The Pros And Cons Of Taking Out A 401k Loan

A 401k loan can be a great way to get the money you need without having to pay taxes or penalties. You will have to pay the loan back with interest, but it can still be a cheaper option than taking out a traditional loan. However, there are a few things you should consider before taking out a 401k loan. Lets get into the details.

How To Repay A 401k Loan

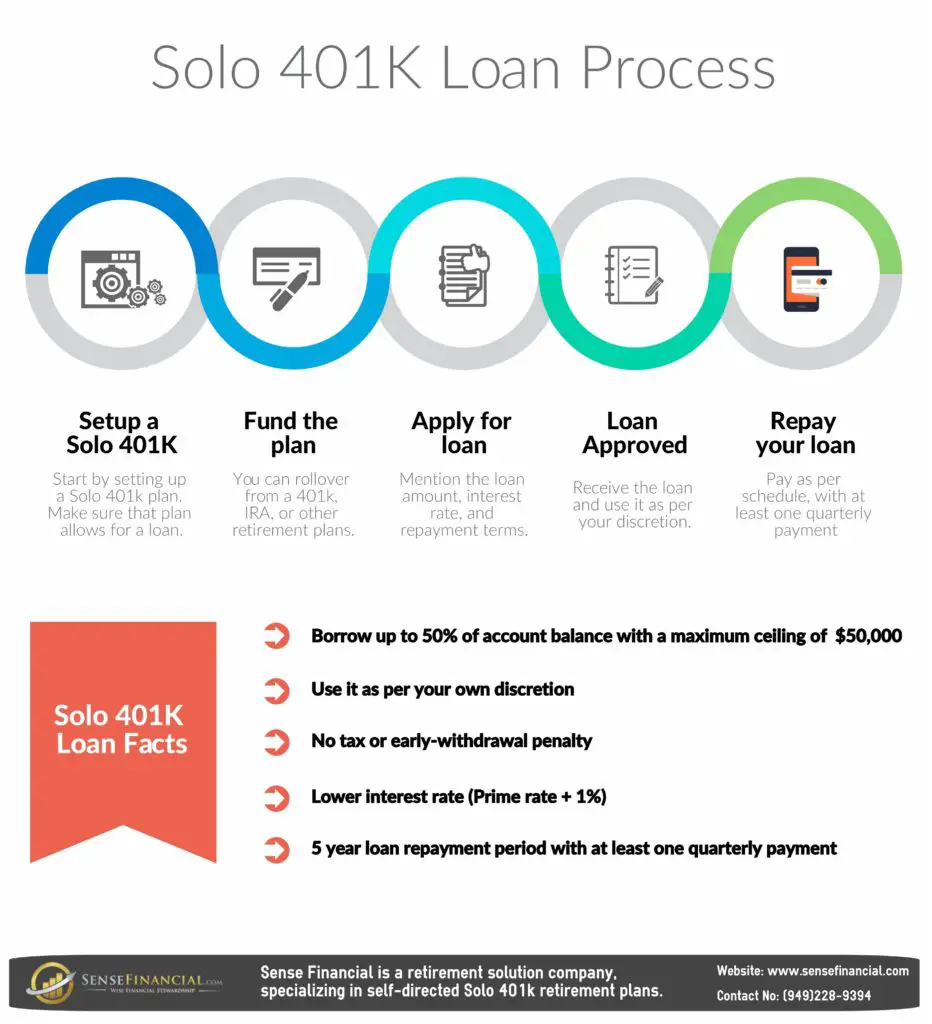

If you take out a loan from your 401k, you will have to repay the loan principal plus interest. The repayment schedule and interest rate will be determined when you take out the loan. You will typically have up to five years to repay a 401k loan, but some employers may require a shorter repayment period.

If you leave your job before the loan is repaid, you will generally have to repay the entire loan within 60 days. If you dont repay the loan, it will be treated as a distribution from your 401k account and will be subject to income taxes and, if you are under age 59 1/2, a 10% early withdrawal penalty.

Take A Hardship Withdrawal: Withdraw Money But Taxes And Penalties May Apply

Your plan may allow you to take hardship withdrawals for large and immediate financial needs, such as expenses for education, housing, medical care, or funerals.

