What Types Of Distributions Cannot Be Qualified Distributions And Must Be Included In Gross Income

You cannot treat the following types of distributions from a designated Roth account as qualified distributions and must include any earnings paid out in gross income:

-

Corrective distributions of elective deferrals in excess of the IRC Section 415 limits or 100% of earnings).

-

Corrective distributions of excess deferrals under Section 402 .

- Corrective distributions of excess contributions or excess aggregate contributions.

- Deemed distributions under IRC Section 72 .

Can I Roll Over Distributions From A Designated Roth Account To Another Employer’s Designated Roth Account Or Into A Roth Ira

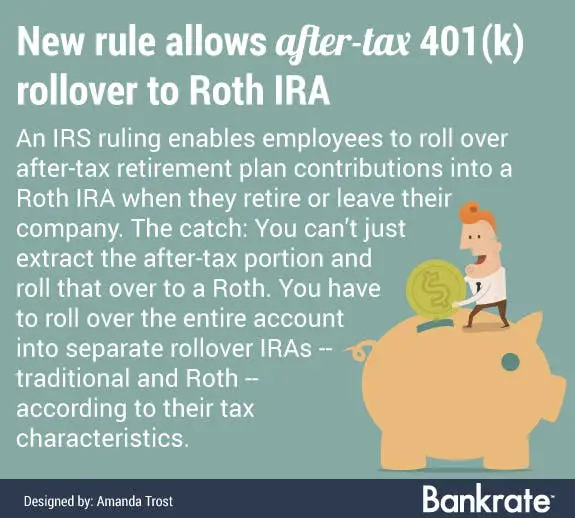

Yes. However, because a distribution from a designated Roth account consists of both pre-tax money and basis , it must be rolled over into a designated Roth account in another plan through a direct rollover. If the distribution is made directly to you and then rolled over within 60 days, the basis portion cannot be rolled over to another designated Roth account, but can be rolled over into a Roth IRA.

If only a portion of the distribution is rolled over, the rolled over portion is treated as consisting first of the amount of the distribution that is includible in gross income. Alternatively, you may roll over the taxable portion of the distribution to another plans designated Roth account within 60 days of receipt. However, your period of participation under the distributing plan is not carried over to the recipient plan for purposes of measuring the 5-taxable-year period under the recipient plan.

The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

Is Income Tax Withholding Required On In

There is no income tax withholding required on an in-plan Roth direct rollover. However, if you receive a distribution from your plan, the plan must withhold 20% federal income tax on the untaxed amount even if you later roll over the distribution to a designated Roth account within 60 days. The IRS may waive the 60-day rollover requirement in certain situations if you missed the deadline because of circumstances beyond your control. See FAQs: Waivers of the 60-Day Rollover Requirement.

You May Like: How To Transfer Your 401k To An Ira

Generally A Roth Ira Conversion Makes Sense If You:

- Wont need the converted Roth funds for at least five years.

- Expect to be in the same or a higher tax bracket during retirement.

- Can pay the conversion taxes without using the retirement funds themselves.

- May not need the funds for retirement and may want to transfer them to your beneficiaries.

A Roth IRA conversion may not be appropriate if you:

- Are not sure what your tax situation will be like this year because once you convert you cannot recharacterize or undo the conversion.

- Have to deplete other assets to pay the taxes due on the conversion.

- Are pushed into a higher tax bracket due to the amount you convert.

- Will be in a lower tax bracket in retirement.

- Will be relocating to a state with no or lower state income tax.

- Are wanting to convert your RMD because RMDs cannot be converted. You must first satisfy your RMD and then complete a Roth conversion.

Your Roth 401 Rollover Options

For the most part, your choices for a Roth 401 follow those of a traditional 401, but the transfers should be to Roth versions of the available accounts. If you opt to roll the funds over to an IRA, you should transfer the funds from the Roth 401 into a Roth IRA. If your new employer has a Roth 401 option and allows for transfers, you should also be able to roll the old Roth 401 into the new Roth 401.

Rolling a Roth 401 over into a Roth IRA is generally optimal, particularly because the investment choices within an IRA are typically wider and better than those of a 401 plan. More frequently than not, individual IRA accounts have more options than a 401. Depending on the custodian, sometimes your options in a 401 are limited to mutual funds or a few different exchange-traded funds , versus being able to invest in a plethora of choices in an IRA.

