When You Owe Income Tax On A Withdrawal

Once you reach age 59½, you can withdraw money without a 10% penalty from any type of IRA.

If it is a Roth IRA and youve had a Roth for five years or more, you wont owe any income tax on the withdrawal. If its not, you will.

Money deposited in a traditional IRA is treated differently from money in a Roth.

If its a traditional IRA, SEP IRA, Simple IRA, or SARSEP IRA, you will owe taxes at your current tax rate on the amount you withdraw. For example, if you are in the 22% tax bracket, your withdrawal will be taxed at 22%.

You wont owe any income tax as long as you leave your money in a traditional IRA until you reach another key age milestone. Once you reach age 72, you will be required to take a distribution from a traditional IRA. The age was set at 70½ until the passage of the Setting Every Community Up for Retirement Enhancement Act in December 2019.

The IRS has specific rules about how much you must withdraw each year, the required minimum distribution . If you fail to withdraw the required amount, you could be charged a hefty 50% tax on the amount not distributed as required.

There are no RMD requirements for your Roth IRA, but if money remains after your death, your beneficiaries may have to pay taxes. There are several different ways your beneficiaries can withdraw the funds, and they should seek advice from a financial advisor or the Roth trustee.

Dont Miss: Free Irs Approved Tax Preparation Courses

What To Ask Yourself Before Making A Withdrawal From Your Retirement Account

There are many valid reasons for dipping into your retirement savings early. However, try to avoid the mindset that your retirement money is accessible. Retirement may feel like an intangible future event, but hopefully, it will be your reality some day. So before you take any money out, ask yourself: Do you actually need the money now?

Think of it this way: Rather than putting money away, you are actually paying it forward. If you are relatively early on in your career, your present self may be unattached and flexible. But your future self may be none of those things. Pay it forward. Do not allow lifestyle inflation to put your future self in a bind.

With all this talk of 10% penalties, and not touching the money until youre retired, we should point out that there is a solution if you feel the need to be able to access your retirement funds before you reach age 59 ½ without penalty.

Contribute to a Roth IRA, if you qualify for one.

Because contributions to Roth accounts are after tax, you are typically able to withdraw from one with fewer consequences. Keep in mind that there are income limits on contributing to Roth IRAs, and that you will still be taxed if you withdraw the funds early or before the account has aged five years, but some people find the ease of access comforting.

For some folks, however, a Roth-type account is not easily available or accessible to them.

What Is The 401 Withdrawal Tax Rate For My Tax Bracket

One of the key benefits of contributing to a 401 account for saving for your retirement is that your contributions are not taxed until you withdraw them. Your contributions are made with pretax dollars, usually taken out of your paycheck. This means that you are liable for lower taxable income each year you make contributions, especially if you contribute up to the maximum limit of $19,500 annually .

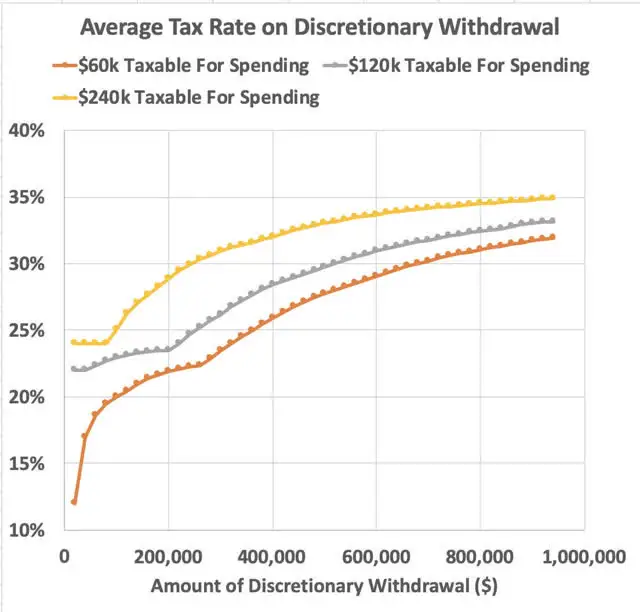

Since you do pay taxes on 401 withdrawals, it helps to know what your tax rate will be based on your tax bracket, so you can plan accordingly.

