What Kind Of Investments Are In A 401

401 accounts often offer a small, curated selection of mutual funds. Thats a good thing and a bad thing: On the plus side, you may have access to lower-cost versions of those specific funds, especially at very large companies that qualify for reduced pricing.

The negative is that even with discounted costs, that small selection narrows your investment options, and some of the funds offered may still have higher expense ratios than what youd pay if you could shop among a longer list of options. That can make it harder to build a low-cost, diversified portfolio.

Some plans also charge administrative fees on top of fund expenses, which can add up. If your 401 is expensive, contribute enough to earn your company match, and then direct any additional retirement savings contributions for the year into an IRA.

What Net Worth Is Considered Rich In Usa

The vast majority of Americans do not meet common definitions of what it means to be rich in the United States. Respondents to the Schwabs 2021 Modern Wealth Survey said that a net worth of $ 1.9 million qualifies a person as wealthy. However, the average net worth of American households is less than half of this.

What percentage of U.S. population has net worth over 5 million?

And the total number of households in the United States was 128.54 million in 2020. If we use the number to determine the percentage of households worth over $ 4 and $ 5 million, the percentage is around 3.5% and 2.8%, respectively.

What is the net worth of the top 5 %?

The threshold to be among the top 5% of household wealth in 2020 started at $ 2,584 130.26.

How Much Do I Need To Retire On $80 000 A Year

Using the built-in assumptions built into the Moneysmart Retirement Calculator and assuming you are single, you will retire at the age of 65, want the funds to last until the age of 90, and will require an annual income of $ 80,000 then you need about $ 1,550,000 before retirement to live in a

How much money do you need to retire with $80000 a year income?

With this guideline in mind, 4% of a $ 2 million nest egg is equivalent to $ 80,000. This means that a $ 2 million wallet should be enough to completely replace an $ 80,000 salary quite sustainably during a typical retirement.

How much super do I need to retire on $100 000 a year?

If youre hoping to retire at age 50 with an annual income of $ 100,000, youll need a whopping $ 1,747,180 in super!

Don’t Miss: Can You Have An Individual 401k

Is Your 401k Savings On Track

Have you met your mark? If you arent there yet, dont panic. These are just rules of thumb. That means they only give you a rough estimate of what you should ideally have by the time you hit these ages. They do not take into account your individual income and experiences or other investments you might have in play.

In reality, theres no one hard answer to how much you should have in your 401k and anyone who tells you otherwise is either lying to you or just doesnt know much about finance. We could pull up a bunch of figures and show you how much someone in their 20s or 30s is saving but that would be a complete waste of time for two reasons:

1. Its impossible to compare two investors fairly. Everyone has their own unique savings situation. Thats why itd just be dumb to compare the Ph.D. student saddled with thousands in student loan debt with the trust fund baby who just snagged a cushy six-figure corporate gig the first month out of college. Theyre both going to save very differently, so its not worth comparing.

2. Most people arent financially prepared for retirement. The American Institute of CPAs recently released a study that found that nearly half of all Americans arent sure if theyll be able to afford retirement. Thats even scarier when you consider the fact that many people underestimate how much theyll need for a comfortable retirement.

Anything Else I Should Know

Yep. A few things, actually.

Once you contribute to a 401, you should consider that money locked up for retirement. In general, distributions prior to age 59½ will be hit with a 10% penalty and income taxes.

If you leave a job, you can roll your 401 into a new 401 or an IRA at an online brokerage or robo-advisor. The IRA can give you more control over your account and allow you to access a larger investment selection.

401s typically force you to begin taking distributions called required minimum distributions, or RMDs at age 72 or when you retire, whichever is later. You may be able to roll a Roth 401 into a Roth IRA to avoid RMDs.

