What Are The Different Types Of 401k Plans That Businesses Can Offer

- Traditional – Employees make contributions from their income before taxes. You do not have to meet an employee requirement to have this type of plan. Businesses can determine if they want to contribute for everyone enrolled in the plan, match their contributions, or do both.

- Simple – There are a number of requirements a business must meet to have this type of 401K plan. First, this type of plan is for small businesses as they have to employ under 100 employees. An employer has to make contributions for everyone enrolled in the plan.

- Roth – This is similar to a traditional plan, however contributions are made after taxes are taken out of an employee’s gross pay. You do not need to have a certain number of employees in your company. You can choose to contribute to your employee’s plans if you would like. If you offer a Roth plan you also have to give your employees the choice of enrolling in a traditional plan.

- – This type of plan is for a business that doesn’t have any employees. This is why this plan is also known as a Solo plan as it is for those individuals that are self-employed.

How Long Does It Take For A Small Business To Set Up A 401

Establishing a 401 can be a fairly straightforward process. However, without due diligence, that approach would be reckless and make your business vulnerable to expensive fees and risks associated with making hasty decisions regarding something as important as selecting a trustee. Depending on how much preliminary research you do, allow yourself ample time to create a plan document, establish a trust, notify employees, and launch your new benefit.

A Beginner’s Guide To Understanding 401k Plans

The word 401k is synonymous with retirement, but how many of us actually know all the rules around 401k accounts? We’ll walk you through all the finer details, but we also know you’re busy, so we’ve also whipped up this handy table of contents for you, too. Feel free to self-serve some of the most frequently asked questions about 401k plans, or binge it all, top to bottom.

Now, onto the good stuff:

You May Like: Can I Access My 401k If I Quit My Job

How A Simple Ira Works

The SIMPLE IRA follows the same investment, rollover, and distribution rules as a traditional or SEP IRA, except for its lower contribution thresholds. You can put all your net earnings from self-employment in the plan, up to a maximum of $13,500 in 2021 , plus an additional $3,000 if you are 50 or older.

Employees can contribute along with employers in the same annual amounts. As the employer, however, you are required to contribute dollar for dollar up to 3% of each participating employee’s income to the plan each year or a fixed 2% contribution to every eligible employee’s income whether they contribute or not.

Like a 401 plan, the SIMPLE IRA is funded by taxdeductible employer contributions and pretax employee contributions. In a way, the employer’s obligation is less. That’s because employees make contributions even though there is that mandated matching. And the amount you can contribute for yourself is subject to the same contribution limit as the employees.

Early withdrawal penalties are hefty at 25% within the first two years of the plan.

Benefits To You And Your Employees

Investments in the plan grow tax-free after contributions are made, and no tax is paid on investment gains until employees take out the money. Contributions to the plan can reduce taxable income for the year.

Employees can make contributions through payroll deductions, and move the assets in their plan to another employers plan when they change jobs.

Recommended Reading: How Do You Pull Out Your 401k

Contribute Enough To Get Any Employer Match

Even the priciest 401 plan can have some redeeming qualities. Free money via an employer match is one of them. Contributing enough money to get the match is the bare minimum level of participation to shoot for. Beyond that, it depends on the quality of the plan.

A standard employer match is 50% or 100% of your contributions, up to a limit, often 3% to 6% of your salary. Note that matching contributions may be subject to a vesting period, which means that leaving the company before matching contributions are vested means leaving that money behind. Any money you contribute to the plan will always be yours to keep.

If your company retirement plan offers a suitable array of low-cost investment choices and has low administrative fees, maxing out contributions in a 401 makes sense. It also ensures you get the most value out of the perks of tax-free investment growth and, depending on the type of account or the Roth version), either upfront or back-end tax savings.

How Much Can You Borrow

With a 401 loan, the IRS has rules around how much money you can borrow from your retirement plan in any given year. You can borrow the lesser amount of:

- $50,000 or

- Half of your vested balance.

As an example, then, lets say you have $80,000 in your 401 account. The maximum you can borrow in a calendar year is half of that balanceâ$40,000. Lets say you borrow $10,000 from your 401 in January of the calendar year. After that, you find that you need more money in July. In July, you can borrow a maximum of $30,000.

Recommended Reading: Can I Sign Up For 401k Anytime

Why Saving Is Hard For The Self

The reasons for not saving toward retirement wont be a surprise to any self-employed person. The most common include:

- Lack of steady income

- Education expenses

- Costs of running the business

Setting up a retirement plan is a do-it-yourself job, just like everything else an entrepreneur undertakes. No human resources staffer is going to walk you through the company-sponsored 401 plan application. There are no matching contributions, no shares of company stock, and no automatic payroll deductions.

