How Much Can You Borrow From Your 401

Even if your 401 plan allows loans, theres a limit on how much you can borrow typically up to 50% of your vested balance, with a maximum loan amount of $50,000.

Lets say you have a vested balance of $130,000 in your 401 account. In this scenario, you wouldnt be able to borrow the full 50%, or $65,000, of your vested account balance. The most youd be able to borrow would be $50,000.

Some plans make an exception to the 50% rule, although theyre not required to: If 50% of your vested account balance is less than $10,000, your plan may allow you to borrow up to $10,000.

You usually must repay the loan within five years. But if you use your 401 home loan to buy a house that will be used for your primary residence, some plans may give you more than five years.

How Can Irar Help

Financial planning isnt as simple anymore as dumping a small portion of your income into a 401 account or an IRA. For nearly 30 years, our dedicated team of self-directed IRA experts have helped clients build wealth through alternative investments like real estate, at a lower cost.

We provide investors of all levels with resources that explain the regulations governing self-directed retirement accounts so they can make an empowered decision to put themselves in the best position financially.

Book a free self-directed IRA consultation with one of our experts today to learn more about how you can leverage a self-directed account to put yourself on the pathway to greater financial freedom.

Mortgage Interest Tax Strategy

Keep in mind that youll be deducting mortgage interest on your taxes after you purchase your home. This may actually wash with some or all of the income you report from a retirement account withdrawal.

For example, lets say you withdrew $25,000 from your 401k and paid $25,000 in mortgage interest the same year. The $25,000 youll report in additional income will wash with the $25,000 mortgage interest deduction. In other words, your taxable income wont be increased by the withdrawal, and you will effectively pay no tax on it.

However, you will still be liable for the 10% penalty, which is $2,500 in this case. This type of strategy can work for IRA, SIMPLE, and SEP withdrawals as well, but you wont be liable for the 10% penalty unless you withdraw more than $10,000.

You May Like: How Can I Pull My 401k Money Out

Using 401k Funds For Down Payments

First-time home buyers who are unable to come up with a down payment can withdraw from their 401ks in order to gain access to funding quickly. When pulling from a 401k,borrowers only have access to the vested amount in their account, rather than the ending balance. This is simply because company matching funds may not be not immediately made available to pull from.

