What Are The Disadvantages Of Rolling Over A 401 To An Ira

Cutting fees, improving investment options, and simplifying your portfolio are compelling reasons to roll your 401 to an IRA. However there are several potential reasons to leave your 401 where it is. They include:

- Superior investment options in some 401 plans,

- Age related benefits of 401 accounts,

- Superior asset protection.

Rollover To A Life Insurance Policy

Technically, you cant roll over your 401 account into an insurance policy however, if you have a life insurance needs, you can withdraw funds from the account and redirect them to pay for a life insurance policy. You can avoid early withdrawal penalties under IRS Rule 72t,2 which allows you to take equal payments from your accounts. However, you must agree to take consistent withdrawals from your account each year for life.

How Long Does A Direct 401 Rollover To Ira Take

The quickest way to rollover your 401 money to an IRA is through a direct rollover. When doing a direct rollover, the 401 plan administrator will transfer your assets directly to your specific IRA, usually through an electronic transfer. A direct rollover can take 1 to 4 days, depending on the plan administrator.

Usually, there are no time limits for a direct rollover. Before requesting a direct rollover, you must open an IRA account where the funds will be transferred, and complete paperwork with your 401 plan administrator. Also, check your 401 balance to know the amount you should expect to receive. Once youâve provided your IRA plan details, the 401 plan administrator will initiate a wire transfer or write a check to the IRA.

If you choose a direct rollover, you will get your 401 money without paying income taxes. This is because the funds do not go through your account, and hence, the funds are not considered a distribution for income tax purposes.

Read Also: Will Walmart Cash A 401k Check

How Do 401s And Iras Work

A 401 is an employer-sponsored retirement savings plan that allows employees to save pre-tax money from their paychecks, often with a partial match from their employers. Money deposited into 401 accounts is not taxed until it is withdrawn. It gets its name from the section of the tax code that covers it.

An IRA is an individual retirement account in which the saver directly deposits pre-tax funds. Often, individuals who leave companies where they had 401 plans will roll the funds from them into IRAs.

Regardless of whether you own a 401k or an IRA, once a distribution is taken, it is taxable as ordinary income. Additionally, if you are withdrawing money prior to the age of 59½, then the IRS levies an additional 10 percent penalty tax. The same rules of taxation apply when you roll a 401 plan or an IRA into an annuity.

Should You Rollover Your 401 To An Ira

Posted by Chris Mamula | Sep 7, 2021 | Investing, Investing & Taxes | 36

During my working years, I invested regularly into my 401. I chose to use my 401 to take advantage of the considerable tax benefits available to an early retiree.

This consistent saving, combined with a bull market over the last decade of my career, left me with a substantial balance in my 401 when I left my job.

One of the first things that I did upon leaving was figure out what to do with these investments. Is it better to leave them in the 401 or roll them into an individual retirement account ?

For simplicity, I will use the terminology 401 throughout this article, but most aspects of this decision making process would apply to any work-sponsored retirement accounts including a 403, SIMPLE IRA, etc. Ill explain the one exception to this rule.

Recommended Reading: Can You Transfer Money From 401k To Ira

Roth Ira Rollover Rules From 401k

As a reminder, you must generally be separated from your employer to roll your 401k into a Roth IRA. However, some employers do permit an in-service rollover, where you can do the rollover while still employed. Its permitted by the IRS, but not all employers participate.

Before January 1, 2008, you werent able to roll your 401 into a Roth IRA directly at all. If you wanted to do so you had to complete a two-step process.

However, the law changed shortly after and this option became available. Still, just because the law has made this option available doesnt mean you can definitely roll your old 401 into a Roth IRA no matter what. Unfortunately, it all depends on your plan administrator.

For example, recently I had two clients who intended to roll their old retirement plans into a Roth IRA.

One client had an old military retirement plan- Thrift Savings Plan and the other had an old state retirement plan. After helping each of them complete the required paperwork, I came across an interesting discovery.

