Why Is My 401 Losing Money

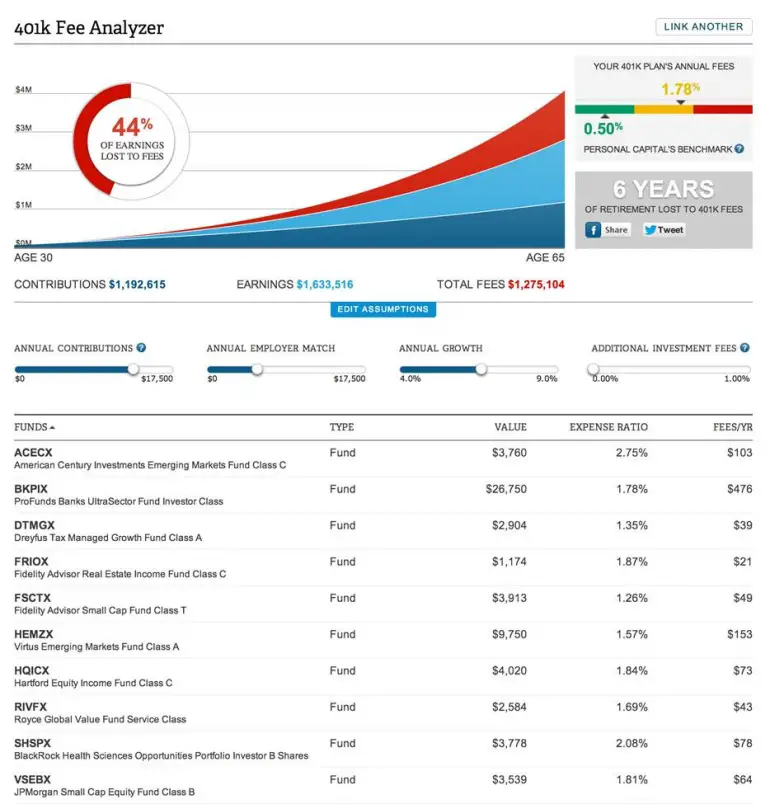

Several reasons your 401 may be losing money. One reason is that the stock market is simply going through a down period. This happens occasionally and does not necessarily indicate anything terrible in the economy. Another reason your 401 may be losing money is that you have invested in a specific company or industry that is not doing well. This is also normal, and it doesnt mean youve made a bad investment. Finally, your 401 may lose money because of fees. Many 401 plans have high fees, affecting your account balance over time.

Open A Brokerage Account

If youve paid off your credit card debt, established an emergency fund, and exhausted all your tax-advantaged accounts, you can open a regular old brokerage account to squirrel away some more money.

A brokerage account is much like an IRA. Its more flexible in terms of investment choices and money withdrawal than 401s, but you dont get any tax breaks. It allows you to buy and sell a wide variety of securities, from stocks and bonds to mutual funds, currency, and futures and options contracts, through a brokerage firm.

You can open a brokerage account with any of the major investment firms like Vanguard,Charles Schwab, or Fidelity. Just like with other financial accounts, you deposit money and work with a broker to buy or sell securities. The broker will recommend investments depending on your personal financial situation and goals. But you have the final say on investment decisions. The brokerage firm takes a commission for executing your trades, and there are fees linked to the transactions, ranging from account maintenance fees and markups/markdowns to wire fees and account closing fees.

Best for: Aggressive investors with high-risk tolerance and extra savings.

Learn About Your Investment Options

Youll also use your plan enrollment form to select your investments for your 401 portfolio. This is where a lot of people get lost. Many folks feel like theyre not doing enough to prepare for retirement or simply dont know how to get started.1

Remember that brochure or booklet that came with your enrollment packet? Its from your 401 plan manager. It should provide fairly detailed descriptions of all your 401 selection options. Some companies do a better job at this than others, but no brochure is going to give you the complete lowdown on all your investing choices.

Another problem with these materials is that they make a big push for target date funds. Target date funds have predetermined investment mixes depending on the date you plan to retire. If youre young and have 30 or more years to retire, youll start out with a decent mix of growth stock mutual funds, but, as your retirement date gets closer, the mix will become more and more conservative.