401 withdrawal tax rate by bracket

Once you start withdrawing from your 401 account, your withdrawals are taxed as ordinary income. This means that your withdrawals are taxed at a similar rate as would be your W-2 employment.

Typically, retirees live on less in their retirement than during the working years, so usually you will be in a lower tax bracket. However, if you have never given tax brackets much thought or want to see how your withdrawals can affect your taxes, this table can help:

| Tax rate |

You May Like: Who Offers Roth Solo 401k

What Is The Tax On 401 Withdrawls After 65

Putting money aside in a 401 during your working years is one of the most effective ways to accumulate wealth for your retirement years. But accumulating that money is only half of the battle. The other half is devising a strategy that allows you to meet your daily living expenses while minimizing your taxes. Understanding how 401 withdrawals impact your taxes makes devising such a strategy a lot easier.

Also Check: How To Grow 401k Fast

Are Rollovers Of 401s Taxed

No, so long as they are done correctly.

There are many benefits to rolling over a 401 to another account. Rolling over an old 401 to a current 401 helps manage all of your retirement accounts in one convenient place. Rolling over 401s to an IRA provides more options to invest your retirement into.

The process of rolling over 401s is simple. Contact your 401 planâs administrator and give them the information of the account you want your funds rolled into. They can facilitate an ACH transfer of the funds for you.

If they insist on sending you a physical check, youâll need to mail it yourself. The funds must reach the destination institution within 60 days to avoid the withdraw from being labeled as an early retirement distribution. This would result in income tax and possibly a 10% penalty tax.

So long as the funds reach the institution within 60 days and are rolled over to an eligible retirement, these can be done tax-free.

Don’t Miss: Where To Transfer My 401k

**qualified Public Safety Employees

Effective for distributions after December 31, 2015, the exception for public safety employees who are age 50 or over is expanded to include specified federal law enforcement officers, customs and border protection officers, federal firefighters and air traffic controllers. Also, the restriction that only defined benefit plans qualify for the exemption is eliminated. Thus, an exemption is allowed for distributions from defined contribution plans or other types of governmental plans, such as the TSP. See IRC Section 72, as amended by the Defending Public Safety Employees Retirement Act, P.L. 114-26.

The 401 Withdrawal Rules For People Between 55 And 59

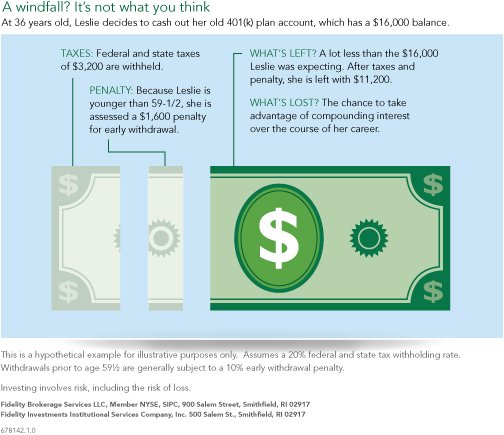

Most of the time, anyone who withdraws from their 401 before they reach 59 ½ will have to pay a 10% penalty as well as their regular income tax. However, you can withdraw your savings without a penalty at age 55 in some circumstances. You cannot be a current employee of the company that runs the 401, and you must have left that employer during or after the calendar year in which you turned 55. Many people call this the Rule of 55.

If youre between 55 and 59 ½ years old and you are considering a 401k withdrawal from an old employer, you should keep a few things in mind. For starters, doesnt matter why your employment stopped. Whether you quit, you were fired, or you were laid off, you can qualify for a penalty-free withdrawal. However, you need to meet the age requirement and your employment must end in the calendar year you turn 55 or later.

