You May Have A Roth 401 Option

Another choice to consider: a Roth 401, which almost 90% of plans offer, according to the Plan Sponsor Council of America. As with a Roth IRA, you are allowed to put in after-tax money in exchange for tax-free growth and tax-free withdrawals in the future.

Things get a little trickier if your employer offers a 401 match, as the match can only go into a traditional 401. The solution is to have one of each. Note that a proposal in the Securing a Strong Retirement Act, which has been nicknamed the SECURE Act 2.0, would allow workers to have employer matching contributions invested in a Roth 401.

One significant difference from a Roth IRA is that there are no income limits on Roth 401 contributions, so these accounts provide a way for high earners to access a Roth option. In 2022, you can contribute up to $20,500 to a Roth 401, a traditional 401 or a combination of the two. Workers 50 or older can contribute up to $27,000 annually.

But beware: Unlike IRA Roth conversions, you cant undo a 401 Roth conversion the decision is irrevocable.

You May Like: How Do I Find Lost 401k Money

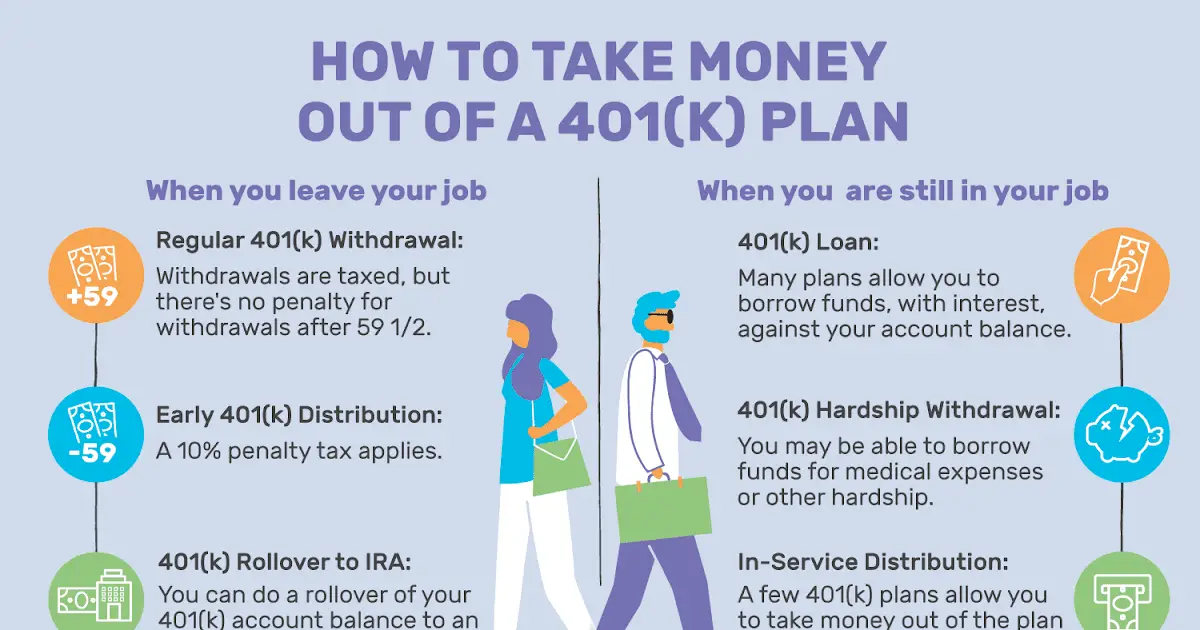

How Does A 401k Loan Work

When you take a 401 loan, you specify the investment account from which you want to borrow money. Those investments are liquidated for the duration of the loan.

You lose any positive earnings that would have been produced by those investments for the period of the loan. The upside is that you also avoid any investment losses on this money.

Is A 401k The Best Retirement Savings Plan

The 401 employee savings plan is a staple in retirement planning, but there are negatives to consider.

- One of the biggest disadvantages is that your annual contributions are made with pre-tax income, which means youll ultimately owe taxes on the money when you withdraw it in retirement.