Youll have to be highly disciplined in contributing to the plan and, because the amount you can put in your retirement accounts depends on how much you earn, you wont know until the end of the year how much you can contribute.

Still, if freelancers have unique challenges when saving for retirement, they have unique opportunities, too. Funding your retirement account can be considered part of your business expenses, as is any time or money you spend on establishing and administering the plan. Even more important, a retirement account allows you to make pretax contributions, which lowers your taxable income.

Many retirement plans for the self-employed allow you, as a business owner, to contribute more money annually than you could to an individual IRA.

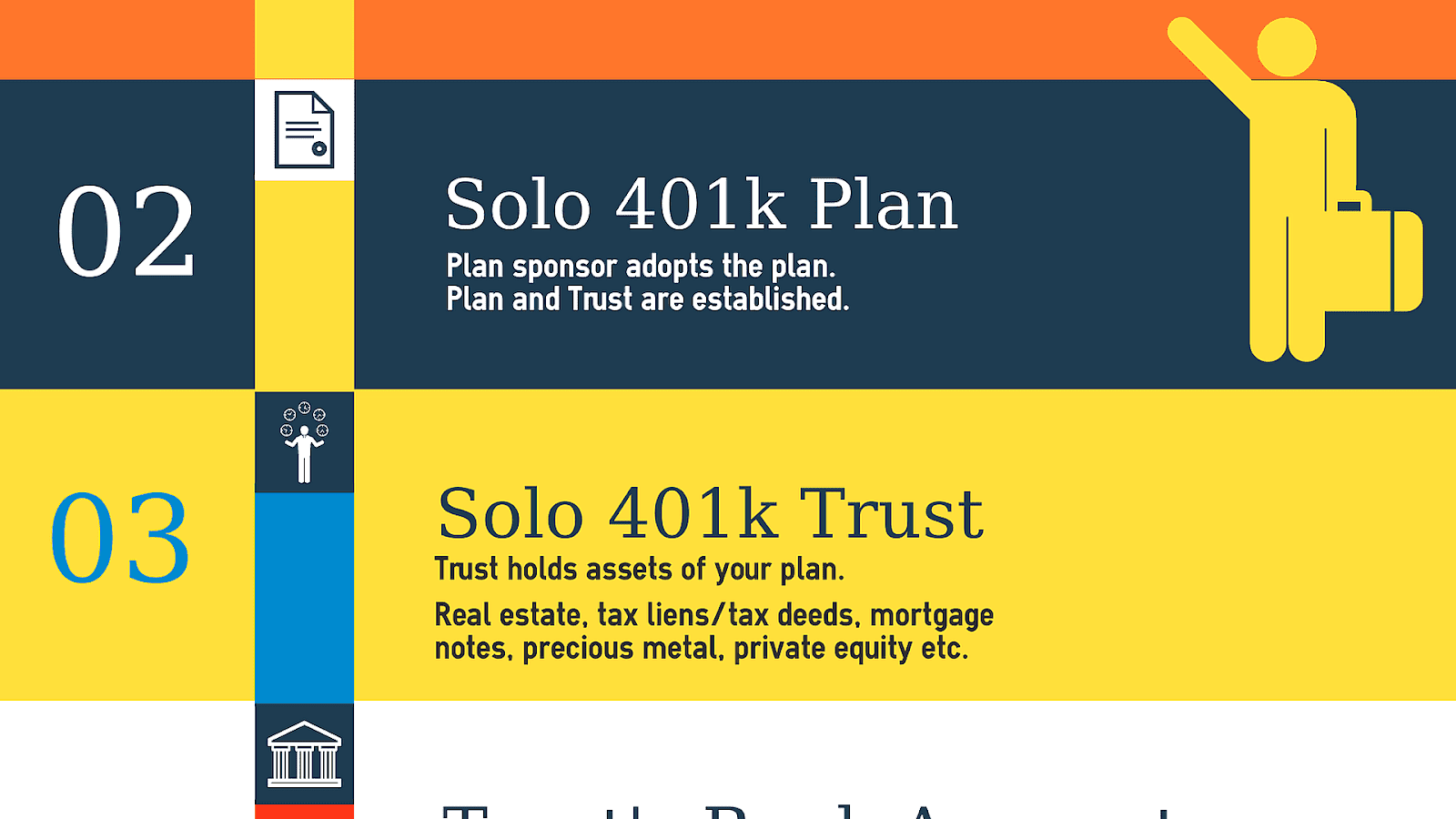

How To Start A 401 For My Business: 4 Steps

Once youve decided that a 401 plan is the right option for your business, its time to get it set up. There are a lot of details that go into starting and managing a 401 plan, but to get started there are four main steps youll need to take:

1. Find a Plan Provider

You can administer a 401 plan yourself, but its much easier to outsource this task to a plan provider. There are a lot of administrative tasks that can be handled by a plan provider who has more experience.

