Tips For Planning Your Retirement

- A financial advisor can help you develop a savings and investment strategy to help you get ready for retirement. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Use calculators to your advantage. A retirement calculator and Social Security calculator to estimate how much money youll need and what youll have coming in for retirement. Update the numbers whenever you experience a major life change that can affect your finances, such as getting married, having a child or changing jobs.

The Simple Way To Save For Retirement

This article is provided for informational purposes only. It does not cover every aspect of the topic it addresses. The content is not intended to be investment advice, tax, legal or any other kind of professional advice. Before taking any action based on this information you should consult a professional. This will ensure that your individual circumstances have been considered properly and that action is taken on the latest available information. We do not endorse any third parties referenced within the article. When you invest, your money is at risk and it is possible that you may lose some or all of your investment. Past performance is not a guarantee of future results. Historical returns, hypothetical returns, expected returns and images included in this content are for illustrative purposes only.

We provide investment services and other financial products through several affiliates.

Wealthsimple Trade is offered by Canadian ShareOwner Investments Inc. , a registered investment dealer in each province and territory of Canada, a member of the Investment Industry Regulatory Organization of Canada and a member of the Canadian Investor Protection Fund , the benefits of which are limited to activities undertaken by ShareOwner.

Wealthsimple Invest and Work are offered by Wealthsimple Inc., a registered portfolio manager in each province and territory of Canada. Assets in your Invest and Work accounts are held with ShareOwner.

