The Main Distinction Involves The Kinds Of Employers Who Offer Them

Thomas J Catalano is a CFP and Registered Investment Adviser with the state of South Carolina, where he launched his own financial advisory firm in 2018. Thomas’ experience gives him expertise in a variety of areas including investments, retirement, insurance, and financial planning.

The two primary types of defined-contribution retirement savings plans offered by employers are 401 plans and 401 plans. They take their names from Section 401 of the United States Internal Revenue Code, which defines them.

The principal differences between a 401 plan and a 401 plan are first in the types of employers that offer them and then in several key provisions regarding contributions and investment choices.

Is It Possible To Roll A 401 Into An Ira Without Penalty

Yes. If you have any funds in your 401 that you would like to move to your IRA for different reasons such as the opportunity to enjoy a wider variety of investment assets, then this is possible. You will, however, have to stick to the guidelines that are specified by the IRS. If you follow the guidelines, then you can make the contributions without getting penalized. Those who do not follow the set guidelines often huge penalties.

Rolling your 401 into an IRA can at times be viewed as being a complex process, but there are service providers who can help simplify the process for you.

Have a look at the recommended companies, below, which can for instance help you roll over your 401 into a self-directed IRA that can hold gold and silver, and the others that can hold cryptocurrencies.

How Should I Save For My Future

The first set in getting ahead financially is setting up some sort of retirement account that allows you to avoid being taxed as your money grows. While there is no one-size-fits-all solution for savings, there are some important things to keep in mind.

As mentioned above, a Roth IRA probably makes the most sense for younger people.

If you are just getting into the workforce, you are likely in a low tax bracket. Once you stash your post-tax earnings in a Roth IRA, you will be able to access your savings tax-free when you are older, and in a higher tax bracket.

The kind of IRA you choose to open for yourself is important to consider, but the kinds of investments you make are going to determine how fast your money can grow.

Read Also: What Happens To 401k When Switching Jobs

Eligible Income Levels For 401 And Ira

401 has no regulations on income levels for the LCE & MCE, but the regulations for HCE greatly complicate it.

Contribution limits to an IRA are based upon income . Below a certain income threshold, you are allowed to contribute up to the full amount, which is $5,500 per individual for 2016. Individuals over the age of 50 can contribute an additional $1,000. These limits are per individual so the limits are effectively double for married couples. However, if your income is above a certain threshold, the contribution limits start decreasing as follows:

- Single, Head of Household, Married Filing Separately: full contribution to $52k, partial to $62k can’t contribute at all if income is greater than $62,000

Benefits Of Ira Plans

- Tax advantages. Many IRA’s allow plan contributions to be tax deductible from your taxes, even though earnings grow tax-deferred into retirement.

- More investment options. As IRA’s are self-directed, you can knock down the investment options of 401 plans and invest in many more investments, including more stocks, funds and fixed-income investments.

- Easy to start. IRA’s aren’t very complicated to set up and many self-directed investors do so on their own. That saves both time and money.

Recommended Reading: How Long Will 500k Last In 401k

How To Pick Between An Ira And 401

There’s much to say in favor of both IRA’s and 401 plans. Both offer tax-deferred growth and taxation in retirement when you’re presumably in a lower tax bracket.

On the cash accumulation side, it’s hard to argue against a 401 plan. After all, plowing $19,000 or more into a tax-deferred savings account every year is a very good thing for hard-working Americans who deserve a comfortable retirement.

On the account management side, IRA’s offer more investment options and more tax advantages Plus, they’re less expensive to run.

In the end, you can have the best of both worlds – and actually have a 401 up and running and, in many cases, open up an IRA plan, too. You’ll be subject to contribution limits, but you’ll also be maximizing your retirement savings on an annual basis, and that’s going to work in your favor over time.

Just make sure to contribute as much as possible into your 401 plan first, as it allows for higher contributions, and then add as much cash as you’re allowed to an IRA.

That’s a balanced retirement plan recipe that, once it’s up and running, should lead directly to a cash-flush retirement for the savvy long-term investor.

Ira Vs 401k: What Are The Key Differences

IRA vs 401k: is there a difference?

Yes, there is a big difference between an IRA and 401k. The main difference between the two is that an IRA is a form of retirement plan that you can create and fund yourself.