The short-term cost of a hardship withdrawal is that youll pay applicable income taxes and early withdrawal penalties. For example, if you needed $10,000 and wanted taxes of 25% withheld, youd need to withdraw $13,333. You might also have to pay an additional 10% for an early withdrawal penalty at tax time.

The long-term cost could be even greater. Unlike loans, hardship withdrawals cannot be paid back. The money withdrawn leaves your account and loses its tax-advantaged growth potential. A withdrawal could leave you with significantly less at retirement unless you increase your contributions. Even then, it may be difficult to make up for lost time and the benefit of compounding. The rules also prevent you from contributing to your plan for six months after a withdrawal.

Don’t Miss: How To Find Out How Much 401k I Have

An Example Of A 401 Loan

Suppose you have $5,000 in and $50,000 in a 401 plan. You borrow $5,000 and agree to pay off the debt within five years at an annual percentage rate of 4.25%. At the end of the five years, after having made payments of $92.65 per month, you will have replenished your account and paid yourself $558.83 in interest.

If you were to take the same amount of time to pay off the $5,000 of credit card debt, which had an annual percentage rate of 14.25%, using money left over after meeting your other expenses, you would have paid the card issuer $2,019.47 in interest after having made monthly payments of $116.99.

What Happens If You Leave Your Job

When you take out a loan from a 401, you may have no intention of leaving your current employer. But if you receive a better job offer, or are laid off or otherwise leave, you could be required to pay the loan back in full or face some serious tax consequences.

Employees who leave their jobs with an outstanding 401 loan have until the tax-return-filing due date for that tax year, including any extensions, to repay the outstanding balance of the loan, or to roll it over into another eligible retirement account. If you cant repay it, the amount of money you still owe will be considered a deemed distribution and could be taxed as it would be if you were to default on the loan.

That means if you left your job in January 2021, you would have until April 18, 2022 when your 2021 federal tax return is due to roll over or repay the loan amount. Prior to the Tax Cuts and Jobs Act of 2017, the deadline was 60 days.

If you cant repay the loan, your employer will treat the remaining unpaid balance as a distribution and issue Form 1099-R to the IRS. That amount is typically considered taxable income and may be subject to a 10% penalty on the amount of the distribution for early withdrawal if youre younger than 59½ or dont otherwise qualify for an exemption.

Recommended Reading: How Do I Find My 401k From A Previous Employer

Can I Take Money Out Of My Fidelity 401k

For a withdrawal from your Employer-Sponsored Retirement Plan Single Withdrawal Request

Keeping this in view, can I take money out of my Fidelity retirement account?

No, as long as your Roth account has been open for at least five years, starting at age 59½, you can begin taking money out of your retirement accounts without penalty. No, starting at age 59½, you can begin taking money out of your retirement accounts without penalty. Fidelity does not provide legal or tax advice.

Beside above, can you take money out of your 401k? In general, when you make a withdrawal from your 401K before you reach age 59 ½, the Internal Revenue Service may charge you a 10% early withdrawal penalty. Youll also pay taxes on any amounts you cash out because these funds come directly from your pre-tax income.

People also ask, how do I withdraw money from my Fidelity 401k?

Your 401k is your money, and making a withdrawal is as simple as contacting Fidelity to let them know you want it. The easiest way is to simply visit Fidelitys website and request a check there. However, you can also reach out via phone if you prefer: Call 800-343-3543 with any questions about the process.

Can I borrow from my Fidelity 401k?

Most workplace retirement plans let you borrow up to $50,000 or 50% of your vested account balance, which- ever is less. Most also have a loan minimum of $1,000.

You May Like Also

No More Earned Interest

When you borrow money from your 401, those funds stop earning compound interest until they are repaid. Even if your 401 balance is small, a couple hundred dollars in interest over a few years could turn into many thousands over 30 years.

Even more important, contributions to your 401 are dependent on you being eligible to receive that benefit from your current employer. If, for any reason, you leave your employer, the entire balance of your 401 loan becomes due.

Read Also: How Much Will My 401k Grow If I Stop Contributing

Don’t Miss: How Do I Get Into My 401k

Better Options For Emergency Cash Than An Early 401 Withdrawal

We know it can be a struggle when suddenly you need emergency cash for medical expenses, student loans, or crushing consumer debt. The extreme impact of coronavirus on public health and the economy has only compounded some of the more routine challenges of consumer cash flow.