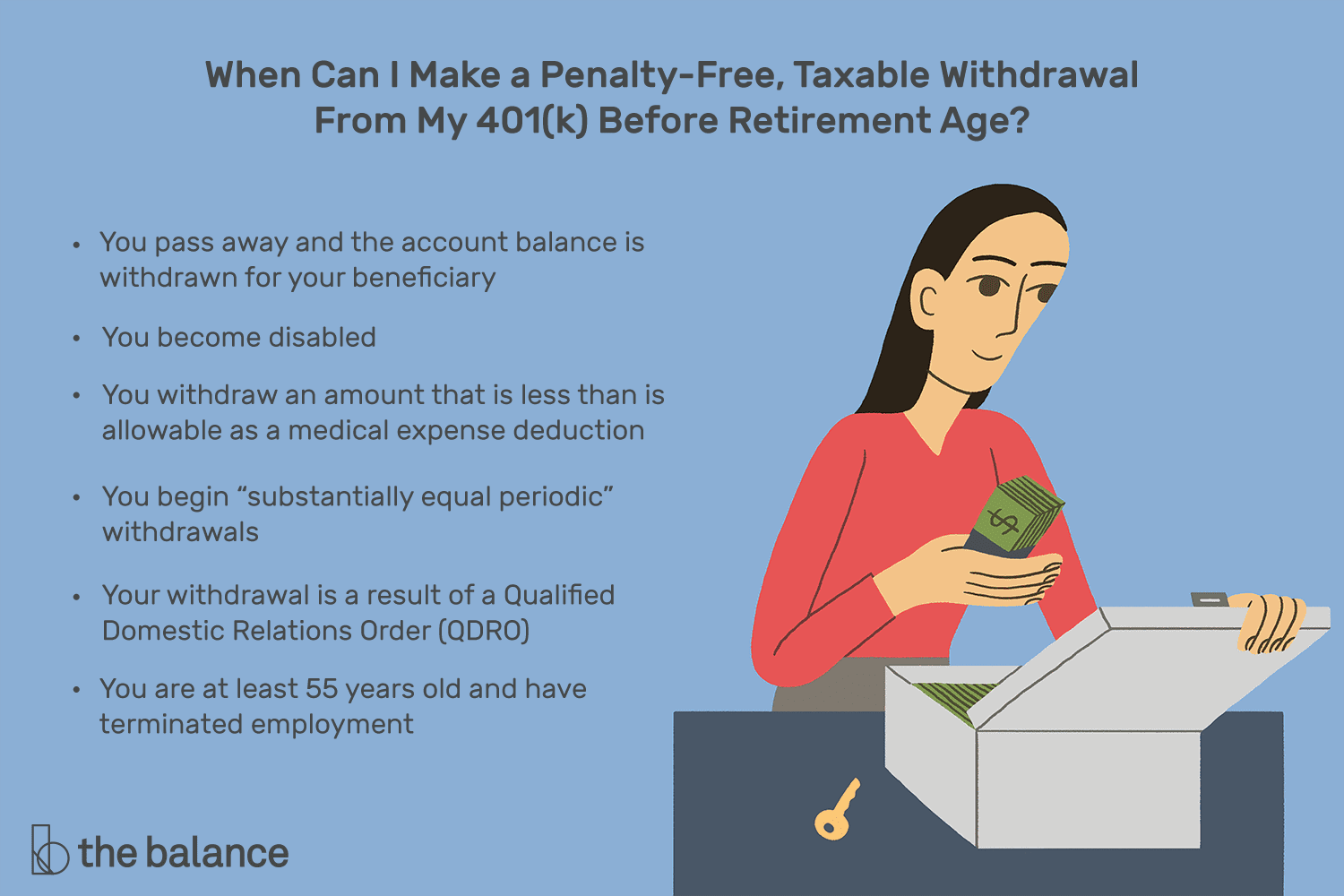

Withdrawing from your 401k before you hit retirement age always incurs penalties and fees. There are also different methods for withdrawing from your funding.

The hardship withdrawal option allows first-time home buyers to withdraw $10,000 from their 401k without incurring the 10% IRS penalty. However, buyers will have to pay income tax on this withdrawal come tax season.

The 401k loan option lets buyers borrower whichever of the below two options is less:

- 50% of the vested 401k balance

Repayment terms are generally within 5 years and often come directly out of an employeeâs check.

A combination of the above two options can also be utilized if you have more than one 401k.

Still Not Sure Ask A Financial Advisor

For most home buyers, withdrawing or borrowing from 401 retirement funds to make a down payment on a house is short-sighted. But there may be exceptions depending on the state of your personal finances and overwhelming financial need.

For some people, hardship distributions or 401 loans could be a sensible solution.

A financial planner can help you weigh your current account balance against your long-term financial goals so you can better decide how to proceed.

Don’t Miss: Is A Solo 401k A Qualified Plan

Using A 401 To Buy A House How To Tap Into Retirement Savings For Real Estate Purchases

The U.S. housing market has been booming as everyday Americans take advantage of record-low mortgage rates. As a result, now is an opportune time for many to become first-time homebuyers.

If you want to buy a house but your bank account balance doesnt seem ready to cooperate, you may wonder if getting money for a down payment from your 401 is the way to go. Is borrowing from your retirement savings a smart way to achieve homeownership?

Lets take a closer look at using a 401 to buy a house.

Recommended Reading: Can You Pull From Your 401k To Buy A House

Set Up Your Plans To Be Self

Several tax-advantaged vehicles include a defined benefits plan, a 401 profit-sharing plan, solo 401, employer-sponsored 401, traditional IRA, and Roth IRA. With any variation, all the documents need to allow you to invest your funds as self-directed for you to invest in real estate. Once self-directed, you can hold alternative investments in your retirement account.

A defined benefit plan is an employee-sponsored retirement plan that is regulated by the Employee Retirement Income Security Act of 1974 and the IRS. They offer higher allowances to defer income based on how much your company earns and are more intricate to set up. Annual government forms are required for all plans if you have retirement assets over $250,000.

If you own a business with no full-time employees other than your spouse, you can set up an individual 401. If you write these plans with a maximum amount of flexibility, you will have many advantages, including check-writing capability. Check writing gives the owner of the plan owner complete signing authority over an account that offers access to their retirement funds. With check writing, the individual monitors their own activity.

Find out how your plan is set up, and remember there are still advantages to advancing your retirement. You can utilize a company match, or if you qualify for a Roth 401 and the company offers both, you can start growing your investments tax-free.