Whereas, a 401k plan is a tax advantaged retirement plan created by your employer, in which you can contribute a certain amount from your salary.

Lets explore more key differences between IRAs and 401s.

Note, if you have questions beyond an IRA and 401k plans, a financial advisor can help you determine the best saving options to help you reach your retirement income goals.

Recommended Reading: Can A Small Business Set Up A 401k

Retirement Accounts Are Essential For Planning For The Future

In addition to having retirement accounts, having a high savings ratewhich is essentially how much money you save each month compared to your gross incomecan also be highly beneficial.

Retirement accounts are essential for financial success and so that you can have a solid amount of money saved up when you retire. With a better understanding of an IRA vs. 401k, you can move onto Chapter 7, where well cover the differences between a 401 vs. 403b.

This is for informational purposes only and should not be construed as legal, investment, credit repair, debt management, or tax advice. You should seek the assistance of a professional for tax and investment advice.

Third-party links are provided as a convenience and for informational purposes only. Intuit accepts no responsibility for the accuracy, legality, or content on these sites.

Save more, spend smarter, and make your money go further

Whats The Difference Between An Ira Plan And A 401k Plan

IRA vs 401k

- An IRA is a retirement account that you create, while a 401k is a retirement account that your employer sets up for you, and one that you fund. In some cases, your employer will match a portion of your 401k contributions.

- Maximum contribution: A 401k allows you to contribute $19,500 and up to $26,000 if youre an older employeeat least 50 years of age. Whereas, with an IRA you can contribute up to $6,000 each year. Your spouse, regardless whether he or she is working, can also contribute up to $6,000 into your IRA, making it a total of $12,000 per year. If you are 50 and older, you can put up to $7,000 in your IRA each year.

- Tax-deduction: Your contributions to a 401k are tax deductible in the year that you make them. Whereas, your contributions to an IRA may or may not be tax deductible.

- You decide where to open your IRA account , while with a 401k must be established by your employer.

Also Check: Can You Transfer Money From 401k To Ira

Which Is A Better Investment For Retirement

It is hard to say which investment is better for retirement. The answer to this question will depend on what options are available to you and what your personal financial situation is. Both can be great avenues for saving money for retirement. A 401 is going to allow you to make more contributions each year than an IRA. However, an IRA generally has lower expenses and fees. If you have access to an employer match with your 401, then you should go ahead and contribute to the 401 first. Contribute at least enough to max out your employer match. Once you are making those contributions to your 401, then you should go ahead and consider opening an IRA. Just be aware that you might not be able to deduct all your IRA contributions from your current taxes if your income is too high and you participate in a 401.

Which Retirement Plan Is Better

Yet 401k plans might be too good to overlook assuming an employer offers a match.

In essence, your employer is giving away free money, says Michael Turner, a risk strategist at Charlotte Wealth Group.

If there is employer matching involved, place into the 401k whatever is matched, Mr Turner told The Sun.

Furthermore, if an individual has $500 to put into a retirement account and is eligible to be matched then Turner recommends putting all into a 401k.

Early on in your career, you might want to take as much advantage as you can with 401k.

However, you might need an IRA later in your life if you leave your employer offering the 401k plan.

If you leave an employer before retirement and go to work somewhere else you still have the option to roll your 401k into an IRA, Brandon Renfro, a financial planner specializing in retirement income planning, said.

He added that there isnt any concern about your employer having control of your retirement money.

While the better plan might go to 401k, it will be important to utilize both retirement savings accounts.

You May Like: Can You Roll A Traditional 401k Into A Roth Ira

What Is The Difference Between A 401 And An Ira

The terms 401 and individual retirement account are bandied about quite a bit when discussing retirement planning, but what are the actual differences between the two? The main distinction is that a 401 — named for the section of the tax code that discusses it — is an employer-based plan, while an IRA is an individual plan, but there are other differences as well.