Average 401k Balance At Age 22

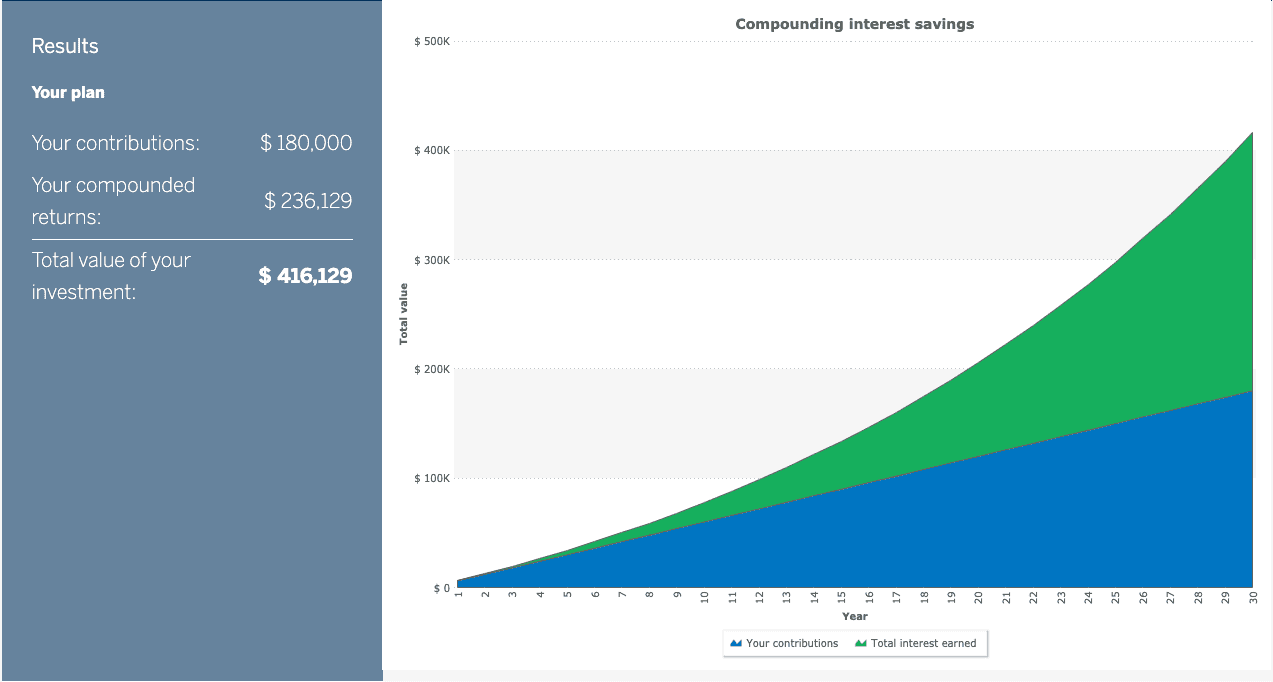

The average 401k balance at ages 22-24 is actually pretty impressive, and indicates that young people using the Personal Capital Dashboard are taking their retirement savings seriously. When youre in your early 20s, if youve paid down any high-interest debt, endeavor to save as much as you can into your 401k. The earlier you start, the better. As you can see from the potential savings chart, compounding interest is no joke.

You May Like: Can You Borrow From Your 401k Twice

What Is A Defined Contribution Plan

A defined contribution plan is any retirement plan to which an employee or employer regularly contributes some amount. Often, the employee chooses to send a fixed percentage of monthly income to the account, and these contributions are automatically withdrawn, directly from her paycheck – no effort required. The money that doesn’t go to the employee’s take-home pay gradually accumulates, the balance earns interest from investments, and by the time retirement rolls around, its grown into a substantial nest egg for the retiree. Thats the idea.

In a defined contribution plan , there are no guarantees about the income youll receive in retirement. That doesnt mean such plans cant be just as effective, however, and employers often sweeten the deal by making contributions of their own, straight into your account.

Can I Retire At 60 With $500k

Yes, you can retire at 60 with five hundred thousand dollars. At age 60, an annuity will provide a guaranteed level income of $26,250 annually starting immediately, for the rest of the insureds lifetime. The income will stay the same and never decrease.

If the annuitant selected the increasing income option, they would receive $23,600 annually initially with the income amount increasing overtime to keep up with inflation.

At age 62, you can start Social Security Benefits. Combining the two sources of income could provide a fixed income stream for the rest of your lifetime.

Either lifetime income option will continue to pay the annuitant, even after the annuity has run out of money. At the time of the annuitants death, the designated beneficiary will inherit the remainder of the annuity.

Im a licensed financial professional. Ive sold annuities and insurance for more than a decade. My former role was training financial advisors, including for a Fortune Global 500 insurance company. Ive been featured in Time Magazine, Yahoo! Finance, MSN, SmartAsset, Entrepreneur, Bloomberg, The Simple Dollar, U.S. News and World Report, and Womens Health Magazine.

My goal is to help you take the guesswork out of retirement planning or find the best insurance coverage at the cheapest rates for you.

Also Check: Can You Use Your 401k To Start A Business

How Much Money Do I Need To Live On

When deciding how much you need to live on in retirement, youll need to consider a number of factors unique to your situation and ideal retirement:

- How much money you spend on housing every month

- How much money you spend on food every month

- What types of transportation and health insurance you want to budget for

- Types of leisure activities that are important to your retirement plan

- How much you plan to spend on entertainment

- Do you wish to provide support to grandchildren through custodial accounts or other educational savings accounts?

- Do you intend to donate to charities you support?

The considerations you will make for how much you need to live on depends on any number of factors.

Its important to take stock of your priorities you wont compromise on while also finding areas that can fall to the wayside once you enter into retirement.

Youll also want to size how much nest egg youll need by identifying a number of other important factors to consider:

- The number of years you plan on living in retirement

- How much money your spouse makes, and how many children under 18 you have at home or plan to support financially .

- The types of investments you plan to hold in retirement and how much you intend to invest in growth or income investments

- Your geographical location, which affects the cost of housing and other expenses significantly

4% Safe Withdrawal Rate

The 4% withdrawal rate has long stood as the golden rule for how much you can safely withdraw from your portfolio each year and remain financially secure during retirement.

The 4% rule relies on a diversified investment portfolio split between 60% stocks and 40% bonds. This also assumes you keep your spending flat during retirement without adjustments for inflation or other cost of living increases or decreases.

Remember, few things remain absolutely static in life. The only certainty in life is change as the old adage goes. If you think these constant returns and spending fits your portfolio and needs, the 4% rule might work for you.