You May Like: How To Sign Up For 401k On Adp

Investing In Rental Properties

One interesting way to use a 401 is to purchase rental property. That is, the 401 can own the property and receive rental income tax-deferred. The 401 custodian must allow for real estate transactions. For example, self-employed individuals can use a self-directed Solo 401 to buy income property. If you buy a second home this way, you cannot live in it nor provide any services to manage or maintain the property. You, your family and certain other individuals are disqualified from occupying the home, becoming tenants in the home, or otherwise receiving any personal benefit from it. The 401 can own a mortgage on the property, as long as the mortgage is collateralized only by property and doesnt make the account owner personally liable for the loan.

References

Alternatives To Tapping Your 401

Saving for a down payment is the simplest way to avoid tapping into 401 savings to buy a home. For most future homebuyers, this means a dedicated savings strategy, though this could still take many years to achieve.

Another option is to look for home loans that require a low down payment. There are three primary programs:

- VA loans allow eligible service members and their families to buy a home with no down payment.

- U.S. Department of Agriculture loans offer no-down-payment loans to qualified buyers who plan to buy a home in an eligible, rural area.

- FHA-backed loans make it possible for some buyers to purchase a home with as little as 3.5% down, as long as they meet certain credit score requirements.

Rather than pull savings from a 401, first-time homebuyers can look into down payment programs in their state. Many of these programs offer down payment assistance and other incentives to eligible buyers when purchasing their first home.

Don’t Miss: How To Rollover 401k From Previous Employer To New Employer

Savings And Investment Accounts

One of the easiest ways to raise money to buy a property is to check whether you have any liquid assets such as cash or short-term investments. Checking savings and investment accounts may be a good way to see whether you have enough funds to cover the costs of a home purchase. Before getting a mortgage, make sure your income supports themonthly mortgage paymentsand that you have savings for emergencies. Checkhow much house I can afford calculatorto help you determine your affordability.

Which Type Of Home Will Best Suit Your Needs

You have a number of options when purchasing a residential property: a traditional single-family home, a duplex, a townhouse, a condominium, a co-operative, or a multifamily building with two to four units. Each option has its pros and cons, depending on your homeownership goals, so you need to decide which type of property will help you reach those goals. You can save on the purchase price in any category by choosing a fixer-upper, but be forewarned: The amount of time, sweat equity, and money required to turn a fixer-upper into your dream home might be a lot more than you bargained for.

Also Check: How To Open 401k Solo

You May Like: How To Diversify 401k Portfolio

How To Use 401k To Buy A House

If you need money for a down payment on a house and have a 401 retirement plan, you may question if you can use these assets.

Typically, a 10% penalty applies when money is withdrawn from a 401 before the age of 5912 years old. You can avoid this cost by using your 401 toward the purchase of a home. Due to the opportunity cost, a 401 withdrawal for a home purchase may not be optimal for some buyers.

How To Take A 401 Loan For A Home Purchase

An alternative to 401 withdrawals for a home purchase is to borrow against your 401 balance. Loans differ from distributions because you have to pay the money back to your account with interest. As a result, 401 loans are not subject to income tax or the early withdrawal penalty tax as long as you repay the loan as agreed.

While taking a loan from your 401 can be a less expensive option than using a 401 withdrawal for a house down payment, it has drawbacks. Like using 401 withdrawals for a home purchase, youll be eating into your retirement funds and removing the money from future earnings potential. Also, you may incur loan fees, and youll be paying back the loan at market interest rates similar to what youd pay on a personal loan and higher than what youd pay on a mortgage-related product. And since you typically repay 401 loans through payroll deductions, your net income will be lower while youre repaying the loan.

Additionally, youll be paying the 401 loan back with after-tax dollars, and then the money will get taxed again when you withdraw funds during your retirement years. This double tax is counterproductive to one of the primary benefits of contributing to a 401 plan.

Read Also: What Is The Difference Between An Annuity And A 401k

Other Down Payment Funding Options

Taking money from your 401 either in loan or withdrawal form is not the only way to come up with money that you can use for a down payment on a house. Here are some other options that are available:

If you’re a first-time homebuyer, you can get an FHA loan to finance your home purchase. With an FHA loan, you will not have to put down 1020%. Instead, you can put a minimum of 3.5% down as long as your credit score is above 580.

