Why Would You Convert Your Ira Or 401k Account To A Roth

Carefully consider the reasons whether to convert your IRA or 401k account to a Roth.

getty

Are you worried that federal income taxes will increase in the future due to the burgeoning federal debt? If that possibility concerns you, you might be thinking you should convert your traditional IRA and 401k retirement savings accounts to a Roth account to save money on your taxes.

Before you decide, youll want to consider the good reasons people choose to convert part or all of the money in their traditional 401k and IRAs to a Roth account and whether those reasons will work in your favor.

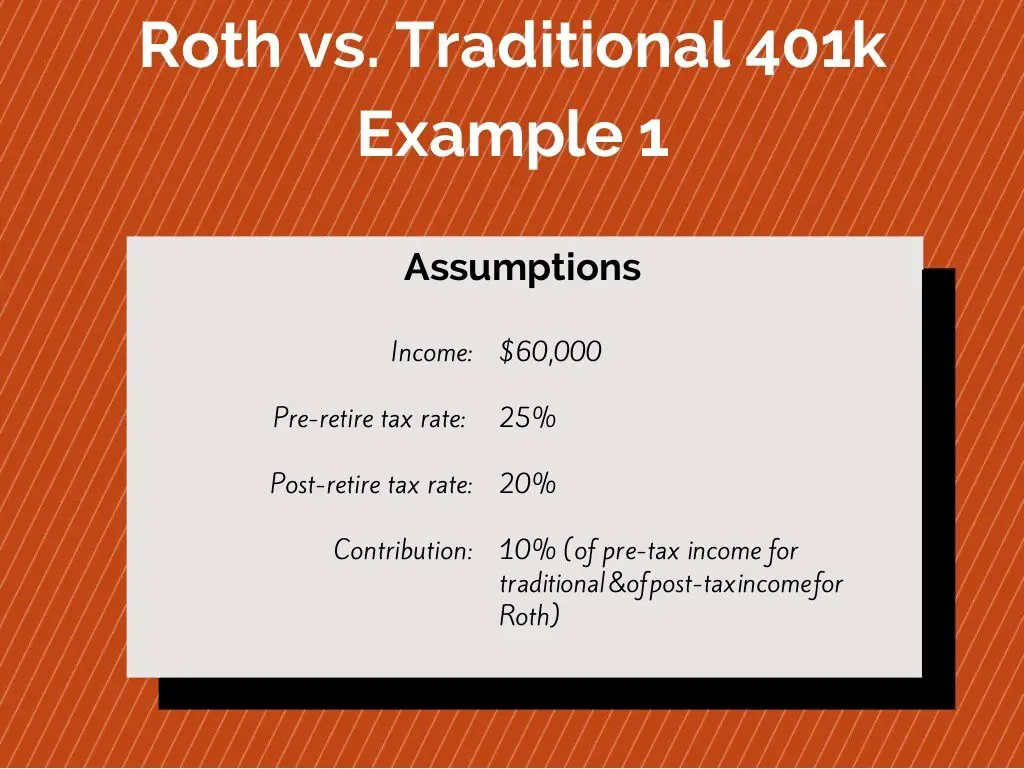

First, lets look at the key features of traditional vs. Roth IRAs and 401k accounts.

Key features of Roth vs. traditional 401k and IRAs

With traditional IRAs and 401k accounts, you arent taxed on the money you save each year, and you wont be taxed on your investment earnings until you make withdrawals. When you begin withdrawing from those accounts in retirement, the money you withdraw is subject to federal income taxes. You might also have to pay state income taxes depending on your state of residence. For many states , their tax rules follow the federal income tax rules.

When you reach age 72, the required minimum distribution rules require you to withdraw minimum amounts from any traditional IRA and 401k accounts you have and include the withdrawal amounts in your total taxable income.

In addition, Roth IRAs arent subject to the RMD rules, but Roth 401k accounts are.

You Want Lower Fees And More Investment Options

Because a 401 account is tied to an employer, it likely has a limited number of investment options, especially if the plan is administered by a small company.

For example, you might have access to only a small group of mutual funds with relatively high expense ratios, or fees. Many discount brokerages, on the other hand, offer index funds with expense ratios close to zero within self-directed IRA accounts.

In a 401, a lot of people feel like theyre handcuffed in terms of what they can own, says Hernandez. In most cases, in an IRA you have a lot more flexibility in what you can own.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

The Rollover Chart PDF summarizes allowable rollover transactions.

Read Also: How Much Money Should I Put In My 401k

You May Like: How To Start 401k On Your Own

Advantages Of Rolling Over Your 401

1. You can consolidate your 401 accounts

Especially if you change jobs often, you might find yourself with many 401 accounts scattered around. The more accounts you have, the harder it may be to actively make decisions. By having your retirement funds all in one place, you may be able to manage them more carefully.

2. Youll have more investment choices in an IRA

With your 401, you are restricted to the investment and account options that are offered in that plan. An IRA can give you a more diverse option of items to invest in. In an IRA you may be able to invest in individual stocks, bonds or other vehicles that may not be available in your 401.