But youll want to take your time to find the right plan provider. When shopping around for a plan provider youll want to consider a few things:

Once youve picked a plan provider, youll need to spend time documenting your decision. You have a fiduciary responsibility to your employees to select and maintain the best provider on their behalf.

Even after youve hired the provider, youll need to monitor your selection to make sure its still the best choice. You should:

- Regularly review their performance

- Review updates to their contract and policies and procedures

- Follow up on participant complaints

2. Decide on Your Employer Contribution

One way you can entice employees to save in the 401 plan you set up is to offer employer contributions. With an employer contribution, youre depositing money into your employees retirement accounts. Employer contributions are a valuable benefit for employees.

With a traditional 401 plan, you have options for offering your contribution.

3. Create Your Vesting Schedule

Read Also: Can I Pull Money From My 401k

Find The Right Account

The first step on your retirement savings journey starts with picking the right account. These come in many forms, depending on your employment status and your income. Ill break down some of the basics, but before we get to that I want to do a quick refresher on what a retirement account is.

Personal finance blogger Paula Pant breaks this down in the easiest-to-understand way. Your account is just a vessel, its not an investment. She compares it to a cup of coffee your account is the cup, the investment is the coffee that you put inside of the cup.

Lets talk about the account first before we jump into filling it with coffee.

How To Make Contributions

How much you decide to contribute to your 401 is really up to you, but there is a maximum amount that is set by the IRS each year. For 2021, the annual contribution limit for workers 50 and younger is $19,500. Those 50 and older are allowed to add a âcatch-upâ contribution of $6,500 .

Apart from knowing the limits, other factors thatâll play into your contribution decision will include how much you think youâll need to save for retirement, whether youâre saving for retirement through other types of accounts and how much you can actually afford to contribute each month.

Also, itâs a good idea to try to contribute enough to meet your employer match, which is free money. A company might, for instance, match half of the contributions you make on the first 6 percent of your salary, or match 100 percent of what you contribute up to a certain dollar amount or percentage of your salary. In some rare cases, your employer might even match what you put in dollar for dollar.

Once you know how much you want to contribute, youâll choose how much you want deducted from each paycheck that will go straight into your 401. This could be either a percentage of your pay or a specific dollar amount. Your human resources department will explain to you how to do this when informing you about your benefits.

Also Check: How To Borrow From 401k

What Happens To My 401k If I Change Jobs

You have a couple of options, but the one most would recommend is a 401k rollover. A 401k rollover is when you transfer your funds from your employer to an individual retirement account or to a 401k plan with your new employer. A much less popular option is to cash out your 401k, but this comes with massive penalties income tax, and an additional 10% withholding fee.

Determine What Your Company’s Purpose Is For Setting Up A 401k Plan

Your reasoning for why you are setting up your 401K plan will dictate how you want your 401K plan set up. Realizing your goal for having a 401K plan will give you a clear focus and provide you with direction so that you won’t get off track, which would be a waste of time and resources.

Now that you know what your purpose is and have your goal set, you can determine which type of 401K plan you would like to offer.

You May Like: How Much Does 401k Cost Per Month

How Much Does It Cost To Set Up A 401 For A Small Business

Costs to set up a 401 plan will vary depending on the size of your business and the types of benefits you select. Initial setup fees can generally run anywhere from $500 to $3,000, depending on the chosen retirement service provider. Other costs to consider are fees associated with rolling assets over from another plan and initial consulting costs for investment advice.

How A Solo 401 Works

The one-participant plan closely mirrors the 401s offered by many larger companies, down to the amounts you can contribute each year. The big difference is that you get to contribute as the employee and the employer, giving you a higher limit than many other tax-advantaged plans.

So if you participate in a standard corporate 401, you would make investments as a pretax payroll deduction from your paycheck, and your employer has the option of matching those contributions up to certain amounts. You get a tax break for your contribution, and the employer gets a tax break for its match. With a one-participant 401 plan, you can contribute in each capacity, as an employee and as a business owner .

