While You Cant Invest In A 401 That Isnt Sponsored By Your Employer There Are A Couple Of Exceptions To The Rule

Photo: 401kcalculator.org via Flickr.

A 401 is the most common type of retirement plan private-sector employers offer. However, many employers dont offer a 401, or any type of retirement plan at all. If you are in this group, can you still take advantage of the many benefits of a 401?

The short answer: not really By definition, a 401 is an employer-sponsored retirement plan designed to encourage employees to save money for retirement and employers to help them do it. So to take advantage of this type of an account, you need to have an employer, and the employer needs to be the sponsor of the plan.

Some specific rules:

- You cant invest in a 401 if youre unemployed.

- You cant invest in a 401 if your employer doesnt offer one, or you dont meet the qualifications for your employers plan .

- You cant invest in an employers 401 if you arent that employers employee.

But just as with many other topics in finance, there are exceptions. Here are two major exceptions to the 401 rules.

Exception 1: You are the employerIf your income comes from self-employment, you can start a retirement savings account known as a Solo 401 or Individual 401.

Essentially, this gives you all the benefits of an employer-sponsored 401, as well as the ability to invest in any stocks, bonds, or mutual funds you want not just in a small, specific basket of funds such as those that most employer-sponsored 401 plans offer.

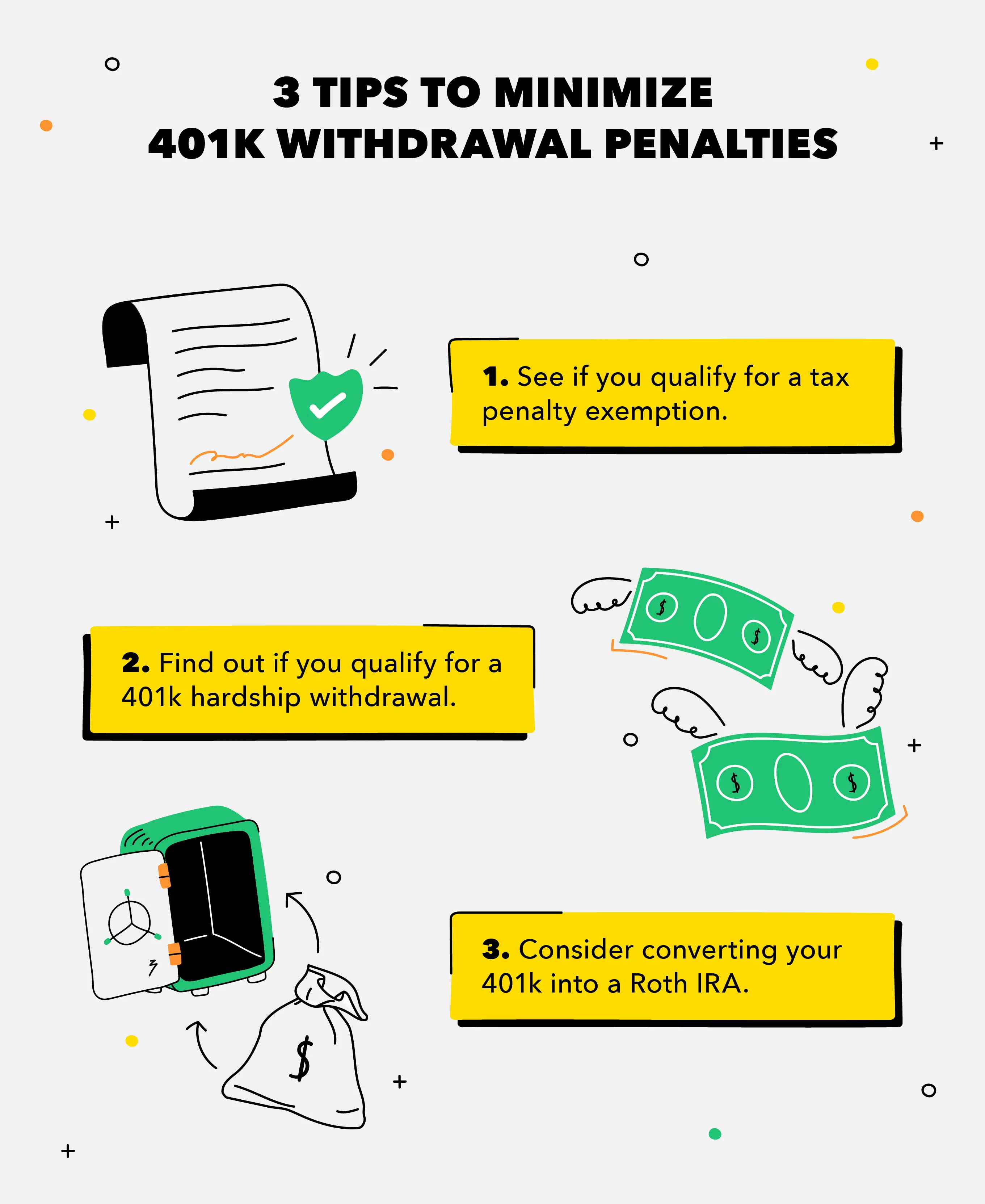

What Is The Tax Penalty For Withdrawing Money From A 401

It depends on when you make the withdrawal. If you are age 59 1/2 or older, then there is no tax penalty. However, if you make a withdrawal before reaching this age, you will be charged an extra 10% penalty on top of your regular income taxes that you pay on the funds. In some cases, you might be able to take a withdrawal without being required to pay the penalty. Some situations include hardship withdrawals, unreimbursed medical expenses, education related expenses, qualified reservists, and death. This is not an exhaustive list, and you should contact your financial planner to discuss your specific situation to see if you can qualify for a penalty-free withdrawal.

Financial Insights: Can You Get A 401 Without An Employer

The 401 retirement account. It is a lot like Coca-Cola. It has wide recognition, and many people even use 401 as a synonym for all retirement plans, like they say Coke for most types of soda. However, many people think that you can only get a 401 if you are employed with a traditional company.

As a result, many self-employed people think they cant get a 401 because they do not have a traditional employer. Employees of start-ups and small businesses that do not offer 401s may also think they cannot get this type of retirement account. However, all these people are mistaken. There is a way you can get a 401 without an employer, and a CERTIFIED FINANCIAL PLANNER can help you learn how.