- Another drawback is that annual contribution limits are relatively low, making saving as much as you need difficult.

- Finally, a lot of guesswork is involved in planning for retirement with a 401, as its difficult to know how much youll have accumulated by the time you retire.

Annuities can correct these shortcomings and help provide a secure retirement. Annuities also have the potential to mimic the employer match with a premium bonus thats often offered with a 401 retirement plan, making them an even more attractive option.

Recommended Reading: Where To Rollover 401k To Ira

Can A Couple Retire On 1 Million Dollars

That means your savings would need to last between 14 and 17 years. The site says that on average when looking at data from the Bureau of Labor Statistics and the average monthly Social Security benefits, having $1 million for retirement could last as long as 29 years, 1 month, and 24 days on paper.

What Is A Roth 401

Some 401s allow you to make Roth contributions. A Roth 401 contribution has a different tax structure than your standard 401 deposit. While the traditional 401 contribution is tax-deductible up front and taxable when you withdraw funds, the Roth contribution is the opposite. You get no tax deduction for a Roth contribution, but your withdrawals in retirement are tax-free.

Read Also: How Much Can I Rollover From 401k To Roth Ira

How Much Money Should You Have In Your 401k

At IWT, we talk about 401ks a lot.

And, thats with good reason. If you want to be rich, the 401k is one of the most powerful investment tools at your disposal, especially for retirement planning. It is also one of the most misunderstood money-maximizing vehicles, starting with how much you should have in your 401k.

That is a solid question, but it doesnt have a simple answer. To answer that burning question How much should I have in my 401k? we need more details. How much to invest in 401k investments will depend on your age and a few other considerations.

Lets start at the beginning.

How Much Should You Contribute To Your 401

When youre young, its hard to visualize your life in 30 or 40 years and predict how much money youll need.

Just a couple of decades ago, pensions were common benefits offered by many employers, and life expectancies were much lower making it easier to finance your retirement.

Today, employers offering pensions are less common, the future availability of Social Security is less certain and, more importantly, people are living longer.

While your grandparents may have lived only 10-15 years in retirement, odds are your retirement years may span 20 to 30 years! Thats a much longer period youll need to finance.

For that reason, many experts recommend investing 10-15 percent of your annual salary in a retirement savings vehicle like a 401.

Of course, when youre just starting out and trying to establish a financial cushion and pay off student loans, thats a pretty big chunk of cash to sock away. You may need to begin at a smaller percentage and set a higher number as your ultimate goal.

Here are a few considerations to keep in mind:

You May Like: Can You Pull Money Out Of 401k

Save Early Often And Aggressively

Yes, saving is hard. Its hard when you are young and not making a large salary, and its hard when youre older and big life expenses get in the way. However, the biggest threat to your retirement is inaction. Even if its uncomfortable to max out your 401k, do it if you can. If you get a salary raise, immediately put 50% of it towards savings if youre able. The earlier and more aggressively you can save, the better off you will be, and you may even surprise yourself with how much you are able to put away. Compounding can do wonders when there is a positive annual return as you can see from the high end of the potential savings chart, so the earlier you can save more, the farther your money will go.

How Much Should I Have In My 401k At 60

Employees should have enough money saved in a 401 to generate 75% of their pre-retirement annual salary. For example, if you earn $100,000 a year, you need to have enough saved to generate $75,000 annually. If you are age 60, you will need $1,229,508 in your 401 to generate $75,000 a year for life, starting immediately. If you wait to retire at age 65, you will need $808,809 in your 401 at age 60.

Read Also: How To Set Up 401k In Quickbooks

Now What What Can You Do About Fees

Unfortunately when you have high fees in your retirement plan, theres not much you can immediately do about it. But just the knowledge of your fees will help you answer questions like:

- Should I consider investing in different funds within my plan?

- What should I do with investment dollars after I reach my company 401K match?

- Should I leave my companys 401K plan because of the absurdly high fees?

- Should I divert funds to a discount online stock brokers?

- What should I do with those funds once I leave my job?