As your investments move to less and less risk, there is less and less return. When you reach retirement age, your 401 will be heavily invested in bonds and money markets that wont provide the growth you need to support you through 30-plus years of retirement.

Your Action Step: Ignore the target date funds so you can build your own 401 portfolio from individual funds.

Read Also: How Much Money Do I Have In My 401k

Read Also: How Do I Find Previous 401k Accounts

How Do I Start A 401

If you work for a company that offers a 401 plan, contact the human resources or payroll specialist responsible for employee benefits. You’ll likely be asked to create a brokerage account through the brokerage firm your employee has selected to manage your funds. During the setup process, you’ll get to choose how much you want to invest as well as which types of investments you want your 401 funds invested in.

Fund Types Offered In 401s

Mutual funds are the most common investment options offered in 401 plans, though some are starting to offer exchange-traded funds . Both mutual funds and ETFs contain a basket of securities such as equities.

Mutual funds range from conservative to aggressive, with plenty of grades in between. Funds may be described as balanced, value, or moderate. All of the major financial firms use similar wording.

Recommended Reading: Can I Take My 401k If I Quit

Dealing With Poor Choices

If your 401 has investment choices that do not allow you to diversify or invest the way you like, you can partially overcome this by putting money into your own IRA, and invest that IRA in the missing asset classes. If your spouses 401 offers what is missing from yours, you also can allocate more money into her account to do the same. In addition, you can speak with your 401 plan administrator or trustee about your investment needs. Over time, you may see your own plans offerings improve.

References

What Are The Best Ways To Invest My 401k Retirement

In itself, the process of investing 401 money should not be difficult, since companies usually offer a series of plans that you can join and they do all the heavy lifting. However, there is a lot of preparation work that you must do before selecting the one that best suits what you are looking for. Lets look at the factors you need to know before you invest money in your 401.

Recommended Reading: How To Use 401k To Buy A Home

Should You Work With A Financial Advisor

Setting your investments on autopilot is not an investing strategy you can count on.

You need the experience and knowledge of a financial advisor or investment professional to help you make well-informed decisions about your investments. A pro will help you understand where your money is going and will answer questions you have about how your 401 plan works.

Your financial advisor may not get paid from helping you make decisions about your 401, since your 401 plan is sponsored by your workplace. Or they may choose to charge a one-time consultation fee. Regardless, you can ask on the front end to make sure there are no surprises.

If you want a solid retirement plan, work with a true pro to create a long-term strategy for your investments. You want a pro who is smarter than you but always knows you call the shots. After all, no one cares more about your retirement than you.

Need help finding a pro? With our SmartVestor program, you can find a financial advisor to help you understand your 401 and how it fits in your overall retirement plan.

Determine How Much You Can Contribute

Workers under 50 can contribute up to $19,500 to a 401 in 2020, but how much you actually earmark for the account depends on your income, debt level and other financial goals. Still, financial experts advise contributing as much as you are able to, ideally between 10% to 15% of your income, especially when you are young: The sooner you start investing, the less you’ll have to save each month to reach your goals, thanks to compound interest.

“That’s your company literally saying: ‘Hey, here’s some free money, do you want to take it?'” financial expert Ramit Sethi told CNBC Make It. “If you don’t take that, you’re making a huge mistake.”

Don’t Miss: Does Employer Matching Contribution To 401k Limit

Know When It Pays To Be Bolder

If you have a guaranteed source of income such as a pension or annuities, treat those holdings as if they were bonds, says David Littell, professor of taxation at The American College of Financial Services.

When you combine those with your 401, your overall allocation might be more risk-averse than you expected. This means you might want to consider a more aggressive asset mix in your 401 than would be suitable for someone who only has a 401. You might say you should keep it all in stocks because your total allocation is still pretty conservative, Littell says.

Why You Should Invest

Investing is essential if you want your savings to grow over time. Although keeping money in a savings account appears safe, the interest youll earn isnt enough to keep up with inflation over many decades.