How can you get a 401 without an employer?

There are many myths and misconceptions about retirement, and one of them is that you cannot get a 401 without an employer. Yet a solo 401 plan allows you to do exactly that.

A solo 401 plan is exactly what it sounds like: a 401 plan where you are the only participant. That means you can be both the employee and the employer on the account, which can offer several benefits. One of the biggest benefits is that you can set aside more money annually. Why? You are both the contributor and the employee match. Let us look at an example of how this might work.

A CFP® can advise you about how to set up a solo 401. These financial pros can also help you find other effective retirement options like traditional or Roth IRAs.

Also Check: Is It Better To Invest In Roth Ira Or 401k

Can I Open A Roth Solo 401k On My Own

A Roth Solo 401k provides the self-employed business owner with a new twist on personal taxes, a retirement boost, and business tax breaks. Your Roth account is the same as a Solo 401k when it comes to business tax breaks. The profound difference is what the twist on personal taxes can do to boost your retirement income.

These plans have only been available since 2006, but they are gaining in popularity as a way to establish a retirement income that is free from tax liability. Roth Solo 401k accounts are increasingly popular with younger participants who have many years remaining to grow their retirement accounts. These are also favored by high-income earners looking to shelter retirement income from taxes.

The Roth Solo 401k involves already-taxed money that becomes tax-free withdrawals. Yes, you pay taxes upfront, but withdrawals are tax-free in retirement. That means if you grow your Roth account by 2X, 5X, 25X, or even 100X its original value, the entire amount remains tax-free when withdrawn at retirement.

If you do know about Roth accounts, it might be the Roth IRA. Many people are unaware that there are income limits associated with Roth IRA accounts. The Roth Solo 401k has no income limits for the employee contribution. This allows high-income earners to qualify for much larger savings in a Roth Solo 401k profit-sharing plan.

Roll The Money Into An Individual Retirement Account

Another option is to open what is known as a rollover IRA, a retirement account that exists to consolidate other retirement accounts in one place. Its like a basket into which you can throw all of your old 401s. Money moved into a rollover IRA remains tax-deferred for retirement, and you can invest it in any way you choose.

You can only complete one IRA rollover in a one-year period, per IRS regulations.

Within a rollover IRA, savers have access to countless investment options, including stocks, bonds, mutual funds, and real estate investment trusts. If that sounds overwhelming, you could instead opt for a lifecycle fund that chooses investments for you according to your target retirement date.