Luckily, the tide is turning, and we are seeing new pressure from U.S. lawmakers to make this fee information more apparent. Sites like BrightScope are also doing a good job of exposing the truth about the company 401K plan.

This guest post is from PT Money: Personal Finance. Follow along as PT discusses things like the best places to store your short-term cash, how to spend your money wisely, and the best cash back credit cards to earn more money on your spending.

Contribution Effects On Your Paycheck

An employer-sponsored retirement savings account could be one of your best tools for creating a secure retirement. It provides two important advantages:

-

All contributions and earnings are tax-deferred. You only pay taxes on contributions and earnings when the money is withdrawn.

-

Many employers provide matching contributions to your account, which can range from 0% to 100% of your contributions.

Use this calculator to see how increasing your contributions to a 401 can affect your paycheck as well as your retirement savings.

This calculator uses the latest withholding schedules, rules and rates .

Also Check: How To Find 401k Account Number

Average 401k Balance At Age 65+ $458563 Median $132101

The most common age to retire in the U.S. is 62, so its not surprising to see the average and median 401k balance figures start to decline after age 65. Once you reach age 65, there are still several considerations for your retirement, even if you are no longer working and accumulating wealth. Some of these include making decisions about Medicare, creating a plan around withdrawing money from your retirement accounts, and evaluating any additional insurance needs.

Calculate Your Retirement Earnings And More

A 401 can be one of your best tools for creating a secure retirement. It provides you with two important advantages. First, all contributions and earnings to your 401 are tax deferred. You only pay taxes on contributions and earnings when the money is withdrawn. Second, many employers provide matching contributions to your 401 account which can range from 0% to 100% of your contributions. The combined result is a retirement savings plan you can not afford to pass up.

Also Check: How Do I Start A 401k For My Business

Also Check: What Should I Do With 401k

Cut Off Date For Making Contributions To 401

Using a 401 plan to save for retirement allows you to put your savings on autopilot with automatic payroll deductions. In addition, you receive tax breaks for your contributions, and the earnings arent taxed until you take distributions from the account. However, to make sure youre on track for the retirement of your dreams, you need to keep tabs on your 401 balance from time to time. In addition to knowing your 401 balance, its also important for you to know how much of your account has vested, especially if youre considering changing jobs in the near future.

What Is The 401k Savings Potential By Age

The following chart depicts 401k savings potential by age, based on several assumptions. These numbers can seem high to many people, especially if you are older and started your retirement savings when the contribution limit was much lower. It can still be used as a guide for your target total retirement savings amounts, including your IRA, Roth IRA, and after-tax savings. While its designed for one person, it can also be used as a guide for a married couple if one spouse decides to no longer work.

The assumptions we used for this chart include:

- The numbers are more forward-looking vs. backward, since the average 401k contribution limits were lower in the past.

- You start full-time employment at age 22 at a company that provides a 401k, without a company match.

- You contribute $8,000 to your 401k after the first year, then from the second year onward, you contribute the maximum annual amount of $20,500.

- The No Growth column shows what you could potentially have in your 401k after so many years of a constant $20,500-per-year contribution and no growth.

- The 8% Growth* column shows what you could potentially have in your 401k after so many years of a constant $20,500-per year contribution compounded over the next 43 years.

- The difference between the two columns emphasizes the power of growth, compounding over time. By starting early and enjoying a historically average return on 401k, at age 65, an individual could turn $869,000 of contributions into over $6.4M dollars.

You May Like: Is A 401k Worth It Anymore

What To Do When You Find Your Old 401 Plan

If find your lost 401, congratulations! However, its not time to celebrate by blowing it all on a fancy vacation or a shopping spree. You invested that money to build a retirement nest egg and thats exactly where those funds should stay.

To invest your old 401, you can do whats known as a rollover to avoid early withdrawal penalties. You can roll over the funds into an individual retirement account or into another retirement plan, such as your current employers 401.

In both cases, you can avoid withholding taxes if you roll over the funds directly via the plan administrator. If a distribution is made directly to you, you have 60 days to deposit it into your new retirement account in order to avoid taxes and penalties.