The rule relies on this diversified portfolio to provide continued capital appreciation as well as income to support your spending needs.

The portfolio has averaged a return of 6.4% per year since 1929, meaning withdrawing 4% per year shouldnt deplete your funds. Rather, it should only take away from your returns and leave the principal largely untouched.

One thing to know about average annual returns, however, is that the average year rarely happens. In fact, youre more likely to have boom and bust years follow one after another.

Therefore, timing your withdrawals becomes a forecasting practice, something fraught with incredible amounts of risk. Its probably not advised to step up your withdrawal rate during a recession to keep your spending constant as is called for by the rule.

Recommended Reading: What Should I Do With 401k

Take Your Timeline Into Account

One of the biggest factors that affects how much you can withdraw is how many years of retirement you plan to fund from your retirement savings. Say you plan on a retirement of 30 years, you invest in a balanced portfolio, and want a high level of confidence that you won’t run out of money. Our research shows that a 4.5% withdrawal rate would have been sustainable 90% of the time .2

But if you work longersay you expect to retire at age 70or if you have health issues that compromise your life expectancy, you may want to plan on a shorter retirement periodsay, 25 years. The historical analysis shows that, over a 25-year retirement period, a 4.9% withdrawal rate has worked 90% of the time.

On the other hand, if you are retiring at age 60 or have a family history of longevity, you may want to plan for a 35-year retirement. In that case, 4.3% was the most you could withdraw for a plan that worked in 90% of the historical periods. These may sound like small differences, but they could equate to thousands of dollars in annual retirement income.

The good news is that even with the market’s historical ups and downs, these withdrawal amounts worked most of the timeassuming that investors stuck to this balanced investment plan. The takeaway from this analysis is that the longer your retirement lasts, the lower the sustainable withdrawal rate.

Past performance is no guarantee of future results.

Here Are Some Additional Items To Keep In Mind:

- If you are regularly spending above the rate indicated by the 75% confidence level , we suggest spending less.

- If you’re subject to required minimum distributions, consider those as part of your withdrawal amount.

- Be sure to factor in Social Security, a pension, annuity income, or other non-portfolio income when determining your annual spending. This analysis estimates the amount you can withdraw from your investable portfolio based on your time horizon and desired confidence, not total spending using all sources of income. For example, if you need $50,000 annually but receive $10,000 from Social Security, you don’t need to withdraw the whole $50,000 from your portfoliojust the $40,000 difference.

- Rather than just interest and dividends, a balanced portfolio should also generate capital gains. We suggest using all sources of portfolio income to support spending. Investing primarily for interest and dividends may inadvertently skew your portfolio away from your desired asset allocation, and may not deliver the combination of stability and growth required to help your portfolio last.

- The projections above and spending rates are before asset management fees, if any, or taxes. Pay those from the gross amount after taking withdrawals.

Read Also: How To Find Old 401k Plans

How Much Income Does $500000 Generate

One option for how to retire on 500K involves living simply on the earnings. If you have other sources of income like what was mentioned above, you may be able to retire with $500,000 invested and just using the earnings that it generates.

Below you can see how much income $500,000 generates at different percentages.

| Rate of Return |

| $75,000 |

So even if $500,000 is only generating 25,000 per year in retirement, you can still retire comfortably if you have other sources of income such as Social Security.

Wait Until Medicare Eligible And Possibly Full Social Security Payout

Closely related to waiting for Social Security is the possibility of waiting until youre Medicare eligible. Healthcare expenses can run high just before Medicare eligibility.

Most full-time positions allow you access to healthcare benefits or at least the income youd need to pay for a policy you can buy on Healthcare.gov.

In either circumstance, having extra money coming in can cover your healthcare expenses until you reach Medicare eligibility and have a higher Social Security payout.

Recommended Reading: Can You Start Your Own 401k

S To Take Now To Improve Your Retirement Readiness

While the average 401k balance at pre-retirement age is around $600K, that balance still falls far below even the no growth column of the savings potential chart for the same age. And while $600,000 is no chump change, its also probably not enough to retire comfortably for most people.