Also Check: Can I Move Money From My 401k To An Ira

What Are The Benefits Of A 401 Plan Compared To Other Retirement Options

When compared to other retirement options , the benefits of a 401 retirement plan include a broad range of advantages for both employers and employees. Along with a vesting schedule to incentivize retention, both business owners and staff can benefit from:

Tax-advantaged retirement saving: With a 401, employees can save upfront with pre-tax dollars while they are working. By the time they need their savings to fund their retirement, they will likely be in a lower tax bracket, which can generate long-term tax savings.

Employer match: Matching contributions are among the top benefits of 401 plans for employees. Employers can either match a percentage of employee contributions up to a set portion of total salary, or contribute up to a certain dollar amount, regardless of employee salary.

Defrayed 401 plan startup costs: Eligible employers may be able to claim a tax credit of up to $5,000 for the first three years to pay for associated costs of starting a qualified plan such as a 401 for employees. Claiming the credit requires completing Internal Revenue Service Form 8881, Credit for Small Employer Pension Plan Startup Costs.

What To Do If Your Employer Doesnt Match

If your 401 plan has any kind of employer match, consider funding your account at least up to that amount to get the full benefit. If your employer doesnt offer a match, investing in your 401 still has advantages, especially if it has a variety of asset options that match your investing goals.

As a tax-advantaged retirement account, you can deduct your contributions from your taxable income. You can contribute substantially more to a 401 than to an individual retirement account , so you can take a larger tax deduction. The maximum that you can contribute to a 401 in 2022 is $20,500 if youre under age 50 or $27,000 if youre 50 or older. With IRAs, the limits are $6,000 and $7,000, respectively.

However, if your 401 doesnt offer the investment options that you want, or if you have concerns about how it is managed, you have other options. For example, you could fund an IRA up to the limit and put any additional money into a regular mutual fund or brokerage account. You wont enjoy the same tax advantages in a typical brokerage account, but you can invest toward building your retirement savings.

You May Like: How To Create Your Own 401k

Understanding Early Withdrawal From A 401

A 401 is a retirement plan that allows you to make tax-deferred contributions into the plan and lets the investments grow tax-free until retirement age. Since this money is supposed to be for retirement, then it needs to remain in the account until you retire. Withdrawing money from your account should only be done in emergency situations. Removing the money early will result in payment of income taxes and a penalty.

Since a 401 is an employer sponsored plan, then your employer sets some of the rules regarding early withdrawal. Not every plan allows for early withdrawals. You should first check your plan documentation to determine whether an early withdrawal will be allowed from your plan. You can also view the details of what qualifies for an early withdrawal and any documentation that may be required.

You should think long and hard before taking any early withdrawals from your plan. You could consider other options such as a personal loan or borrowing from friends or family. Once you pay the income tax and early withdrawal penalty on your funds, you are likely to only be left with about 60% of the money that you removed from your account. This can put a huge dent in your account and set you way back in your retirement planning goals.

What Happens To A 401 Loan When An Employee Changes Jobs

When an employee leaves your company, the outstanding loan balance becomes due. Unless the employee repays the loan, the outstanding balance will be considered taxable income the earlier of an employee taking distribution of their entire retirement account or the quarter after the quarter the last payment was received.

Again, the employee will be responsible for all tax consequences and penalties .

Read Also: Can I Put Money In A 401k And An Ira

Is An Ira Better Than A 401

Both plans have advantages, and the better option will depend on your individual situation. A 401 plan offers higher annual contribution limits than an IRA. However, most 401s offer a limited number of investment options, whereas an IRA typically offers a wide range of investment types. Some 401 plans offer an excellent menu of investment options at a low cost others dont. Ideally, you would fund both types of plans if youre able.

Choose A Type Of Plan

Private 401k providers require a written investment plan from each investor that includes the type of plan you wish to start. You have two options: traditional and Roth. Traditional plans entail investing money pre-tax. When the time comes for you to retire, you pay taxes on your money as you make withdrawals. Consider the potential tax rate increases before choosing this option. Instead, also consider your other option. If you open a Roth private 401k, you will invest your funds after-tax. While this could decrease the amount you can afford to invest while you are working, you have more funds to obtain when you retire. Determine which type will benefit you the most when starting a private 401k.

You May Like: How Much Can You Put In Your 401k A Year

Cares Act 401 Early Withdrawals

The CARES Act contains a provision allowing those who are under age 59 ½ to take a distribution from their retirement plan while working, waiving the 10% penalty that would normally be associated with this type of distribution.