The best way to accomplish a rollover to either a Roth IRA or another Roth 401 is from trustee to trustee. This ensures a seamless transaction that should not be challenged later by the IRS, which may be concerned about whether the transaction was made for the full amount or in a timely manner.

If, however, you decide to have the funds sent to you instead of directly to the new trustee, you can still roll over the entire distribution to a Roth IRA within 60 days of receipt. If you choose this route, however, the paying trustee is generally required to withhold 20% of the account balance for taxes.

Don’t Miss: How Much Should I Put In My 401k Per Paycheck

Roth Ira Eligibility Contribution Rules

Roth IRAs were not designed for wealthy savers. In fact, there is an income cap on Roth IRA eligibility. The IRS income rules for Roth IRAs use your adjusted gross income as a guide. Your AGI is simply the total of all your taxable income, minus certain qualified deductions such as those for medical expenses and unreimbursed business expenses.

The IRS sets an income eligibility range that tells you whether you can make:

For 2022, the AGI phase-out range for a married couple filing jointly is $204,000-$214,000. For those filing single, the range is $129,000 to $144,000.

If your income falls below the bottom of the range, you can contribute the full $6,000 to a Roth IRA. If its within the range, you are subject to contribution phase-out rules, meaning that you wont be able to contribute the full $6,000. If your income is above the top of the phase-out range, IRS rules prohibit you from contributing to a Roth IRA.

Converting A Traditional 401k Into A Roth Ira

You also have the option to convert a traditional 401k into a Roth IRA transfer. The process is a bit more complicated than a straight rollover, because you will be required to pay income tax on the amount in your 401k. The savings overall will be worth it, but you need to be prepared to pay the taxes before you begin the process.

Also Check: How To Make A Loan From 401k

Roth Iras And Roth 401s Arent The Same Know The Important Differences

Investors have key differences to consider between Roth IRAs and Roth 401s

Getty

Many employers now offer Roth versions of their 401 plans. Though many people believe Roth IRAs and Roth 401s plans) are identical, there are important differences between the two types of retirement plans.

You know the basic differences between Roth-type accounts, and traditional IRAs and 401s. In the traditional accounts, most contributions are either deductible or not included in gross income s). Contributions to Roth accounts are included in gross income youre contributing after-tax money. Distributions from the traditional accounts are taxed as ordinary income, unless they are distributions of after-tax money. Distributions of income from Roth accounts are tax-free after the five-year waiting period.

But Roth IRAs and Roth 401s arent exactly the same. You should know the differences. The knowledge will help you decide whether to open a Roth 401 or Roth IRA. It also might influence a decision of whether to keep money in a Roth 401 or roll it over to a Roth IRA.

Roth 401 To Roth Ira Conversion

Roth 401s are essentially the same as traditional 401s, except they’re funded with after-tax dollars, like the Roth IRA, instead of pre-tax dollars. The exception to this rule is employer-matched funds. These are considered pre-tax dollars even in a Roth IRA.

Because the government taxes Roth 401 and Roth IRA contributions the same way, you can roll over Roth 401 savings to a Roth IRA without paying any taxes on your Roth 401 contributions. But if the amount you’re rolling over includes employer-matched funds, these will affect your tax bill for the year.

Read Also: What Happens To My 401k If I Lose My Job

Pick An Ira Provider For Your 401 Rollover

When moving your money, you need to figure out which brokerage will provide you with the services, investment offerings and fees you need. If youre a hands-on investor who wants to buy assets beyond stocks, bonds, ETFs or mutual funds, you need to look for a custodian that will allow you to open a self-directed IRA. On the other hand, if youre more hands-off, it might make sense to choose a robo-advisor or a brokerage that offers target date funds.

May Be Worth A Second Look

There are many aspects of a Roth 401 benefit that make the option worth a second look for many participants.

As your employees come to you and ask questions about their retirement planning needs, understanding the differences could help you to financially empower your workforce.

If you have questions, feel free to reach out to your Morgan Stanley Financial Advisor to discuss your options. You should also consult with your legal and tax advisor.