Elective deferrals for 2021 can be up to $19,500, or $26,000 if age 50 or older . Total contributions to the plan cannot exceed $58,000, or $64,500 for people age 50 or older as of 2021 . If your spouse works for you, they can also make contributions up to the same amount, and then you can match those. So you see why the solo 401 offers the most generous contribution limits of the plans.

You May Like: Can You Use Your 401k To Start A Business

Taking Withdrawals From A 401

Once money goes into a 401, it is difficult to withdraw it without paying taxes on the withdrawal amounts.

“Make sure that you still save enough on the outside for emergencies and expenses you may have before retirement,” says Dan Stewart, CFA®, president of Revere Asset Management Inc., in Dallas. “Do not put all of your savings into your 401 where you cannot easily access it, if necessary.”

The earnings in a 401 account are tax-deferred in the case of traditional 401s and tax-free in the case of Roths. When the traditional 401 owner makes withdrawals, that money will be taxed as ordinary income. Roth account owners have already paid income tax on the money they contributed to the plan and will owe no tax on their withdrawals as long as they satisfy certain requirements.

Both traditional and Roth 401 owners must be at least age 59½or meet other criteria spelled out by the IRS, such as being totally and permanently disabledwhen they start to make withdrawals.

Otherwise, they usually will face an additional 10% early-distribution penalty tax on top of any other tax they owe.

Some employers allow employees to take out a loan against their contributions to a 401 plan. The employee is essentially borrowing from themselves. If you take out a 401 loan, please consider that if you leave the job before the loan is repaid, you’ll have to repay it in a lump sum or face the 10% penalty for an early withdrawal.

How To Maintain Your 401

You can’t just forget about your 401 after you’ve set it up. You must regularly revisit it to determine if you need to make any changes to your contribution amount or to your asset allocation. Check on your plan at least once or twice per year or following any major life event that could affect your finances or retirement plans.

First, look at how your investments are performing. Small losses here and there are to be expected, especially if you have a lot of your money invested in stocks. However, if you’re routinely losing money, that’s a sign something needs to change. You may also want to consider moving some of your money around if it’s underperforming major market benchmark indexes, like the Dow Jones Industrial Average and the S& P 500. In this case, switching to an affordable index fund that tracks these benchmarks may provide better, more predictable returns.

You should also evaluate how much money you’re contributing to your 401. Income usually rises over the course of one’s career, so you may feel more comfortable contributing more of each paycheck as your income grows. Some people choose to start small and increase their contributions by 1% of their salary every year until they reach their goal amount.

Also Check: How To Check How Much Is In Your 401k

Traditional Or Roth Ira

If none of the above plans seems a good fit, you can start your own individual IRA. Both Roth and traditional individual retirement accounts are available to anyone with employment income, including freelancers. Roth IRAs let you contribute after-tax dollars, while traditional IRAs let you contribute pretax dollars. In 2021 and 2022, the maximum annual contribution is $6,000, $7,000 if you are age 50 or older, or your total earned income, whichever is less.

Most freelancers work for someone else before striking out on their own. If you had a retirement plan such as a 401, 403, or 457 with a former employer, the best way to manage the accumulated savings is often to transfer them to a rollover IRA or a one-participant 401.

Rolling over allows you to choose how to invest the money rather than being limited by the choices in an employer-sponsored plan. Also, the transferred sum can jump-start you into saving in your new entrepreneurial career.

Choose A Plan That Meets Your Business Goals

Plan design optionsThe big difference between 401 plan designs is how and when an employer makes contributions on behalf of its employees. Here are three types of plan designs, their requirements, and some other implications:

What other 401 plan features should I consider?Offering retirement benefits is a great way to attract and retain talent. But specific plan features can really boost participation and make your small business 401 plan even more enticing.

Traditional vs. Roth 401. Whats the difference?Generally speaking, the key difference between the two is when employee contributions are taxed. With traditional accounts, contributions are made before taxes are taken out of pay. Under Roth accounts, contributions are taxed first and then deposited. When an employee retires, withdrawals from traditional accounts are taxed at ordinary income rates, whereas Roth withdrawals can generally be made on a tax-free basis.* Read more about traditional vs Roth accounts.

Should I match employee contributions?Matching contributions can be hugely beneficial for both employees and employers. For employees, theyre an additional form of compensation that can help maximize their retirement savings.

Don’t Miss: How Can I Check How Much Is In My 401k