The distributions are still subject to income taxes, but these taxes can be spread over a three-year period. You can re-contribute some or all of the money taken via this route over a three-year period and avoid some or all of these taxes.

These distributions require that you document that COVID-19 has impacted you or a family member. This means that you or a family member has contracted the virus or that you or a family member has been financially impacted by COVID-19 in ways that might include a job loss or reduced income. For a 401 plan, the ability to take these distributions is not automatic, your employer needs to adopt this as a provision of the plan.

Read Also: How Does 401k Work When You Quit

Option : Cash Out Your Old 401

Another option is cashing out your 401, which does exactly what you would expect provides cash. But there are many implications to consider. The cash you withdraw is considered income, and you may incur local, state and federal taxes by doing so. You will lose the benefit of giving your accounts investments time to grow, and you may need to work longer to make up the difference. Whats more, if you leave your employer prior to the year you turn 55 and are younger than 59 ½, you will be required to pay a 10% early withdrawal penalty on top of any taxes on the money.

Read Also: Should I Rollover My 401k To A Traditional Ira

Also Check: How To Calculate Employer 401k Match

What About A Traditional Ira

If your income is too high to contribute to a Roth IRA, you can go with a traditional IRA. Like a Roth IRA, you can contribute up to $6,000 a year$7,000 if youre 50 or olderand you and your spouse can both have an account.4

Thats where the similarities end. Unlike a Roth IRA, there are no annual income limits. But youre required to begin withdrawing once you turn 72, and even though contributions to a traditional IRA are tax-deductible, youll have to pay taxes on the money you take from it in retirement.5

Still with us? Now, lets look at some other options you can explore if youre self-employed.

Also Check: How Much Do You Get From 401k

It Makes Sense To Invest On Your Own If You Can

Saving for retirement can feel like a daunting task, especially without the help of an employer-sponsored plan.

But it’s worth it to start investing in a retirement account as soon as you can, even if it’s just small amounts of money.

That’s because compound interest over time will help that money grow by a lot more than if you saved it in a checking or savings account.

“You’re getting interest on top of interest,” Zigo said. “So not only are you getting interest on your money but you’re also getting interest on the interest your money is earning.”

Read Also: Can I Move My 401k

Contribution Limits If You Participate In Another 401 Plan

If you have a solo 401 and you also work for another company and participate in its 401 plan, the limits on employee contributions are cumulative across all accounts. The employer contribution limits are based on plans, meaning two unrelated employers can contribute up to the employer maximum annually.

Note that anyone who is considering a solo 401 to save earnings from a side job for retirement should check first with a tax professional, who can help confirm your eligibility for the account, including your self-employment status.

When You Can’t Open A 401 Without An Employer

To be eligible for most retirement accounts, you need to have earned income during that year. If you don’t have an employer and received only unemployment income for the year, you won’t be eligible to contribute to many of these retirement account options.

The one exception to this is the Roth IRA. If you have a significant amount of savings, you can contribute up to the limits set by the IRS.

However, if you are employed, and your employer doesn’t offer a retirement plan, you can still participate in the Traditional and Roth IRAs.

Read Also: Does 401k Transfer Between Jobs

You Have Options But Some May Be Better Than Others

After you leave your job, there are several options for your 401. You may be able to leave your account where it is. Alternatively, you may roll over the money from the old 401 into either your new employers plan or an individual retirement account . You can also take out some or all of the money, but there can be serious tax consequences.

Make sure to understand the particulars of the options available to you before deciding which route to take.

You May Like: Can I Change My 401k Contribution At Any Time

Taxes On Other Types Of 401 Plans

All of the information above applies to traditional 401 plans. However, there are variations on the traditional 401. Some of these have different rules on taxation.

SIMPLE 401 plans and safe harbor 401 plans function mostly the same as far as employee taxes are concerned. They differ mostly in that employers have to make certain contributions. SIMPLE 401 plans also have a lower contribution limit.

The other type of 401 to note is a Roth 401. These work quite differently from traditional 401 plans. All contributions you make to a Roth 401 come from money that you have already paid payroll and income taxes on. Since you pay taxes before you contribute, you do not need to pay any taxes when you withdraw the money.

Its advantageous to use a Roth 401 if you are in a low income tax bracket and expect that you will find yourself in a higher bracket later in your life. This is very similar to why you might want a Roth IRA.

Read Also: How Can I Get My 401k Without Penalty

Read Also: What’s The Difference Between A Roth Ira And A 401k