We get it. The money squeeze can be quick and traumatic, especially in a more volatile economy.

Thats why information about an early 401 withdrawal is among the most frequently searched items on principal.com. Understandably so, in a world keen on saddling us with debt.

But the sad reality is that if you do it, you could be missing out on crucial long-term growth, says Stanley Poorman, an advice and planning manager for Principal® Advised Services who helps clients on household money matters.

In short, he says, Youre harming your ability to reach retirement. More on that in a minute. First, lets cover your alternatives.

Dont Miss: Should I Transfer 401k To Roth Ira

Can You Pay Off A 401 Loan Early

Yes, loans from a 401 plan can be repaid early with no prepayment penalty. Many plans offer the option of repaying loans through regular payroll deductions, which can be increased to pay off the loan sooner than the five-year requirement. Remember that those payments are made with after-tax dollars unlike contributions, which are made before taxes.

You May Like: How To Roll My 401k Into A Roth Ira

Consider The Impact On Your Retirement Savings

Dont forget that a 401 loan may give you access to ready cash, but its actually diminishing your retirement savings. First, you may have to sell stocks or bonds at an unfavorable price to free up the cash for the loan. In addition, youre losing the potential for tax-deferred growth of your savings.

Also think about whether youll be able to contribute to your 401 while you are paying back the loan. A lot of people cant, possibly derailing their savings even more.

How Much Can You Borrow From Your 401

In general, you can borrow the greater of $10,000 or 50% of your vested account balance up to $50,000. You are limited to the balance in your current companyâs 401, not the collective balance of all of your retirement accounts. You may, however, be able to roll over funds into your current 401 to increase the amount you can borrow. You are limited to borrowing from the assets in your current employerâs 401 plan.

Read Also: Can You Convert Your 401k To A Roth Ira

What Is An Ira And Should I Invest In One

If youre getting ready to save for retirement, you may be thinking of opening whats known as an Individual Retirement Account . This is a common retirement savings tool to help you make the most of your hard-earned money. There are many different types of IRAs to choose from. Making the right choice all depends on your finances and future plans for your savings.

Q: Does It Make Sense To Borrow From My 401 If I Need Cash

When cash is tight, your 401 can seem like a perfectly reasonable way to make life a little easier. The money is there and its yoursso why not tap it to pay off debt or get out of some other financial jam? Or you might be tempted to use it to pay for that dream vacation you deserve to take.

Stop right there. The cash in your 401 may be calling youbut so is your financial future. The real question here: Will taking the money today jeopardize your financial security tomorrow?

Im not saying a 401 loan is always a bad idea. Sometimes, it may be your best option for handling a current cash need or an emergency. Interest rates are generally low and paperwork is minimal. But a 401 loan is just thata loan. And it needs to be paid back with interest. Yes, youre paying the interest to yourself, but you still have to come up with the money. Whats worse is that you pay yourself back with after-tax dollars that will be taxed again when you eventually withdraw the moneythats double taxation!

Read Also: When Leaving A Company What To Do With 401k

Take A 401k Loan: What You Should Know

Borrowing against funds in your plan may be allowed. But is it ever a good idea?

After years of regular contributions, a 401 plan through your employer may become one of your largest financial assets. In some cases, your employer may also allow you to borrow against the funds in that plan, which may be another financial benefit to you.

As you continue to work and build for your retirement, you may be tempted to take a loan to cover emergencies or big expenses like college. But before you make that decision, there are some things you should know about 401k loan rules.

Weighing Pros And Cons

Before you determine whether to borrow from your 401 account, consider the following advantages and drawbacks to this decision.

On the plus side:

- You usually dont have to explain why you need the money or how you intend to spend it.

- You may qualify for a lower interest rate than you would at a bank or other lender, especially if you have a low credit score.

- The interest you repay is paid back into your account.

- Since youre borrowing rather than withdrawing money, no income tax or potential early withdrawal penalty is due.

On the negative side:

- The money you withdraw will not grow if it isnt invested.

- Repayments are made with after-tax dollars that will be taxed again when you eventually withdraw them from your account.

- The fees you pay to arrange the loan may be higher than on a conventional loan, depending on the way they are calculated.