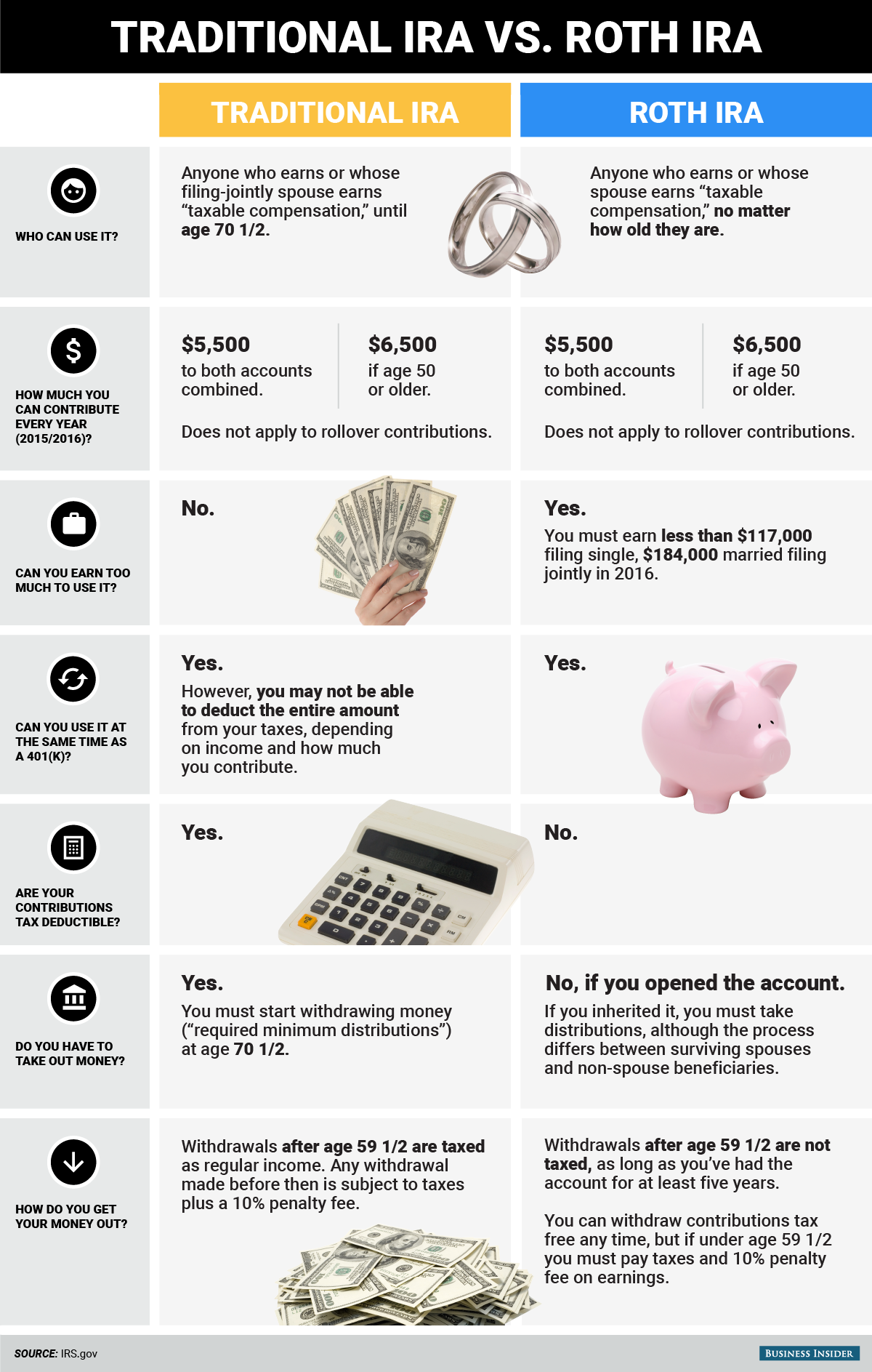

Both 401s and IRAs are retirement savings plans that allow you put away money for retirement. You may begin taking distributions from these plans at age 59 ½. There are two main types of IRAs: Roth and traditional. With a traditional IRA, you don’t pay taxes when you make contributions because the taxes are paid only when you withdraw the money, whereas with a Roth IRA, you pay the taxes up front and any gains accumulate tax-free. In addition, with a traditional IRA and 401, you are required to start taking minimum distributions at age 72 , but with a Roth IRA there is no requirement to take minimum distributions.