Recommended Reading: How To Pull From 401k

Can A Plan Automatically Enroll Me To Make Designated Roth Contributions If I Fail To Decline Participation

Yes, a plan can provide that your employer will automatically withhold elective deferrals from your pay unless you decline participation. If the plan has both traditional, pre-tax elective contributions and designated Roth contributions, the plan must state how the employer will allocate your automatic contributions between the pre-tax elective contributions and designated Roth contributions.

How A 401 To Roth Ira Conversion Works

Converting a 401 to a Roth IRA is essentially the same process as rolling your 401 funds over to a traditional IRA, but there’s the extra step of paying taxes on your converted funds, as most 401s are taxed differently from Roth IRAs.

First, make sure you’re allowed to do a 401 to Roth IRA conversion. Many companies will allow only former employees to do rollovers or conversions, but a few may permit current employees to roll some of their savings over to an IRA as well. You should also check to see whether you’re allowed to roll over your 401 funds directly to a Roth IRA. Some plans permit you to roll your 401 savings only into a traditional IRA. Then you can open a Roth IRA and do your conversion.

Second, you must decide how much you’d like to convert. You can convert the full value of your plan, or you may be able to convert just a portion if your plan allows it. If you can’t do a partial conversion but don’t want to convert everything to Roth savings, you can always roll part of your savings into a Roth IRA and the other part into a traditional IRA.

There aren’t any limits on how much you can convert to a Roth IRA in a single year, but most people try to keep themselves from jumping up to the next tax bracket, which we will discuss below.

Don’t Miss: Do You Lose Your 401k If You Quit

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Roth Ira Conversion Ladder

A Roth IRA conversion ladder is a series of Roth IRA conversions made year after year. It’s a way for people to tap their retirement savings early without penalty. The government lets you withdraw your Roth IRA conversions tax- and penalty-free after they’ve been in your account for five years, and Roth IRA conversion ladders leverage this to get around the government’s 10% early withdrawal penalty on tax-deferred savings for those under 59 1/2.

You start by converting the sum you expect to spend in your first year of retirement from your 401 or other tax-deferred account to a Roth IRA at least five years beforehand so you can access it penalty-free when you retire. Then, four years before you’re ready to retire, you convert another sum you can use in your second year of retirement. You continue doing this until you have enough to last you until you’re 59 1/2, at which point you can use all your savings penalty-free.

It requires a lot of retirement savings to pull off, and it could result in a larger tax bill, but it’s a strategy worth considering if you plan to retire before you’re 59 1/2.

There are quite a few rules to keep in mind when you’re doing a 401 to Roth IRA conversion, but as long as you check your plan’s restrictions and prepare yourself for the accompanying tax bill, you shouldn’t run into any problems.

You May Like: How Much Of My Paycheck Should Go To 401k

Rollover To A Roth Ira Or A Designated Roth Account

Are you eligible to receive a distribution from your 401, 403 or governmental 457 retirement plan?

You can roll over eligible rollover distributions from these plans to a Roth IRA or to a designated Roth account in the same plan .

You may want to note the differences between Roth IRAs and designated Roth accounts before you decide which type of account to choose. For example, when you reach age 70 1/2, you may have to take required minimum distributions from designated Roth accounts, but not from Roth IRAs.

Roth IRAs and designated Roth accounts only accept rollovers of money that has already been taxed. You will likely have to pay income tax on the previously untaxed portion of the distribution that you rollover to a designated Roth account or a Roth IRA.

Withdrawals from a Roth IRA or designated Roth account, including earnings, will be tax-free if you:

- have held the account for at least 5 years, and

Are There Any Examples To Help Explain The Rollover Rules

Yes, the following examples illustrate the rollover rules.

You May Like: What Is The Best 401k Rollover Option

Benefits Of Roth 401k Rollovers Into An Ira

- An IRA offers more control over the type of investments that you want to have in your IRA, and if you choose a self-directed IRA, it can include investment property.

- It is easier to track one account then several different accounts at a wide variety of employers.

- The ability to choose the company that manages the funds or investments within your IRA.

S To Roth 401k Rollovers Into An Ira

You May Like: How Much Goes Into 401k