- The interest is never deductible even if you use the money to buy or renovate your home.

CAUTION: Perhaps the biggest risk you run is leaving your job while you have an outstanding loan balance. If thats the case, youll probably have to repay the entire balance within 90 days of your departure. If you dont repay, youre in default, and the remaining loan balance is considered a withdrawal. Income taxes are due on the full amount. And if youre younger than 59½, you may owe the 10 percent early withdrawal penalty as well. If this should happen, you could find your retirement savings substantially drained.

Don’t Miss: How Much You Should Have In 401k By Age

Will Your Employer Know If You Take Out A 401 Loan

Yes, its likely your employer will know about any loan from their own sponsored plan. You may need to go through the human resources department to request the loan and youd pay it back through payroll deduction, which theyd also be aware of. Loans arent guaranteed to be approved either or your plan may not offer them at all. If youre concerned about a manager or executive finding out about the loan request, consider asking HR to keep your request confidential.

Roth Ira Hardship Withdrawals

If turning to your retirement savings is your last resort and you have a Roth IRA, this is the account you may want to consider tapping into first. The contributions you make into these accounts are taxed before they go in. So the IRS cant tax your contributions twice.

You can withdraw your contributions from a Roth IRA at any time without penalty. So if your Roth IRA contributions have been large enough to cover your financial burden, it might make sense to withdraw these first. Again, not the best financial decision. But as a last resort, youd at least avoid taxes and penalties.

However, its important to keep in mind were talking about contributions here.

This is the money you put into these accounts via automatic paycheck deduction or a bank transfer you initiated. This is separate from the earnings your contributions make from investment funds, interest, dividends or any other source.

The IRS doesnt permit you to withdraw any investment earnings on your contributions tax-free unless you meet two requirements. First, you have to be at least 59.5-years-old. Second, your account must have been open for at least five years. You must meet both stipulations before you can make tax-free qualified withdrawals from a Roth IRA.

Its also important to note that while you can withdraw your own contributions from a Roth IRA at any time, this is not the case with a Roth 401.

Also Check: How Much Do You Need In 401k To Retire

Loans To Purchase A Home

Regulations require 401 plan loans to be repaid on an amortizing basis over not more than five years unless the loan is used to purchase a primary residence. Longer payback periods are allowed for these particular loans. The IRS doesn’t specify how long, though, so it’s something to work out with your plan administrator. And ask whether you get an extra year because of the CARES bill.

Also, remember that CARES extended the amount participants can borrow from their plans to $100,000. Previously, the maximum amount that participants may borrow from their plan is 50% of the vested account balance or $50,000, whichever is less. If the vested account balance is less than $10,000, you can still borrow up to $10,000.

Borrowing from a 401 to completely finance a residential purchase may not be as attractive as taking out a mortgage loan. Plan loans do not offer tax deductions for interest payments, as do most types of mortgages. And, while withdrawing and repaying within five years is fine in the usual scheme of 401 things, the impact on your retirement progress for a loan that has to be paid back over many years can be significant.

If you do need a sizable sum to purchase a house and want to use 401 funds, you might consider a hardship withdrawal instead of, or in addition to, the loan. But you will owe income tax on the withdrawal and, if the amount is more than $10,000, a 10% penalty as well.

How Much You Can Withdraw

You cant just withdraw as much as you want it must be the amount necessary to satisfy the financial need. That sum can, however, include whats required to pay taxes and penalties on the withdrawal.

The recent reforms allow the maximum withdrawal to represent a larger proportion of your 401 or 403 plan. Under the old rules, you could only withdraw your own salary-deferral contributionsthe amounts you had withheld from your paycheckfrom your plan when taking a hardship withdrawal. Also, taking a hardship withdrawal meant you couldn’t make new contributions to your plan for the next six months.

Under the new rules, you may, if your employer allows it, be able to withdraw your employers contributions plus any investment earnings in addition to your salary-deferral contributions. Youll also be able to keep contributing, which means youll lose less ground on saving for retirement and still be eligible to receive your employers matching contributions.

Some might argue that the ability to withdraw not just salary-deferral contributions but also employer contributions and investment returns is not an improvement to the program. Heres why.

Read Also: What’s The Difference Between An Ira And A 401k Account