While riskier in the short-term, over the long-term the stock market delivers compound returns that not only keep up with inflation, but outpace it.

Read more:Why The Stock Market Really Is The Best Place To Grow Your Money

Take a minute to learn how compound growth works in our guide. Itll help you quickly understand why you simply must start investing today.

Say you got a small inheritance and you decided to invest it if you put $5,000 in an account with an interest rate of 7% and contribute an extra $200 a month, after 30 years youll have a little over $284,000.

Also Check: How Do You Roll A 401k Into An Ira

You May Like: Can You Convert A 401k Into A Roth Ira

Periodic Distributions From 401

Instead of cashing out the entire 401, you may choose to receive regular distributions of income from your 401. Usually, you can choose to receive monthly or quarterly distributions, especially if inflation increases your living expenses. If the 401 is your main source of income, you should budget properly so that the distributions are enough to meet your expenses.

For example, if you have accumulated $1 million in retirement savings, you can choose to receive $3,330 every month, which amounts to approximately $40,000 annually. You can adjust the amount once a year or every few months if your 401 plan allows it. This option allows the remaining savings to continue growing over time as you take periodic distributions.

Avoid Making Premature Withdrawals

Most 401 plans offer a hardship withdrawal option, as well as a loan option if you find that you have to take money out of your plan before you retire. But there are limitations and downsides.

A withdrawal could cost you a 10% early withdrawal penalty on money you take out before age 59½, depending on what you spend the money on. Youll have to pay it back with interest by a certain time if you take a loan from your 401.

NOTE: The Balance doesnt provide tax or investment services or advice. This information is presented without consideration of the investment objectives, risk tolerance, or financial circumstances of any one investor. It might not be right for all investors. Investing involves risk, including the loss of principal.