Local Elder Law Attorneys in Your City

Participation

In order to have a 401, you must work for an employer that offers this type of plan as part of its benefit package. Because it is a benefit, your employer may limit which employees may join the plan. Contributions are usually made through deductions from your paycheck.

Contributions

Investments

Loans

Beneficiaries

With an IRA, you can designate whomever you want to be your beneficiary without needing spousal consent.

What Is The Difference Between A Traditional Ira And A Roth Ira

The main difference between a traditional and Roth IRA is the timing of the tax benefits. With a traditional account, you make tax-deferred contributions. This means that you will not pay income tax on those dollars today, but rather will pay taxes on them when you make withdrawals. With a Roth account, you pay taxes on the dollars today like normal income. When you withdraw those contributions, you get to enjoy them tax-free in retirement. There are also eligibility differences between the two types of accounts. If your income is too high, you will not be allowed to make Roth contributions. At that level of income, you can still make contributions to a traditional IRA, but your contributions may not be tax deductible. When considering a 401k vs Roth IRA, it is best if you can contribute to both plans.

Also Check: When Can You Roll Over 401k To Ira

What’s The Difference Between An Ira And A 401k

There are some notable differences that you should be aware of when comparing IRAs with 401ks.

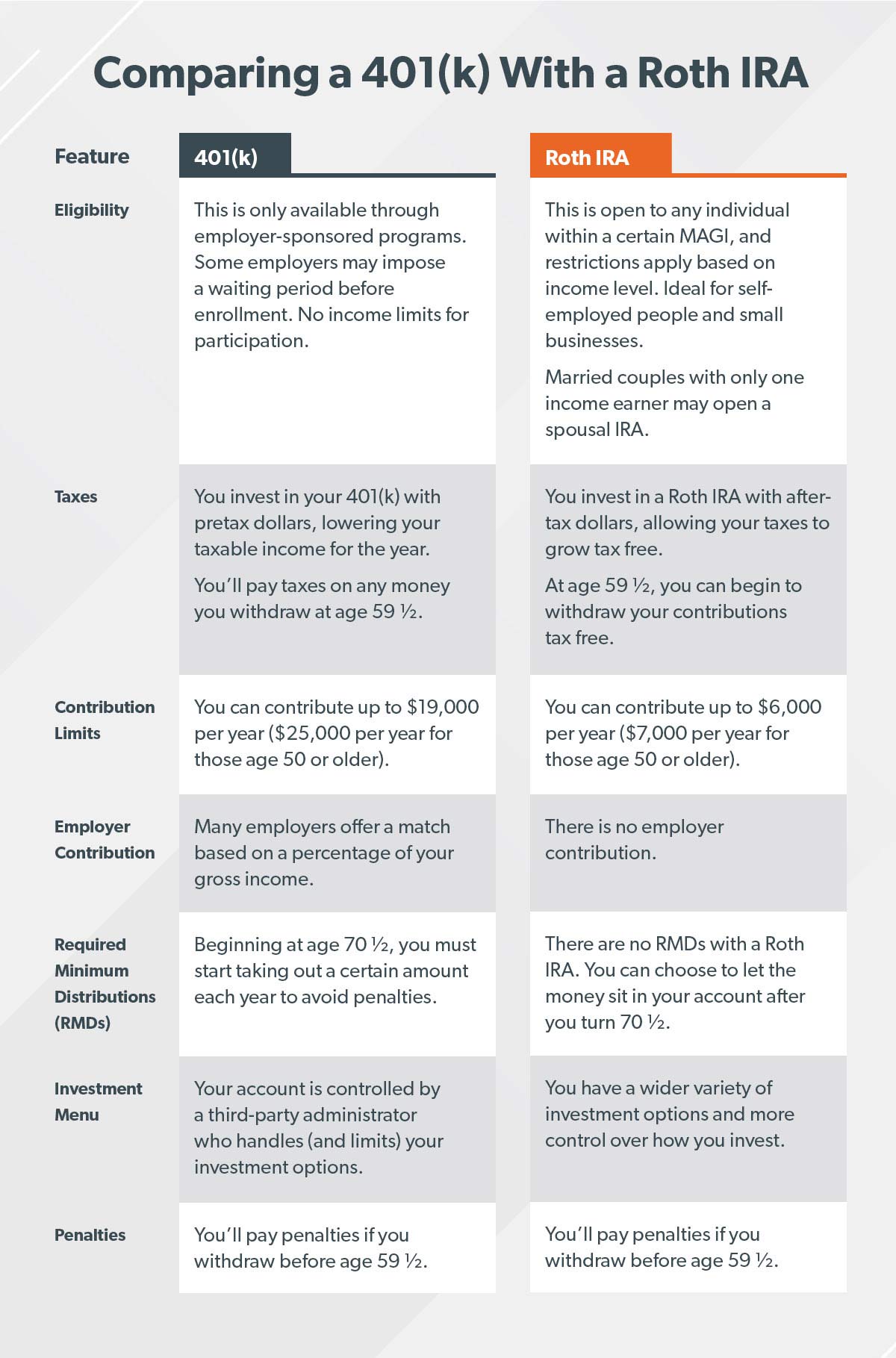

A 401k is a retirement plan offered by an employer. This allows employees to allocate a portion of their income into a long-term investment account.

Youll have to check with your employer, but some companies will agree to match up to 5% of each paycheck.

Whats The Difference Between An Ira And A 401

An IRA is a tax-advantaged retirement account that stands for individual retirement arrangement, although its typically referred to as an individual retirement account. Typically, an IRA is an account you open for yourself as an individual. However, a few types of IRAs, such as a simplified employee pension or a Simplified Incentive Match for Employees IRA, allow an employer to open and fund an account on your behalf.

A 401 is a type of retirement savings plan employers can set up on their workers behalf. As with an IRA, you get tax advantages for saving in a 401. Some companies also contribute to employees accounts. A 401 operates under the rules of the Employee Retirement Income Security Act , a federal law that sets minimum standards for private-sector workplace retirement plans.

If youre self-employed, you can open a solo 401 and make contributions as both the employee and the employer.

The tax advantages you get with an IRA versus a 401 depend on the type of account. The withdrawal rules also vary, however, if you take money out of either account before age 59 ½ you could owe taxes and a 10% penalty.