You cant add to the 401 at your previous employer. But if you roll this money over into a traditional IRA, you can add to that traditional IRA over time, up to the annual maximum. Youll have to follow the IRA contribution guidelines.

3. Youll have the choice to bring the account anywhere youd like

With an IRA, you can take your money with you to any advisor, if you already have a financial advisor or financial planner that you work with, for example. Or maybe you already have a brokerage where some of your money is being managed, and you want all your funds there.

Youre Our First Priorityevery Time

NerdWallet, Inc. is an independent publisher and comparison service, not an investment advisor. Its articles, interactive tools and other content are provided to you for free, as self-help tools and for informational purposes only. They are not intended to provide investment advice. NerdWallet does not and cannot guarantee the accuracy or applicability of any information in regard to your individual circumstances. Examples are hypothetical, and we encourage you to seek personalized advice from qualified professionals regarding specific investment issues. Our estimates are based on past market performance, and past performance is not a guarantee of future performance.

We believe everyone should be able to make financial decisions with confidence. And while our site doesnt feature every company or financial product available on the market, were proud that the guidance we offer, the information we provide and the tools we create are objective, independent, straightforward and free.

So how do we make money? Our partners compensate us. This may influence which products we review and write about , but it in no way affects our recommendations or advice, which are grounded in thousands of hours of research. Our partners cannot pay us to guarantee favorable reviews of their products or services.Here is a list of our partners.

Recommended Reading: How To Find My 401k Contributions

Consider The Following Two Strategies:

-

Strategy #1: $500,000 contributed to Traditional 401K, then converted to Roth IRA all at once

-

Strategy #2: $500,000 contributed to Traditional 401K, then gradually converted to Roth IRA over a 26-year span

Figure 1.1

If you were to employ strategy #1, the Roth IRA account will end up with over $3.4M at the end of 26 years. And youll end up paying $135K in taxes at the time of conversion. Not too shabby. Strategy #1 is what most people end up doing because its simple. However, check out what strategy #2 looks like:

Figure 1.2

If you were to employ strategy #2, the Roth IRA account will end up with over $3.4M at the end of 26 yearssame as strategy #1. But the total taxes paid is only $119K, compared to $135K. More importantly, the tax burden is spread across a 26-year time span. To illustrate the significance of this, have a look at the right-most column in Figure 1.2. There are 2 key insights that brings this together:

Once your money is in a Roth IRA, you wont ever need to worry about taxes or worry about being required to withdraw from it when youre 70.5 years old. Also, at the time of your death, your inheritor will be able to take that amount of money as a lump sum, tax free!

If you enjoy this content, please consider following me on my for the latest and subscribing below!

Completing The Roth 401k Rollover Process

It is important to complete the rollover in a timely manner so that you can avoid 401k taxes and 401k withdrawal penalties for an early withdrawal. The deadline is not flexible, and you may want to choose where you want to open your IRA before you begin the process of cashing out your 401k. They may be willing to work with you on the paperwork, and have the check for the proceeds of your 401k mailed directly to them. Be sure to follow up on the process to make sure everything is in place before the deadline.

Also Check: How Can I Get My 401k Money Without Paying Taxes

Converting A Nondeductible Ira Contribution To A Roth Ira

You may know that if you or your spouse have a retirement plan available at work, it limits the deductible contributions you can make to a traditional IRA.3 If you’re in that boat and want to make the most of your tax-advantaged saving options, you can still make nondeductible IRA contributions. Earnings on these contributions will be tax-deferred but you do have the option of converting to a Roth IRA. In that case, your nondeductible contributions wont be taxed again, although any earnings would be treated as pre-tax balances, which means they would be taxable when converted. This type of conversion is sometimes called a backdoor Roth IRA.

If you do decide to convert either pre-tax or non-deductible contributions, the timing can be a little bit tricky. Some time should pass between the date of the contribution and the date of the conversion, but it’s not completely clear how much is enough. If you do decide to convert, consult your tax advisor first to ensure that you understand the full scope of potential tax consequences.

Rollover To Ira: How To Do It In 4 Steps

Many or all of the products featured here are from our partners who compensate us. This may influence which products we write about and where and how the product appears on a page. However, this does not influence our evaluations. Our opinions are our own. Here is a list ofour partnersandhere’s how we make money.

The investing information provided on this page is for educational purposes only. NerdWallet does not offer advisory or brokerage services, nor does it recommend or advise investors to buy or sell particular stocks or securities.

A 401 rollover is a transfer of money from an old 401 to an individual retirement account or another 401. You’d most likely need to do a rollover when you leave a new job to start a new one, and if you’re in this situation, you likely have a few options, such as rolling your old 401 into your new workplace 401, or cashing it out.

This article focuses on rolling a 401 over to an IRA, which is a great way to consolidate your retirement accounts and keep an eye on your investments.

You May Like: What Can You Roll Your 401k Into

When You Dont Roll Over

Cashing out your account is a simple but costly option. You can ask your plan administrator for a checkbut your employer will withhold 20 percent of your account balance to prepay the tax youll owe. Plus, the IRS will consider your payout an early distribution, meaning you could owe the 10 percent early withdrawal penalty on top of combined federal, state and local taxes. That could total more than 50 percent of your account value.