Don’t Miss: What Is Asset Allocation In 401k

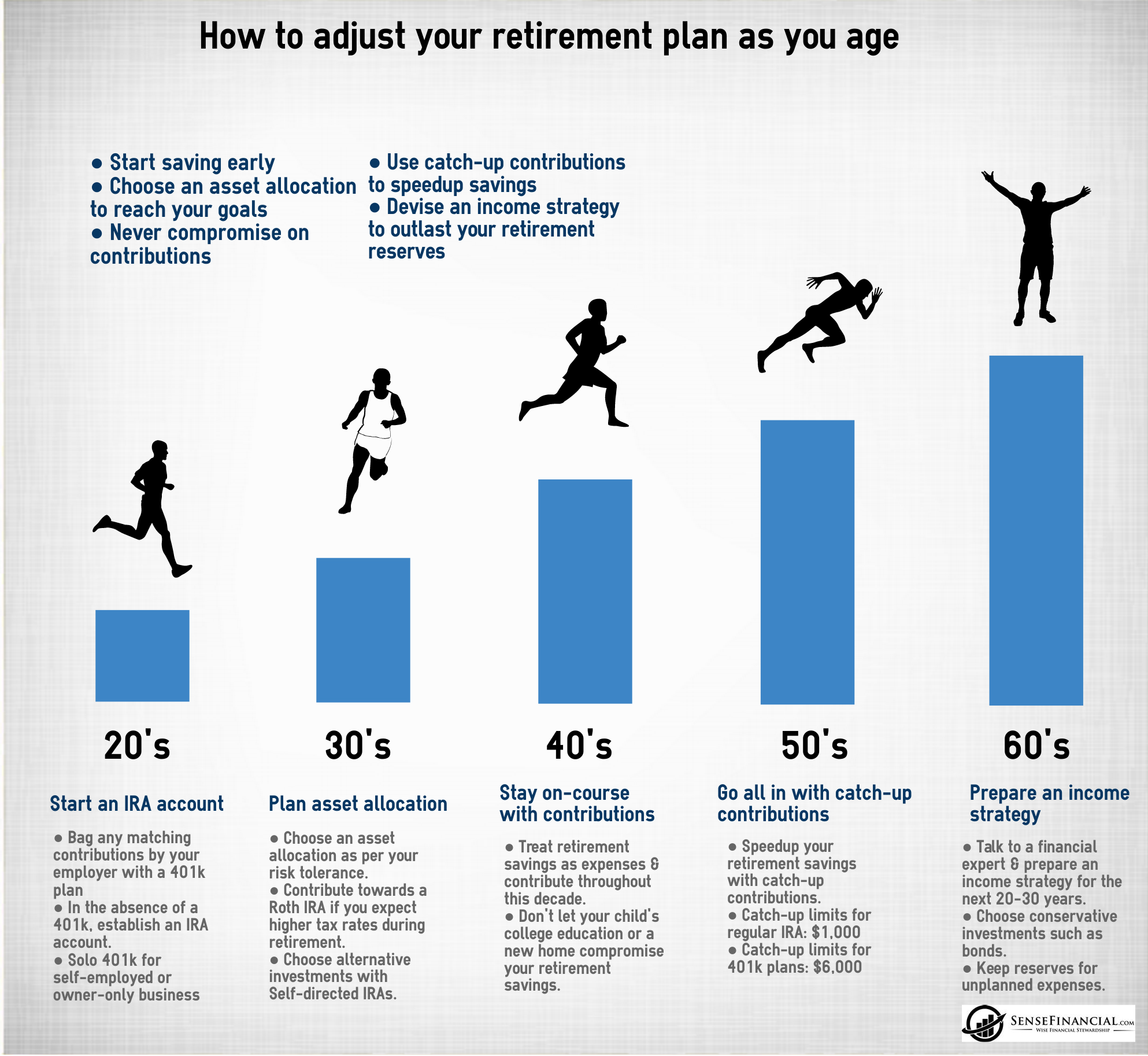

How Much Should You Invest In Your 401k Each Month/year Based On Your Age And Income Level

Here is a general guideline based on the current contribution limits:

-If you’re 50 or older, you can contribute up to $26,000 annually.

-If you’re under age 50, you can contribute up to $19,500 annually.

-When your income is low, and you cannot afford to contribute the maximum amount each year, you can still benefit from investing as much as you can afford.

Keep in mind these contribution limits change year by year. In addition, these numbers are based on the 2022 published limits, which are constantly updated here.

You should aim to maximize your 401k contribution because the sooner you start investing and the higher investment capital you have, the more time your money has to grow. This is due to the power of compound investing, which allows you to multiply your money over time.

How Can I Protect My 401 From A Stock Market Crash

Although there is no way to perfectly protect your investments from a financial downturn, there are solid strategies you can take to hedge against a major crash. These include keeping a diverse portfolio, not panicking about a stock market crash when dips happen in the market, and consistently funding your 401 over time.

Also Check: Is A 401k Or Roth Ira Better

Extra Benefits For Lower

The federal government offers another benefit to lower-income people. Called the Saver’s Tax Credit, it can raise your refund or reduce the taxes owed by offsetting a percentage of the first $2,000 that you contribute to your 401, IRA, or similar tax-advantaged retirement plan.

This offset is in addition to the usual tax benefits of these plans. The size of the percentage depends on the taxpayer’s adjusted gross income for the year and tax-filing status. The income limits to qualify for the minimum percentage offset under the Saver’s Tax Credit are as follows:

- For single taxpayers , the income limit is $34,000 in 2022.

- For married couples filing jointly, it’s $66,000 in 2021 and $68,000 in 2022.

- For heads of household, it maxes out at $49,500 in 2021 and $51,000 in 2022.

How To Maximize Employer Contributions

If your employer offers a 401 match program, you should take full advantage of it. 401 match programs are essentially free money for you. You dont see a withdrawal from your paycheck, yet you double the amount you save for retirement. There are no downsides to using these match programs especially as a younger investor.

First, find out how your companys 401 match program works. There are 2 common matching schedules your employer may use:

- 50% match up to a certain percentage: In this match schedule, your employer will contribute $0.50 into your 401 for every dollar you contribute up to a set percentage. For example, lets say that you earn $50,000 per year and your employer offers a 50% match up to 6%. If you contribute the maximum matching amount to your 401 each year, youd contribute $3,000 of your pretax income. Your employer would then put in $1,500 of their own money, giving you a total balance of $4,500.