Recommended Reading: What Happens To My 401k After I Quit

Your 401 Rate Of Return Doesn’t Depend Only On The Stock Market Your Investment Choices Have A Huge Impact On What You Earn

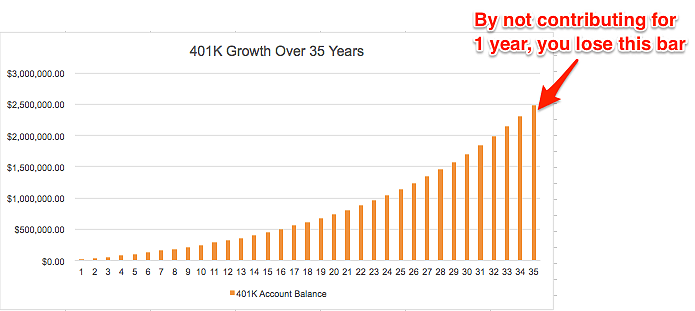

A 401 plan can be invaluable in saving for retirement. But achieving your retirement goals isn’t just a matter of how much you save in your 401. Your returns, or how much your investments earn each year, play a major role, too. Periodically reviewing your annual returns is a must for your 401 plan, as well as your entire investment portfolio.

With your 401 returns, results will vary based on a number of factors. Some of these, like how the stock market performs, are out of your hands. But the decisions you make about how you invest have a big impact as well.

What Is The Maximum 401k Contribution Amount

Starting in 2020 , you can contribute up to $19,500 each year to your 401k if you are under 50. If you are over the age of 50, you may be able to make catch-up contributions. This provision lets you invest up to an additional $6,500 in your 401k .

PRO TIP: You need to be behind in your 401k contributions to make catchup contributions.

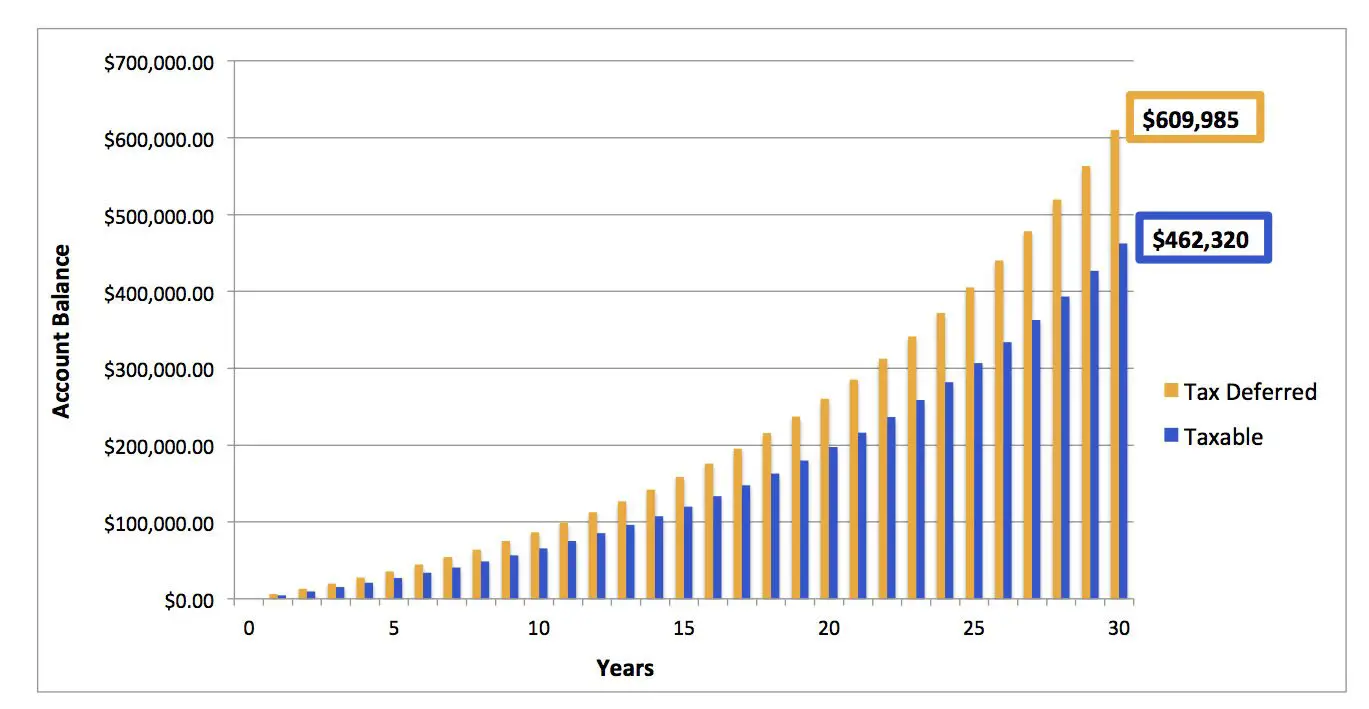

When compared to a Roth IRA, where you can only contribute up to $6,000/year, this is an amazing opportunity especially since your pre-tax money is being compounded over time.

