If You Want To Open A New Roth Ira

You need to have a Vanguard Roth IRA already set up in order to receive converted assets. So there are a few extra steps.

When asked to select your funding method, choose Exchange and then follow the remaining instructions.

If there’s more than one Vanguard mutual fund in your traditional IRA, you can only exchange one fund when you first open the Roth IRA. Once the account is set up, you can exchange the remaining funds by following the instructions in the section above.

Can You Convert An Employer

If you have an employer-sponsored 401k or 403b, you can usually convert to a Roth IRA once you leave the employer. Most businesses dont allow in-service rollovers, but there are exceptions to the rule.

When you leave your job, you can ask to roll the funds over to a Roth account, but we said previously, you must do a direct rollover or make sure you deposit the funds within 60 days of withdrawing them.

However, if you are planning on rolling over funds from a 401k or 403b into an IRA, I highly recommend you check out my friends over at Capitalize. Capitalize provides a completely free service where they will handle all paperwork and phone calls necessary to rollover your old 401k into an IRA. They handle the paperwork, phone calls, moving your money, and all that hassle completely for free.

How To Convert To A Roth Ira

There are plenty of reasons to consider a Roth individual retirement account rollover, which moves funds from an existing traditional IRA into a Roth IRA. Here’s a quick look at how to convert to a Roth IRA, plus considerations when deciding whether it makes sense for you.

Also Check: What Is The Contribution Limit For 401k

Traditional 401 Vs Roth 401

There are two types of 401 plans: Traditional and Roth 401s.

The traditional 401, named after the relevant section of the IRS code, has been around since 1978.

With this plan, any contributions you make to the 401 account will reduce your income taxes for that year and will be taxed when they are withdrawn.

Roth 401s, named after former senator William Roth of Delaware, were introduced in 2006.

Unlike a traditional 401, all contributions are made with after-tax dollars and the funds in the Roth 401 account accrue tax free.

Typically, employees can take advantage of both plans at the same time, which is recommended among financial advisors to maximize retirement savings.

Because of the way the contribution limits work, it is possible to invest different amounts into each account, even year-to-year, so long as the total contribution does not exceed the set limit.

Confusion Of The Roths

Unlike the similarly named Roth IRA, the Roth 401 is different. A Roth IRA is an individual retirement account whereas a Roth 401 is part of and offered through an employer sponsored retirement plan.

This minor confusion might be an invisible obstacle for some employees, especially high-income earners who have been told they cannot contribute to a Roth.

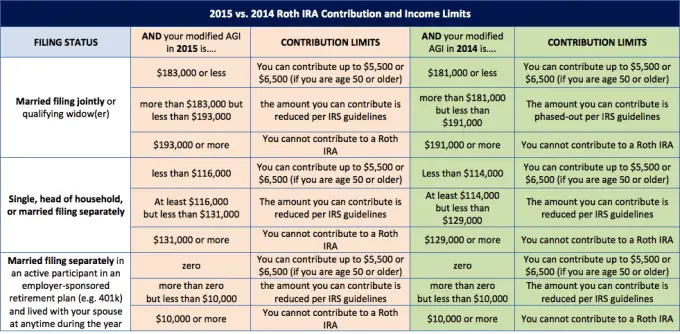

High-income earners may be pleasantly surprised to hear they can contribute because a Roth 401 does not have income limits like a Roth IRA does. This means they now have access to a savings vehicle that can grow tax-free.

Additionally, since Roth 401 accounts follow traditional 401 contribution guidelines, the amount that can be saved per year is subject to 401 maximums. For example, in 2020, employees can contribute up to $19,500 in a Roth 401 and if the employee is 50 years old or older, they may make a catch-up contribution of up to $6,500, for a potential total annual contribution of $26,000.5

Read Also: How Do You Take Money Out Of 401k

Does A Roth Ira Conversion Make Sense For You

It depends on what your goals are. Here are six common reasons where a Roth IRA conversion makes sense:

On the other hand, a Roth IRA conversion wont make much sense if youre close to retiring, would cause your taxable income to rise too much, or you dont have the cash on hand to pay the income tax upfront. In these scenarios, a conversion would likely be counterproductive to your financial plans. As always, talk with a tax professional to see if it makes sense for your situation.

How To Roll Over Funds To A Roth Ira

Converting your traditional IRA to a Roth IRA isnt overly difficult, but its important to follow the steps of the process carefully. If you dont follow the proper procedures or take too long to complete the conversion, you may owe penalties.

The IRS recommends three methods for completing the conversion.

Also Check: Can I Pull Out My 401k

Immediately Convert Your Traditional Ira To A Roth Ira

Why do you want to take this step immediately? Because if you leave the money in your traditional IRA, you could have earnings, and if you have earnings, you have to pay taxes on those earnings when you do your conversion. If you accumulate enough earnings and then convert your entire account balance, youll have an excess contribution you will have to correct by paying taxes. Any untaxed amounts in the traditional IRA will result in taxation after the conversion. Keep life simple: Dont procrastinate on your conversion.