- Dollar-for-dollar match up to a certain percentage: In this match schedule, your employer contributes $1 for every $1 you put into your 401 account up to a certain percentage. For example, if you earn $50,000 a year and your employer offers a dollar-to-dollar match up to 5%, maxing out your percentage leaves you with $5,000 in your account.

Keep in mind that company match programs are employer-specific. Your employer may match more than the above percentage examples, or they might not match at all.

Recommended Reading: Should I Rollover My Old 401k To An Ira

Go With The Simplest Option

Alternatively, you can opt for a target-date fund, which takes most of the guesswork out of the equation. With these funds, you select a “target” retirement year and risk tolerance, and the fund is automatically set to an appropriate asset allocation for you. These are great options for beginner investors.

“Most people aren’t interested in researching selecting funds for their 401,” Charles C. Weeks, a Philadelphia-based CFP, tells CNBC Make It. “Target date funds will help people avoid blowing up their portfolios by making avoidable mistakes like putting too much in one asset class, chasing returns by investing based on past performance and/or letting greed and fear dictate their investment strategy.”

Over time, the fund will automatically rebalance, becoming more conservative as you near retirement. If you choose a target-date fund, you only need to choose the one fund otherwise you’re essentially canceling out its benefits. Another mistake to avoid with target-date funds is choosing a year without researching how it will change its mix of stocks and bonds over time, Howard Pressman, a Virginia-based CFP, tells CNBC Make It.

Can You Lose Money In A 401

Its possible to lose money in a 401, depending on what youre invested in. The U.S. government does not protect the value of investments in market-based securities such as stocks and bonds. Investments in stock funds, for example, can fluctuate significantly depending on the overall market. But thats the trade-off for the potentially much higher returns available in stocks.

That said, if you invest in a stable value fund, the fund does not really fluctuate much, and your returns or yield are guaranteed by private insurance against loss. The tradeoff is that the returns to stable value funds are much lower, on average, than returns to stock and bond funds over long periods of time.

So its key to understand what youre invested in, and what the potential risks and rewards are.

Also Check: How To Transfer 401k From Prudential To Fidelity

How To Invest Your 401

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks, securities or other investments.

Nothing is more central to your retirement plan than your 401. It represents the largest chunk of most retirement nest eggs.

Finding the money to save in the account is just step one. Step two is investing it, and thats one place where people get tripped up: According to a 2014 Charles Schwab survey, more than half of 401 plan owners wish it were easier to choose the right investments.

Heres what you need to know about investing your 401.

If You’re Ready To Invest Beyond Your 401 First Understand Two Key Elements: Asset Allocation And Diversification

You understand why investing is important and are seeing your 401 grow over time, despite occasional market downturns. Are you ready to explore additional investment opportunities but not sure where to start?

Before you start picking and choosing stocks, make sure you’re considering whether maximizing your contributions to your 401 retirement plan should come first. Also work with your financial professional to discuss whether setting up a Roth IRA is a good option. “You want to take these steps first because contributions to a 401, 403, and Traditional IRA may be tax deductible so not only do you pay less in taxes today, but your earnings can grow tax free until you take a disbursement in retirement,” says Christina Fanelli-Becker, Vice President and Portfolio Manager at Regions Private Wealth Management in Tampa, Florida. “Although Roth IRA’s are not tax deductible, they are tax free,” she said.

Once you are comfortable that your retirement accounts are in order, you can start rounding out your investment portfolio based on your own objectives and the principles of asset allocation and diversification.

Guiding Principles for All Investors

Before diving into investing, it’s important to understand asset allocation and diversification.

The three primary asset classes are:

- Cash equivalents

If your portfolio is made up mostly of bonds and other fixed-income investments, it’s typically considered conservative.

Expanding your Investment Portfolio

Content Type: Article

Recommended Reading: Can You Move A 401k Into A Roth Ira