The TSP rollover paperwork had a box you could mark if you wanted to roll over the plan into a Roth IRA . However, the state retirement plan did not give that option.

The only option was to open a traditional IRA to accept the rollover then immediately convert it to a Roth IRA. That certainly seemed like a hassle at the time, and it definitely was.

Reasons You May Want To Roll Over Now

- Diversification. Investment options in your 401 can be limited and are selected by the plan sponsor. Rolling your funds over into an IRA can often broaden your choice of investments. More choices can mean more diversification in your retirement portfolio and the opportunity to invest in a wider range of asset classes including individual stocks and bonds, managed accounts, REITs and annuities.

- Beneficiary flexibility. With some IRAs, you may be able to name multiple and contingent beneficiaries or name a trust as the beneficiary. Other IRAs may allow you to impose restrictions on beneficiaries. These options aren’t usually available with 401s. But, keep in mind, not all IRA custodians have the same rules about beneficiaries so be sure to check carefully.

- Ownership control. You are the owner and have access rights with an IRA. The assets in your IRA are also not subject to blackout periods. With a 401 plan, the qualified plan trustee owns the assets and assets may be subject to blackout periods in which account access is limited.

- Distribution options. If your IRA is set up as a Roth IRA, there is not a set age when the owner is required to take minimum distributions. With 401 plans and traditional IRAs, the owner will have to take required minimum distributions by April 1 of the year after they turn age 72.

Also Check: How Long Do You Have To Roll Over Your 401k

Roll Your Money Into An Ira

What if your new company doesnt offer a 401 plan? Or perhaps you want more control over your investments and a wider array of asset options. If so, rolling your 401 into an IRA may suit your needs.

After opening an IRA with a bank or brokerage firm, youll use a direct rollover or 60-day rollover to move the money from your 401 into the IRA. By rolling your retirement savings into an IRA, youll assume control over your investments and may have a broader range of options.

While contributions to a 401 or traditional IRA are taxed when money is pulled out of the account, a Roth IRA allows your money to grow tax-free because the contributions are made after being taxed. Its important to note that some 401 plans wont allow you to roll over your money directly into a Roth IRA. If thats the case, you can move the funds into a traditional IRA and then convert it to a Roth account, but a financial advisor can help you through this process.

Why Roll A 401 Into An Ira

IRAs are a way to save for your retirement from your own contributions, which is ideal if you are planning to work for yourself or your new employer does not offer a retirement plan. They also offer certain benefits that 401s do not. For example, while most employer-sponsored plans offer limited investment choices, IRAs put you in the driver’s seat when it comes to growing your wealth. Stocks, bonds, money-exchanges, real estate investment trusts, certificates of deposit you can invest in all of these and more with an IRA.

Like a 401, you are supposed to leave the money in the IRA until you retire. Withdraw the money before age 59 1/2, and the tax man will hit you with an early payment penalty equal to 10 percent of the distribution, and you’ll have to pay income tax on the amount you’ve withdrawn. An IRA is more flexible than a 401, however, in that you can withdraw up to $10,000 penalty-free before age 59 1/2 to purchase a first-time home or to pay for college expenses.

Read Also: How To Claim 401k Money

Can You Be Required To Roll Over Your 401

Sometimes you have no choice in the matter. You might be required to roll over your 401 if:

You dont meet a minimum balance requirement. For example, if you have less than $5,000 in your 401, your employer can require you to roll your 401 into a different account.

Your old employer changes 401 providers. Depending on your company, your account may not be rolled over and your existing provider may not continue service. If your account is rolled over, the new provider might have requirements you cant meet, or they might not provide the services you want.

Read Also: Can I Convert My 401k To A Roth

Can I Rollover My 401k While Still Employed

In recent conversations, the question has come up as to whether you call rollover your 401k to a traditional IRA while still employed at the sponsoring employer. There seems to be some confusion about this and rumors of new laws that allow it.