Needless to say, many people are falling way below their savings potential. But the good news is, its not too late to turn things around.

How Spending Habits Change As You Grow Older

While healthcare costs increase, some costs shrink considerably or even disappear when you retire. Once you stop going to work, your spending habits evolve as your priorities change. Your risk tolerance is also lower when it comes to investments. This means youre less likely to invest in new or unfamiliar ventures than when you were younger. Knowing your resources are now limited, youll prioritize costs that are more practical and beneficial at a later stage in life.

Heres how the following expenses are affected after you retire:

Read Also: How To Get A Hardship Loan From My 401k

Slash Your Living Expenses Pay Off All Debt

When thinking about retirement, youve got to project a lot of things into the future, often decades. Fortunately, youve developed a sense of your financial needs to this point in life, know what your lifestyle affords and how you can handle money.

Retirement experts use a conservative estimation to determine how much money youll need in retirement. The number people often cite for your expenses comes to roughly 80% of what you need while working.

That can be a big number to manage on your own so its often worth considering what you should do for the remainder of your life if you have less than $500k or $600k in savings and investments when retiring.

One way to make the number more manageable is to slash your living expenses where possible. This means:

- right-sizing your budget

- making big purchases before retiring that you wont eat into your retirement nest egg

- looking into ways to reduce what you own and need

- practicing minimalism to clear your house of unneeded possessions and reducing your future needs

Another strategy involves paying off all debt before entering retirement. This sheds the unshakeable overhead of debt payments.

Debt represents a double-edged sword. First, it enabled you to buy something in a moment of need you couldnt have otherwise afforded it. You did this by pulling your spending power forward and agreeing to repay it over a future period of time.

How To Retire On $500000

Creating a mock-up retirement budget can reveal if your $500,000 target is realistic based on the type of lifestyle you plan to enjoy. The budget should account for basic living expenses including housing, food, utilities and transportation, as well as health care, hobbies and travel. If you have no idea where to begin, review your current spending patterns.

Try tracking your spending for at least six months and then ask yourself some key questions, such as:

- Is what youre spending now likely similar to what youll spend in retirement?

- Are there any expenses you have now that may increase or decrease when you retire? Any that could disappear altogether?

- Are there expense categories you dont have now that you might add to your budget when you retire?

These questions will provide insight into what it will cost to maintain your standard of living in retirement and help you decide a realistic draw down rate. Typically, experts recommend withdrawing 4% of your retirement assets or less each year to ensure the money lasts. Assuming you have $500,000 in retirement, you could realistically withdraw $20,000 your first year of retirement. That amount would shrink incrementally each subsequent year, assuming zero portfolio growth.

You May Like: Where Is My 401k Account Number

How Long Will $300000 Last In Retirement

So lets say that youve got $300,000 saved up and you withdraw 4% per year, that sum alone will probably last you about 25 years. That’s if you left it sitting in an account that provides no return at all. Withdrawing 4% per year would mean your yearly withdrawals would be $12,000. Thats probably not enough to live on, unless you have additional income or if you own your own home.

Your funds have the potential to last much longer though. That’s because that sizeable sum also has a chance to increase in value over the course of your retirement if you’re willing to invest or save it. Some savings accounts come with guarantees meaning at least some of your money is safe but with investing there are no guarantees as investments rise and fall.

Investing money in a portfolio with high yields will mean you’re getting more out of your money than most savings accounts. Historically, the stock market has provided an average return of 7% per year. That’s not to say it will provide the same returns going forward though. The returns could be better or they could be worse, but historically speaking, this has been the return.

Can I Retire At 60 With 500k Uk

Can I retire at 60 with 500K? Sure, £500K may sound like a decent amount of money but it might not provide you with the luxurious lifestyle you were hoping for if you plan to retire at 60. If you retire at 60 with £500k in the UK, you could reasonably expect to take between £15-20K from your pension every year.

Don’t Miss: Can I Use 401k To Pay Off Debt