These rules for early 401 withdrawal only apply to assets in 401 plans maintained by former employers. The rules dont apply if youre still working for your employer. For example, an employee of Washington and Sons usually wont be able to make a penalty-free withdrawal before they turn 59 ½. However, the same employee can make a withdrawal from a former employers 401 account and avoid the penalty when he or she turns 55.

Recommended Reading: How To Access My Fidelity 401k Account

Defer Taking Social Security

To keep your taxable income lower withdrawal) and also possibly stay in a lower tax bracket, consider putting off taking your Social Security benefits. One way is to delay or defer Social Security payments as part of a tax-saving strategy that includes converting some funds to a Roth IRA.

If retirees can afford to delay collecting Social Security benefits, they can raise their payment by almost a third. If you were born within the years 19431954, for example, your full retirement agethe point at which you will get 100% of your benefitsis 66. But if you delay to age 67, you’ll get 108% of your age 66 benefit, and at age 70, you’ll get 132% . This strategy stops yielding any extra benefit at age 70, however, and no matter what, you should still file for Medicare Part A at age 65.

Don’t confuse delaying Social Security benefits with the old “file and suspend” strategy for spouses. The government closed that loophole in 2016.

The Hardship Withdrawal Option

A hardship withdrawal can be taken without a penalty. For example, taking out money to help with economic hardship, pay college tuition, or fund a down payment for a first home are all withdrawals that are not subject to penalties, though you still will have to pay income tax at your regular tax rate. You may also withdraw up to $5,000 without penalty to deal with a birth or adoption under the terms of the SECURE Act of 2019.

A hardship withdrawal from a participants elective deferral account can only be made if the distribution meets two conditions.

- Itâs due to an immediate and heavy financial need.

- Itâs limited to the amount necessary to satisfy that financial need.

In some cases, if you left your employer in or after the year in which you turned 55, you may not be subject to the 10% early withdrawal penalty.

Once you have determined your eligibility and the type of withdrawal, you will need to fill out the necessary paperwork and provide the requested documents. The paperwork and documents will vary depending on your employer and the reason for the withdrawal, but once all the paperwork has been submitted, you will receive a check for the requested fundsone hopes without having to pay the 10% penalty.

Don’t Miss: How Do I Find Out What My 401k Balance Is

Tips For Retirement Savings

- Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- Prefer to take a DIY approach to investing and retirement planning? You can start by using this retirement calculator to see if youre on pace for a comfortable retirement. If youd like to invest more to grow that nest egg, check out one of these brokerages where you can open an IRA. You might also use a robo-advisor, which generates an investment plan for you for less than youd pay a traditional advisor.

- If youre over the age of 50, take advantage of catch-up contributions. Catch-up contributions are a great way to boost your savings. Use SmartAssets retirement calculator to ensure youre saving enough to retire comfortably.

What Are The Pros And Cons Of Withdrawal Vs A 401k Loan

| Pros and Cons of 401k Withdrawal vs. 401k Loan | ||

|---|---|---|

| 401k Withdrawal | ||

|

|

|

| Cons |

|

|

Recommended Reading: What’s The Difference Between A Roth Ira And A 401k

What About Roth 401s

Roth 401s work slightly differently than traditional 401s, mainly the taxes. While 401 contributions are made with pre-tax dollars, Roth 401s are done with after-tax dollars.

In turn, when withdrawals are taken from a Roth 401 during retirement, there is no tax obligation. The IRS considers the taxes taken out of the paycheck prior to contributing good enough.

However, the matching contributions your employer made will be subject to taxes. While your contributions went into your Roth 401, your employerâs contributions went into a separate 401. They didnât pay taxes on their contributions, so youâll need to.

How A 401 Loan Works

Given all the drawbacks of early withdrawals, you might consider borrowing from your 401 instead.