Move Your 401 To A New Employer

You can usually move your 401 balance to your new employers plan. As with an IRA rollover, this maintains the accounts tax-deferred status and avoids immediate taxes.

It could be a wise move if you arent comfortable with making the investment decisions involved in managing a rollover IRA and would rather leave some of that work to the new plans administrator.

Dont Miss: What Should I Do With 401k

Also Check: How Do You Find Lost 401k Accounts

What Is A 401

A 401 is an employer-sponsored retirement plan enabling workers to save money in a tax-deferred way. Often employers will match contributions up to a percentage of salary. Its just like any other retirement plan in the sense that youre trying to save money and reduce taxes as you do it. Like an IRA, you will pay taxes once you start taking withdrawals in retirement.

If you opted for it when you were hired, every paycheck a percentage of your salary is taken out and put into a 401 retirement account. Your employer may add some more money, maybe even the same amount, on top of that. That money is usually invested, and has been accumulating. How much is in there?

There are different types of 401s. A Roth 401 operates much in the same fashion as a Roth IRA. While still employer-sponsored, it uses after-tax income to fund itself, so you pay the taxes now, and not later in retirement. While one can deliberate the merits of which to use, the general consensus is that a Roth format is useful if one believes they will be in an higher tax bracket later in life when withdrawing from their retirement accounts.

Conversely, a traditional 401 advocate might argue that the ability to put more money into an account in the beginning and through time, allows the saver to make the most of compound interest.

Read more about how a 401 works in this article from TheStreet.

Breaking It Down: Where Do You Fit In

There are many reasons you might think this chart seems totally reasonable, or, conversely, totally unreasonable. And thats understandable. Life presents us all with different challenges. We have unexpected medical expenses, decide to go back to school, or have kids and want to pay their college tuitions. These are all perfectly valid excuses as to why you might be falling behind where this chart says you should, or could, be.

Based on this chart, you would think that most Americans should be retiring as multi-millionaires at age 65. This probably seems way off-base, and in reality, it is most people retire with very little in the way of savings and investments. The point is that this chart shows what is possible if you are disciplined and strategic about your 401k savings.

If you are on the younger end of the ages shown on the chart, you may be daunted at the prospect of contributing $8,000 per year to your 401k, not to mention $20,500. Where you live, what your first-year salary is, or what loans you may be paying can make it difficult for this contribution to seem realistic. Its crucial, however, to recognize the importance of saving as much as you can for retirement as early as you can.

So, lets determine, based on the two scenarios in the potential savings chart, whether these figures would be sufficient to support your lifestyle for the rest of your retirement.

The average life expectancy for men is around 84 years old, and 86.5 years old for women.

Read Also: What Is The Tax On 401k Withdrawal

Option : Move The Money To An Ira

If you’re not able to transfer the funds to your current 401 or you don’t want to, you can roll over the funds to an IRA instead. The process is the same as doing a rollover to a new 401, and you still have the choice between a direct or indirect rollover.

You’ll need to set up a new IRA with any broker if you don’t already have one. Make sure you choose an IRA that’s taxed the same way as your old 401 funds. Most 401s are tax-deferred, which means your contributions reduce your taxable income in the year you make them, but you pay taxes on your withdrawals in retirement. You want a traditional IRA in this case because the government taxes these funds the same way.

If you had a Roth 401, you want a Roth IRA. Both of these accounts give you tax-free withdrawals in retirement if you pay taxes on your contributions the year you make them.

In most cases, losing track of your old 401 doesn’t mean the money is gone for good. But finding it is only half the challenge. You must also decide where to keep those funds going forward so they’ll be most useful to you. Think the decision through carefully, then follow the steps above.

What Is An Investment Calculator For

An investment calculator is a simple way to estimate how your money will grow if you keep investing at the rate youre going right now.

But rememberan investment calculator doesnt replace professional advice! If you need help with your investments, we recommend working with an expert wholl help you understand what youre investing in. If thats your next step, we can help you connect with a pro near you.

Also Check: How To Transfer 401k Accounts

Read Also: How Do I Withdraw Money From My 401k Fidelity