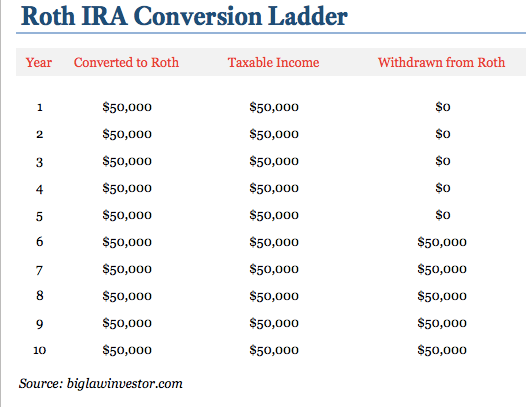

Consider Converting Over A Period Of Years

Experts such as Victor advise careful planning to minimize the tax hit that comes with a conversion. Individuals could space the conversion out over many years rather than convert the full amount in one year. By doing so, they may be able to avoid jumping up to a higher tax bracket and paying more on each incremental dollar of converted money.

Dont Miss: How To Cancel 401k Plan

Also Check: How To Get Your 401k Without Penalty

Heres What To Expect:

Step 1 Contact a Wells Fargo retirement professional at 1-877-493-4727 to initiate your conversion request and get an overview of the process.

Step 2 Our team will help you open a new Roth IRA account if you don’t already have one, fill out the appropriate paperwork, and answer any questions you may have.

Step 3 An account form will be sent to you to initiate your conversion.

- Whether youre converting a Wells Fargo Traditional IRA, an IRA from another financial institution, or a qualified employer sponsored retirement plan such as 401, 403, or governmental 457, well walk you through the process to make sure all of your questions are answered.

Step 4 Return the paperwork to complete your request.

Disadvantages Of Roth Conversion

You expect your tax rate in retirement to be lower. If youre in a high federal tax bracket today and expect your retirement income to be low enough that your tax rate will be lower, too, Roth conversions dont make any sense. That said, you still face the wildcard issue of what Congress might do with tax rates in coming years.

Paying taxes upfront. Do you have the free cash flow to handle the extra tax hit from a Roth conversion? If you have high-rate credit card debt, or your emergency fund is a bit thin, you might want to tackle those issues before giving yourself a bigger tax bill.

Social Security issues. If youre already collecting Social Security, whether the payout is taxableand the extent to which it will be taxedis based in part on your income. The year you do a Roth conversion, your taxable income will rise, which could cause a portion of your Social Security benefit to be taxed or push you into a situation where more of your benefit is taxed.

Less bankruptcy protection. Creditors cant touch money inside a 401 account, but there is a limit on protection of IRA assets. The current combined IRA amount protected from creditors is $1,362,800. This cap is reset every three years to adjust for inflationthe next adjustment will be in April 2022.

Dont Miss: Should I Transfer 401k To New Employer

Also Check: Can You Borrow From Your 401k Twice

How Does A 401 To Roth Ira Conversion Work

Converting a 401 into a Roth IRA gives you greater ownership and direction over your money. A 401 is a tax-advantaged retirement account that is managed by an employer, while a Roth IRA is a tax-advantaged retirement account that is managed by you.

In practice, this means youll open a Roth IRA account at an online brokerage firm and then roll any money in your 401 into your new account.

Beware: this will likely be a taxable event. Most, but not all, 401 accounts are tax-deferred. This means that youve never paid any taxes on the money within. Roth IRAs, on the other hand, are post-tax, meaning that they must contain only money that has already been taxed. If you have a tax-deferred 401, also known as a traditional 401, you will owe ordinary income taxes on the amount of money you convert into a Roth IRA.

How Traditional And Roth Iras Work

IRAs, both the traditional and Roth versions, can boost retirement savings while helping you rack up on tax benefits.

The timing of your tax perks is based on the account you choose to put your money in. A traditional IRA allows you to set aside pretax funds for retirement. You won’t have to pay taxes on the money until you withdraw the money, usually years later in retirement, often when your tax rate has dropped.

On the flip side, you pay taxes on your Roth IRA dollars immediately. You can take care of your tax bill up front and enjoy tax-free growth and withdrawals during retirement. But you must not exceed income limits to qualify for making direct contributions to a Roth IRA. High earners can sidestep that limitation through a Roth IRA conversion.

Recommended Reading: Can I Take 401k Money To Buy A House

Beware The Pro Rata Rule On Conversions

If you have traditional IRA accounts with deductible contributions, youll need to factor that in if you convert any nondeductible amounts into a Roth IRA. Youll need to follow the IRSs pro rata rule, which forces you to calculate the tax consequences considering your IRA assets in total.

In effect, youll have to figure out what proportion of your funds have never been taxed that is, deductible contributions and earnings to your total IRA assets. That percentage of the conversion is subject to tax at ordinary income tax rates.

Its a complex calculation and can create significant confusion.

Tips For Saving For Retirement

- Having trouble figuring out how taxes fit into your retirement plan? It may be smart to work with a financial advisor on such decisions. Finding a qualified financial advisor doesnt have to be hard. SmartAssets free tool matches you with up to three financial advisors in your area, and you can interview your advisor matches at no cost to decide which one is right for you. If youre ready to find an advisor who can help you achieve your financial goals, get started now.