- Gift From Friends or Family

If you have a generous friend or family member who is willing to help you out with a down payment, then this is a good option. Most lenders will allow gifts to be used for a down payment. However, the amount of gift money that can be used for the down payment may vary depending on the type of loan and the lender. Be sure to ask your lender what their policies are before you try to use a gift as a down payment.

One party that you are not allowed to get a gift from for a down payment is the seller. As Sullivan at HUD explains, “We have long prohibited that the sources of payment be the seller. It is critically important that there be separation between buyer and seller in the transaction. There was a time, for a while, when the FHA would insure mortgages where the buyer of the home was contributing a down payment that was financed by the seller. We found those loans to be incredibly risky and defaulted at a much greater rate. And so, we prohibited that practice.”

- IRA Withdrawals

- Assistance Programs

About the Author

Can I Use My 401 To Buy A House

Disclosure: This post contains affiliate links, which means we receive a commission if you click a link and purchase something that we have recommended. Please check out our disclosure policy for more details.

For many would-be homeowners, the down payment is the biggest entry barrier to buying a house. While down payments can be as low as 3.5%, 20% is ideal if you want to secure a mortgage without monthly mortgage insurance fees.

If youre having trouble gathering funds for a down payment, you might find yourself considering using your 401 retirement fund as a convenient source of cash. While this is technically allowed, and could help you cover your down payment, it shouldnt be your first choice. There are some factors and drawbacks that you might want to consider before using your 401 to buy a house.

Well break down the pros and cons of making a 401 withdrawal for a home purchase, as well as some alternatives.

Recommended Reading: Can Business Owners Have A 401k

Making A 401 Withdrawal For A Home

Compared to a loan, a withdrawal seems like a much more straightforward way to get the money you need to buy a home. The money doesn’t have to be repaid and you’re not limited in the amount you can withdraw, which is the case with a 401 loan. Withdrawing from a 401 isn’t as easy as it seems, though.

The first thing to understand is that your employer may not even allow withdrawals from your 401 plan due to age. If they do allow employees to tap 401 funds early, you may have to prove that you’re experiencing a financial hardship before they’ll allow a withdrawal. Under the IRS rules, consumer purchases generally don’t fit the hardship guidelines.

You may be able to withdraw funds from a 401 plan that you’ve left behind at a previous employer and haven’t rolled over to your new 401. This, however, is where things can get tricky.

If you’re under age 59 1/2 and decide to cash out an old 401, you’ll owe both a 10% early withdrawal penalty on the amount withdrawn and ordinary income tax. Your plan custodian will withhold 20% of the amount withdrawn for taxes. If you withdraw $40,000, $8,000 would be set aside for taxes upfront, and you’d still owe another $4,000 as an early-withdrawal penalty.

Disadvantages Of Using 401k To Purchase A Home

While there are advantages to using your 401k to buy a house, not least of which includes homeownership, you might want to exhaust all your other options first.

Thats because there are downsides to using your 401k for a real estate deal too, which you should be aware of so there are no surprises down the road.

- By taking money out of your 401k plan to buy a house, you could potentially miss out on profits in the financial markets. As a result, when it comes time to retire, your savings will be smaller than they would otherwise be in your golden years.

- If you take a distribution, your tax bill will be anywhere from 10-20% higher than it would otherwise be if you did not make an early withdrawal.

- If you take a loan, the funds must be repaid which could cripple your cash flow for years as you make regular payments. These funds might be automatically deducted from your pay considering your employer is the sponsor of a 401k plan. As a result, you will have a smaller paycheck than you otherwise would.

Recommended Reading: When I Retire What Should I Do With My 401k

Hows Your Financial Health

Before clicking through pages of online listings or falling in love with your dream home, do a serious audit of your finances. You need to be prepared for both the purchase and the ongoing expenses of a home. The outcome of this audit will tell you whether youre ready to take this big step, or if you need to do more to prepare. Follow these steps:

Look at your savings. Dont even consider buying a home before you have an emergency savings account with three to six months of living expenses. When you buy a home, there will be considerable up-front costs, including the down payment and closing costs. You need money put away not only for those costs but also for your emergency fund. Lenders will require it.

One of the biggest challenges is keeping your savings in an accessible, relatively safe vehicle that still provides a return so that youre keeping up with inflation.

Review your spending.You need to know exactly how much youre spending every monthand where its going. This calculation will tell you how much you can allocate to a mortgage payment. Make sure you account for everythingutilities, food, car maintenance and payments, student debt, clothing, kids activities, entertainment, retirement savings, regular savings, and any miscellaneous items.