The short answer to the question is, no. By law, you can not withdraw 401k contributions, that is, pre-tax salary deferrals, before severance, plan termination, turning 59 1/2, death, disability or hardship .

The long answer is, yes, under certain circumstances, you can.

The standard exceptions do apply, for example, if you are 60 years of age or older, and still working, most qualified plans allow age 59 1/2 rollovers. If a particular plan does not, they most likely allow rollovers at age 65. The exceptions can add to the confusion and there is such a thing as the in-service withdrawal.

To me, the most interesting exception being the fact that the law only applies to your pre-tax salary deferrals. You CAN rollover employer contributions, or employee contributions. And you can do so without any required taxes or penalties.

This can be a big deal. I know someone whos matching contributions from his company were paid in company preferred stock and it ended up comprising a whopping 75% of his total plan holdings. He was not allowed, then, to diversify any matching funds elsewhere within the plan.

I need a book on the subject of in-service-withdrawals from a credible source.

Any suggestions?

Recommended Reading: How Much Do You Have To Withdraw From 401k

Losing Access To Superior Investment Options

One potential problem with 401 plans is that your investment options are limited to the choices provided by the plan. On the flip side, some large companies and government plans can use the economy of scale to provide superior investments than retail investors can get on their own.

One example of the latter would include plans that offer ultra-low cost Vanguard Institutional Shares. Another example of a plan with great investment options is the Thrift Savings Plan offered to many government employees.

If your work sponsored retirement account offers acceptable investment options, and especially if it offers superior funds than individual investors can purchase, there are compelling benefits to not roll over your account to an IRA.

Background Of The One

Under the basic rollover rule, you don’t have to include in your gross income any amount distributed to you from an IRA if you deposit the amount into another eligible plan within 60 days ) also see FAQs: Waivers of the 60-Day Rollover Requirement). Internal Revenue Code Section 408 limits taxpayers to one IRA-to-IRA rollover in any 12-month period. Proposed Treasury Regulation Section 1.408-4, published in 1981, and IRS Publication 590-A, Contributions to Individual Retirement Arrangements interpreted this limitation as applying on an IRA-by-IRA basis, meaning a rollover from one IRA to another would not affect a rollover involving other IRAs of the same individual. However, the Tax Court held in 2014 that you can’t make a non-taxable rollover from one IRA to another if you have already made a rollover from any of your IRAs in the preceding 1-year period .

You May Like: How Do You Roll Over Your 401k

Net Unrealized Appreciation Rules

People who have appreciated employer stock in their 401 may also elect to roll over everything except that stock in order to take advantage of the net unrealized appreciation rules.

What are we talking about?

The NUA of the stock is subject to different tax rules than ordinary funds and is not taxed upon distribution. You can defer the tax on the stock until you sell it and instead of paying ordinary income tax rates, youll follow capital gains tax rules. This can earn you a more favorable rate and save you some money.

Keep in mind that your basis in the stock is not part of this and is still subject to ordinary income tax rates. You also may face unfavorable tax implications or a 10% penalty if you pull money out before you turn 55.

Rollovers Of Retirement Plan And Ira Distributions

Information on this page may be affected by coronavirus relief for retirement plans and IRAs.

Most pre-retirement payments you receive from a retirement plan or IRA can be rolled over by depositing the payment in another retirement plan or IRA within 60 days. You can also have your financial institution or plan directly transfer the payment to another plan or IRA.