Think TwiceThe repercussions of taking money out now could be enormous: If you took $10,000 out of your 401 instead of rolling it over into an account earning 8 percent tax-deferred earnings, your retirement fund could end up more than $100,000 short after 30 years.

If your former employers plan has provided strong returns with reasonable fees, you might consider leaving your account behind. You dont give up the right to move your account to your new 401 or an IRA at any time. While your money remains in your former employers 401 plan, you wont be able to make additional contributions to the account, and you may not be able to take a loan from the plan. In addition, some employers might charge higher fees if youre not an active employee.

Further, you might not qualify to stay in your old 401 account: Your employer has the option of cashing out your account if the balance is less than $1,000 though it must provide for the automatic rolling over of your assets out of the plan and into an IRA if your plan balance is more than$1,000.

Pros And Cons: 401 Vs Ira

401 Pros |

|

|---|---|

|

|

|

|

Read Also: How To Get Money From 401k After Retirement

You May Like: How Can I Use My 401k To Buy A House

Option : Move The Money To Your New Employer’s 401 Plan

Moving money to your new employers 401 may be an option, depending on whether your current employer has a 401 plan and the terms of the plan. Like your former employer’s plan, many factors ultimately depend on the terms of your plan, but you should keep the following mind:

- Ability to add money: You’ll generally be able to add money to your new employer’s plan as long as you meet the plan’s requirements. This option also allows you to consolidate your retirement accounts, which may make it easier to monitor your investments and simplify your account information at tax time.

- Investment choices: 401 plans typically have a more limited number of investment options compared to an IRA, but they may include investments you can’t get through an IRA.

- Available services: Some plans may offer educational materials, planning tools, telephone help lines and workshops. Your plan may or may not provide access to a financial advisor.

- Fees and expenses: 401 fees and expenses often include administrative fees, investment-related expenses and distribution fees. These fees and expenses may be lower than the fees and expenses of an IRA.

- Penalty-free distributions: Generally, you can take money from your plan without tax penalties at age 55, if you leave your employer in the calendar year you turn 55 or older.

- Required minimum distributions: Generally, you must take minimum distributions from your plan beginning at age 72, unless you are still working at the company.

What Is A 401 Rollover

If you have an employer-sponsored plan, you can rollover your present savings to a new account, particularly in an IRA. The rollover typically occurs when an individual changes employment or approaches retirement. Rolling over an old 401 is advisable if you have one.

A rollover 401 meaning will be withdrawing the funds from one individual retirement savings and depositing them in another. And, like with the preceding IRA, the new account will provide tax advantages, and in general, you can move money from a 401k to an IRA or into a Roth IRA.

This is not always obligatory to roll over your 401 to an IRA you can just pick a new 401 at your new workplace. However, there are loads of options for 401 rollovers, the most well-known of which is the rollover of a 401 to a Roth IRA. We have included all of the relevant information concerning the rollover procedure and the implications of rollover in this article.

You May Like: Where Is My 401k Account

Taxes And Additional Penalties On 401k Rollovers

The process is very similar to that of a straight rollover into the same type of account except for the taxes. If you choose to pay the taxes with money from your 401k, you will also need to pay the penalty. Your 401k plan will report the transaction and whether or not it was supposed to be rolled into a new account to the IRS. If you do not indicate that it is a rollover on the application, then they will send a portion of the payment to the IRS. However, you may still owe more in taxes. For this type of conversion, it is important to talk to your accountant in addition to your investment company to make sure that you have covered all of your tax liability. If you do not have the cash on hand to pay the taxes, you may be better off rolling a traditional 401k into a traditional IRA.

When you are ready to roll your 401k over into an IRA, you need to find a company that you can trust. You can receive referrals of trusted 401k companies for self-directed IRAs and other IRA options by contacting us today.

Is My Ira Contribution Deductible On My Tax Return

If neither you nor your spouse is covered by a retirement plan at work, your deduction is allowed in full.

For contributions to a traditional IRA, the amount you can deduct may be limited if you or your spouse is covered by a retirement plan at work and your income exceeds certain levels.

Roth IRA contributions arent deductible.

Read Also: Can You Switch A 401k To A Roth Ira

Can You Convert A 401k To A Roth Ira

First, it is legal to convert a 401k to a Roth?

Absolutely.

Don’t be confused if you run across conflicting information that states otherwise. It’s probably just old information that hasn’t been updated.

Why do I say that?

Because, prior to 2008, you could only convert a Traditional IRA, a SIMPLE IRA, or a SEP IRA to a Roth IRA. If you wanted to convert a 401k to a Roth IRA, you first needed to convert your 401k to a Traditional IRA, and then convert your Traditional IRA to a Roth IRA.

But post-2008, you have the option of performing a direct 401k to Roth IRA conversion.

In fact, as of 2008, you can convert all or part of the following accounts to a Roth IRA:

- Employer’s qualified pension, profit sharing, or stock bonus plan

- Annuity plan

- Tax-sheltered annuity plan , or

- Governmental deferred compensation plan

As a result of the 2008 law change, you are now able to directly convert a 401k to a Roth IRA.