Also Check: What Is A Good Percentage For 401k

How Can I Make My 401k Grow Faster

Try these strategies to help your 401 account grow and to minimize the risk of 401 loss.

- Do not accept the standard savings rate.

- Get a 401 Match.

- Stay until you deserve it.

- Maximize your tax break.

- Diversify with a Roth 401

- Do not pay early.

- Rollover free of charge.

- Minimize fees.

How much should I have in 401k at 40? Fidelity says at the age of 40, aim to have a multiple of three times your salary saved up. This means that if you earn $ 75,000, your retirement balance should be around $ 225,000 when you turn 40. If your employer offers both a traditional and a Roth 401 , you may want to split your savings between the two.

How Much Can You Put In A 401 Per Year

The IRS sets the maximum 401 savings rate each year. It is common for the total to stay the same or just increase slightly depending on economic conditions. For 2020, the maximum you can save in a 401 is $19,500.

Individuals 50 years of age and older are allowed to make an additional catch up contribution on top of the regular 401 limit. For 2020, this total is $6,500. The total savings limit for these individuals is $26,000 including both the regular maximum and catch up contribution allowance.

Recommended Reading: How To Borrow From 401k For Home Purchase

Dont Rely Only On Social Security

Based on Personal Capitals recent retirement survey, we found that a quarter of Americans expect Social Security to be their primary source of income during retirement. With half of Americans planning to retire at 65 or younger, its crucial to save in other investment vehicles, such as a 401k, in order to maintain your desired lifestyle in retirement.

We recommend not relying on Social Security it may not fully be there when you retire!

How Much Should I Have In My 401k At Age 60

From the results, an average 60-year-old should have between $ 800,000- $ 5,000,000 saved up in his 401k, depending on the companys match and investment performance. Just one or two percentage points in performance difference can really make up much over a 30-year savings period.

How much should you have saved by the time you are 60?

According to guidelines made by the investment company Fidelity, you should at the age of 60 have saved about eight times your annual salary if you plan to retire at age 67, the age at which people born after 1960 can receive full social security benefits.

How much does the average 60 year old have in their retirement account?

How much does an average 60-year-old have in retirement savings? According to Federal Reserve data, for 55- to 64-year-olds, that number is a little over $ 408,000.

Read Also: How To Provide 401k To Employees

Which Account Is Right For You

Traditional 401

- Taxes: You make pre-tax contributions and pay tax on withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are added directly to your 401 account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- RMDs

- You must take RMDs starting at age 72

- Heirs are subject to RMDs and taxed on distributions

Roth 401

- Taxes: You make after-tax contributions and don’t pay tax on qualified withdrawals in retirement

- Salary deferral limits for 2022: $20,500

- Employer match: Funds are deposited into a separate tax-deferred account

- Total contribution limits for 2022: $61,000 , includes salary deferral amount and employer matches

- RMDs

- You must take RMDs starting at age 72 however, you could roll over funds to a Roth IRA to avoid RMDs

- Heirs are subject to RMDs but not taxed on distributions

Now that you have a better understanding of a Roth 401, you might be wondering how it differs from a Roth IRA. Contributions to either account type are made with after-tax dollars, and you won’t pay taxes on qualified distributions. The differences between the two types of Roth accounts come down to contribution limits, income limits, and RMDs.

Early Withdrawals At Age 55

If you retireor lose your jobwhen you are age 55 but not yet 59½, you can avoid the 10% early withdrawal penalty for taking money out of your 401. However, this only applies to the 401 from the employer that you just left. Money that is still in an earlier employers plan is not eligible for this exceptionnor is money in an IRA.

Recommended Reading: Where Can I Cash A 401k Check

Why Stop Contributing To A 401k

The most common reason that people stop contributing to 401ks is that they stop working for the company that supports their 401k. If you go from one company to another, you can take the funds in your 401k and transfer them to another companys 401k.

If you do not want to transfer your funds to another companys 401k, most companies allow you to leave the funds in your original 401k, as long as it is over a certain amount, which is usually $5,000.

If you have less than the minimum amount, your company will either pay you out with a check or help you transfer it to another company.

When you leave your funds in the original 401k, your money will continue to grow, which depends on the fund.