The two main types of IRAs are:

With a traditional 401, you defer a portion of your income and get a tax break on your contributions. Youre taxed later on when you take distributions from the account.

Also Check: How Can I Get My 401k

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Choosing Between A 401 And Ira: What Should You Pick

Both 401s and IRAs have their benefits and drawbacks, and you should pick the option that helps you achieve your savings goals.

If your employer has a 401 plan, you should consider enrolling in the plan and start saving for your retirement early if you are eligible. A 401 has higher contribution limits and it can help you accumulate your savings over time. However, the limited investment options mean that you cannot invest in a desired investment that is not among the available investment options. If your employer offers a match, you should consider taking up the offer and watch your investments grow over time.

If you are looking to get greater control over your retirement money, you should consider rolling over your old 401s to an IRA. An IRA allows investors to directly manage their portfolio, and hold the funds in an IRA savings account. If you want to buy your first home, pay medical bills, pay higher-education expenses, you may also qualify to take an early withdrawal without paying the 10% penalty tax. However, you will still be required to pay income taxes on the withdrawal amount.

Tags

Recommended Reading: Why Cant I Take A Loan From My 401k

S To Take If Your Employer Does Not Offer A 401 Match

Even if your employer doesnt offer matching contributions, you can still make contributions to your 401 a priority. However, investing in your traditional or Roth IRA should come first. This account generally has lower fees and more flexibility. You can choose your IRA service provider, select your preferred type of investments, and have more control over the costs and risks. Contribute the maximum amount based on your income and employment situation. Depending on your income level, your contributions may not be deductible or even permissible.

Only after you max out your IRA should you invest in your 401. While an employer match is a good savings incentive, so is the tax-deferred nature of the retirement account. Contribute as much as possible up to the contribution cap for your 401 plan year.

Both 401s and IRAs offer strong benefits for people who make contributions. Its especially important to prioritize your 401 if your employer offers matching contributions. If you want to learn more about creating a 401 plan with strong employee incentives for your company, contact Human Interest today.

Article By

The Human Interest Team

We believe that everyone deserves access to a secure financial future, which is why we make it easy to provide a 401 to your employees. Human Interest offers a low-cost 401 with automated administration, built-in investment advising, and integration with leading payroll providers.