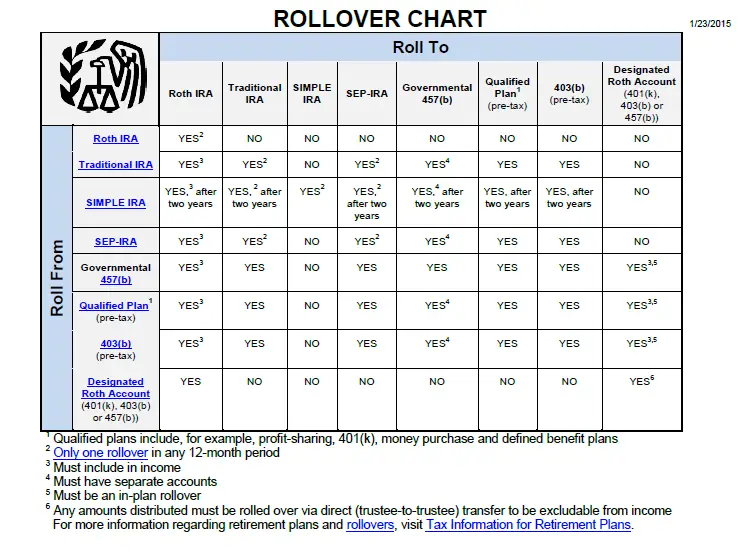

The Rollover Chart PDF summarizes allowable rollover transactions.

Don’t Miss: Can You Leave Your 401k At Your Old Job

How Do I Roll Over My 401 To An Ira

When you leave your job for any reason, you have the option to roll over a 401 to an IRA. This involves opening an account with a broker or other financial institution and completing the paperwork with your 401 administrator to move your funds over.

Usually, any investments in your 401 will be sold. The money will then be deposited into your new account or you will receive a check that you must deposit into your IRA within 60 days to avoid early withdrawal penalties.

Tips For Rolling Over Your 401

- A financial advisor can help you decide whether rolling over your 401 is right for you. SmartAssets financial advisor tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- If you choose to roll over your retirement savings into a new 401 or IRA, you can contact your plans administrator and request a direct rollover. By doing so, youll avoid the possibility of exceeding the 60-day threshold and owing taxes on the money.

- Dont forget to compare the fees of various plans by locating their fee disclosure notices. Pay attention to asset-based fees and administrative fees.

Also Check: How Do I Open A 401k

Rules For Simple Ira Rollovers To 401 Plans

Transferring your SIMPLE IRA assets to a 401 is straightforward. But you must complete the rollover within the terms of your SIMPLE IRA plan and the IRS rules to ensure that the rollover qualifies as tax- and penalty-free.

You can only make a tax-free rollover from a SIMPLE IRA to a 401 following a two-year period. The clock starts running from the date you first participated in the plan, not the date you left your employer.

You’ll have to pay taxes if you don’t comply with this two-year rule. The amount will be treated as a withdrawal if it occurs within the two-year period and you roll over your SIMPLE assets into a 401 plan. You’ll have to include the withdrawal in your taxable income for that year.

You may be on the hook for an increased age-related penalty as well.The 10% penalty you’d pay if you’re younger than 59½ increases to 25% if you roll over your SIMPLE IRA within the two-year period unless you qualify for an exception. Changing jobs in itself is not considered an exception. You may qualify for an exception if the amount you withdraw is less than the amount you pay for health insurance while you’re unemployed, however.

Your SIMPLE IRA must be in place for at least two years from the date of plan participation to qualify for a tax-free rollover to a 401.

When Leaving Your Job You Can Typically Cash Out Your 401 Or Roll It Over Into A Different Retirement Account Certain Options Can Make You Much Richer

Both a 401 and IRA are tax-advantaged retirement accounts, but they work differently. 401s are sponsored by employers and often offer limited investment options. IRAs aren’t linked to employment. They can be opened with any brokerage firm or other financial institutions and have a wider variety of investment selections, but require more hands-on management.

Because 401s are offered through employers, you’ll need to determine what to do with yours when you leave your job. Your options include:

- Leave it invested

- Rollover to a new 401

- Rollover to an IRA

There are plenty of pros and cons to these options, but let’s take a close look at when rolling your workplace 401 into an IRA may make sense for you.

Don’t Miss: How Much Can You Invest In 401k