For example, if you have a portfolio of stocks and bonds, your money will grow based on the markets growth. If you have a 401k savings account, your money will grow based on the interest rate of your account.

When you roll your money over between two companies, make sure it is through an automatic transfer.

If you withdraw your money from the first 401k, then place the money into the new account, you may need to pay taxes or fees on the money. You also may face issues with company restrictions like annual maximums.

If you do not leave your funds in the original account or roll them over to a new account, your money will not grow.

How Much Should You Have In Your 401k By Age

Now that we have established that you need a 401k in your life and explained how much you can contribute, lets talk cash. Aside from investing enough to meet your employer match, how much should you have in your 401k, really?

One way to answer that question is to look at your age.

While there is no one-size-fits-all answer to the question, How much should I have in my 401k? there are some best practices you can keep in mind to guide your efforts. Yes, while you should start investing in a 401k as soon as possible, some people might not get that opportunity right away and thats okay. The point is to do it when you can.

When you do finally start investing, there are a few good rules of thumb to help you make a sound decision on how much you should have in your 401k.

You May Like: How To Switch 401k To Roth Ira

Maximize Employer 401 Match Calculator

Contribution percentages that are too low or too high may not take full advantage of employer matches. If the percentage is too high, contributions may reach the IRS limit before the end of the year. As a result, employers will not match for the rest of the year. This calculation can show the contribution percentage window in order to take full advantage of the employer’s matching contributions.

Investing Matters Because Inflation Matters

Lets say you live for 25 years after retiring at 60. You only get to live on $40,000 $100,000 a year on the low-to-mid end. Sounds feasible in todays dollars, but not so much in future dollars due to inflation.

If goodness forbid you live for 35 years after retiring at 60, then you can only live off of $28,571 $71,000. If we use a 2% inflation rate to calculate what $1,000,000 $5,000,000 is worth today, its only worth about $5500,000 $2,355,000.

We know that due to inflation, a dollar today will not go as far as a dollar 30+ years from now. Private university tuition will probably cost over $100,000 a year in 20 years. That is ridiculous since education is now free thanks to the internet.

Then there is the incredible growth of healthcare costs that is the most worrisome for retirees. For example, Ive been paying $23,000+ a year in healthcare premiums for a platinum plan for my family of three. This is despite us all in good health.

Does that sound affordable for the average American household who makes $68,000 a year? Absolutely not, which is why employees should not underestimate the value of their overall work benefits.

In fact, inflation is the reason why it takes $3 million to be a real millionaire today. Make sure you own assets like stocks, real estate, and more to let inflation work for you!

You May Like: How Much Money Can You Put Into A 401k

Improve Your 401 Balance

Improving your 401 balance depends on how well you can handle your finances and how much you can contribute to it. Doing your research for the best interest options for your 401 plan can be a good way to start building compound interest, which will result in a higher balance.

If you think youre at a good place with your finances and making sure your living expenses and debts are being paid off, it might be worth considering maxing out your 401 contributions. According to Vanguard, only 12 percent of 401participants maxed out their contribution limit of $19,500 in 2020, and you could be one of them.

Whether you start small or contribute close to the limit, consistently contributing to your 401 and making sure your plan meets your goals will help you improve your average 401 balance and save more for retirement.

What Are My 401 Plan Fees

The 401 plan is complex machine with plenty of moving parts, and fees could be hiding anywhere. But well explain what to look for and where to find them. For starters, you can look into your 401 plan summary annual report. This document depicts the plans total assets and expenses. Another crucial document is your fund prospectus. This one details the costs associated with managing the mutual fund or funds that youre invested in.

When reviewing these and other documents, these are some of the fees you should look out for.

Administrative Fees: These are fees associated with the overall management of your companys 401 plan. They can include expenses for record keeping, legal representation and services offered to employees such as educational seminars.

Expense Ratios: This represents the portion of a funds assets used to pay for overall management and ongoing operation of the fund. The expense ratio comes out of a funds total assets, so you and everyone invested in the same fund pay indirectly via investment returns. Your fund prospectus should detail the expense ratio.

12b-1 fees: If present, these fees are factored into the funds expense ratio. 12b-1 fees generally pay for marketing of the fund.

If all of these 401 fee designations sound a little difficult to wrap your head around, dont fret.

Recommended Reading: How To Use Your 401k In Retirement