In general, you can borrow up to $50,000 or 50% of your vested account on a tax-free basis if you repay the loan within five years. That said, if you leave your job, you may be expected to pay off the loan in a short period of time. A 401 loan can be a better option than an early withdrawal for a couple of reasons:

- You won’t owe taxes or a penalty on the amount you borrow unless you violate the loan limits and repayment rules.

- If you repay the loan on time, you won’t miss out on years of growth like you would with a withdrawal.

- The interest you pay on a 401 loan can go back into your 401.

That said, some 401 loan plans don’t let you contribute to retirement while you have an outstanding balance. Additionally, the money you use to pay back the loan is already after-tax income. This money will be taxed again once you take it out after you’ve retired.

Note: Not all companies offer 401 loans. Don’t assume you can take one before checking with your plan’s administrator.

Don’t Miss: How Do I Find Out Where My Old 401k Is

Calculating The Basic Penalty

Assume you have a 401 plan worth $25,000 through your current employer. If you suddenly need that money for an unforeseen expense, there is no legal reason you cannot simply liquidate the whole account. However, you are required to pay an additional $2,500 at tax time for the privilege of early access. This effectively reduces your withdrawal to $22,500.

There are certain exemptions that you can use to take a penalty-free withdrawal however, you will still owe taxes on that money. These are for immediate and heavy financial needs that constitute a hardship withdrawal. Such a withdrawal can also be made to accommodate the need of a spouse, dependent, or beneficiary. These include:

- Certain medical expenses

- Home-buying expenses for a principal residence

- Up to 12 months worth of tuition and fees

- Expenses to prevent being foreclosed on or evicted

- Burial or funeral expenses

- Certain expenses to repair casualty losses to a principal residence (such as losses from fires, earthquakes, or floods

You likely will not qualify for a hardship withdrawal if you hold other assets that could be drawn from, such as a bank account, brokerage account, or insurance policy, in order to meet your pressing needs.

Tax Rules: Withdrawals Deductions & More

If youre building your retirement saving, 401 plans are a great option. These employer-sponsored plans allow you to contribute up to $19,500 in pretax money in 2021 or $20,500 in 2022. Some employers will also match some of your contributions, which means free money for you. Come retirement, though, your withdrawals are subject to income taxes and other rules. Heres what you need to know about how 401 contributions and withdrawals are taxed. For help with all retirement issues, consider working with a financial advisor.

Read Also: Can I Roll My 401k Into A Self Directed Ira

Do You Need To Deduct 401 Contributions On Your Tax Return

You do not need to deduct 401 contributions on your tax return. In fact, there is no way for you to deduct that money.

When employers report your earnings at the end of the year, they account for the fact that you made 401 contributions. To give you an example, lets say you have a salary of $50,000 and you contribute $5,000 into a 401 account. Only $45,000 of your salary is taxable income. Your employer will report that $45,000 on your W-2. So if you try to deduct the $5,000 when you file your taxes, you will be double-counting your contributions, which is incorrect.

Traditional Ira And 401 Accounts

Traditional IRA and traditional 401 accounts are funded with pre-tax dollars. That is, you can deduct your contribution to a traditional IRA every year. That reduces your taxable income for the year while funding your retirement.

There are restrictions on how much money you can add to these accounts. For example, you may only invest up to $6,000 if you are younger than age 50 in a traditional account for the 2021 and 2022 tax years. If you are age 50 or older, you may contribute an additional $1,000 in catch-up funds for a total of $7,000.

The contribution for a 401 for 2021 is $19,500 and $20,500 in 2022, plus the additional catch-up contribution of $5,500 for both years.

You don’t even have to claim the deduction if it’s an employer-sponsored traditional 401. Your 401 contributions generally come directly from your paycheck, using pre-tax dollars. This lowers your taxable income for the yearand saves you money at tax time. With either type of accounta traditional IRA or 401your contributions and earnings grow on a tax-deferred basis until you eventually withdraw the money in retirement.

Recommended Reading: How Do I Access My Wells Fargo 401k