- As you plan for your retirement income, you should also consider how Social Security benefits fit into the equation. Our Social Security calculator can help in this regard. Fill in your age, income and target retirement date and well calculate what you can expect in annual benefits.

Also Check: How To Cash Out My 401k

How To Convert A 401 To Traditional Or Roth Ira

When I hear the word convert, I can’t help but think of Michael Jackson.

60% of workers in their 20s fail to convert their 401 to an IRA when leaving or changing jobs. Thus, creating an unnecessary taxable event.

Besides Packers+win, I cant think of a combination of words I least like hearing in the same sentence than unnecessary+taxable.

The purpose of this post is to explain your options with your 401 when leaving or changing jobs. More specifically, to look at the steps to convert your 401K to an IRA, since this is most likely the optimal choice.

Question 6 Of : How Do I Roll Over A Simple Ira To A Roth Ira

Recommended Reading: How To Access An Old 401k Account

Special Changes In 2020

In 2020, the coronavirus stimulus bill allows those affected by the coronavirus pandemic a hardship distribution of up to $100,000 without the 10% early distribution penalty those younger than 59½ normally owe.

Account owners also have three years to pay the tax owed on withdrawals, instead of owing it in the current year, or they can repay the withdrawal and avoid owing any taxeven if the amount exceeds the annual contribution limit for that type of retirement account.

Unlike Roth IRAs, Roth 401s are subject to RMDs during the owner’s lifetime. But the CARES Act suspended this requirement in 2020.

Calculating Income To Report On A Roth Conversion

The first step is to figure out your Roth conversion income. If youre converting deductible IRA funds, youd report the current value of the funds on the day you make the conversion as your income. Your basis in a deductible IRA is zero because you received a tax deduction for your savings contributions.

If youre converting nondeductible IRA funds, report as income the current value of the funds on the day you convert, less your basis. If you contributed $5,000 to a traditional IRA in 2016 and received no deduction for that contribution, your basis in those funds would be $5,000: $5,000 of income minus zero for the deduction.

Now lets say you decide to convert that IRA to a Roth two years later in 2018. The value is now $5,500. You would report $500 of income on your tax return: $5,500 current value minus the $5,000.

Don’t Miss: Can You Withdraw From Fidelity 401k

Choose Which Type Of Ira Account To Open

An IRA may give you more investment options and lower fees than your old 401 had.

-

If you do a rollover to a Roth IRA, youll owe taxes on the rolled amount.

-

If you do a rollover to a traditional IRA, the taxes are deferred.

-

If you do a rollover from a Roth 401, you won’t incur taxes if you roll to a Roth IRA.

A Tax Loophole Lets High Earners Contribute Indirectly To A Roth Ira

InvestopediaForbes AdvisorThe Motley Fool, CredibleInsider

High-income earners cant contribute directly to a Roth IRA. But thanks to a tax loophole, they can still make contributions indirectly. If you take advantage and maximize your retirement savings, you can save tens or even hundreds of thousands of dollars on taxes over the years. Let’s delve deeper into this loophole and the benefits of setting up a backdoor Roth IRA.

You May Like: Where Can I Find My 401k Balance

Is A Backdoor Roth Ira Worth It

Yes. Roth IRAs don’t have required minimum distributions, which means you can leave your money in the account and let it grow. And the money you do withdraw isn’t taxable, which means you pay on the contributionsnot the distributions themselves. If you leave the money in a traditional IRA, any earnings are subject to taxes. Just make sure you know the rules so you don’t end up paying more than you save.

Why You Can Trust Bankrate

Founded in 1976, Bankrate has a long track record of helping people make smart financial choices. Weve maintained this reputation for over four decades by demystifying the financial decision-making process and giving people confidence in which actions to take next.

Bankrate follows a strict editorial policy, so you can trust that were putting your interests first. All of our content is authored by highly qualified professionals and edited by subject matter experts, who ensure everything we publish is objective, accurate and trustworthy.

Our reporters and editors focus on the points consumers care about most how to save for retirement, understanding the types of accounts, how to choose investments and more so you can feel confident when planning for your future.

Read Also: Should I Cash Out My 401k To Start A Business

Benefits Of A Roth 401

There are certain financial motivations as to why employees may want to consider contributing into a Roth 401. Here are a few:

- Retirement account grows tax-free

- Employee pays taxes now while in an assumed lower tax bracket than during retirement

- The possibility that Federal, State and Local income tax rates will continue to rise

- Ability for future tax diversification

- Qualified distributions are tax-free

These reasons can be particularly appealing for high-income earners, high-net worth individuals, and younger employees who seek the flexibility offered through Roth diversification.

During times of market volatility or a recession, similar to our current economic environment, participants may consider taking their lower account values as a conversion opportunity, since they would owe less taxes on the smaller account basis. For specific participants, the long-term tax advantages, growth potential of assets, and investable time horizon could be a valuable retirement, tax and estate planning strategy.