial shape, its still a good practice to not put more than 5% or 10% of your 401 funds into your company stock. Just ask the employees of Enron who did this and saw their company stock become worthless.Nothing in life is ever 100% certain, and that certainly includes investing in a 401 plan, but if you follow these time-tested principles of investing, the odds are you will be prepared for a comfortable retirement.

How Does The Stock Market Work And How Can It Affect Your 401

The stock market is a public resource that everyone can use to invest in companies. When you buy a companys shares, youre purchasing a certain percentage of their business. So if they do well, your money will grow along with them, but if they do poorly, then youll lose part of your investment.

In laymans terms, the stock market is the result of many buyers and sellers worldwide who trade stocks daily. These stocks can be from big, multinational, publicly-traded corporations like Apple, Tesla, and Meta , and smaller companies and startups from many different sectors of the economy.

Recommended Reading: How Do I Find My 401k Plan

Tracking Down A Lost 401

Its easy to understand why some workers might lose track of an old 401: Those born between 1957 and 1964 held an average of 12.4 jobs before the age of 54, according to the Bureau of Labor Statistics. The more accounts you acquire, the more challenging it is to keep track of them all.

Perhaps this is why there are some 24 million forgotten 401s holding assets in excess of $1.3 trillion.1 Left unattended too long, old accounts can be converted to cashand even transferred to the state as unclaimed propertyforgoing their future growth potential.

If youre among those with misplaced savings, heres how to locate and retrieve them: